Comparison of Gross Split Production Sharing Contract and Taxation Aspects for Economic Incentives in Indonesia

Corresponding email: ekusrini@che.ui.ac.id

Published at : 04 Apr 2023

Volume : IJtech

Vol 14, No 2 (2023)

DOI : https://doi.org/10.14716/ijtech.v14i2.5441

Permatasari, D., Ambia, F., Kusrini, E., Zulkarnain, M., 2023. Comparison of Gross Split Production Sharing Contract and Taxation Aspects for Economic Incentives in Indonesia. International Journal of Technology. Volume 14(2), pp. 246-256

| Dewi Permatasari | 1. Departement of Chemical Engineering, Faculty of Engineering, Universitas Indonesia, Kampus UI Depok 16424, Indonesia, 2. Special Task Force for Upstream Oil and Gas Business Activities Republic of |

| Fajril Ambia | 1. Special Task Force for Upstream Oil and Gas Business Activities Republic of Indonesia, Wisma Mulia 23 Fl, Jl. Gatot Subroto Kav. 42, Jakarta Selatan, 12710, Indonesia 2. Departement of Petrole |

| Eny Kusrini | Departement of Chemical Engineering, Faculty of Engineering, Universitas Indonesia, Kampus UI Depok 16424, Indonesia |

| Muhammad Zulkarnain | Fakulti Kejuruteraan Mekanikal dan Pembuatan, Universiti Teknikal Malaysia Melaka (UTeM), Melaka, 75450, Malaysia |

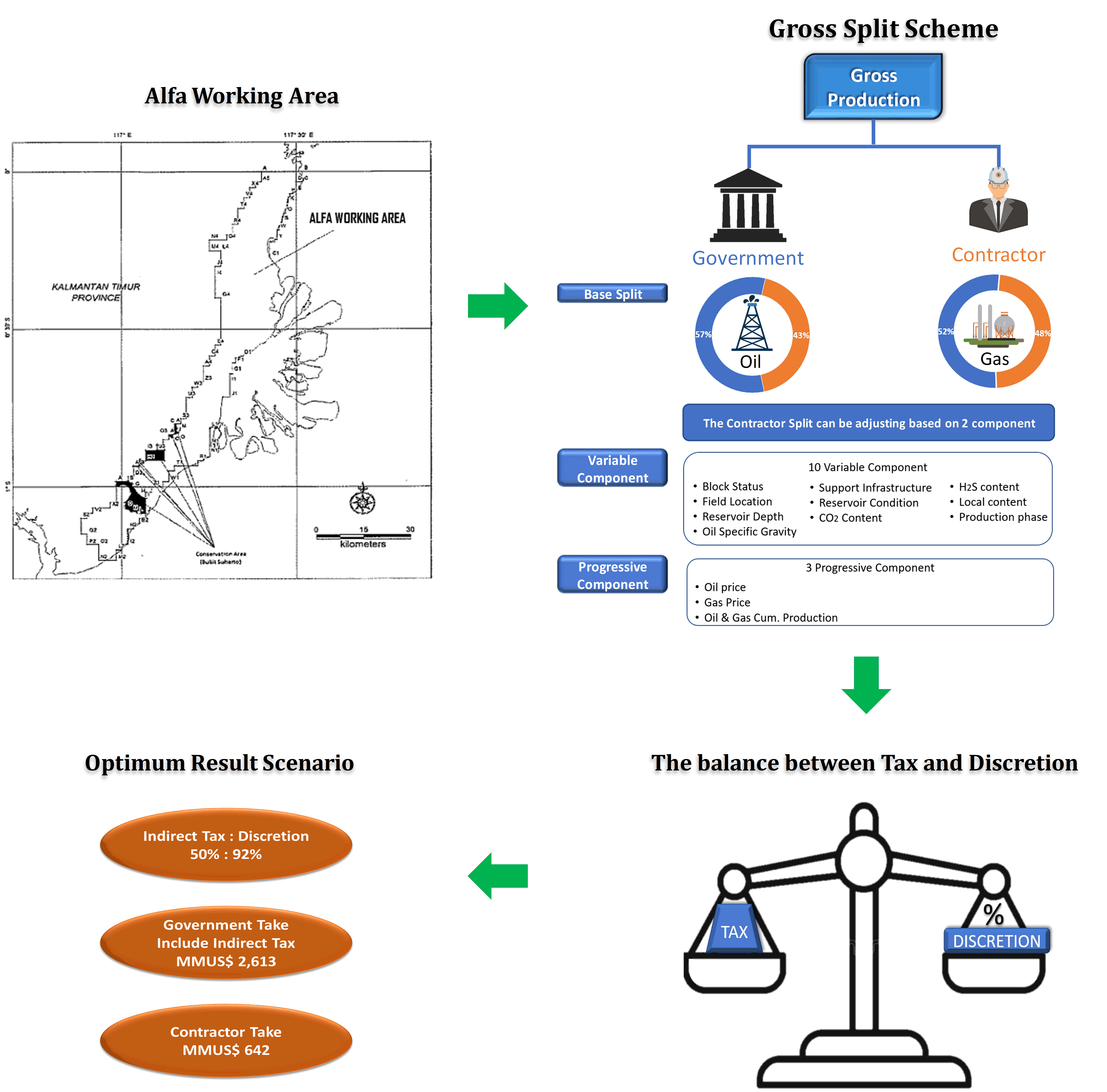

The objective of this study is to

evaluate the comparison of economic incentives from the aspect of production

sharing contract gross split, and taxation, especially to determine the balance

of incentives that the government can provide either in taxation or additional

discretion splits to contractors in the Alfa working area, which is an oil and

gas operational work area located in Kalimantan. The method used in this study

is a quantitative method, by performing calculations using a gross split profit

sharing scheme to observe the economic comparison of Alfa working area without

discretion, with additional discretion and a combination of tax percentages,

with various combinations, it provides 25 (twenty-five) scenarios for economic

calculations to the Alfa working area. Based on the economic calculation in

Alfa's work area, the profitability index (PI) value is 1.09, where this value

shows the minimum economic value of the contractor. Based on these scenarios,

an economic analysis was obtained with a combination of indirect tax 0-100% and

additional discretion split of 0-100%. According to the study's results,

if the additional discretion incentive was less than 50%, the contractor's NPV

value was negative. On the other hand, 75% discretion was given with indirect

tax between 0-50%, and 100% discretion was offered. Through scenario simulation

calculation with a PI target of 1.09, the optimum result was obtained with a

balanced incentive amount at 50% indirect tax and an additional 92% split

discretion.

Discretion; Gross split; Incentives; Indirect tax; Profitability index

Indonesia’s upstream oil and gas

industry is still one of the drivers of the national economy. Oil and gas have

an important role in modern industry, and the demand for oil and gas is closely

related to economic development (Cheng et

al., 2018). Indonesia’s

oil reserves and declining oil production is the focus of the Indonesian

government, which aims to quickly change and accelerate the use of a mixed-energy

policy

(Bawono and Kusrini, 2017). Therefore the

government continues to strive to create an attractive investment climate to

achieve the petroleum production target of 1 million barrels per day and 12 billion cubic feet per day of natural gas (BSCFD) by 2030.

Investors say that oil and gas sector investment

in Indonesia is less attractive. Some publications such as IHS Markit, Wood

Mackenzie, Fraser, and others mention that Indonesia's upstream fiscal

attractiveness rating is relatively low compared to other countries (BUMI, 2021). Indonesia is currently making advances related to the

investment climate in the field of oil and gas, where other countries are also

increasing their attractiveness, Radical investment climate improvements can help to attract oil and gas investors.

To achieve the oil and gas production

target by 2030, all parties need joint efforts. Currently, investors are given

the option to choose the form of the production sharing contract (PSC),

including gross split PSC or cost recovery PSC. There are several incentives

provided by the government, in the Cost recovery Production Sharing Contract

(PSC), the government provides DMO (Domestic Market Obligation) Holiday

rewards, Investment credit, and accelerated depreciation. In the gross split

PSC, the government provides an adjustment to the number of profit sharing,

incentives for the use of state property based on field economic

considerations, exemptions from VAT related to the import and delivery of

certain strategic taxable goods (including LNG), and elimination of the

provision on utilization fees for exterminated state-owned goods

Production sharing contracts in

Indonesia continue to develop according to regulatory changes and the times,

Indonesia has implemented the PSC cost recovery system since 1965 and has

passed through three generations. Since 2017 the government has issued a new

model of the PSC

scheme through Ministerial Regulation No. 8/2017 about Gross Split Production

Sharing Contracts. Since the implementation of this gross split scheme, 16 oil

and gas areas have used the system (Directorate

General of Oil and Gas, 2018). In the gross split scheme, this cost recovery

component is eliminated and secure government revenue (Daniel, 2017), because the split calculation

scheme between the government and the contractor is determined at first (base split),

there are also variable and progressive components and additional components

for contractor revenue sharing, the discretion of the Minister of Energy and

Mineral Resources to improve the economic level of upstream oil and gas

projects. With this discretion, the policy will encourage contractors to drill

more wells. So that the potential of finding new oil reserves will be higher,

which benefits contractors and the government without changing the oil split in

government regulations (Giranza and Bergmann,

2018). Gross split

PSC has similar characteristics to a royalty scheme, which has been successful

elsewhere in the world (Roach and Dunstan, 2018).

Several

researchers have also conducted many studies by comparing PSC Cost recovery and

PSC gross split. Research conducted by Buhori, Rokhim, and Wibowo (2018) shows that PSC cost recovery is more attractive to contractors, In other

research, the results show that this gross split system provides higher cash

flow results for contractors (Jumiati and Sismartono, 2018). An interesting research result was reported by Daniel

(2017), which showed that using the gross

split PSC system would be better without indirect tax. This research was conducted in the Alfa

working area. The Alfa working area received an extension production sharing

contract gross split scheme, the minimum economic indicator that must be achieved

by the contractor is from the value of profitability index is 1.09. The use of

this profitability index indicator is due to the very volatile cash flow

conditions from Alfa working area is always positive so the IRR value is

inaccurate. The Novelty of this paper is to find a

balance of the number of incentives that can divide between taxation and

discretion.

Economic calculations Alfa Working

area uses the Gross Split PSC scheme (Regulation

MEMR No.8, 2017). Table 1, details the gross split

PSC regulates.

The split on this gross split can be

adjusted based on 13 (thirteen) components consisting of 10 (ten) variable

components and 3 (three) progressive components (Regulation MEMR No.8,

2017), this component can be seen in Table

1. Based on the Minister of Energy and Mineral Resources Regulation No.

52/2017, in the economic calculation of the Gross Split PSC in a working area,

the Minister of Energy and Mineral Resources and the Minister of Finance can

provide incentive approval by adding a percentage of split to the contractor.

2.1.

Project Economy

The

decision-making process to determine the value of a long-term investment in a

project requires a techno-economic analysis and should be based on the maximum

return on equity of the investment (Wicaksono,

Arshad, and Sihombing, 2018). This study uses NPV, PI, and POT to determine the economics

of a project.

2.1.1. Net Present Value (NPV) is the discrepancy between the value

of cash inflows and the value of cash outflows for a period. NPV is usually

used as a capital allocation to analyze the benefits of a project to execute.

In addition, NPV is a direct measure of profitability and provides an overview

of how the contractor's cash flow will be affected by each project (Sajjad et al., 2021). Generally, a positive NPV value

will be profitable, while projects with a negative NPV value will result in

losses (Peterson

and Fabozzi, 2002). NPV

can be calculated using the formula 1 below:

Where: N = Number of periods, t = time of cash flow being measured, I = cost of capital, and Rt = cash flow at time t.

2.1.2. Profitability Index This method calculates the comparison

between the value of net cash flows that will come with the value of the

current investment. The

profitability index can be calculated using formula 2 below:

Where:

CF=Annual cash inflow, IO=Total investment, n=project age, and k=capital

interest rate. The Profitability Index must be

greater than one to be considered feasible. The larger the profitability index,

the more feasible the investment (Peterson and Fabozzi, 2002).

2.1.3. Pay Out Time

(POT) or payback period is the time required to recover the initial cost of a

project. This POT is a parameter that indicates the year in which the

Cumulative Cash Flow is equal to 0 (Pramadika and Satiyawara, 2018). POT can be calculated using the formula 3 below:

Where: IO=Initial investment and

CF=Cash inflow

Based on research conducted by (Lyukevich et al., 2020), evaluating the project’s economic risk can use an

algorithm method that is faster with accurate results. This is very important

because the calculation of techno-economic analysis, evaluation of economic

risk is needed to assess risk factors in developing a project. In addition, mitigation

can be made from the risks that have been determined so that the project

implementation is under the plan.

2.2.

Executive summary of Alfa working

area

2.3.

Scenario for calculating the

economics of incentives and taxation

Figure

2 Scenario calculating the

economics of incentives and taxation

The percentage of discretion used is the

greater percentage split obtained from the results of the economic calculation

of the Alfa working area, and for percentage indirect tax is the percentage of

VAT dan LBT. Tax revenue is an important source for sustainable development,

which increases the country's ability to generate its tax revenue (Victorova

et al., 2020). However, to improve the oil

and gas investment climate and contractors can develop alfa working areas, then

the provision of tax incentives is necessary. It follows that if there are no

incentives, the Alfa working area is not developed, and of course, the

government will not receive revenue from this oil and gas sector. Besides, the 25 scenarios

above, this study also simulates calculation scenarios with a target PI of 1.09

and using an indirect tax 0-100%, to find the optimum value of discretion.

3.1. Fiscal terms for

the Alfa working area

Before running economic calculations, it is necessary to determine the distribution of split for the Alfa working area between the government and the contractor formerly using the gross split PSC scheme, according to the MEMR Regulation. Details of the base split based on a base split contractor in Table 1 for oil 43% and gas 48%, variable component, and progressive split based on the condition for the Alfa working area, as shown in Table 2.

Table 2 Fiscal

terms Alfa working area

|

Component Splits |

Status |

Contractor Split | |

|

Gas |

Oil | ||

|

I. Base

Split |

48% |

43% | |

|

II.

Variable Split | |||

|

Block

Status |

No POD |

0% |

0% |

|

Field

location |

Onshore |

0% |

0% |

|

Reservoir

depth (m) |

>

2500 |

1% |

1% |

|

Infrastructure |

Well

Developed |

0% |

0% |

|

Reservoir

Condition |

Conventional |

0% |

0% |

|

CO2

(%) |

40 <

x < 60 |

2% |

2% |

|

H2S

(ppm) |

< 100 |

0% |

0% |

|

Specific

Gravity of oil (API) |

>25 |

0% |

0% |

|

Local

Content (%) |

50 <

x < 70 |

3% |

3% |

|

Production

Phase |

Primary |

0% |

0% |

|

III.

Progressive Split |

|

|

|

|

Cumulative

production |

<30

MMBOE |

10% |

10% |

|

Oil/gas

price |

US$/bbl.

US$/MMBtu |

5% |

12% |

|

Total

contractor Split |

69% |

71% | |

|

Government

split |

31% |

29% | |

Based on

the determination of the alfa working area split, the total results for the

contractor split for gas are 69% and for oil 71%, while the revenue sharing for

the government is 31% for oil and 29% for gas.

3.2.

Alfa working area development costs

Calculating development costs in the Alfa working area

requires data and estimates of capital expenditure costs (CAPEX), and operation

and maintenance costs (OPEX). In the gross

split PSC, the contractor must be as efficient as possible to execute activities

to improve the contractor’s profits. Therefore, CAPEX and OPEX efficiency are

needed, one of which is optimizing development drilling activities. In drilling

activities, it is necessary to formulate the best and optimal drilling fluid to

get the minimum cost (Kusrini et al., 2018; Kusrini et al., 2020).

This

capital expenditure cost (CAPEX) includes drilling costs, facilities, and costs

for G&G Study and seismic, so the total cost of CAPEX is MMUS$ 4,490.8.

This cost needs to execute all the long-term plan work programs in the Alfa

working area, with detailed

annual costs, as

shown in Figure 3.

3.3. Economy Alfa

working area

From the results of economic

calculations using the fiscal term of Alfa working area where the number of

splits has been determined, the contractor's NPV is positive, with discretion

26%, the value of the profitability index (PI) is 1.09, meaning the PI value

more than one which is the minimum value for the contractor to be able to

develop the working area and pay out time is 8 years. From this calculation,

revenue from contractors is MMUS$ 647, and government revenue is MMUS$ 2,899,

as shown in Table 3.

Table 3 Alfa working area economic calculation

|

Parameter |

Unit |

Fiscal Term Alfa Working Area |

|

Contractor gas split |

% |

69% |

|

Contractor oil split |

% |

71% |

|

Discretion |

% |

26% |

|

WAP Gas |

S$/MMBtu |

6 |

|

WAP Oil |

US$/bbl |

59 |

|

Gross Revenue |

MMUS$ |

10,766 |

|

Total CAPEX |

MMUS$ |

4,491 |

|

Total OPEX |

MMUS$ |

3,941 |

|

Contractor Profitability: | ||

|

Contractor Net Operating Profit |

MMUS$ |

647 |

|

(% Gross Revenue) |

6.68% | |

|

Total Contractor Net Cash Flow |

MMUS$ |

600.64 |

|

(% Gross Revenue) |

6.20% | |

|

Contractor NPV |

MMUS$ |

173 |

|

Profitability Index Pay Out Time |

Years |

1.09 8.4 |

|

Government Profitability: | ||

|

Government Take |

MMUS$ |

1,632 |

|

(% Gross Revenue) |

15% | |

|

Indirect Tax (VAT, LBT &

Asset Lease) |

MMUS$ |

1,268 |

|

(% Gross Rev) |

12% | |

|

Government Take includes Ind Tax |

MMUS$ |

2,899 |

|

(% Gross Revenue) |

|

27% |

3.4. Calculation of

Profitability Index from 2017-2020 POD Data with Economic Data of Alfa Working

Area

Figure

5 Comparison of PI Data POD 2017 – 2020 with PI Alfa working area

Based on the POD data shows that the

average PI from POD data is 1.55, which means that the results for the economic

calculation of the Alfa working area, where the PI is 1.09, results in

reasonable incentives for the Alfa working area. However, it is below the

average value when compared to the data for each PI POD, the PI value of 1.09,

according to the contractor, is sufficient to develop the Alfa working area.

However, based on the discretion

previously given by the government, the percentage is currently very high.

Therefore, the government wishes to see the discretion value lowered to below

26%. So, a re-evaluation is carried out

regarding the additional amount of the split given. So that in this study an

analysis of the number of incentives provided is not only from the portion of

the Ministry of Energy and Mineral Resources but also from tax, along with

indirect tax exemptions (VAT and LBT), which includes a combination scenario of

a predetermined percentage that has been set upon in the beginning.

3.5. Economic calculation with discretion and

taxation scenario

From the results of the economic calculations of 25 scenarios, it will get the profitability index and NPV value, as shown in Figures 6 and 7. Based on the calculation using formula 1, results in 25 (twenty-five) economic scenarios. Based on Figure 6, the contractor's NPV is negative if discretion is below 75%.

The economic viability of a project other than the NPV value can also be seen from the PI value using formula 2. The PI value is below one if the discretion is below 75%. The PI value in Figure 7 will exceed the minimum value of 1.09 if the contractor gets a tax incentive of 0-75%. At a later stage for pay out time (POT) which was calculated using Formula 3, if NPV is negative, POT is zero. If a value of 75% discretion applies, then the POT is 8 to 18 years.

Figure 7 Comparison of profitability Index of 25 economic

scenarios

For the balance

of the incentive portion between the additional split discretion given by the

Ministry of Energy and Mineral Resources and the indirect tax incentive

provided by the ministry of finance, a calculation simulation with a target PI

value of 1.09, as shown in Table 4.

Table 4 Summary of calculation simulation scenario

|

Parameter |

Unit |

Indirect Tax: Discretion | |||

|

0%: 85% |

25%:88% |

50%:92% |

75%:96% | ||

|

Gross Revenue |

MUS$ |

10,766 |

10,766 |

10,766 |

10,766 |

|

Total CAPEX |

MMUS$ |

4,491 |

4,491 |

4,491 |

4,491 |

|

Total OPEX |

MMUS$ |

3,514 |

3,621 |

3,727 |

3,834 |

|

Contractor Profitability: | |||||

|

Contractor Net Operating Profit |

MMUS$ |

643 |

643 |

642 |

646 |

|

(% Gross Rev) |

6.64% |

6.64% |

6.63% |

6.67% | |

|

Total Contractor Net Cash Flow |

MMUS$ |

606 |

604 |

600 |

602 |

|

(% Gross Rev) |

6.26% |

6.23% |

6.19% |

6.21% | |

|

Contractor NPV |

MMUS$ |

173.11 |

172.82 |

172 |

173.44 |

|

Profitability Index Pay Out Time |

% Years |

8.24 |

1.09 8.26 |

1.09 8.27 |

1.09 8.28 |

|

Government Profitability: | |||||

|

Government Take |

MMUS$ |

2,057 |

1,952 |

1,848 |

1,738 |

|

(% Gross Rev) |

19.11% |

18.13% |

17.17% |

16.15% | |

|

Indirect Tax (VAT, LBT & Asset Lease) |

MMUS$ |

262 |

513 |

765 |

1,016 |

|

(% Gross Rev) |

2.43% |

4.77% |

7.10% |

9.44% | |

|

Gov. Take includes Indirect Tax |

MMUS$ |

2,319 |

2,465 |

2,613 |

2,754 |

|

(% Gross Rev) |

|

21.54% |

22.90% |

24.27% |

25.59% |

Based on the calculation of the simulation scenario with a

target of 1.09, the results indicate that there are two comparisons of indirect

tax and discretion with large government revenues, in a ratio of 50%:92% and

75%:96%. At a ratio of 75%:96%, the discretion value is 24.9%, where this value

is still close to the initial discretion value of 26%. Thus, the government

wants to calculate the economics of the Alfa working area to achieve a balance

between the number of taxes and discretion. The optimum result is in a ratio of

50%:92%, with a discretion of 23.9%. Similar to the results of research conducted by Daniel (2017), it is emphasized that a gross split PSC is more

attractive than cost recovery PSC if there is no indirect tax, but PP 79/2010

has regulated indirect taxes. The Government's effort in the Alfa working area

by evaluating the balance between tax and discretion is that contractors get

appropriate incentives to continue the development of this work area.

The economic

analysis of the Alfa working area uses the gross split PSC with an additional

split discretion of 26%, the PI value is 1.09 which is the contractor's minimum

economic value. From the approval of the previous economic calculation of the

development of the working area or field, the discretion value of 26% can be

optimized. The results of the optimization calculation for the government

include an indirect tax of MMUS$ 2,613. Based on economic calculations in the

Alfa working area with various scenarios, it can be resumed that with a tax

incentive of 0-100%, the additional discretion split cannot be below 20%. From the evaluation results in the Alfa

working area, it can be seen that consolidation is needed between the Ministry of Finance and the Ministry

of Energy and Mineral Resources to ensure oil and gas incentives for contractors. In this study, the tax incentives used in the scenario

are only limited to VAT and LBT. Suggestions for further research can be an

assessment of other incentives that can be provided by the government such as

the exemption from the use of state property, exemptions from import duties for

goods used for petroleum operation purposes, accelerated depreciation, and

other incentives. This research can be used as a reference to the government

for calculating the balance of incentives in the Alfa working area to obtain

optimum results.

Dr. Eny Kusrini is thankful to Kemendikbudristek for

Penelitian Dasar Unggulan Perguruan Tinggi (PDUPT) Grant No.: NKB-995/UN2.RST/HKP.05.00/2022, and

special task force for Upstream Oil and Gas Business Activities Republic of

Indonesia for the financial support for this work. Authors also thank to Prof. Lee D. Wilson

from Department of Chemistry, University of Saskatchewan, Canada for the

correction on some part of this paper.

| Filename | Description |

|---|---|

| R3-CE-5441-20220203154300.docx | Supplementary CAPEX and OPEX |

| R3-CE-5441-20220203154323.docx | Supplementary Oil and Gas Production |

Bawono, A.A., Kusrini, E., 2017. The impacts of financing

investment scenario on piped-natural gas prices (GPs) For Households in

Indonesia. International Journal of Technology, Volume 8(8), 1402–1413

Buhori, A., Rokhim, R., Wibowo, B., 2018. Perbandingan keekonomian antara

skema kontrak bagi hasil cost recovery dengan skema gross split (Economic

comparison between the cost recovery production sharing contract scheme and the

gross split scheme). Master's Thesis, Graduate Program, Universitas Indonesia, Indonesia

BUMI, 2021. Umpan

bagus dorong eksplorasi masif (Good bait encourage massive exploration). Buletin

SKKMigas (Deliverability Not Availability). Jakarta:

Indonesia

Cheng, C., Wang, Z., Wang, J., Liu, M.,Ren, X., 2018. Domestic oil and gas or imported

oil and gas – an energy return on investment perspective. Resources,

Conservation & Recycling, Volume 136, pp. 63–76

Daniel, H., 2017. Indonesian milestone in

production-sharing contract in perspective of government take, contractor take,

cost recovery, and production target. Society of Petroleum Engineers

(SPE-187008-MS). Jakarta: SPE International.

Directorate General of Oil and Gas, 2018. Gross split answers doubts. Jurnal

Migas, pp. 28–29. Available online

at https://migas.esdm.go.id/uploads/perpustakaan/majalah

/Buletin-Migas-Edisi-1.pdf, Accessed on September 22, 2021

Giranza, M.J., Bergmann, E.A., 2018. Indonesia’s new gross split PSC:

is it more superior than the previous standard PSC? Journal of Economics,

Business and Management, Volume 6(2), pp. 51–55

Jumiati, W., Sismartono, D., 2018. Tantangan keekonomian kontrak

bagi hasil gross split dan cost recovery: studi kasus lapangan gas offshore di

sumatera bagian utara (Economic challenges of gross split psc and cost

recovery:a case study of offshore gas fields in northern sumatra). Lembaran

Publikasi Minyak dan Gas Bumi, Volume 53(2), pp. 4–5

Kusrini, E., Oktavianto, F., Usman, A., Mawarni, D.P., 2020. Synthesis, characterization, and

performance of graphene oxide and phosphorylated graphene oxide as additive in

water-based drilling fluids. Applied Surface Science, Volume 506, p.

145005

Kusrini, E., Suseno, B., Khalil, M., Nasruddin,

Usman, A., 2018. Study of the use of nanomaterials as drilling mud additives. In: E3S Web of Conferences, Volume 67, p. 02007

Lyukevich, I., Agranov, A., Lvova, N., Guzikova, L., 2020. Digital experience: how to find a

tool for evaluating business economic risk. International Journal of

Technology, Volume 11(6), pp. 1244–1254

Peterson, P.P., Fabozzi, F.J., 2002. Capital budgeting: Theory and practice. Canada: John Wiley & Sons, Inc

Pramadika, H., Satiyawara, B., 2018. Pengaruh harga gas dan komponen

variable terhadap keuntungan kontraktor pada gross split (Effect of gas prices

and variable components on contractor profits on gross split). Jurnal Petro,

Volume 7(3), pp. 113–117

Regulation MEMR No.8, 2017. Gross split production sharing

contract. Jakarta: Ministry of Energy and Mineral Resources

Roach, B., Dunstan, A., 2018. The Indonesia PSc: the end of an

era. Journal of World Energy Law and Business, Volume 11(2), pp. 116–135

Sajjad, F., Jaenudin, J., Chandra, S., Wirawan, A., Prawesti,

A., Muksin, M. G., Nugroho, W.A.,

Mujib, E.M., Naja, S., 2021. Data-driven multi-asset optimisation

under uncertainty: a case study using the new indonesia's fiscal policy. In: International

Petroleum Technology Conference, Virtual, March 2021

Victorova, N., Rytova, E., Koroleva, L., Pokrovskaia, N., 2020. Determinants of tax capacity for a

territory (The case of the

russian federal districts). International Journal of Technology, Volume 11(6), pp. 1255–1264

Wicaksono, F.D.,

Arshad, Y.B., Sihombing, H., 2019. Monte carlo net present value for

techno-economic analysis of oil and gas production sharing contract. International

Journal of Technology, Volume 10(4), pp. 829–840