Impact of the Significant Financial Potential Factors on the Economic Development of the Region

Corresponding email: burova_ev@spbstu.ru

Published at : 28 May 2025

Volume : IJtech

Vol 16, No 3 (2025)

DOI : https://doi.org/10.14716/ijtech.v16i3.7407

Koshevarova, A, Ekaterina, B, Suloeva, S, Kozhina, K & Makhmudova, G 2025, ’ Impact of the significant financial potential factors on economic development of the region’, International Journal of Technology, vol. 16, no. 3, pp. 769-779

| Anastasiya Koshevarova | Peter the Great St. Petersburg Polytechnic University, 29 Politechnicheskaya Ulitsa, St. Petersburg, 195251, Russia |

| Burova Ekaterina | Peter the Great St. Petersburg Polytechnic University, 29 Politechnicheskaya Ulitsa, St. Petersburg, 195251, Russia |

| Svetlana Suloeva | Peter the Great St. Petersburg Polytechnic University, 29 Politechnicheskaya Ulitsa, St. Petersburg, 195251, Russia |

| Kseniya Kozhina | Peter the Great St. Petersburg Polytechnic University, 29 Politechnicheskaya Ulitsa, St. Petersburg, 195251, Russia |

| Guljakhon Makhmudova | Tashkent State University of Economics, 49 Islam Karimov street, Tashkent 100066, Uzbekistan |

Financial potential is an important indicator that reflects the availability of resources and opportunities for the development of a region. A comprehensive study of this indicator is very necessary to achieve growth and improve the financial and economic climate in any country and region. Therefore, this study aimed to identify statistically significant factors of financial capacity that affect economic growth and financial potential. In order to achieve the stated objectives, regression analysis was adopted and the study sample comprised data obtained from 82 regions of Russia. It is also important to comprehend that this study spanned the period from 2009 to 2022. Three models were examined, namely Fixed Effects Model (FEM), Ordinary Least Squares (OLS), and Random Effects Model (REM), and FEM was identified as more precise for the study analysis. The results showed nine very important factors with the capability to influence financial potential. These factors include budget (coefficient of covering budget expenses with own income, external financing ratio), investment (investment in fixed assets per capita, financial performance ratio of organizations per capita), credit (level of debt load of corporations, level of debt load of individuals; loans to deposit ratio), and household financial performance (consumer spending per capita), all of which were identified at a 99% confidence level. Accordingly, all factors, except the loan-to-deposit ratio, were observed to be positively correlated with indicators of socio-economic development (GRP per capita) and financial potential.

Economic growth; Financial potential; Fixed effects model; Regression analysis

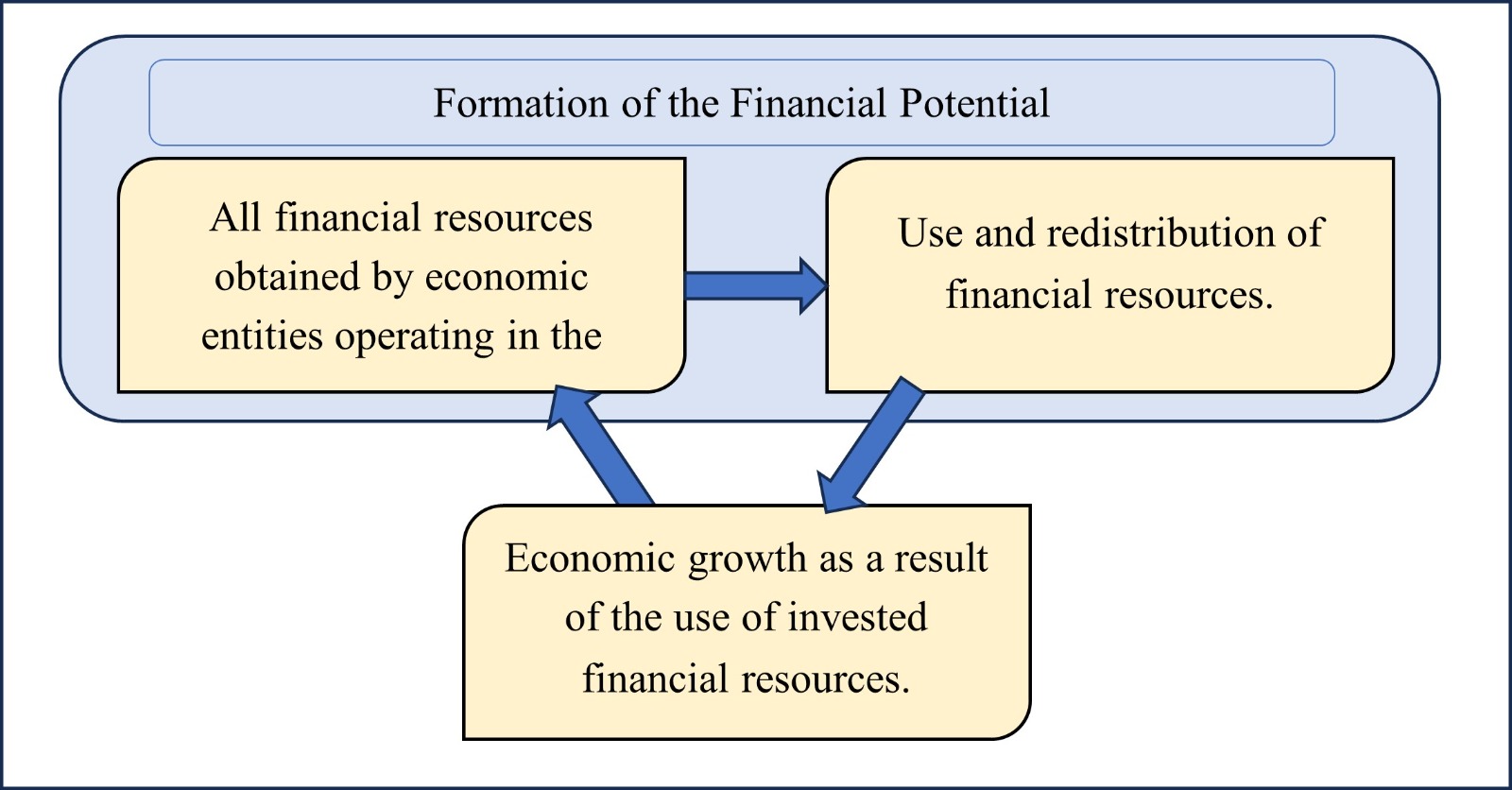

The proper functioning, development, and economic growth of any region is typically conditioned by the possibility of the region to possess and attract sufficient financial resources. This is evidenced by a previous study, where financial factors were reported to play a very significant role in economic development as these factors invariably provided the necessary resources for investment and innovation (Wang and Tan, 2021). Access to financial resources enables the continuation and expansion of businesses, thereby fostering entire economic growth, as financial factors have been observed to contribute substantially to stability and confidence in the economy (Ozili and Iorember, 2023). A well-functioning financial system promotes transparency and trust, which attracts both domestic and foreign investments in return. Moreover, the efficient allocation of financial resources allows for the achievement of maximum economic growth in regions (Petropoulos et al., 2024). Financial potential is an indicator that can be used to effectively measure the capability of the subjects of a region's economy (government bodies, corporate structures, population) to accumulate financial assets and transform income into potential resources with the primary aim of ensuring the strategic goals of the region is met (Boldyreva, 2018; Yarullin and Galimova 2011; Ataeva, 2010; Bulatova, 2010). Typically, regional authorities are saddled with the task of controlling the allocation and maximizing the inclusiveness and optimal utilization of all available financial resources. The group is actively engaged in activities that focus on discovering, attracting, and generating financial potential. This financial potential is necessary to achieve the strategic goals of the region's socio-economic development (Rogateniuk, 2022).

Based on these insights, an inference can be made that a comprehensive study of the importance of financial potential as an indicator is very essential. However, the complexity and ambiguity surrounding the methods used to calculate financial potential indicators present a significant challenge. This issue invariably emphasizes the necessity of continued explorations to analyze the indicator using a systematic approach.

Various methodologies exist for assessing financial potential, most of which converge in defining the aspect as an integral indicator influenced by multiple factors (Zakhidov, 2024; Avduevskaya 2023; Chen et al., 2021; Markeeva, 2020; Goridko and Nizhegorodtsev, 2012; Konyarova 2005). It is important to comprehend that the scientific community remains divided, particularly regarding the selection of factors capable of significantly impacting financial potential. This is evidenced by the fact that while some investigators rely on expert judgment to determine the factors influencing the indicator, a statistically substantiated method appears to be more reliable and justified. Therefore, this study aims to identify statistically meaningful factors that can be used in the assessment of financial potential.

As stated in a previous study, the financial potential of a region comprises budgetary, credit, investment, and household financial potentials, all of which can be examined independently (Boldyreva, 2018). These components, in turn, depend on the volume of available financial resources and the efficiency of the resources redistribution and utilization. In a bid to identify and select relevant factors for analysis, existing studies on the previously outlined components were reviewed. For instance, budget potential has been estimated using regression analysis methods in studies by Oladipupo and Oladipo (2022); Awwaliyah et al. (2019); Veprev (2015), and investment potential was investigated by Drapkin and Dubinina (2020); Jumaev et al. (2019); Kosinova et al. (2014). Meanwhile, household financial potential has been examined in the works of Andrejovská and Buleca (2016); Ang (2008); Konyarova (2005).

Regardless of the availability of various publications on this subject matter, no study was identified where regression analysis was applied to credit potential factors in a regional context. To address the gap, a method that considers the territorial peculiarities of the credit component, specifically examining the level of credit distribution among the population and organizations, as well as the loan-to-deposit ratio was proposed in the current study. Theoretical aspects of this topic have been explored in works by Verbinenko and Badylevich (2018); Crocco et al. (2014).

The literature review conducted showed a lack of studies that analyze financial potential from a systematic perspective, particularly concerning its specific components. Therefore, the scientific novelty of this study lies in its examination of the statistical significance of individual factors associated with the four key components of financial potential, namely budgetary, investment, credit, and household financial capacities. This investigation was carried out with the aim of filling a very important gap by investigating the statistical significance of credit potential factors, which had been largely overlooked in previous studies.

The article is expected to contribute significantly to the existing body of scientific discourse on the subject matter by addressing the aforementioned gaps. Identifying relevant factors and understanding respective correlation with the dependent variable enables a more precise calculation of the financial potential of a region. These calculations are instrumental in assessing the current state of a region by evaluating its resilience and forecasting its capacity for economic acceleration as well as improved financial performance.

The identified factors can also serve as a basis for independent regional analyses. For instance, examining the current values of a region alongside its dynamic changes can help identify problematic indicators, which would invariably facilitate the monitoring of financial and economic developments. This method not only tracks fluctuations over time but also emphasizes deficiencies in financial factors, enabling the implementation of targeted corrective measures. Furthermore, the values of the introduced variables can serve as key monitoring indicators for financial regulators, considering the direct influence each of the variables has on financial potential and respective roles as determinants of regional economic growth (GRP). To achieve the objectives of this study, a comprehensive literature review was conducted, potential variables for analysis were identified, relevant data was collected, and regression modeling was adopted and performed.

In line with a previous exploration, regression analysis was adopted to examine the relationships between the dependent and independent variables, as well as to test the formulated hypotheses (Rytova and Skhvediani, 2021). In analyzing panel data, three types of regression models were developed namely the pooled Ordinary Least Squares (OLS) model, Fixed Effects Model (FEM), and Random Effects Model (REM). Generally, a linear regression model for panel data, consisting of explanatory variables, can be expressed as follows (Equation 1).

where yit is the dependent variable, Xk,it is the explanatory variable matrix with k columns and N = i × t rows,

FEM (Equation 2) examines the relationship between predictors and the dependent variables in each region. As stated in a previous study, when applying a regression with fixed effects, it is assumed that certain regional factors may influence both the dependent and independent variables (Sheytanova, 2015). Therefore, controlling for these factors is essential to ensure the reliability of the analysis. By adopting fixed effects, the influence of time-invariant characteristics was successfully eliminated from the independent variables, allowing for a more precise evaluation of the true impact of each variable in the regression model.

where i is specific for each region, which can explain correlations between observations that are not caused by dynamic trends over time.

In REM (Equation 3), variations between entities are typically assumed to be random and uncorrelated with the explanatory variables in the model, distinguishing it from FEM. In REM, error terms are also assumed to be uncorrelated with the predictors, which allows for the inclusion of stationary (time-independent) variables as explanatory factors.

where uit is the region-specific random effect, and is the country-specific random effect.

According to a previous exploration, the preferred models for analyzing panel data are FEM and REM, while the pooled OLS model is commonly used for comparison (Jigeer et al., 2023). The selection of the most appropriate model is determined through statistical hypothesis testing.

During the course of this study, data were analyzed for 82 out of 89 regions of the Russian Federation for the period from 2013 to 2022. The set of data obtained from the Nenetsky Autonomous Okrug was considered part of the Arkhangelsk Region and analyzed accordingly. Similarly, the Khanty-Mansiysk Autonomous Okrug and the Yamalo-Nenets Autonomous Okrug were analyzed as part of the Tyumen Region. It is important to establish that regions adjoined with the Russian Federation after 2022 were excluded from the study due to the availability of insufficient statistical data. Additionally, territorial changes led to the inclusion of missing values for the Republic of Crimea and Sevastopol in the dataset for the period from 2009 to 2013, but considering the large sample size, the impact of these omissions on the model was minimal (Rosstat, 2024).

List of the variables used in the modelling process is presented in the Table 1. The Gross regional product (GRP) per capita has been selected as the dependent variable, as it is closely interrelated with financial potential of the region and is used as a result in empirical models of economic growth.

Based on existing literature and an understanding of economic processes, the following hypotheses were formulated, with respective rationales explained.

Table 1 Variables considered for modeling

H1: A high coefficient of budget spending coverage with own income shows financial stability, fiscal responsibility, reduced dependence on external sources, and efficient resource allocation. These factors positively influence economic growth.

H2: A government that efficiently manages its budget and funds its spendings is more probable to develop a conducive environment for economic growth (Afonso and Alegre, 2011). This is because a well-managed government budget fosters a stable economic climate, which, in turn, can lead to higher GRP per capita (Victorova et al., 2024).

H3: External financing can provide essential funds for investment in infrastructure, technology, and other sectors that stimulate economic growth (Do and Levchenko, 2007). This may lead to increased productivity, job creation, and entire economic development, thereby contributing significantly to higher GRP per capita (Tanina et al., 2023, Arteeva et al., 2022).

H4: Investment in fixed assets, such as infrastructure, equipment, and real estate, serves as a key driver of economic growth by enhancing productivity and efficiency. When entities invest in self-development, a positive multiplier effect occurs, benefiting the broader economy (Musnitskaya and Kolotova, 2021). Increased business activity can spur growth in related industries, supply chains, and service sectors, further increasing GRP per capita.

H5: Strong financial performance in businesses signifies dynamic economic activity and innovation. These factors contribute to the entire economic growth, which positively impacts GRP per capita.

H6: The corporate debt load per capita can positively influence GRP per capita by financing business operations and expansion. Investments supported by debt, such as infrastructure development, job creation, and innovation, enhance economic activity and drive growth.

H7: Individual debt can serve as a source of household spending. A moderate level of personal debt enhances purchasing power and can support individual investments, contributing to economic development and GRP per capita growth.

H8: A high loan-to-deposit ratio may signify that financial institutions are lending out more money than they hold in deposits, potentially signaling financial instability and increased credit risk (Malede, 2014). However, a low loan-to-deposit ratio may imply financial institutions possess excess liquidity that are being underutilized. This form of liquidity issue in the banking sector can negatively impact economic growth and GRP expansion.

H9: Consumer spending per capita plays a very important role in driving economic growth and influencing GRP per capita. As consumers increase respective spendings on goods and services, businesses respond by expanding operations, availing job opportunities, and generating income. This dynamic foster a more prosperous and resilient regional economy.

H10: Savings serve as a critical source of investment, often deposited into financial institutions that, in turn, provide funding for businesses and government projects, as well as drive economic growth. Additionally, a higher average savings rate enhances financial stability in a region, developing a buffer against economic downturns.

H11: Employment levels are a key determinant of regional economic performance and can positively influence GRP per capita. By fostering job creation, increasing household incomes, stimulating consumer spending, attracting investments, and promoting innovation, a comprehensive labor market contributes to a dynamic and thriving economy. The methodology adopted in this study is presented in Figure 1.

The results obtained from the regression analysis conducted, as presented in Table 2, show that 9 out of the 11 observed factors were statistically significant and influenced GRP per capita. The security ratio and average saving propensity were excluded from the model due to high multicollinearity with other variables. This suggested a strong interdependence among factors, which could negatively affect the model's reliability. Accordingly, Variance Inflation Factor (VIF) of the revised model remained below 10, reflecting the absence of multicollinearity.

The level of employment was further excluded due to its statistical insignificance at the 95% confidence level. An F-test was conducted to assess the collective significance of the independent variables in explaining variations in the dependent variable (Ratnikova and Furmanov, 2014). Furthermore, the results showed how the p-value of the F-statistic was above the 5% threshold, leading to the failure to reject the null hypothesis that all coefficients were equal to zero. This suggested that, relative to other selected factors, the level of employment did not have a significant effect on GRP per capita.

A comparison of OLS, FEM, and REM models was subsequently performed to determine which was preferable. First, OLS and FEM were compared with each other using Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC) (Kassambara, 2018). Based on the observations made, FEM had the lowest AIC and BIC scores, signifying the model as the better choice. Subsequently, FEM and REM were compared using the Hausman specification test. The test produced a p-value significantly lower than the selected significance level, leading to the rejection of the null hypothesis and confirming that the fixed-effects estimator was more consistent. Based on these insights, FEM was identified as the most appropriate model for this analysis.

Table 2 Results of Regression analysis

***, **, * showed significant values at 1%, 5%, and 10% levels (Values represent the maximum acceptable chance of incorrectly rejecting the null hypothesis if the null hypothesis is, in fact, true), with standard errors stated in parenthesis.

The adjusted R-squared value of the model was observed to be high (96%), reflecting that the selected factors were capable of explaining a significant portion of the variation in the dependent variable. This suggested the presence of a strong explanatory power of the model. Accordingly, all variables retained in the model were statistically significant. The p-values in F-test were below 1%, leading to the rejection of the null hypothesis that all regression coefficients were equal to zero. This confirmed the entire significance of the model, which can be expressed by Equation 4.

The results obtained from this study showed that variables from all four groups of financial potential, namely budget, investment, credit, and household potentials, significantly influenced GRP per capita. Specifically, the coefficient of covering budget expenses with own income, external financing ratio, investment in fixed assets per capita, financial performance ratio of organizations per capita, level of corporate debt load, level of individual debt load, and consumer spending per capita all had a positive correlation with GRP per capita. This implied that a 1% increase in these variables leads to a corresponding percentage growth in GRP per capita, as determined by the estimated coefficients. Among these, consumer spending per capita was observed to be the most influential factor in the model. However, the loans-to-deposits ratio negatively correlated with GRP per capita. Specifically, a 1% increase in the loans-to-deposits ratio will lead to a 0.2% decrease in GRP per capita. A comparative analysis of these insights with those of previous works (Table 3) showed the consistency of the results with established publications on the relationship between GRP per capita and financial factors. Prior studies were observed to have primarily relied on OLS modeling, while this current study introduces a more comprehensive method by incorporating FEM and REM.

Table 3 Correspondence of the received results and previous results

Identifying these factors is not the final stage of the analysis but serves as an important step in confirming the relationships between the dependent variable, namely economic potential, and the independent variables. The obtained results provide a solid foundation for further analysis, enabling more precise calculations of financial potential.

Essentially, a systematic examination of financial potential factors at the regional level is instrumental in identifying problematic values in different regions (Shkarupeta et al., 2022). This method allows for tracking dynamic changes over time and uncovering deeper issues affecting economic development. It also facilitates the implementation of targeted improvement measures. Monitoring the outlined key factors is essential for both government agencies and financial institutions, as proper monitoring enables timely interventions to mitigate risks and enhance financial stability. The insights availed by this study invariably reinforce the importance of integrating identified factors into strategic planning, which will contribute to sustainable economic growth across regions in return.

In conclusion, this study successfully identified significant factors of financial potential alongside the influence of each factor on regional economic development, measured through GRP per capita. The relationships between these variables were also rigorously examined using regression analysis. Accordingly, the novelty of the current study is based on its comprehensive method, which considered various financial potential components including credit factors. Despite its contributions, the exploration acknowledged certain limitations. These limitations include the fact that the selected models did not capture the full complexity of financial interdependencies, but each effectively emphasized key patterns in regional financial development. The obtained results can be used in the further development of assessment methods, conducting economic analysis and forecasting, and formulating supportive measures at regional and national levels. Lastly, the investigation contributes to addressing pressing issues related to financial capacity and economic growth, while offering valuable insights for policymakers at the state, regional, and municipal governance. Explorations in this field are necessary to expand on the presented insight and enhance strategies for economic development.

This study is funded under the project “Development of a methodology and instrumental framework for analyzing and modeling the spatial socio-economic development of systems based on internal reserves in the context of digitalization” (FSEG-2023-0008).

Afonso, A & Alegre, JG 2011, ‘Economic growth and budgetary components: a panel assessment for the EU, Empirical Economics, vol. 41, pp. 703-723, https://doi.org/10.1007/s00181-010-0400-9

Andrejovská, A & Buleca, J 2016, ‘Regression analysis of factors influencing volume of households’ savings in the V4 countries’, Mediterranean Journal of Social Sciences, vol. 7, no. 1, pp. 213-222, https://doi.org/10.5901/mjss.2016.v7n1p213

Ang, JB 2008, ‘What are the mechanisms linking financial development and economic growth in Malaysia?’, Economic modelling, vol. 25, no. 1, pp. 38-53, https://doi.org/10.1016/j.econmod.2007.04.006

Arteeva, V, Sokol, I, Asanova, E & Ushakov, D 2022, ‘The impact of digitalization and infrastructure development on domestic tourism in Russia’, International Journal of Technology, vol. 13, no. 7, pp. 1495–1504, https://doi.org/10.14716/ijtech.v13i7.6197

Ataeva, AG 2010, ‘The concept and signs of the financial potential of a municipal entity’, Bulletin of Samara State University of Economics, vol. 7, no. 69, pp. 5-10

Avduevskaya, E, Nadezhina, O & Zaborovskaia, O 2023, ‘The impact of socio-economic factors on the regional economic security indicator’, International Journal of Technology, vol. 14, no. 8, pp. 1706-1716, https://10.14716/ijtech.v14i8.6829

Awwaliyah, NF, Agriyanto, R & Farida, DN 2019, ‘The effect of regional original income and balance funding on regional government financial performance’, Journal of Islamic Accounting and Finance Research–Vol, vol. 1, no. 1, https://10.21580/jiafr.2019.1.1.3745

Benoit, K 2011, ‘Linear regression models with logarithmic transformations’, London School of Economics, London, vol. 22, no. 1, pp. 23-36

Boldyreva, IA 2018, ‘5.2. Financial potential and financial infrastructure of regional development’, Audit and Financial Analysis, no. 2, pp. 177-184

Bulatova YI 2010, ‘Financial potential of the region: content and structure, Izvestiya SPbSEU, no. 5, pp 56-60

Chen, Y, Kumara, EK & Sivakumar, V 2021, ‘Invesitigation of finance industry on risk awareness model and digital economic growth’, Annals of Operations Research, pp. 1-22, https://10.1007/s10479-021-04287-7

Do, QT & Levchenko, AA 2007, ‘Comparative advantage, demand for external finance, and financial development’, Journal of Financial Economics, vol. 86, no. 3, pp. 796-834, https://10.2139/ssrn.898170

Drapkin, IM & Dubinina, EO 2020, ‘Econometric modelling of a region's potential to attract foreign direct investments’, Economy of Regions, p.31, https://10.17059/2020-1-23

Federal agency of government statistics of the Russian Federation (Rosstat) Available Online at: https://rosstat.gov.ru Accessed on 29.04.2024

Goridko, NP & Nizhegorodtsev, RM 2012, ‘Regressional modeling and forecasting of economic growth for Arkhangelsk region’, Regions economy, vol. 4, pp. 122-130, https://10.17059/2012-4-12

Gorshenina, EV 2019, ‘The economic potential of the region: Methodical and practical aspects of evaluation’, Proceedings of the International Scientific Conference ‘Far East Con’ (ISCFEC 2018), https://doi.org/10.2991/iscfec-18.2019.114

Jigeer, Shawuya & Ekaterina Koroleva 2023, ‘The determinants of profitability in the city commercial banks: Case of China’, Risks, vol. 11, p. 53, https://10.3390/risks11030053

Jones, CI & Vollrath, D 2013, Introduction to Economic Growth. W. W. Norton

Jumaev, NX, Rakhmonov, DA & Sulaymanov, SA 2019, ‘Ways to attract investment with assessment of investment potential of the regions’, International journal of economics, commerce and management, vol. 7, no. 2, pp.664-672, https://ijecm.co.uk/

Kassambara, A 2018, Machine learning essentials: Practical guide in R. Sthda, Oxford, p. 548

Konyarova, EK 2005, Management of reproduction of the financial potential of the region (on the example of the Udmurt Republic), Izhevsk State Technical University, p. 60

Kosinova, NN, Tolstel, MS & Chekalkina, AA 2014, ‘Comprehensive evaluation of investment potential’, Asian Social Science, vol. 10, no. 23, p. 231, https://10.5539/ass.v10n23p231

Malede, M 2014, ‘Determinants of commercial banks lending: evidence from Ethiopian commercial banks’, European Journal of Business and Management, vol. 6, no. 20, pp. 109-117

Markeeva, AS 2020, Study of the Impact of Regional Financial Infrastructure on Regional Investment Climate Indicators Moskva – 88 p

Musnitskaya, LGE & Kolotova, NS 2021, ‘Econometric analysis of investment in fixed assets in the Chelyabinsk region’, Journal of Computational and Engineering Mathematics, vol. 8, no. 4, pp. 3-8, https://10.14529/jcem210401

Oladipupo, OF & Oladipo, ON 2022, ‘The combine impact of tax and non-tax revenue in stimulating economic growth, mediating on the role of public sector financial management’, Italienisch, vol. 12, no. 1, pp. 448-456, https://doi.org/10.47363/JMSCM/2022(1)104

Ozili, PK & Iorember, PT 2023, ‘Financial stability and sustainable development’, International Journal of Finance & Economics, vol. 29, no. 3, pp. 2620-2646, https://doi.org/10.1002/ijfe.2803

Petropoulos, T, Thalassinos Y & Liapis K 2024, ‘Greek public sector’s efficient resource allocation: Key findings and policy management’, Journal of Risk and Financial Management , vol. 17, no. 2, p. 60, https://doi.org/10.3390/jrfm17020060

Qin, D 2024, ‘Factor study: Factors influencing GRP in various provinces of China’, Highlights in Business, Economics and Management, vol. 24, pp. 692-697, https://doi.org/10.54097/fsqv9p41

Ratnikova, T & Furmanov, K 2014, Analysis of Panel Data 2014, HSE Publishing House, Moscow, p. 375

Rogateniuk, EV 2022, ‘Financial potential of the region's development: theoretical aspect’, Economics of construction and natural resources management, vol. 4, no, 85, pp. 31-38

Rytova, EV & Skhvediani, AE 2021, Econometric modeling of socio-economic systems: textbook, SPb.: POLYTECHNIC-PRESS, 2021, - 333 ?

Sheytanova, T 2015, The accuracy of the Hausman Test in panel data: A Monte Carlo study, Master’s thesis, Örebro University School of Business, Örebro, Sweden

Shkarupeta, E, Babkin, A, Palash, S, Syshchikova, E & Babenyshev, S 2024, ‘Economic security management in regions with weak economies in the conditions of digital transformation’, International Journal of Technology, vol. 15, no. 4, pp. 1183-1193, https://doi.org/10.14716/ijtech.v15i4.6838

Tanina, A, Orel, A, Zaborovskaia, O & Tanin, E 2023, ‘Integral indicator assessment of municipalities sustainability in the leningrad region’, International Journal of Technology, vol. 14, no. 8, pp. 1694-1705, https://doi.org/10.14716/ijtech.v14i8.6835

Veprev AY 2015, ‘Multiple regression models, using in the analysis and forecasting, the calculation on the example of tax revenues to the Moscow budget, International Student Scientific Conference VII, pp. 5-15

Verbinenko, EA & Badylevich, RV 2018, ‘Credit potential of the region: essence, significance, assessment and management’, Fundamental Research, vol. 11, no. 2, pp. 195-200

Victorova, N, Vylkova, E, Naumov, V & Pokrovskaia, N 2024, ‘An evaluation of the state of the top-priority and socially important industries of russian regions: An analysis based on digital tax calculator data. International Journal of Technology, vol. 15, no. 4, pp. 732-742, https://doi.org/10.14716/ijtech.v15i3.6163

Wang, R & Tan, J 2021, ‘Exploring the coupling and forecasting of financial development, technological innovation, and economic growth’, Technological Forecasting and Social Change, vol. 163, p.120466, https://doi.org/10.1016/j.techfore.2020.120466

Yarullin, RR & Galimova, GA 2011, ‘Theoretical foundations of the financial potential of the region’, Modern Problems of Science and Education, vol. 6, pp. 209-209

Zakhidov, G 2024, ‘Economic indicators: tools for analyzing market trends and predicting future performance’, International Multidisciplinary Journal of Universal Scientific Prospectives, vol. 2, no. 3, pp. 23-29