Hybrid Cyber-Physical Stock Exchange Robot with Artificial Intelligence and Fuzzy Module

Corresponding email: tel9033176642@yahoo.com

Published at : 22 Sep 2025

Volume : IJtech

Vol 16, No 5 (2025)

DOI : https://doi.org/10.14716/ijtech.v16i5.7495

Lomakin, N, Angi, S, Kizim, A, Lomakin, I, Boriskina, T, Kosobokova, E, Kuzmina, A & Samsonova, E 2025, ’Hybrid cyber-physical stock exchange robot with artificial intelligence and fuzzy module’, International Journal of Technology, vol. 16, no. 5, pp. 1533-1548

| Nikolay Lomakin | Volgograd State Technical University, 400005, ave. V.I. Lenina, 28, Volgograd, Russia |

| Skhvediani Angi | Peter the Great St. Petersburg Polytechnic University, 195251, Polytechnicheskaya, 29, St.Petersburg, Russia |

| Alexey Kizim | Volgograd State Technical University, 400005, ave. V.I. Lenina, 28, Volgograd, Russia |

| Ivan Lomakin | Volgograd State Technical University, 400005, ave. V.I. Lenina, 28, Volgograd, Russia |

| Tatyana Boriskina | Volgograd State Technical University, 400005, ave. V.I. Lenina, 28, Volgograd, Russia |

| Ekaterina Kosobokova | Volgograd branch of REU named G.V. Plekhanov, 400005, st. Volgodonskaya, 13, Volgograd, Russia |

| Alena Kuzmina | Volgograd State Technical University, 400005, ave. V.I. Lenina, 28, Volgograd, Russia |

| Elena Samsonova | Volgograd State Technical University, 400005, ave. V.I. Lenina, 28, Volgograd, Russia |

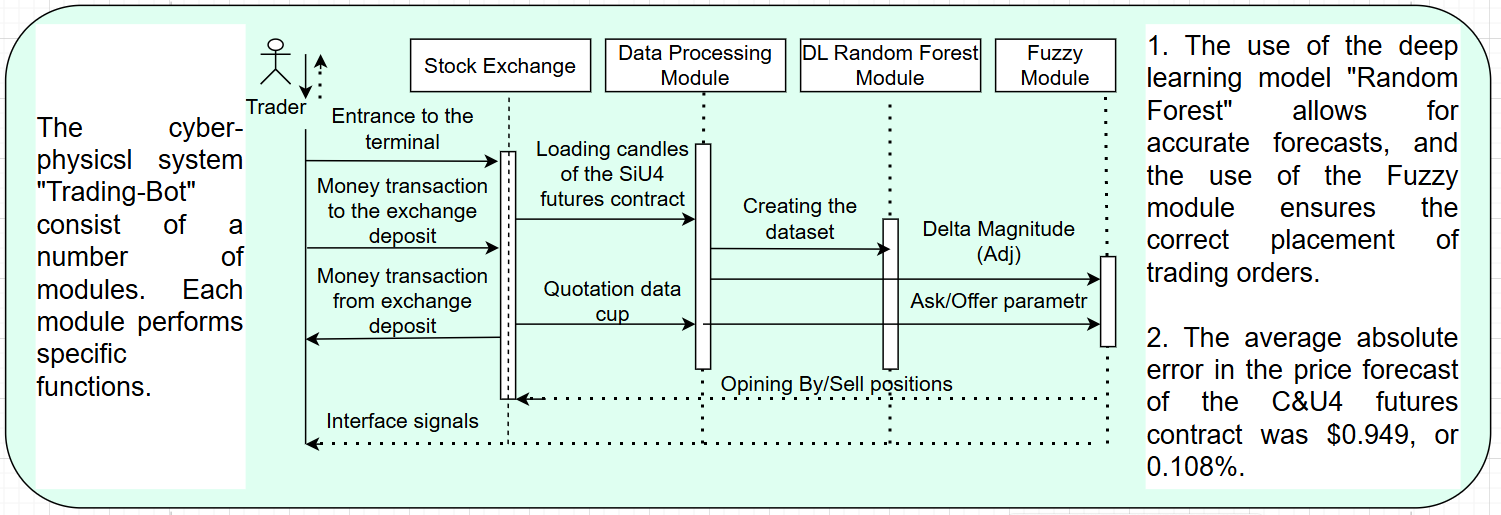

In modern conditions, the use of trading algorithms based on artificial intelligence, as well as mathematical algorithms, including fuzzy ones, which operate as a single system, which ensures the efficiency of trading operations, is very relevant. Despite a significant number of scientific papers on this topic, individual aspects have not been sufficiently studied, and there are some gaps that require additional research. The relevance lies in the fact that the algorithms of hybrid CP systems are increasingly used in exchange trading, increasing its efficiency. The scientific novelty lies in the fact that the authors proposed the simultaneous use of two algorithms in the trading bot: the deep learning model "Random Forest" (DL) and the fuzzy learning algorithm, which operate as a single system (GCFS). During the study, an exchange trading bot, a hybrid cyber-physical system, was formed. This study aims to develop a hybrid cyber-physical system (HCS) containing a DL model and a fuzzy algorithm. Methods used in the study: hybrid cyber-physical system, deep learning model, and fuzzy algorithm. The significant conclusion is that the goal has been achieved and the cyber-physical system has been successfully developed. One of the factors of the bot’s effective trading is the low error in asset price forecasting. For example, the average absolute error of the MCE does not exceed USD 0.9495 or 0.11%. Fuzzy provides profit, in our example $2.10 positive margin of $2.10, instead of a negative margin of $1.61, for 11 minutes of trading one contract.

Deep learning; Exchange robot; Fuzzy; Hybrid cyber-physical system; Price forecast; SiU4 futures

Abdel, KR, Abdelmoez, WM & Shoukry, A 2021, ‘A

synchronous deep reinforcement learning model for automated multi-stock

trading’, Progress in Artificial Intelligence, vol. 10, pp. 83–97, https://doi.org/10.1007/s13748-020-00225-z

Anton, SG & Nucu, AEA 2020, ‘Enterprise risk

management: A literature review and agenda for future research’, Journal of

Risk and Financial Management, vol. 13, no. 11, article 281, https://doi.org/10.3390/jrfm13110281

Aruna, DP & Rajat, B 2024, ‘Artificial intelligence

(AI) transforming the financial sector operations’, ESG, vol. 7, article

e01624, https://doi.org/10.37497/esg.v7iesg.1624

Azhikodan, AR, Bhat, AGK & Jadhav, MV 2019, ‘Stock

trading bot using deep reinforcement learning’, In: H Saini, R Sayal, A

Govardhan & R Buyya (eds), Innovations in computer science and

engineering, Lecture Notes in Networks and Systems, vol. 32, pp. 41-49, https://doi.org/10.1007/978-981-10-8201-6_5

Berawi, MA 2020, ‘Managing artificial intelligence

technology for added value’, International Journal of Technology, vol.

11, no. 1, pp. 1–4, https://doi.org/10.14716/ijtech.v11i1.3889

Biswas, A, Mondal, KK & Guha, RD 2023, ‘A study of

smart evolution on AI-based cyber-physical system using blockchain techniques’,

In: B Bhushan, AK Sangaiah & TN Nguyen (eds), AI models for

blockchain-based intelligent networks in IoT systems, Engineering

Cyber-Physical Systems and Critical Infrastructures, vol. 6, pp. 327-346, https://doi.org/10.1007/978-3-031-31952-5_14

Cao, SS, Jiang, W, Lei, LG & Zhou, QC 2024, ‘Applied

AI for finance and accounting: Alternative data and opportunities’, Pacific-Basin

Finance Journal, vol. 84, article 102307, https://doi.org/10.1016/j.pacfin.2024.102307

Chen, J, Meng, W, Chen, Y & Zhou, W 2024, ‘To be an

eco- and tech-friendly society: Impact research of green finance on AI

innovation’, Journal of Cleaner Production, vol. 466, article 142900, https://doi.org/10.1016/j.jclepro.2024.142900

Chishti, MZ, Dogan, E & Binsaeed, RH 2024, ‘Can

artificial intelligence and green finance affect economic cycles?’, Technological

Forecasting and Social Change, vol. 209, article 123740, https://doi.org/10.1016/j.techfore.2024.123740

Chuen, ALF, How, KW, Han, PY & Yen, YH 2024,

‘Revolutionizing signature recognition: A contactless method with convolutional

recurrent neural networks’, International Journal of Technology, vol.

15, no. 4, pp. 1102–1117, https://doi.org/10.14716/ijtech.v15i4.6744

Deng, X, Liu, C & Ong, SE 2023, ‘Shadow bank,

risk-taking, and real estate financing: Evidence from the online loan market’, The

Journal of Real Estate Finance and Economics, vol. 68, no. 1, pp. 1-27, https://doi.org/10.1007/s11146-022-09936-7

Dhyani, A, Bisht, D, Kathuria, S, Gehlot, A, Chhabra, G

& Tiwari, P 2024, ‘Cyber physical system role in stock market’, In: 2023

IEEE Devices for Integrated Circuit (DevIC), pp. 203–206, https://doi.org/10.1109/DevIC57758.2023.10135047

Dimirovski, GM 2005, ‘Fuzzy-petri-net reasoning

supervisory controller and estimating states of Markov chain models’, Computing

and Informatics, vol. 24, no. 6, pp. 563–576

Fama, EF & MacBeth, JD 2025, ‘Risk, return and equilibrium:

Empirical tests’, Journal of Political Economy, vol. 81, no. 3, pp.

607–636, https://doi.org/10.1086/260061

Franklin, A, Qian, Y, Tu, G & Yu, F 2019, ‘Entrusted

loans: A close look at China's shadow banking system’, Journal of Financial

Economics, vol. 133, no. 1, pp. 18–41, https://doi.org/10.1016/j.jfineco.2019.01.006

Huang, JZ & Huang, Z 2020, ‘Testing moving average

trading strategies on ETFs’, Journal of Empirical Finance, vol. 57, pp.

16–32, https://doi.org/10.1016/j.jempfin.2019.10.002

Kang, Z, Zhao, Y & Kim, D 2023, ‘Investigation of

enterprise economic management model based on fuzzy logic algorithm’, Heliyon,

vol. 9, no. 8, article e19016, https://doi.org/10.1016/j.heliyon.2023.e19016

Kostas, S, Dimitrios, S & Elias, K 2017, Cyber-physical

systems, CRC Press, New York, https://doi.org/10.1201/9781003337805

Kuang, M, Kuang, D, Rasool, Z, Saleem, HMNS & Ullah,

MI 2024, ‘From bytes to sustainability: Asymmetric nexus between industrial

artificial intelligence and green finance in advanced industrial AI nations’, Borsa

Istanbul Review, vol. 24, no. 5, pp. 886–897, https://doi.org/10.1016/j.bir.2024.03.010

Lomakin, N, Maramygin, M, Kosobokova, E, Bestuzheva, L,

Yurova, O, Polozhentsev, A & Lomakin, I 2024, ‘Development of a

cyber-physical system in Python and QLua for trading on the QUIK platform on

MoEx in line with the digitalization of the economy’, The World Economics,

vol. 3, pp. 214–231, https://doi.org/10.33920/vne-04-2403-06

Lomakin, NI 2022, ‘Exchange trading Quik-bot’,

Certificate of registration of the computer program no. 2022662398, 04 July

2022, Russian Federation, viewed 8 December 2024, https://www.elibrary.ru/download/elibrary_49197775_29449593.PDF

Lu, Y & Yang, J 2024, ‘Quantum financing system: A

survey on quantum algorithms, potential scenarios and open research issues’, Journal

of Industrial Information Integration, vol. 41, article 100663, https://doi.org/10.1016/j.jii.2024.100663

Meng, J, Ye, Z & Wang, Y 2024, ‘Financing and

investing in sustainable infrastructure: A review and research agenda’, Sustainable

Futures, vol. 8, article 100312, https://doi.org/10.1016/j.sftr.2024.100312

Naidenko, AV, Polkovnikov, AA & Lomakin, NI 2019,

‘Software package for automated decision-making on the QUIK trading platform’,

Certificate of state registration of the computer program no. 2019661095, 19

August 2019, Volgograd State University, viewed 8 December 2024, https://www.elibrary.ru/download/elibrary_39321186_22245309.PDF

Nickolaevich, LI, Igorevna, GI & Grigorievich, RD

2020, ‘Generating a multi-timeframe trading strategy based on three exponential

moving averages and a stochastic oscillator’, International Journal of

Technology, vol. 11, no. 6, pp. 1233–1243, https://doi.org/10.14716/ijtech.v11i6.4445

Pedro, HJN 2022, Cyber-physical systems: Theory,

methodology, and applications, Wiley, , https://doi.org/10.1002/9781119785194

Petrov, S, Yashin, S, Yashina, N, Kashina, O,

Pronchatova-Rubtsova, N & Kravchenko, V 2021, ‘Digital techniques share

price modeling based on a time-varying Walrasian equilibrium under exchange

processes in the financial market’, International Journal of Technology,

vol. 12, no. 7, pp. 1557–1567, https://doi.org/10.14716/ijtech.v12i7.5387

Prasetya, B, Yopi & Tampubolon, BD 2023, ‘Role of

risk management and standardization for supporting innovation in new normal

based on lessons learned during pandemic COVID-19’, International Journal of

Technology, vol. 14, no. 5, pp. 954–971, https://doi.org/10.14716/ijtech.v14i5.5299

Ruiz-Vanoye, J, Díaz-Parra, O, Fuentes-Penna, A,

Simancas-Acevedo, E & Barrera-Cámara, RA 2024, ‘Artificial intelligences in

industrial robots: A framework based on Gardner’s multiple intelligences’, International

Journal of Combinatorial Optimization Problems and Informatics, vol. 15,

no. 4, pp. 118–129, https://doi.org/10.61467/2007.1558.2024.v15i4.536

Sarthak, S, Vedank, GL, Sarthak, G & Taneja, HC 2022, ‘Deep reinforcement learning models

for automated stock trading’, Advanced Production and Industrial Engineering,

vol. 27, pp. 175–180, https://doi.org/10.3233/ATDE220738

Šeho, M, Bacha, OI & Smolo, E 2024, ‘Bank financing

diversification, market structure, and stability in a dual-banking system’, Pacific-Basin

Finance Journal, vol. 86, article 102461, https://doi.org/10.1016/j.pacfin.2024.102461

Shkarupeta, E, Babkin, A, Palash, S, Syshchikova, E &

Babenyshev, S 2024, ‘Economic security management in regions with weak

economies in the conditions of digital transformation’, International

Journal of Technology, vol. 15, no. 4, pp. 1183–1193, https://doi.org/10.14716/ijtech.v15i4.6838

Shvedin, BYa 2010, ‘Ontologiya predpriyatiya: opytnyj

podhod’ (Ontology of the enterprise: an experiential approach), LENAND,

Moscow, https://rusneb.ru/catalog/000199_000009_004709572/

Siripath, N, Suranuntchai, S & Sucharitpwatskul, S

2024, ‘Modeling dynamic recrystallization kinetics in BS 080M46 medium carbon

steel: Experimental verification and finite element simulation’, International

Journal of Technology, vol. 15, no. 5, pp. 1292–1307, https://doi.org/10.14716/ijtech.v15i5.6770

Stephan, B 2019, ‘Artificial intelligence (AI) in the

financial sector—potential and public strategies’, Frontiers in Artificial

Intelligence, vol. 2, article 16, https://doi.org/10.3389/frai.2019.00016

Sushkov, VM, Leonov, PY, Nadezhina, OS & Blagova, IY

2023, ‘Integrating data mining techniques for fraud detection in financial

control processes’, International Journal of Technology, vol. 14, no. 8,

pp. 1675–1684, https://doi.org/10.14716/ijtech.v14i8.6830

Villaverde, L & Maneetham, D 2024, ‘Kinematic and

parametric modeling of 6DOF industrial welding robot design and

implementation’, International Journal of Technology, vol. 15, no. 4,

pp. 1056–1070, https://doi.org/10.14716/ijtech.v15i4.6559

Whulanza, Y, Kusrini, E, Sangaiah, AK, Hermansyah, H,

Sahlan, M, Asvial, M, Harwahyu, R & Fitri, IR 2024, ‘Bridging human and

machine cognition: Advances in brain-machine interface and reverse engineering

the brain’, International Journal of Technology, vol. 15, no. 5, pp.

1194–1202, https://doi.org/10.14716/ijtech.v15i5.7297

Xu, Q, Wang, L, Jiang, C & Zhang, X 2019, ‘A novel

UMIDAS-SVQR model with mixed frequency investor sentiment for predicting stock

market volatility’, Expert Systems with Applications, vol. 132, pp.

12-27. https://doi.org/10.1016/j.eswa.2019.04.066

Yashina, N, Kashina, O, Yashin, S, Pronchatova-Rubtsova,

N & Khorosheva, I 2022, ‘Digital methods of technical analysis for

diagnosis of crisis phenomena in the financial market’, International

Journal of Technology, vol. 13, no. 7, pp. 1403-1411, https://doi.org/10.14716/ijtech.v13i7.6187

Zeng, M & Zhang, W 2024, ‘Green finance: The catalyst

for artificial intelligence and energy efficiency in Chinese urban sustainable

development’, Energy Economics, vol. 139, article 107883, https://doi.org/10.25904/1912/5205