The Role of Digital Technologies in Capital Market Development: A Pathway to Economic Growth in Developing Countries

Corresponding email: rodion_dm@mail.ru

Published at : 25 Mar 2025

Volume : IJtech

Vol 16, No 2 (2025)

DOI : https://doi.org/10.14716/ijtech.v16i2.7421

Sandoyan, E, Rodionov, D, Voskanyan, M & Galstyan, A 2025, ‘The role of digital technologies in capital market development: a pathway to economic growth in developing countries’, International Journal of Technology, vol. 16, no. 2, pp. 573-584

| Edward Sandoyan | Russian-Armenian University, H. Emin 123, 0054, Yerevan, Armenia |

| Dmitrii Rodionov | Peter the Great St. Petersburg Polytechnic University, Novorossiyskaya street, 50, St. Petersburg, 194021, Russian Federation |

| Mariam Voskanyan | Russian-Armenian University, H. Emin 123, 0054, Yerevan, Armenia |

| Ani Galstyan | Russian-Armenian University, H. Emin 123, 0054, Yerevan, Armenia |

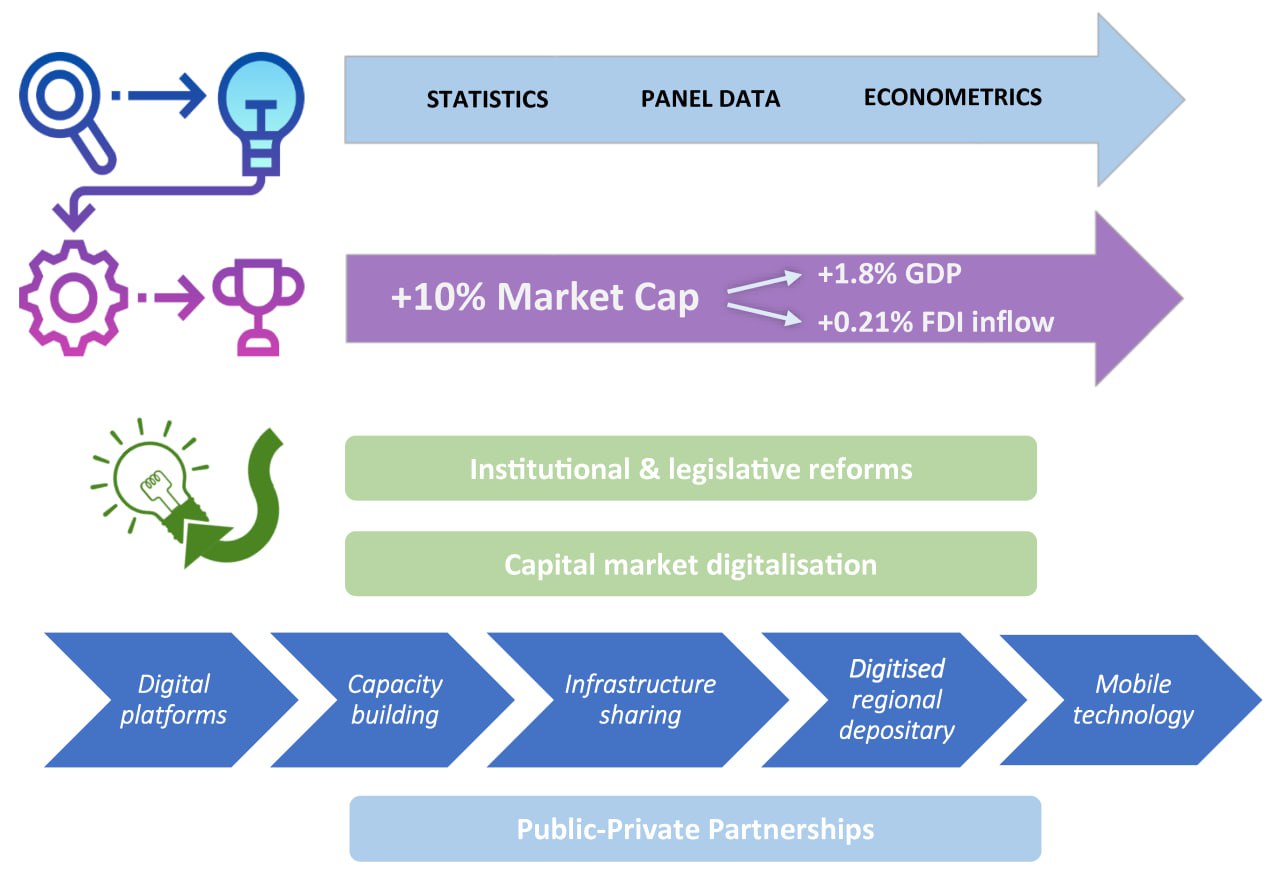

Digital technologies are important in developing capital markets in modern economic realities. Capital markets also have an essential role and weight in financial systems and can stimulate economic growth, investment, and savings in the country. Therefore, this research aimed to evaluate the causal relationship between market capitalization and economic growth in 27 developing countries, focusing on the role of regional integration and digitalisation. The hypothesis is that developing countries should focus on improving capital markets through regional integration and digitalization to stimulate economic growth. Quantitative data was used and based on the research results policy recommendations were developed. The research adopted a mixed method, including statistical and econometric analysis. The statistical analysis was carried out using graphical representations, deduction, and logical assumptions, while the econometric analysis was based on a panel data regression framework. The results showed that the weak development of the capital market due to poor digitalization in developing countries with small open economies had a significant negative effect on the investment environment and economic growth. Furthermore, a 10% increase in market capitalisation leads to a 1.8% and 0.21% increase in GDP and a 0.21% increase in GDP and FDI inflow, respectively. Recommendations on a complex institutional reform of the sector have been developed to eliminate possible obstacles to financial integration in the following directions, including institutional, legislative, and technical issues related to digital technologies. Implementation of public-private partnerships was also recommended as the best solution for overcoming financial barriers implementing digital technologies and developing capital markets in resource-constrained countries.

Capital market; Developing countries; Digitalisation; Economic growth

Globalisation and digitalisation of financial markets are the most

critical trends in global economic development in recent decades (Batten et al.,

2023; Na and Kim, 2022; Behera, 2021). Capital markets also have an

essential role and weight in modern financial systems. Stock markets stimulate

economic growth, investment, and savings in the country (Nneka et al., 2022;

Samargandi et al., 2020). According to academic literature, an increase

in stock prices leads to a simultaneous increase in individual portfolios,

resulting in more consumption or savings (Degiannakis, 2022; Pradhan et al., 2019).

The integration of capital markets enables companies to access more funding and

sometimes competitive capital markets, thereby increasing economic development

in the country. However, there is a need to have a high level of digitalisation

in the integration of capital markets to avoid technical issues (Shkarupeta et al.,

2024; Babkin et al. 2022; Grishunin et al. 2022).

Research on the relationship between capital market development and economic

growth has gained the attention of economists for the past decades (Thaddeus et al.,

2022; Yemelyanova, 2021; Nathaniel et al., 2020). There is no common

opinion about the issue under discussion as the academic literature provides

ambiguous results on the causal relationship under review. Some research showed

no significant relationship between the stock market and economic growth (Nathaniel et al.,

2020; Gulay, 2019), while others found a negative (Setiawan et al.,

2021; Kapaya, 2020) or a positive influence (Bhattarai et al.,

2021; Grbic, 2021).

The academic literature on the relationship between capital markets

and economic growth can be divided into three categories. The first category

includes research that provides evidence about the positive effect of capital

markets on economic growth, through several major factors, namely market

capitalization and capital mobility, as well as foreign direct and portfolio investments

(Ji, 2010).

Based on the analyses of relevant data from 1989Q1 to 2012Q4 and using the

Global Vector Autoregressive (GVAR) framework, Samargandi et al. (2020) concluded

that there was a strong positive influence of equity market and market

capitalization on economic growth in BRICS economies. Similarly, Mcgowan (2008) suggested

that a well-developed capital market facilitates allocation to an economy for

growth and development, as well as provides successful entrepreneurs with the

financing needed for corporate development. Guesmi et al. (2014) also

research the regional integration of the Indonesian capital market and

concluded that the differentiation of market assets (diversification) provides

significant profits. The development of capital market integration also expands

the choice of investors and companies in need of financing, thereby leading to

higher economic growth while reducing dependence on bank loans (CMUR, 2015).

The capital market plays an important role in providing liquidity to

investors (Debata,

2021), enabling easy and fast buying and selling of securities, thereby

promoting market investment. The ability to trade securities facilitates the

flow of funds between investors and businesses, enabling companies to raise

capital quickly and efficiently. The capital market also promotes corporate

governance and transparency (Ye et al., 2022). Listed companies are required to

follow strict reporting requirements and publish financial results regularly.

This promotes accountability and transparency, which is important to maintain

investor confidence and attract new investment. By promoting better corporate

governance, the capital market also helps reduce the risk of financial scandals

and corporate failures.

The development of the capital market can lead to better economic

competitiveness in individual economies through the promotion of innovation and

entrepreneurship (Bae et al., 2021). Companies issue equity capital, which provides

the necessary funds to invest in research and development. This can lead to the

development of new products, technologies, and services, stimulating economic

growth. Another way capital markets can stimulate economic growth is through

international trade and investment (Silva et al., 2023; Bermejo et al., 2020).

Companies receive funding from investors in other countries, thereby

stimulating international trade and investment, as well as accelerating

economic activity and growth.

Financial integration also has a significant influence on financial

stability, by contributing to the ability to absorb shocks and promote

development. However, in a world endowed with high capital mobility, close

financial ties can increase the risk of cross-border financial

"contagion" (Ulyah et al., 2023; Yu et al., 2012).

Based on panel data analysis of 36 countries in Africa from 1980 to

2010, Ngare

et al. (2014) reported that stock market development had a strong

positive influence on economic growth, particularly in small developing

countries. Moreover, the stock market development leads to faster economic

growth in countries with lower corruption levels.

The literature review shows that the capital market is important to

economic growth and development. This provides a platform for businesses and

individuals to access financing, and promote corporate governance and

transparency, as well as international trade and investment. By providing

businesses with the needed capital to expand and innovate, the capital market

helps spur economic growth and improve the standard of living for individuals

and societies worldwide.

The second category of academic literature on the topic under

discussion argued that capital markets negatively influence economic growth (Setiawan et al.,

2021; Kapaya, 2020; Asteriou and Spanos, 2019). Meanwhile, the third

category showed no significant influence between these two macroeconomic

concepts (Nathaniel

et al. 2020; Gulay, 2019; Pan and Mishra, 2018).

Pan and Mishra

(2018) studied the relationship

between economic growth and the stock market in China using an Autoregressive

distributed lag (ARDL) model to investigate. The results showed no evidence of

the influence of stock market development on the real economy in the short run.

Asteriou and

Spanos (2019) also examined the influence of financial development on

the economic activity in the European Union from 1990 to 2016 and concluded

that after the global financial crisis of 2008, financial development hindered

economic activity.

The integration of financial markets is an active topic of debate,

especially in developing and transition economies. Despite the positive

effects, capital markets remain underdeveloped, usually due to structural

constraints. Limited revenues and the small size of the private sector can lead

to a shortage of investors and issuers. However, capital market governance

includes huge initial and operational costs for both regulators and

participants. This is possible for countries with limited capacity and small

markets. Relevant authorities are needed to create and manage regulatory legal

frameworks and trading platforms. Similarly, issuers need to go through certain

stages for listing and conduct more thorough and transparent financial

reporting afterward. Empirical research by Eichengrin and Luengnarumitchai (2004)

showed that there was a minimum efficient size of the stock market because

larger trading volumes and issuance were more profitable.

Integrated capital markets will allow for the spread of savings

across the region, cost and information sharing among market participants, and

risk differentiation. Furthermore, there will be enhanced competition and

innovation, expanded choice of financial products offered to regional and

foreign investors, and deepened integration into the global economy due to an

increase in the attractiveness of markets (MFW4A, 2007; Irving, 2005). The

role of digital technologies and regional integration as a primary driver of

capital market development has not been thoroughly explored. Therefore, this

research attempted to bridge this gap by focusing on developing countries.

The current research aimed to

evaluate the causal relationship between market capitalization and economic

growth in 27 developing countries focusing on the role of regional integration

and digitalisation. The hypothesis is that developing countries

should focus on developing capital markets through regional integration and

digitalization to stimulate economic growth. Based on the research results,

policy recommendations were developed.

The research adopted a mixed method by analysing

quantitative data using statistical and econometric analysis. The statistical

analysis was carried out using the methods of graphical analysis, deduction,

and logical assumptions. The

secondary data was collected from the World Bank database.

There is strong academic

evidence that the panel data framework is the most suitable method to estimate

the relationship between economic indicators through time in a regional

perspective (Jandhana and Agustini, 2024; Ngare et al., 2014). This method has

been used by research to obtain robust results that will hold true for more

than one country in a given period (Fuente-Mella et al. 2021; Musa et al., 2021).

The panel data method is also commonly used for estimating the determinants of

economic growth. Dewan and Hussein (2001) examined the determinants of economic

growth using the panel data on 41 middle-income economies. The authors built

random and fixed effects panel data models to estimate the coefficients. Tiwari and Mutascu

(2011) also examined the influence of foreign direct investments (FDI) on economic growth in 23 Asian countries from

1986 to 2008 using the panel data method and the random effects model. Olamide et al.

(2022) investigated the effect of exchange rate

and inflation on economic growth in SADC countries based on the dynamic panel

method. Furthermore, Zardoub and Sboui (2020) used the panel data method

to examine the relationship between economic growth, FDI, and

remittances.

This research developed

two-panel regression models to identify the effect of market

capitalization on economic growth and foreign direct investments (the FDI to

GDP ratio was used) from 2011 to 2019. The crisis year

2020 was not considered to obtain a more accurate average picture. The sample includes data on market

capitalization, GDP, and FDI from 27 developing countries, including Argentina,

Bangladesh, Bermudas, China, Colombia, Costa Rica, Cote d'Ivoire, Egypt, India,

Indonesia, Iran, Jordan, Kazakhstan, Lebanon, Malaysia, Mauritius, Mexico,

Morocco, Nigeria, Peru, Philippines, Russia, Sri Lanka, Thailand, Tunisia,

Turkey, Vietnam. The countries were selected based on the level of economic

development (criteria: developing country), market capitalization (criteria:

from very low to very high), and data availability (criteria: no missing data).

Data were subjected to primary statistical processing using the first

differences method to ensure that all time series were stationary, which was

confirmed using unit root tests. The econometric analysis was conducted using the

Eviews 10 econometric package and the regression model (1) is as follows:

where i = 1, …, N represents the countries included

in the model,

t = 1, …, T represents

the periods used for the analysis,

represents a vector of

time-varying explanatory variables of market capitalization in the selected 27

developing countries

is the model's error term.

Considering that the data sample has all available years, the models'

panels were balanced, with 243 observations.

The regression model (2) is as follows:

where i = 1,

…, N represents the countries included in the model,

t = 1, …, T represents periods used for the analysis,

represents a vector of

time-varying explanatory variables of market capitalization in the selected 27

developing countries,

is the model's dependent variable,

is the model's error term.

Figure 1 Time series analysis process.

3.1. Statistical analysis

In recent times, there is a fierce

competition between countries to attract FDI. However, the statistical analysis

shows that the majority of FDI (35-40%) continues to be directed to the US and

EU member states. Based on this point of view, financial markets contribute to economic growth through the capital

market, which facilitates the development of long-term investments, helps to

reduce risk, and provides liquidity for organizations. The capital market is

important for economic growth by attracting funds for new investments. The more

developed the capital market, the higher the flow of FDI to a given country. The trend of the positive influence of market capitalization on

investment attraction in selected developing countries is evident through the

scatter graph shown in Figure 2. Meanwhile, this relationship is much more

robust in developed countries.

Figure 2 The effect of market

capitalization on foreign direct investment in 1a. Selected developing

countries and 1b. selected developed countries over five years, 2015-2019

average.

The statistical analysis shows that the development and deepening of the

capital market increase market capitalisation, as well as have a positive influence on investments and

economic growth in selected developing countries. Malaysia, Thailand, India,

Philippines, and China, with the highest market capitalization, had the highest

and most stable average economic growth rates during the last five pre-crisis

years. Figure 3 shows the trend of the

positive influence of market capitalization on economic growth in the selected

developing countries. Meanwhile, this effect is much weaker in developed

countries, which are characterised by relatively lower economic growth rates

characterize developed countries.

Figure 3 The effect of market capitalization on economic growth in (a) selected

developing countries and (b) selected developed countries over five years,

2015-2019 average.

In summary, the statistical analysis showed that market capitalization had a positive effect on economic growth directly and through

attracting foreign direct investments. However, to get more valid grounds for

hypothesis testing the next stage of the current research consists of an

econometric analysis based on panel data.

3.2. The

role of the capital market in economic growth. Panel data analysis

A panel regression

analysis was carried out to identify the effect of market capitalization on economic growth in developing countries. The

sample includes data from 27 developing countries from 2011 to 2019, as shown

in section 2.

There are three

possible submodels for estimating the coefficients of the panel data model

presented in section 2, depending on the nature of the individual residual,

namely Pooled-OLS, Fixed, and Random effect. Considering the results of the

performed tests, the Random effects sub-model was selected for estimating the

coefficients, as shown in Table 1.

Table 1 Model (1) panel data regression results

|

Variable |

Coeff. |

t stat. |

p-value |

|

MC |

0.018 |

3.01 |

0.0029 |

|

C |

3.07758 |

9.9356 |

0.00 |

|

R-squared |

0.068716 | ||

|

F-statistic |

1.910237 | ||

The model (1) with estimated coefficients is

as follows:

According to the

panel data analysis results for model (1), market capitalization is a

significant variable influencing economic growth in individual economies. The

value of the F-statistic shows that the model results are valid, while the

p-value suggests that the coefficients are significant at a 1% confidence

level. This shows that an increase in market capitalization by 10 percentage points can increase

the annual economic growth rate in developing countries by 1.8%.

3.3. The role of the capital market in stimulating

investments. Panel data analysis

A panel regression

analysis was carried out to identify the effect of market capitalization on attracting investments in developing

countries. The sample includes data from 27 developing countries from 2011 to

2019, as shown in section 2.

The Fixed Random

effects sub-model was selected for estimating the regression model coefficients

based on the result of the possible sub-models presented in the previous

section. The model estimation results are shown in Table 2.

Table 2 Model (2) panel data regression results

|

Variable |

Coeff. |

t stat. |

p-value |

|

MC |

0.0021 |

2.024 |

0.044 |

|

C |

2.3775 |

14.721 |

0.00 |

|

R-squared |

0.0029 | ||

|

F-statistic |

1.98056 |

||

The model (2) with

estimated coefficients is as follows:

According to the panel data analysis results

for model (2), market capitalization is a significant variable influencing the

inflow of FDI in individual economies. The value of the

F-statistic shows that the model results are valid, while the p-value suggests

significant coefficients at a 5% confidence level. This result shows that an

increase in market capitalization in developing countries by 10 percentage

points can increase the inflow of FDI to GDP ratio by 0.21%. In this context, the

research on the capital market integration issue in developing countries,

particularly with a small open economy and a low level of FDI inflow is quite

relevant to stimulating FDI inflow, economic growth, and competitiveness.

3.4. Capital

market development in developing countries

The deepening and

development of capital markets are essential for the economic growth and

stability of developing countries. To address this challenge, integrating the

capital market into larger, regional, or global markets was recommended. The

best choice would be a regional capital market integration considering the

existing economic relations of individual developing countries with more

developed partners. However, certain factors can hinder financial integration,

such as institutional, legislative, and technical issues, as well as the

macroeconomic environment.

The most severe institutional issue of many small

developing countries is the high economic concentration in different sectors,

especially the import of goods and services, allowing those with a dominant

position to influence the financial market strongly. In addition, the

unfavourable institutional and business environment hinders the economy's

attractiveness to foreign investors. This is evidenced by the annual ratings

carried out by international rating organizations, which can be eliminated

through some legislative changes. There is a need to legislatively obligate

that all banks (except subsidiaries of foreign banks) be open joint-stock

companies. At the same time, one shareholder and affiliated persons should not

have the right to own more than 4.99% of shares. The companies occupying a

natural dominant position, regardless of the field of economic activity should

also be legislatively obligated to become OJSCs. The requirement should also

extend to organizations with liabilities exceeding their funds. This

necessitates disclosure of substantial information, increases transparency, and

enables public participation in profit distribution. In addition, there is a

need to normalize the shares concentrated in the hands of one person. Regarding

the macroeconomic environment, significant challenges include the limited depth

of the financial market, the relatively small size of the capital market, and

the typically dominant role of banks within the financial market.

In general,

integrating capital markets is impossible without adequate technical support

through digital technologies. The software must guarantee the free and fast

flow of information between markets. Therefore, to overcome this issue, the

countries should allocate the necessary financial resources for implementing

the software used in the regional capital markets and put enough effort into

the digitalisation process. The steps for the successful digitalisation of the

capital market are described in Figure 4.

Figure 4 Capital market digitalisation process.

Despite

digitization being a critical factor for capital market development, it poses

financial barriers for resource-constrained developing countries. The limited

fiscal resources of these countries restrict the ability of public investments

in digital technologies and infrastructure. Therefore, there is a need to

consider the implementation of public-private partnerships to stimulate

collaboration with the private sector, attracting companies and international

organisations to share the burden of digitizing the capital market.

Another problem

that resource-constrained developing countries may face is the shortage of

skilled labour force to manage and maintain the implemented new digital

systems. In this case, the government should organise capacity-building

programs, especially for regulators and financial institutions to enhance

technical expertise. Regarding legislative issues, the execution of an

interstate memorandum with the selected country is necessary, providing for the

following:

1.

The placement of shares and

debt securities listed on the selected country's capital market in the local

secondary market should be allowed.

2.

Records made by the central

depository of the individual country should be recognized by the selected

country and vice versa.

The citizens of

developing countries are allowed to expand investment opportunities and

participate in the distribution of profits, which will facilitate the

investment process and capital movement between countries. This will also

contribute to the formation of an investment culture among the population,

thereby invigorating national issuers.

3.5. Discussion

The results of this

research contradict the report of Gulay (2019). The research conducted a

nonlinear autoregressive distributed lag model (NARDL) to estimate the

relationship between economic growth and the stock market. The result showed an

asymmetric relationship while this present research suggested the presence of a

significant positive influence between the two variables. Contrary to Pan and Mishra

(2018) who did not report a short-term relationship between market

capitalisation and economic growth in China, this research suggests a positive

relationship. These results were not consistent with the report of Kapaya (2020) who

used the ARDL model to test the relationship between economic growth and stock

market development in Tanzania. The analysis was carried out based on quarterly

data from 2001 to 2019 and the result showed both negative and positive

influence given the particular circumstances for short-run and long-run,

respectively.

Bhattarai et al. (2021) estimated the relationship between these variables through an ARDL model

on empirical data for Nepal from 1994 to 2019. The result found a long-run

strong positive causality relationship between capital market to GDP growth.

Another recent research carried out by Grbic (2021) on empirical data for the Republic

of Serbia from 2002 to 2018 also confirmed the existence of a positive

influence. Furthermore, the positive relationship between market capitalisation

and FDIs was discussed by Samargandi et al. (2020), who observed similar trends

in BRICS economies.

The current research results showed the role of digital technologies

and regional integration as a pathway to economic growth in developing

countries, including those with limited resources, a perspective that has been

previously overlooked. These results suggested that implementing the

recommendations developed within the research and attracting investments

through public-private partnerships may enhance the positive effects of market

capitalisation on economic growth (ceteris paribus). While this research

assesses the effects of market capitalisation on economic growth (ceteris

paribus), there are also other critical drivers, such as institutional

quality, policy stability, and technological infrastructure that require

special focus in future investigations. Previous research on the topic

suggested that the higher institutional quality, the greater the capital market

effects on economic growth (Ngare et al., 2014). Similar suggestions can be drawn

for infrastructure that significantly improves the adoption of digital

technologies in the capital market. Table 3 summarizes the literature review on

the main channels of capital market influence on the economy in developing

countries compared to the results of the present research.

Table 3 Literature review key results

|

Impact channel |

Results |

Authors |

|

Access to capital |

The capital market enables developing countries to raise capital to

invest in productive sectors by also attracting foreign capital that can be

used to invest in new technologies, expand existing businesses, and develop

infrastructure. Access to capital can promote economic growth and stimulate

job creation, leading to improved living standards for the population. |

Ji (2010);

Mcgowan (2008) |

|

Better corporate governance |

The capital market promotes better corporate governance by

requiring transparency and disclosure of financial information. This boosts

the confidence of investors and attracts more investments that can be used to

finance new ventures and expand existing businesses. Improved corporate

governance could also help reduce the risk of financial scandals, as well as

damage the country's reputation and undermine investor confidence. |

Ye et al. (2022), Eichengrin and Luengnarumitchai (2004) |

|

Innovation and entrepreneurship |

The capital market promotes innovation and entrepreneurship by

financing businesses that want to invest in research and development. This

can lead to the development of new products and services, stimulating

economic growth and improving the country's competitiveness in the global

market. |

Bae et al.

(2021) |

|

Foreign investments |

The capital market attracts foreign investment to developing

countries, which can be used to finance economic growth. Foreign investors

can access the capital market to invest in local companies that provide jobs

and stimulate economic growth. This can also help increase capital flows into

the country, improving economic performance. |

Silva et al. (2023), Debata (2021), Bermejo et al. (2020), CMUR (2015) |

|

Improving access to credit |

The capital market can improve access to credit by providing an

alternative source of financing for businesses. This reduces dependence on

bank lending, often limited in developing countries. Improving access to

credit can also help increase investments and improve economic growth. |

Batten et al.

(2023) |

In conclusion, the weak development of the capital market

in developing countries with small open economies had a significant negative

influence on the investment environment, economic growth, and competitiveness.

Investments from pension systems or savings were not converted into long-term

domestic investments, instead being directed towards medium-term investments in

bonds, cash, and deposits, or invested in foreign equities that accessed

foreign capital markets. Furthermore, the underdevelopment of the capital

market hinders the country's investment attractiveness for foreign investors.

There was a need to develop a capital market that would be integrated with larger

markets to overcome the issues. In particular, the integration of the regional

capital market should be considered. Recommendations on a complex institutional

reform of the sector have been developed to eliminate possible obstacles to

financial integration in the direction of institutional, legislative, and

technical issues. The research limitations included the probability of omitted

variable bias, as only market capitalization was used to analyse the

relationship between economic indicators and capital markets. This research did

not incorporate the crisis of 2020 to avoid data distortions and statistical

outliers. The possible directions for future research could include examining

the influence of other capital market indicators and the developments after the

COVID-19 pandemic.

Acknowledgements

The research is carried out within the

frameworks as part of the project “Development of a methodology for

instrumental base formation for analysis and modeling of the spatial

socio-economic development of systems based on internal reserves in the context

of digitalization” (FSEG-2023-0008).

Author Contributions

Sandoyan E.

and Rodionov D. were responsible for the concept and policy recommendations.

Voslanyan M. has prepared the original draft, Galstyan A. conducted the

regression analysis and prepared the final draft.

The

authors declare no conflicts of interest.

Asteriou, D & Spanos, K 2019, 'The

relationship between financial development and economic growth during the

recent crisis: Evidence from the EU', Finance Research Letters, vol. 28,

pp. 238-245, https://doi.org/10.1016/j.frl.2018.05.011

Babkin, A, Tashenova, L, Mamrayeva, D,

Shkarupeta, Y, Pulyaeva, V & Leifei, C 2022, 'Digitalization of industry in

Russia and Kazakhstan: The best practices', International Journal of

Technology, vol. 13, no. 7, pp. 1568-1577, https://doi.org/10.14716/ijtech.v13i7.6200

Bae, KH, Bailey, W & Kang, J 2021,

'Why is stock market concentration bad for the economy?', Journal of

Financial Economics, vol. 140, no. 2, pp. 436-459, https://doi.org/10.1016/j.jfineco.2021.01.002

Batten, JA, Bilgin, MH, Demir, E &

Gozgor, G 2023, 'Does globalization affect credit market controls?', International

Review of Economics & Finance, vol. 85, pp. 21-43, https://doi.org/10.1016/j.iref.2022.11.012

Behera, C 2021, 'Economic

globalization and financial development: Empirical evidence from India and Sri

Lanka', Journal of Asian Finance, Economics and Business, vol. 8, no. 5,

pp. 11-19, https://doi.org/10.13106/jafeb.2021.vol8.no5.0011

Bermejo, VJ, Campa, JM, Campos, RG

& Zakriya, M 2020, 'Do foreign stocks substitute for international

diversification?', European Financial Management, vol. 26, no. 5, pp.

1191-1223, https://doi.org/10.1111/eufm.12275

Bhattarai, JK, Gautam, R &

Chettri, KK 2021, 'Stock market development and economic growth: Empirical

evidence from Nepal', Global Business Review, vol. 25, no.6, https://doi.org/10.1177/09721509211016818

Capital Market Union Report (CMUR)

2015, 'Integration of capital markets in the European Union', PWC Market

Research Centre, Capital Market Union Report, pp. 1–70

Debata, B, Dash, SR & Mahakud, J

2021, 'Stock market liquidity: Implication of local and global investor

sentiment', Journal of Public Affairs, vol. 21, no. 3, p. e2231, https://doi.org/10.1002/pa.2231

Degiannakis, S 2022, 'Stock market as

a nowcasting indicator for real investment', Journal of Forecasting,

vol. 41, no. 5, pp. 911-919, https://doi.org/10.1002/for.2838

Dewan, E & Hussein, S 2001, Determinants

of economic growth (Panel data approach), Suva Fiji: Economics Department,

Reserve Bank of Fiji

Eichengreen, B &

Luengnaruemitchai, P 2004, 'Why doesn't Asia have bigger bond markets?', viewed

6 August 2024 (https://www.nber.org/papers/w10576)

Fuente-Mella, Hdl, Rubilar, R,

Chahuán-Jiménez, K & Leiva, V 2021, 'Modeling COVID-19 cases statistically

and evaluating their effect on the economy of countries', Mathematics,

vol. 9, no. 13, p. 1558, https://doi.org/10.3390/math9131558

Grbi?, M 2021, 'Stock market

development and economic growth: The case of the Republic of Serbia', Post-Communist

Economies, vol. 33, no. 4, pp. 484-499, https://doi.org/10.1080/14631377.2020.1745566

Grishunin, S, Naumova, E, Burova, E,

Suloeva, S & Nekrasova, T 2022, 'The impact of sustainability disclosures

on value of companies following digital transformation strategies', International

Journal of Technology, vol. 13, no. 7, pp. 1432-1441, https://doi.org/10.14716/ijtech.v13i7.6194

Guesmi, K, Teulon, F & Muzaffar,

AT 2014, 'The evolution of risk premium as a measure for intra-regional equity

market integration', International Review of Financial Analysis, vol.

35, pp. 13-19, https://doi.org/10.1016/j.irfa.2014.07.003

Gulay, E 2019, 'The nexus prevalent in

nonlinear finance and growth in the presence of macroeconomic instability in

Turkey: Does the stock market really matter?', Business and Economic

Horizons, vol. 15, no. 1, pp. 1-19, https://doi.org/10.15208/beh.2019.1

Irving, J 2005, 'Regional integration

of stock exchanges in Eastern and Southern Africa: Progress and prospects', IMF

Working Paper, no. 05, viewed 6 August 2024, (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=887991)

Jandhana, IBM, Agustini, HN 2024,

'Performance evaluation of the industrial resilience index by using

cross-correlation method', International Journal of Technology, vol. 15,

no. 5, pp. 1462-1472, https://doi.org/10.14716/ijtech.v15i5.5599

Ji, D 2010, 'Stock market and economic

growth: The empirical study of China', In: Proceedings of the 2nd

International Conference on Education Technology and Computer (ICETC), vol. 4,

pp. V4-178–V4-181, https://doi.org/10.1109/ICETC.2010.5529558 .

Kapaya, SM 2020, 'Stock market

development and economic growth in Tanzania: An ARDL and bound testing

approach', Review of Economics and Political Science, vol. 5, no. 3, pp.

187-206, https://doi.org/10.1108/REPS-11-2019-0150

Making Finance Work for Africa (MFW4A)

2007, 'Financial sector integration in two regions of Sub-Saharan

Africa', Making Finance Work for Africa

McGowan Jr, CB 2008, 'A research of

the relationship between stock market development and economic growth and

development for 1994 to 2003', International Business & Economics

Research Journal (IBER), vol. 7, no. 5, https://doi.org/10.19030/iber.v7i5.3257

Musa, MS, Jelilov, G, Iorember, PT

& Usman, O 2021, 'Effects of tourism, financial development, and renewable

energy on environmental performance in EU-28: Does institutional quality

matter?', Environmental Science and Pollution Research, vol. 28, no. 38,

pp. 53328-53339, https://doi.org/10.1007/s11356-021-14450-z

Na, H & Kim, S 2022, 'The impact of

globalization and the legal system on stock market quality', Applied

Economics, vol. 54, no. 36, pp. 4203-4212, https://doi.org/10.1080/00036846.2022.2026869

Nathaniel, SP, Omojolaibi, JA & Ezeh, CJ

2020, 'Does stock market-based financial development promote economic growth in

emerging markets? New evidence from Nigeria', Serbian Journal of Management,

vol. 15, no. 1, pp. 45-54, https://doi.org/10.5937/sjm15-17704

Ngare, E, Nyamongo, EM & Misati, RN 2014,

'Stock market development and economic growth in Africa', Journal of

Economics and Business, vol. 74, pp. 24-39, https://doi.org/10.1016/j.jeconbus.2014.03.002

Nneka, UJ, Ngong, CA, Ugoada, OA &

Onwumere, JUJ 2022, 'Effect of bond market development on economic growth of

selected developing countries', Journal of Economic and Administrative

Sciences, vol. 14, no. 1, https://doi.org/10.1108/JEAS-01-2022-0015

Olamide, E, Ogujiuba, K & Maredza, A

2022, 'Exchange rate volatility, inflation and economic growth in developing

countries: Panel data approach for SADC', Economies, vol. 10, no. 3,

article 67, https://doi.org/10.3390/economies10030067

Pan, L & Mishra, V 2018, 'Stock market

development and economic growth: Empirical evidence from China', Economic

Modelling, vol. 68, pp. 661-673, https://doi.org/10.1016/j.econmod.2017.07.005

Pradhan, RP, Arvin, MB & Hall, JH 2019,

'The nexus between economic growth, stock market depth, trade openness, and

foreign direct investment: The case of ASEAN countries', The Singapore

Economic Review, vol. 64, no. 3, pp. 461-493, https://doi.org/10.1142/S0217590817500175

Samargandi, N, Kutan, AM, Sohag, K &

Alqahtani, F 2020, 'Equity market and money supply spillovers and economic

growth in BRICS economies: A global vector autoregressive approach', The

North American Journal of Economics and Finance, vol. 51, article 101060, https://doi.org/10.1016/j.najef.2019.101060

Setiawan, B, Saleem, A, Nathan, RJ, Zeman, Z,

Magda, R & Barczi, J 2021, 'Financial market development and economic

growth: Evidence from ASEAN and CEE Region', Polish Journal of Management

Studies, vol. 23, https://doi.org/10.17512/pjms.2021.23.2.29

Shkarupeta, E, Babkin, A, Palash, S,

Syshchikova, E & Babenyshev, S 2024, 'Economic security management in

regions with weak economies in the conditions of digital transformation', International

Journal of Technology, vol. 15, no. 4, pp. 1183-1193, https://doi.org/10.14716/ijtech.v15i4.6838

Silva, TC, Wilhelm, PVB & Tabak, BM 2023,

'Trade matters except to war neighbors: The international stock market reaction

to 2022 Russia’s invasion of Ukraine', Research in International Business

and Finance, vol. 65, p. 101935, https://doi.org/10.1016/j.ribaf.2023.101935

Thaddeus, KJ, Ngong, CA, Nneka, UJ, Nubong,

NM, Ibe, GI, Chinyere, CO & Onwumere, JUJ 2024, 'Stock market development

and economic growth in sub-Saharan Africa (1990–2020): An ARDL approach', Journal

of Economic and Administrative Sciences, vol. 40, no. 2, pp. 344-363, https://doi.org/10.1108/JEAS-04-2021-0075

Tiwari, AK & Mutascu, M 2011, 'Economic

growth and FDI in Asia: A panel-data approach', Economic Analysis and Policy,

vol. 41, no. 2, pp. 173-187, https://doi.org/10.1016/S0313-5926(11)50018-9

Ulyah, SM, Susanti, R, Andreas, C,

Rahmayanti, IA, Rifada, M, Fitriyani, NL & Ana, E 2023, 'A multivariate

regression with time series error in forecasting Jakarta composite index and

stock prices of banking industry in Indonesia by considering COVID-19 effect', International

Journal of Technology, vol. 15, no. 6, pp. 1839-1850, https://doi.org/10.14716/ijtech.v15i6.5469

Ye, Y, Wang, Y & Yang, X 2022, 'Bank loan

information and information asymmetry in the stock market: Evidence from

China', Financial Innovation, vol. 8, no. 1, p. 62, https://doi.org/10.1186/s40854-022-00367-0

Yemelyanova, L 2021, 'Relationship between

the stock market development, banking sector development and economic growth in

the CEE countries', Baltic Journal of Economic Studies, vol. 7, no. 3,

pp. 118-126, https://doi.org/10.30525/2256-0742/2021-7-3-118-126

Yu, JS, Hassan, MK & Sanchez, B 2012, 'A

re-examination of financial development, stock markets development and economic

growth', Applied Economics, vol. 44, no. 27, pp. 3479-3489, https://doi.org/10.1080/00036846.2011.577019

Zardoub, A & Sboui, F 2020, 'Impact of

foreign direct investment, remittances and official development assistance on

economic growth: Panel data approach', PSU Research Review, vol. 7, no.

2, pp. 73-89, http://dx.doi.org/10.1108/PRR-04-2020-0012