Market Valuation of High-Tech Companies in the IT and Automotive Industries: A Regression Analysis of Key Factors

Published at : 25 Mar 2025

Volume : IJtech

Vol 16, No 2 (2025)

DOI : https://doi.org/10.14716/ijtech.v16i2.7418

Verevka, T & Gao, Y 2025, ‘Market valuation of high-tech companies in the it and automotive industries: a regression analysis of key factors’, International Journal of Technology, vol. 16, no. 2, pp. 585-601

| Tatiana Verevka | Peter the Great St. Petersburg Polytechnic University, Novorossiyskaya street, 50, St. Petersburg, 194021, Russian Federation |

| Yuanxiang Gao | 1Peter the Great St. Petersburg Polytechnic University, Novorossiyskaya street, 50, St. Petersburg, 194021, Russian Federation |

The market value of a

company is a key performance indicator for any modern business. The issue of

market value growth is particularly relevant for high-tech companies, which

serve as the leading drivers of digital economy development. Therefore, this

study aimed to identify and analyze the key factors influencing the market

value of high-tech companies. Using regression analysis tools and STATA 14.2

statistical software, econometric models were developed to describe the

relationship between a company's market value and various influencing factors

in two high-tech industries namely automotive and information technology (IT).

To construct a multiple linear regression model, market capitalization was

selected as the dependent variable (Y) while 15 indicators—including economic

value added (EVA), equity capital, revenue, profit, number of employees,

Research and Development (R&D) costs, goodwill, and intangible assets—were

chosen as explanatory variables. Furthermore, this study was based on 10 years

of panel data (2013–2022) from 25 listed automotive and IT companies each all

of which were global leaders by market capitalization. Ordinary least squares

regression models (OLS) with a high degree of fit were constructed for each

industry. The results of the regression analysis showed that the models

possessed high explanatory power with R-square values of 0.958 for the

automobile industry and 0.921 for the IT industry. These figures suggested that

95.8% and 92.1% of the variance, respectively, could be explained and predicted

by the obtained regression equations while avoiding issues of multicollinearity

(strong linear dependence between independent variables) and heteroscedasticity

in random errors. The study showed that the main common factors significantly

impacting the market capitalization of high-tech IT and automotive companies

were EVA and share price. However, R&D expenses and intangible assets were

found to have no significant impact on market value of high-tech companies.

Beyond the shared key factors, industry-specific factors influencing market

capitalization were also identified for each sector. The high explanatory power

of the obtained models allowed the framework to be used as an effective tool

for managing, analyzing, and forecasting the value of IT and automobile

companies.

Company value factors; Eco-metric model; High-tech companies; Market value; Regression analysis

Companies in high-tech industries that spend the most on

research and development (R&D) are becoming major forces driving the

digital economy forward. The world's top R&D-investing sectors include

three main areas namely ICT producers (computer hardware and electronics

manufacturing), health industries (pharmaceuticals and biotechnology), and the

automotive industry (Verevka et al., 2019). Therefore, this study focuses on high-tech

companies in the automotive and information technology (IT) industries. During

growing competition, high-tech companies are forced to rapidly intensify

R&D efforts, continuously updating the products, and introducing

fundamentally new technological solutions as well as global platforms. These

innovations are becoming increasingly knowledge- and resource-intensive (Li, 2024; Aliu and Dedaj, 2023; Berawi, 2022; Park and Lee, 2022; Berawi, 2021), while companies compete with one another to maximize

profitability.

According to the authors of the Global Innovation 1000

project, “there is no long-term correlation between the total amount of money

that companies spend on supporting innovation programs and projects as well as

the overall performance of the financial and economic activities” (Jaruzelski, 2024). Consequently, many studies assess a

company’s success based on market value (Demidenko et al., 2020; Zaytsev et al., 2020; Koller

et al., 2020). An increasing company value indicates

business growth, while a decline suggests operational challenges (Lazzari and Vena, 2025). Considering the objective characteristics,

enterprise value serves as a key performance indicator for leading

international companies across various industries and is a critical measure for

investors (Yue et

al., 2024; Chubuk and Zhukova, 2024). In

addition to evaluating financial performance, companies should understand other

factors that influence the value. Only by identifying these factors can

businesses enhance their commercial viability and long-term sustainability.

The scientific literature contains numerous studies on

the relationship between market value and various individual influencing

factors. For example, publications on the impact of economic sustainability

practices on market capitalization have produced mixed results approximately

30% of studies show a positive relationship, 14% a negative one, and the

remainder report ambiguous results (Grishunin et al., 2023; 2022; Whelan et

al., 2021). In some

studies, a close connection can be traced between brand and company value (Kilian, 2009). An

empirical study by Dosso and Vezzani (2019) showed a

positive correlation between intellectual property and the dynamics of

high-tech companies in the pharmaceutical, automotive, and IT industries (Dosso and Vezzani, 2019). The study by Ustinova and Ustinov (2014) considered the impact of intellectual capital

on the capitalization of Russian industrial companies (Ustinova and Ustinova, 2014) while Berzkalne & Zelgalve focused on

Baltic companies (Berzkalne and Zelgalve, 2014). Boiarko & Paskevicius further investigated the

relationship between the market value of the company and market costs (Boiarko and Paskevicius, 2017). Sorescu (2012) and Zaytsev et al., (2020) analyzed the effect of

innovation activity on the market value of specific economic entities.

Furthermore, Stern emphasized the significant role of economic value added

(EVA) in shaping enterprise market value (Stern et al., 2002).

Despite these studies, there is a lack of

industry-specific publications as most analyses are cross-industrial. This gap

makes the present study particularly relevant. There is currently no

comprehensive comparative analysis of the factors influencing market value in

the automotive and IT industries. Furthermore, no extensive empirical studies

evaluate the impact of EVA and other factors on various performance indicators,

including market capitalization. Theoretical studies on the nature of

influencing factors remain limited.

This study aims to identify and analyze the key factors

affecting the market value of high-tech companies. To achieve this objective,

the analysis constructs econometric models including ordinary least squares

(OLS), fixed-effects, and random-effects models to describe the relationship

between company value and various cost factors in the automotive and IT

industries. The study selects OLS models due to the following advantages.

- Unbiased Estimates: For large

samples, OLS estimators are unbiased meaning the expected value

equals the true value.

- Minimal Variance: OLS estimators have the

lowest variance among all linear unbiased estimation methods.

- Ease of calculation and

interpretation: OLS models are relatively simple to compute, and the

relationships between dependent and independent variables can be visually

interpreted through regression coefficients.

Developing OLS regression models

for the IT and automotive industries allows for the identification of key

drivers of market capitalization in these high-tech sectors, as well as a

comparative analysis. Since industry-specific factors significantly influence

company performance, a thorough assessment of market capitalization as a key

performance indicator can help identify strengths, weaknesses, and

opportunities for business growth and expansion.

2.1. Analysis of Existing Methods, Development of

Algorithm, and Selection of Methodologies

Financial indicators served as fundamental measures of a company's

financial position, providing investors and stakeholders with insights into the

financial well-being (Kara et al., 2024).

Multicriteria decision-making (MCDM) played a crucial role in solving

multidimensional, complex problems in business and real-life scenarios (Lee et al., 2012). When analyzing a company's financial

performance using the MCDM method, factors such as liquidity, profitability,

turnover, financial leverage, and cash flow were considered. Additionally,

various classical methods were used to analyze company value including the cost

approach, and the income approach—incorporating models such as the DDM, FCFF,

EVA (Su, 2024), RIM, APV, and DCF models (Kim-Duc and Nam, 2024)—and the market approach, which was applied in this study. Since market

value calculations relied on the closing prices of listed companies, these

figures fluctuated depending on changes in share prices (Cogliati et al.,

2011).

To analyze the factors influencing company value,

multiple regression analysis was employed. For instance, studies had previously

used regression models to examine the correlation between brand value, market

value, and total overseas sales of high-tech companies (Matsumura et al., 2019). Similarly, this study treated the market

value of high-tech companies as the dependent variable, identified independent

variables affecting market value, and constructed a regression model.

An econometric model was defined as a

probabilistic-statistical framework describing the functioning of an economic

or socio-economic system. A model was considered adequate when it accurately

reflected the regularities of real-world processes with a sufficient degree of

approximation accuracy (Ilyin and

Levina, 2016). The regression

model represented a subset of econometric models.

Regression analysis which was

part of the primary tools in econometrics had been widely applied and adapted across

interdisciplinary studies, as demonstrated in the work of Draper & Smith.

In general terms, regression described and estimated the relationship between a

given variable and one or more other variables. The variable under study was

traditionally denoted as while explanatory variables

were labeled as

This method assumed that changes in the independent

variables

influenced the dependent variable

This study used a linear regression model commonly

used for predictive modeling. In this method, the dependent variable was

continuous while the independent variables could be either continuous or

discrete with the regression line being linear in nature. Linear regression

aimed to find the best-fit straight line (also known as the regression line) to

establish the relationship between the dependent variable and one

or more independent variables

The equation for simple linear regression

was as follows.

where represented the

dependent variable,

was the

independent variable,

were the regression equation

parameters, and

denoted the

random variable.

Linear regression (equation 1) helped determine how

independent variables influenced the dependent variable and allowed for future

outcome predictions. In

reality, economic and financial phenomena were rarely described by a single

independent variable, multiple factors often influenced the dependent variable.

Therefore, multiple regression analysis was necessary to resolve this situation

showing the following form.

Before performing regression analysis, correlation tests were conducted to assess the degree of correlation between independent (explanatory) variables and the dependent variable. This process helped determine whether statistically significant linear relationships existed between variables and measured the strength of these relationships.

Conducting a correlation test was an essential preliminary step before regression analysis. When no significant correlation was found between independent and dependent variables, the regression model would not yield useful predictive information. Conversely, when strong correlations existed these variables provided valuable insights in the model. The formula for calculating the linear correlation coefficient was as follows.

where represented the

correlation coefficient,

was the

mathematical expectation of series

was the

mathematical expectation of series

Correlation tests typically used Pearson's correlation

coefficient, which ranged between -1 and 1. The closer the coefficient's value

was to ±1, the stronger the linear relationship between the variables. When the

coefficient's value was close to 0, it indicated little to no linear

relationship. The positive and negative signs of represented positive and negative correlations,

respectively (Carlberg, 2016).

Linear regression models related

to econometrics included OLS, fixed effects, and random-effects models. The OLS model was a technique for

modeling data based on a linear predictive model. Its fundamental principle was

to minimize the sum of squared errors between observed values and predicted

values, ensuring the best fit for the linear model. The OLS model was based on

the linear regression equations (1) and (2).

The fixed effects regression model (FEM) was a method

for analyzing panel data. This approach allowed for comparisons between

specific categories of independent variables and the interaction effects

between these categories, while excluding other variables. Fixed effects

regression accounted for variables in spatial panel data that varied across

individuals iii but remained unchanged over time. The equation was expressed as

follows (4).

where was the

observed value of the dependent variable for individual

was the

observed value of the independent variable for individual

was the

coefficient of the independent variable,

was the fixed effect representing the specific intercept for the

individual

was the error term.

In a linear

regression model with fixed effects,

only the intercept of the model changed across different time series while the

slope coefficients remained constant. In contrast, a random-effects model

treated the original (fixed) regression coefficients as random variables. The

equation for this model was expressed as follows (5).

where was the

dependent variable,

was the

independent variables,

was the

coefficient of the independent variable,

was the

individual effect which varied across individuals i but remained constant for the same i at different times

was the error term, i – represented the individual, and t – denoted time.

In this model (equation 5), was treated as

a random variable that was generally assumed to be uncorrelated with

and normally

distribution with a mean of zero. Equation (5) was useful for estimating

correlations in time series or panel data. Random effects extended fixed

effects by allowing for variability across individuals. When building models,

both fixed-effects and random-effects models were considered and the Hausman

test was used to determine which model best fit the data. When the test results

indicated that the fixed-effects model provided a better fit, it was selected.

However, the random-effecs model was used when there was no significant

difference between the two.

2.2. Selection of Study Objects for the Regression

Model and Industry-Specific Analysis

The study sample included

high-tech companies from two industries namely the automotive and IT

industries. Financial data for these companies were obtained from Macrotrends (Macrotrends, 2024), GuruFocus (Gurufocus, 2024), and company annual reports

covering 10 years (2013-2022). The automotive industry was part of the largest

and most profitable sectors worldwide with a high degree of technology and

capital intensity. The industry

remained a high-tech field due to advancements in digital technology with a long

history of innovation. Table 1 presented a list of the top 25 largest automotive companies in

the world ranked by market capitalization selected for the study (Companies

Market Cap, 2024a).

Table 1 Largest Automotive Companies by Market Capitalization.

|

Rating |

Company name |

Rating |

Company name |

|

1 |

Tesla (USA) |

14 |

Mahindra & Mahindra (India) |

|

2 |

Toyota (Japan) |

15 |

Kia (South Korea) |

|

3 |

BYD (China) |

16 |

Great Wall Motors (China) |

|

4 |

Mercedes-Benz (Germany) |

17 |

Li Auto (China) |

|

5 |

Ferrari (Italy) |

18 |

SAIC Motor (China) |

|

6 |

Volkswagen (Germany) |

19 |

Suzuki Motor (Japan) |

|

7 |

Stellantis (Netherlands) |

20 |

Chongqing Changan (China) |

|

8 |

BMW (Germany) |

21 |

Renault (France) |

|

9 |

Honda (Japan) |

22 |

Isuzu Motors (Japan) |

|

10 |

General Motors (USA) |

23 |

Paccar (USA) |

|

11 |

Ford (USA) |

24 |

Nissan Motor (Japan) |

|

12 |

Geely Automobile Holdings (China) |

25 |

Mazda Motor (Japan) |

|

13 |

Hyundai (South Korea) |

|

|

The information

technology (IT) industry—also referred to as the information

industry—focused on using information tools and technologies for collecting,

organizing, storing, and transmitting data. It also provided various

information services and technological solutions. The study included the 25

largest IT companies (Internet and software service providers) globally ranked

by market capitalization as shown in Table 2.

Table 2 List of 25 largest IT Companies in the World Ranked by

Market Capitalization (Companies Market Cap, 2024b; 2024c).

|

Rating |

Company Name |

Rating |

Company Name |

|

1 |

Microsoft (USA) |

14 |

ServiceNow (USA) |

|

2 |

Alphabet (USA) |

15 |

IBM (USA) |

|

3 |

Amazon (USA) |

16 |

Uber (USA) |

|

4 |

Meta Platforms (USA) |

17 |

Booking Holdings (USA) |

|

5 |

Tencent (China) |

18 |

Automatic Data Processing (USA) |

|

6 |

Oracle (USA) |

19 |

Palo Alto Networks (USA) |

|

7 |

Salesforce (USA) |

20 |

Meituan (China) |

|

8 |

SAP (Germany) |

21 |

Airbnb (USA) |

|

9 |

Netflix (USA) |

22 |

MercadoLibre (Uruguay) |

|

10 |

Alibaba (China) |

23 |

Synopsys (Russia) |

|

11 |

Adobe (USA) |

24 |

Cadence Design Systems (USA) |

|

12 |

Pinduoduo (China) |

25 |

Equinix (USA) |

|

13 |

Intuit (USA) |

|

|

2.3. Selection of Result and Factor Indicators for

Building an Econometric Model Describing the Relationship Between Company Value

and Cost Factors

The

study selected market

capitalization as

the dependent variable (Y). Market capitalization represented the total

value of the company’s outstanding shares calculated based on stock market

prices.

Publications found a significant positive correlation between a high market

value and industrial investment (Farooq et al., 2022). Companies with a high capitalization ratio

typically operated with low external influence, becoming more independent and

prosperous. These companies could reinvest the funds into future improvements

to enhance operations. Additionally, capitalization growth helped attract investors

increasing the volume of direct and portfolio investments.

Since the dependent variable Y (market capitalization) could be

influenced by various financial and non-financial factors, we selected 15

independent variables to build a multiple linear regression model. These

factors included EVA, equity, revenue, R&D costs, intangible asset value,

number of employees, and others (Table 3). The EVA indicator was defined as the difference

between net operating profit and the value of capital invested in the company (Verevka, 2018). The EVA model which showed the

factors of value formation was expressed as follows (Equation 6).

where NOPAT – represented the operating profit after taxes but before

interest payments, – denoted the weighted average cost of

capital, and

– was the

invested capital.

EVA measured a company's added value based on the

funds it reinvested. In other words, a positive value indicated that the

company generated sufficient profit after covering its capital investment. EVA

also motivated companies to improve capital utilization efficiency, leading to

superior value performance (Tortella and

Brusco, 2003). Corporate R&D played a crucial role in high-tech companies, as the

company allocated a significantly higher share of investment to research and

development compared to other industries. Developing new products attracted

consumers and enhanced competitiveness, eventually increasing company

profitability. Therefore, examining the impact of this factor on company

valuation was particularly important.

3.1. Preliminary data analysis

After selecting the study objects

and independent variables, a model in the STATA software package was

constructed using IT industry companies as an example. Table 3 presented a

description of the selected indicators for IT companies. Next, the correlation between variables was

considered particularly the relationship between independent and dependent

variable Y.

The conducted correlation analysis showed that some factors did not follow a linear distribution. Combined with the results in Table 3, this outcome suggested the presence of outliers in the dataset. To address this issue, the next step included logarithmizing the variables to minimize the impact of extreme values.

Table 3 Descriptive

Statistics of Variables

|

Name of the variable in the

model |

Average |

Standard deviation |

min |

max |

|

Market capitalization,

$mn |

221677.7 |

345624.5 |

690 |

2044480 |

|

EVA (Economic value added) ,

$mn |

2452.286 |

8197.43 |

-31022.67 |

54290.47 |

|

Revenue, $mn |

39930.92 |

69919.6 |

396.107 |

513983 |

|

Inventory, $mn |

3052.435 |

6819.389 |

0.222 |

34405 |

|

Depreciation and

Amortisation, $mn |

3208.075 |

5240.927 |

11.835 |

41921 |

|

Equity capital, $mn |

31450.21 |

48682.18 |

-5768 |

256144 |

|

Total current liabilities,

$mn |

17368.45 |

24128.6 |

206.102 |

155393 |

|

Number of Employees |

89257.08 |

198201.7 |

1147 |

1608000 |

|

Inventory Turnover Ratio |

7058.435 |

61294.75 |

2.653 |

537931 |

|

R&D expenses, $mn |

5857.728 |

9792.176 |

40.888 |

73213 |

|

Return on investment (ROI),

% |

9.487317 |

19.49827 |

-127.1429 |

54.9665 |

|

Gross Margin, % |

65.13839 |

18.49333 |

22.6 |

100 |

|

Goodwill and Intangible

Assets, $mn |

14525.99 |

17322.92 |

1.358 |

78822 |

|

Share price, USD/share |

230.6892 |

387.5178 |

5.4 |

2393.209 |

|

Return on equity |

20.04517 |

121.7009 |

-522.59 |

1677.108 |

|

Current assets as a share of

total assets, % |

45.60425 |

21.91879 |

1.148082 |

95.98169 |

After logarithmization, the

distribution of each variable became linear. To further determine whether the

relevant variables were related to the market capitalization of the dependent

variable, an OLS model was constructed. The correlation analysis of the

logarithmic form of the factors was presented in Figure 1.

Figure 1 Correlation Analysis After

Logarithmization of Variables

3.2. Construction and Validation of OLS Model

Conditions

The regression model constructed

using STATA based on the raw values was presented in Table 4. From the

regression results, the R² of the model was 0.944 and not significantly

different from the adjusted R² indicating a high degree of model fit. The table

also showed that not all variables had a significant correlation with Y,

prompting some variables to be excluded. To identify variables for exclusion,

we used a Variance Inflation Factor (VIF) test to check for multicollinearity

among the variables. The final regression model was presented in Table 5.

The results presented in Table 5

indicated that after screening, five variables remained significant in the

model with p-values less than 0.01, and there was no multicollinearity. Next,

the linear relationship between the variables was examined. The following

figure showed the relationship between the indicator and the regressor (Figure

2).

Figure 2 Checking the Linearity of the Relationship Between the Dependent and Independent Variables in the Selected OLS Model

Table 4 Construction of Regression Model Based on Raw Values

|

Market capitalization, $mn |

Coef. |

St.Err. |

t-value |

p-value |

[95% Conf |

Interval] |

Sig | |||

|

EVA (Economic value added) , $mn |

18.037 |

3.739 |

4.82 |

0 |

10.558 |

25.516 |

*** | |||

|

Revenue, $mn |

8.041 |

2.962 |

2.71 |

0.009 |

2.116 |

13.965 |

*** | |||

|

Inventory, $mn |

9.766 |

17.287 |

0.56 |

0.574 |

-24.813 |

44.346 |

| |||

|

Depreciation and Amortisation, $mn |

11.886 |

15.663 |

0.76 |

0.451 |

-19.445 |

43.217 |

| |||

|

Equity capital, $mn |

-0.296 |

1.3 |

-0.23 |

0.821 |

-2.896 |

2.304 |

| |||

|

Total current liabilities, $mn |

-1.277 |

3.04 |

-0.42 |

0.676 |

-7.357 |

4.804 |

| |||

|

Number of Employees |

-1.012 |

0.302 |

-3.35 |

0.001 |

-1.616 |

-0.407 |

*** | |||

|

Inventory Turnover

Ratio |

-0.062 |

0.268 |

-0.23 |

0.818 |

-0.597 |

0.473 |

| |||

|

R&D expenses, $mn |

-22.442 |

16.8 |

-1.34 |

0.187 |

-56.046 |

11.163 |

| |||

|

Return on investment

(ROI) % |

4769.747 |

4846.186 |

0.98 |

0.329 |

-4924.069 |

14463.562 |

| |||

|

Gross Margin, % |

1315.021 |

1927.213 |

0.68 |

0.498 |

-2539.98 |

5170.022 |

| |||

|

Goodwill and Intangible Assets, $mn |

2.655 |

1.556 |

1.71 |

0.093 |

-0.458 |

5.768 |

* | |||

|

Share price, USD/share |

171.069 |

78.401 |

2.18 |

0.033 |

14.243 |

327.895 |

** | |||

|

Return on equity |

-3594.295 |

2038.565 |

-1.76 |

0.083 |

-7672.033 |

483.442 |

* | |||

|

Current assets as a share of total assets,

% |

-2431.512 |

1243.072 |

-1.96 |

0.055 |

-4918.026 |

55.002 |

* | |||

|

Constant |

-637.832 |

153390.76 |

-0.00 |

0.997 |

-307465.04 |

306189.37 |

| |||

|

Mean

dependent var |

394095.526 |

SD dependent var |

502540.368 | |||||||

|

R-squared

|

0.944 |

Number of obs |

76 | |||||||

|

F-test |

67.982 |

Prob > F |

0.000 | |||||||

|

Akaike

crit. (AIC) |

2022.392 |

Bayesian crit. (BIC) |

2059.684 | |||||||

|

*** p<0.01, ** p<0.05, * p<.1 |

||||||||||

As shown in Figure 2, the

distribution of the variable “Equity” was very uniform and followed a normal

distribution. However, the variables “Company Stock Price” and “ROE” were not

evenly distributed with possible outliers. To further investigate, separate

histograms of the market value variable’s distribution were constructed which

confirmed that in logarithmic form the distribution was symmetrical. The RESET test (Regression

Equation Specification Error Test) was also constructed to check the model for

missing explanatory variables. The result of RESET test was 0.015, rejecting

the hypothesis that there were no missing variables in the model. The obtained

value of hatsq exceeded 0.05, indicating that no missing variables with a

quadratic term were present. Subsequently, the residuals and the

homoscedasticity of the model were analyzed.

As shown in Figure 3, Alibaba's

observation leverage was relatively high located in the upper left corner of

the plot. This suggested that the data point exerted a relatively greater

influence on the model despite having a low sum of squared residuals. Booking

Holdings had lower leverage but a higher sum of squared residuals. However, due

to its relatively low leverage, its influence on the model was minimal.

Table 5 Variant Regression Model After Screening

|

lnmarketcap |

Coef. |

St.Err. |

t-value |

p-value |

[95% Conf |

Interval] |

Sig | |||

|

ln Equity capital |

0.458 |

0.057 |

8.09 |

0 |

0.346 |

0.57 |

*** | |||

|

ln EVA |

0.16 |

0.035 |

4.61 |

0 |

0.092 |

0.229 |

*** | |||

|

ln Share price |

0.172 |

0.032 |

5.38 |

0 |

0.108 |

0.235 |

*** | |||

|

Return on equity |

0.001 |

0 |

3.27 |

0.001 |

0 |

0.001 |

*** | |||

|

ln Revenue |

0.255 |

0.068 |

3.77 |

0 |

0.121 |

0.389 |

*** | |||

|

Constant |

2.78 |

0.315 |

8.82 |

0 |

2.156 |

3.404 |

*** | |||

|

| ||||||||||

|

Mean

dependent var |

11.797 |

SD dependent var |

1.339 | |||||||

|

R-squared

|

0.921 |

Number of obs |

129 | |||||||

|

F-test |

287.299 |

Prob > F |

0.000 | |||||||

|

Akaike

crit. (AIC) |

124.743 |

Bayesian crit. (BIC) |

141.902 | |||||||

|

*** p<0.01, ** p<0.05, * p<0.1 |

||||||||||

Figure 3 Residuals and Regression Leverage

The

remaining companies, such as IBM, Amazon, and most others, clustered in the

lower left corner of the graph. This indicated that the company had both low

leverage and residuals, suggesting a good model fit for these data points with

minimal impact on the regression results.

A Breusch-Pagan test was

conducted to rule out heteroscedasticity which was a non-constant variance of

the error terms (Gutman et al., 2022; Bolakale et al., 2021;

Halunga et al., 2017). The results of this test were

presented in Figure 4.

Figure 4

Results of the Breusch-Pagan Test

The test results indicated that the p-value was

0.9386, which suggested the model was homoscedastic according to the

Breusch-Pagan criterion, as the p-value exceeded the significance level of

0.05. Therefore, the null hypothesis was accepted, confirming no

heteroscedasticity in the model. This implied that the error variance remained

constant. Additionally, White’s test corroborated that the residuals were

homoscedastic. The density curve of the normally distributed random residual

term was symmetrical, further supporting a normal distribution.

3.3. Selection of a

Regression Model Using Panel Analysis

To determine the best regression

model in addition to the OLS model, both fixed-effects and random-effects

models were constructed. The OLS, fixed-effects, and random-effects aspects

were compared to select the optimal model and the results were summarized in

Table 6.

According to the results presented, some variables were

non-significant in both the fixed-effects and random-effects models. All

variables in the OLS model were significant, prompting the OLS model to be

selected. Using the regression

analysis of panel data from 10 years (2013–2022) for 25 listed companies in the

IT industry, the significant economic factors affecting the market value of IT

companies were identified while constructing the following regression model

(Equation 7).

Table 6

Comparison of Regression Models

|

Variable

|

OLS |

FE |

RE |

|

ln Equity capital |

0.458*** |

0.103*** |

0.214*** |

|

ln EVA |

0.160*** |

0.004 |

0.042** |

|

ln Share price |

0.172*** |

1.034*** |

0.745*** |

|

Return on equity |

0.001 ** |

0 |

0.001** |

|

ln Revenue |

0.255*** |

0.089*** |

0.077 |

|

year |

| ||

|

2014 |

-0.062** | ||

|

2015 |

-0.108*** | ||

|

2016 |

-0.143*** | ||

|

2017 |

-0.198*** | ||

|

2018 |

-0.247*** | ||

|

2019 |

-0.311*** | ||

|

2020 |

-0.357*** | ||

|

2021 |

-0.414*** | ||

|

2022 |

-0.377*** | ||

|

_cons |

2.779*** |

5.228*** |

5.037*** |

where Y was the market

capitalization, X1 – represented equity capital, X2 – denoted EVA, X3- was share price, X4 – served as return

on equity (ROE), and X5 – indicated revenue.

Using the same methodology and

algorithm, a regression model for the automotive sector was developed based on

panel data from 10 years (2013–2022) for 25 listed automotive companies. The

resulting model was given in Equation 8.

where Y represented the market capitalization, X1 indicated EVA, X2 served as share

price, and X3 denoted current assets as a share of total assets.

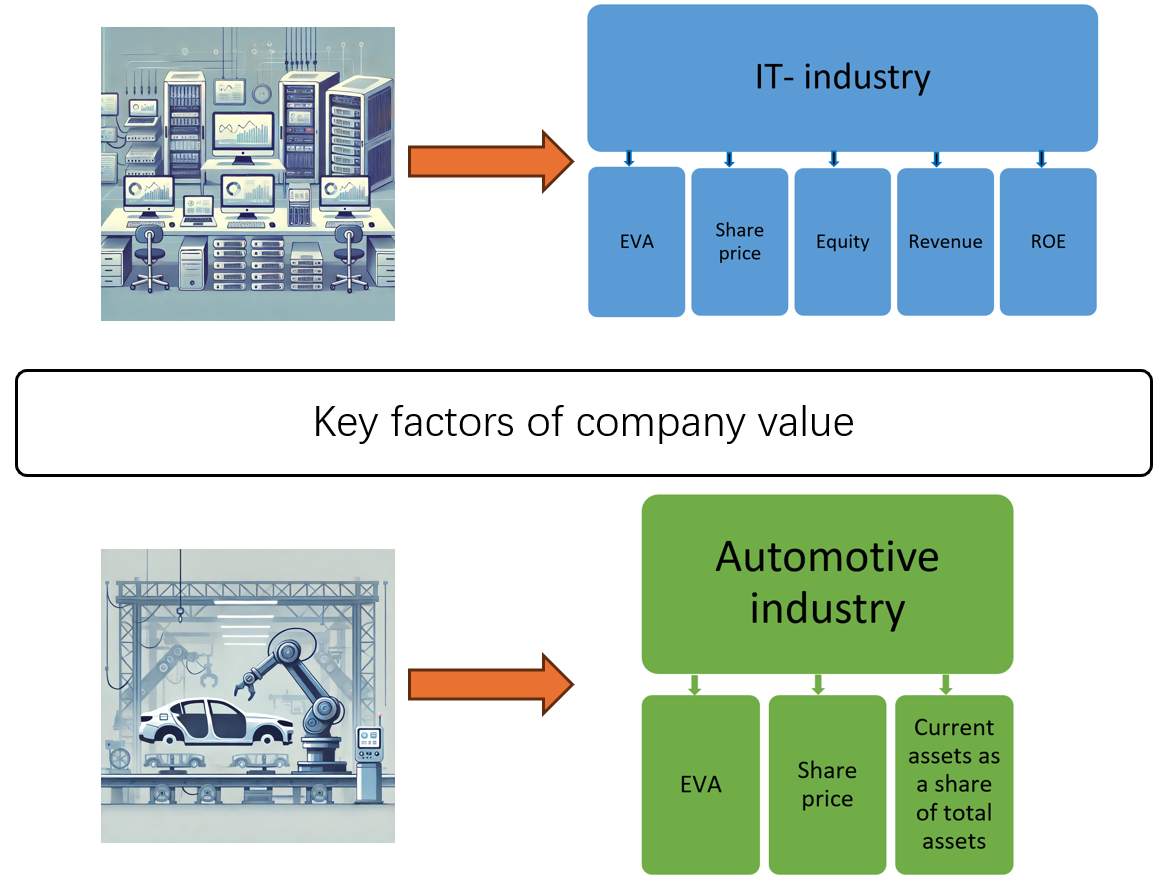

The regression

analysis results showed that the models possessed high explanatory power. The

R-squared value for the automotive industry model was 0.958, while for the IT

industry model, it was 0.921. This indicated that 95.8% and 92.1% of the

variance, respectively, could be explained and predicted by the resulting

regression equations. Furthermore, the models avoided issues related to

multicollinearity (strong linear dependence between independent variables) and

heteroscedasticity of random errors. The constructed models effectively

identified key factors influencing the market value of companies in the

automotive and IT industries, a comparison of which is presented in Table 7. These

models demonstrated that EVA and stock price were the common variables that

simultaneously affected both industries. When EVA and stock price increased,

the market capitalization of companies in both the IT and automotive industries

also increased. This indicated that EVA and stock price were two crucial

factors influencing the market value of high-tech companies in these

industries.

Table

7 Comparison of Key Factors Influencing the

Value of Companies in the IT and Automotive Industries

|

IT- industry |

Automotive

industry |

|

EVA |

EVA |

|

Share price |

Share price |

|

Equity |

Current

assets as a share of total assets |

|

Revenue |

|

|

ROE |

|

However,

the regression models for the two industries included different variables. In

the IT industry model, along with EVA and stock price, other significant

factors influencing market capitalization were equity, ROE, and sales revenue.

The amount of equity represented the real capitalization of a company and

reduced investor risk. Therefore, companies with greater equity assets, all

else being equal—tended to be valued more highly in the market (Peijie, 2023).

Companies experiencing higher sales growth were more inclined to achieve higher

market valuations, confirming the positive assessment investors assigned to

growth performance. Moreover, companies with higher return on equity, a signal

of efficiency and greater potential profitability, were rewarded with higher

valuations in financial markets. This effect was reflected in the positive

coefficient of return on equity, measured as the ratio of earnings to equity.

In contrast, the automotive industry model showed that a company’s market

value was influenced by the percentage of current assets relative to total

assets. The negative effect of a higher ratio of current assets to total assets

was statistically significant in this model due to the specific characteristics

of the automotive industry. Traditional auto manufacturers faced increasing

technological competition in the parts and components sector, as well as

growing standardization, which shifted competitive advantages from auto brands

to suppliers. These dynamics shortened process, operational, and financial

cycles, while the introduction of just-in-time and MRP systems significantly

increased inventory turnover rates. Consequently, the overall share of working

capital in the industry declined.

These

conclusions were supported by specific

examples of enterprises. Companies with a higher share of working capital in

their asset structure compared to the industry average—such as Renault Group,

Nissan Motor, and Mazda Motor—experienced a more than threefold decline in

market capitalization over the last 10 years. Additionally, the differences in regression models between the

IT and automotive industries outlined certain structural characteristics,

including the complexity and modularity of products, industry-specific

technological frameworks, and variations in strategic and competitive behavior.

A

seemingly paradoxical conclusion from this study was the insignificant impact

of R&D expenses and intangible assets on the market value of high-tech

companies. This finding supported the earlier hypothesis that the scale of

R&D spending was not a guarantee of a company’s success, as measured by its

market capitalization growth. The results showed that in both the computer and

automotive industries, markets did not necessarily reward companies for

additional innovative assets. Furthermore, there was a possibility that markets

might even penalize companies with exceptionally high R&D expenditures. For

instance, Tesla’s annual R&D spending doubled between 2020 and 2023,

surpassing $3 billion, while its market capitalization was reduced by half over

the same period.

Figures 5 and 6 showed that from 2013 to 2020,

Microsoft's market capitalization and R&D investment tended to increase,

while Tesla's market capitalization fluctuated significantly despite relatively

stable R&D spending. From 2021 onward, although both companies continued to

increase R&D investment, the market capitalization began to decline,

suggesting a lack of direct correlation between R&D investment and market

value.

Figure 5 Dynamics of Market

Value– Microsoft and Tesla

Since R&D investment might not yield immediate financial returns but

remained crucial for long-term growth and innovation in high-tech sectors, it

could cause cyclical fluctuations in the value of high-tech companies.

Therefore, using the method proposed by Eremina and Rodionov (2023) which

identified and corrected situational

distortions in time series through data shifting and modification to determine

the cyclical dominance of the modified series, the study attempted to add a

lagged "R&D investment" variable to the regression model. Based

on the normative efficiency coefficient for long-term investments in these

industries, the R&D investment variable was lagged by four periods (four

years) and was incorporated into the regression model. However, the results

indicated that R&D expenditure remained insignificant and did not influence

market value fluctuations in the long term.

Figure 6 Dynamics of R&D

Expenditures – Microsoft and Tesla

This

conclusion correlated with results from other publications such as Kalantonis et al. (2020). The results also supported those of Chernova and Mikhaylova (2019), who

examined the impact of internal R&D expenditure on the market

capitalization of high-tech companies in the aerospace and defense industries.

The study identified only a weak to moderate relationship between R&D costs

and market capitalization. Therefore, the implementation of R&D costs did

not automatically translate into an intangible asset that generated income.

However,

there might be an indirect relationship between R&D expenditure and company

value through revenue and profitability indicators. The introduction and launch

of innovative products undoubtedly had a positive impact on market demand and

stimulated sales, thereby increasing revenue, gross profit, ROE, and EVA. These

indicators were included among the explanatory variables, and three were

identified as key value drivers for IT companies, which did not contradict the

findings of this study.

A

similar situation was observed with important

non-financial performance indicators of high-tech companies, such as customer

satisfaction (discussed in more detail in Verevka (2018)).

Increased customer satisfaction led to a growth in loyal

customers, higher revenue and profit, and greater EVA. The limitation of this study to primarily

financial indicators was not due to the prioritization over non-financial

indicators, but rather to the lack of publicly available industry-wide data on

non-financial indicators for high-tech companies, which prevented the creation

of a sufficiently large sample for an objective study.

The lack of

significance of intangible assets in valuation within the computer and

automotive industries might also be related to the “dense network of

overlapping intellectual property rights through which a company should cut its

way to commercialize a new technology” (Shapiro, 2001), commonly referred to as a patent thicket. The existence of these barriers made it difficult to assess

individual intellectual property rights in these complex industries (Heeley et al., 2007), and consequently to assess the

direct impact on the market value.

In conclusion, the regression models developed for the IT

and automotive sectors enabled the identification of variables that influenced

the commercial value of a company, specifically its market capitalization. The

study showed that EVA and stock price were the main factors that significantly

impacted the value of successful high-tech IT and automotive companies. The observed differences in econometric models between the

computer and automotive industries further confirmed the importance of

industry-specific factors in determining value drivers. The developed

regression models provided a powerful tool for strategic planning and value

management in IT and automotive companies. The analysis offered valuable

insights for developing a Balanced Scorecard (BSC) and facilitated effective

decision-making in asset and capital management. The

regression modeling approach used in this study could be applied to other

high-tech industries, such as pharmaceuticals, biotechnology, aerospace, and

defense. Therefore, future studies should focus on constructing models for

additional industries to enable a more comprehensive comparative analysis of

various high-tech sectors. This would eventually help identify common key value

drivers across all high-tech companies, as well as specific factors unique to

individual sectors within the high-tech economy.

Acknowledgements

This study

was financed as part of the project "Development of a methodology for

instrumental base formation for analysis and modeling of the spatial

socio-economic development of systems based on internal reserves in the context

of digitalization" (FSEG-2023-0008).

Author

Contributions

Tatiana Verevka and Yuanxiang Gao equally contributed to the design and implementation of the

research, to the analysis of the results and to the writing of the manuscript.

The authors declared no

conflicts of interest.

Aliu Mulaj, L

& Dedaj, B 2023, 'Knowledge-based society: R&D investments in new

economic transformation', In: Accounting, Finance, Sustainability,

Governance and Fraud, vol. 4, pp. 49-67, https://doi.org/10.1007/978-981-16-9499-8_4

Berawi, MA 2021,

'Philosophy of technology design: creating innovation and added value', International

Journal of Technology, vol. 12, no. 3, pp. 444-447, https://doi.org/10.14716/ijtech.v12i3.5038

Berawi, MA 2022,

'Innovative digital technology and economy capacity development', International

Journal of Technology, vol. 13, no. 7, pp. 1369-1372, https://doi.org/10.14716/ijtech.v13i7.6277

Berzkalne, I

& Zelgalve, E 2014, 'Intellectual capital and company value', Procedia

Social and Behavioral Sciences, vol. 110, no. 1, pp. 887-896, https://doi.org/10.1016/j.sbspro.2013.12.934

Boiarko, I &

Paskevicius, A 2017, 'Evaluation of the market value of the enterprise with

consideration of exogenous factors', In: Business Ethics and Leadership,

vol. 1, no. 3, pp. 75-83, https://doi.org/10.21272/bel.1(3).75-83.2017

Bolakale, A

& Oyeyemi, G 2021, 'A modified Breusch–Pagan test for detecting

heteroscedasticity in the presence of outliers', Pure and Applied

Mathematics Journal, vol. 10, no. 6, pp. 139-149, https://doi.org/10.11648/j.pamj.20211006.13

Carlberg, C

2016, Regression analysis Microsoft Excel, 1st edn, Que Publishing

Chernova, O

& Mikhaylova, E 2019, 'The cost of research as factor of development

potential of capitalizing high-tech companies', Azimut of Scientific

Research: Economics and Administration, vol. 8, no. 1, pp. 226-228

Chubuk, L &

Zhukova, Y 2024, 'Comparison of the methods of realizing the sensitivity

analysis of the enterprise’s value to risks', pp. 426–437, https://doi.org/10.1007/978-3-031-71801-4_31

Cogliati, G,

Paleari, S & Vismara, S 2011, 'IPO pricing: growth rates implied in offer

prices', Annals of Finance, vol. 7, no. 1, pp. 53–82, https://doi.org/10.1007/s10436-010-0170-6

Companies Market Cap 2024a, Largest automakers by market capitalization

2024, Companies Market Cap,

viewed 17 May 2024 (https://companiesmarketcap.com/automakers/largest-automakers-by-market-cap)

Companies Market

Cap 2024b, ‘Largest

internet companies by market capitalization 2024’, Companies Market Cap, viewed

17 May 2024 (https://companiesmarketcap.com/internet/largest-internet-companies-by-market-cap)

Companies Market

Cap 2024c, ‘Largest

software companies by market capitalization’, Companies Market Cap, viewed 17 May 2024 https://companiesmarketcap.com/software/largest-software-companies-by-market-cap

Demidenko, D,

Kulibanova, V & Maruta, V 2018, 'Using the methods of the company's

capitalization optimal management', in Proceedings of the 32nd International

Business Information Management Association Conference (IBIMA 2018), Vision

2020: Sustainable Economic Development and Application of Innovation Management

from Regional Expansion to Global Growth

Dosso, M &

Vezzani, A 2019, 'Firm market valuation and intellectual property assets', Industry

and Innovation, vol. 27, no. 7, pp. 1-25, https://doi.org/10.1080/13662716.2019.1685374

Eremina, I &

Rodionov, D 2023, 'The special aspects of devising a methodology for predicting

economic indicators in the context of situational response to digital

transformation', International

Journal of Technology, vol. 14, no. 8, pp. 1653-1662, https://doi.org/10.14716/ijtech.v14i8.6839

Farooq, U,

Tabash, M, Anagreh, S & Khudoykulov, K 2022, 'How do market capitalization

and intellectual capital determine industrial investment?', Borsa Istanbul Review, vol.

22, no. 4, pp. 828-837, https://doi.org/10.1016/j.bir.2022.05.002

Grishunin, S,

Burova, E & Suloeva, S 2023, 'Assessment of impact of economic

sustainability on shareholder return and economic profit of BRICS industrial

companies following digital transformation strategy', International Journal of Technology,

vol. 14, no. 8, pp. 1685-1693, https://doi.org/10.14716/ijtech.v14i8.6842

Grishunin, S,

Naumova, E, Burova, E, Suloeva, S & Nekrasova, T 2022, 'The impact of

sustainability disclosures on value of companies following digital

transformation strategies', International

Journal of Technology, vol. 13, no. 7, pp. 1432–1441, https://doi.org/10.14716/ijtech.v13i7.6194

Gurufocus 2024, Financial market insights,

viewed 17 May 2024 (https://www.gurufocus.cn)

Gutman, S,

Rytova, E, Brazovskaia, V & Skhvediani, A 2022, 'The impact of firms’

activities on regional sustainable development', International Journal of Technology, vol. 13, no.

7, pp. 1505-1514, https://doi.org/10.14716/ijtech.v13i7.6195

Halunga, A,

Orme, C & Yamagata, T 2017, 'A heteroskedasticity robust Breusch–Pagan test

for contemporaneous correlation in dynamic panel data models', Journal of Econometrics, vol.

198, no. 2, pp. 209-230, https://doi.org/10.1016/j.jeconom.2016.12.005

Heeley, M,

Matusik, S & Jain, N 2007, 'Innovation, appropriability, and the

underpricing of initial public offerings', Academy

of Management Journal, vol. 50, no. 2, pp. 209-225, https://doi.org/10.5465/amj.2007.24162388

Ilyin, I &

Levina, A 2016, Econometrics:

methods and models of regression analysis, St. Petersburg:

Publishing House of the Polytechnic University

Jaruzelski, B

2018, 'The six ways high-leverage innovators consistently outperform the

competition', Forbes,

viewed 18 May 2024, (https://www.forbes.com/sites/strategyand/2018/11/06/the-six-ways-high-leverage-innovators-consistently-outperform-the-competition/#4edfae9877b4)

Kalantonis, P,

Schoina, S, Missiakoulis, S & Zopounidis, C 2020, 'The impact of the

disclosed R&D expenditure on the value relevance of the accounting

information: evidence from Greek listed firms', Mathematics, vol. 8, no. 5, article 730, https://doi.org/10.3390/math8050730

Kara, K, Yalç?n,

G, Cetinkaya, A, Simic, V & Pamucar, D 2024, 'A single-valued neutrosophic

CIMAS-CRITIC-RBNAR decision support model for the financial performance

analysis: a study of technology companies', Socio-Economic

Planning Sciences, vol. 92, article 101851, https://doi.org/10.1016/j.seps.2024.101851

Kilian, K 2009,

'Value creation: the power of brand equity', Journal

of Product & Brand Management, vol. 18, no. 3, pp. 234-235

Kim-Duc, N &

Nam, PK 2024, 'Earnings growth rates in business valuation models: the

impossible quaternity', Global

Finance Journal, vol. 60, article 100930, https://doi.org/10.1016/j.gfj.2024.100930

Koller, T,

Goedhart, M & Wessels, D 2020, Valuation:

measuring and managing the value of companies, 7th edn, John Wiley

& Sons, Hoboken, New Jersey

Lazzari, V &

Vena, L 2025, 'Enterprise value and risk taking in the banking industry:

cooperatives vs. corporations', Research

in International Business and Finance, vol. 73, article 102622, https://doi.org/10.1016/j.ribaf.2024.102622

Lee, T, Cheng, W

& Sung, H 2012, 'A comparative study on financial positions of shipping

companies in Taiwan and Korea using entropy and grey relation analysis', Expert Systems with Applications,

vol. 39, no. 5, pp. 5649-5657, https://doi.org/10.1016/j.eswa.2011.11.052

Li, T 2024,

'Does smart transformation in manufacturing promote enterprise value chain

upgrades?', Finance Research

Letters, vol. 69, article 106124, https://doi.org/10.1016/j.frl.2024.106124

Macrotrends

2024, Economic and financial

data trends, viewed 17 May

2024 (https://www.macrotrends.net)

Matsumura, H,

Ueda, T & Sagane, Y 2019, 'Data on the correlations among brand value,

market capitalization, and consolidated overseas sales ratios of Japanese

companies', Data in Brief,

vol. 23, article 103808, https://doi.org/10.1016/j.dib.2019.103808

Park, BJ &

Lee, CY 2022, 'Does R&D cooperation with competitors cause firms to invest

in R&D more intensively? Evidence from Korean manufacturing firms', The Journal of Technology Transfer,

vol. 48, no. 3, pp. 1045–1076, https://doi.org/10.1007/s10961-022-09937-x

Peijie, D 2023,

'Asset structure, firm size and firm value: research based on A-share

manufacturing listed firms', Finance,

vol. 13, no. 3, pp. 503-509, http://dx.doi.org/10.12677/FIN.2023.133049

Shapiro, C 2001,

'Navigating the patent thicket: cross licenses, patent pools, and standard

setting', NBER Chapters,

in Innovation Policy and the

Economy, vol. 1, pp. 119-150

Sorescu, A 2012,

'Innovation and the market value of firms', In: Handbook of Marketing and Finance, Edward Elgar

Publishing, pp. 129-154

Stern, J,

Shiely, J & Ross, I 2002, The

EVA challenge: implementing value-added change in an organization,

John Wiley & Sons

Su, W 2024,

'Performance analysis of BYD Auto based on EVA model', Procedia Computer Science,

vol. 243, pp. 1125-1132, https://doi.org/10.1016/j.procs.2024.09.133

Tortella, BD

& Brusco, S 2003, 'The economic value added (EVA): an analysis of market

reaction', Advances in

Accounting, vol. 20, no. 265–290, https://doi.org/10.1016/S0882-6110(03)20012-2

Ustinova, L

& Ustinov, A 2014, 'Studying the impact of intellectual capital at

industrial enterprises on their market capitalization', Asian Social Science, vol. 10,

no. 20, pp. 15-20

Verevka, T 2018, 'Key performance indicators

of high-tech enterprises', SHS

Web of Conferences, vol. 44, article 00077, https://doi.org/10.1051/shsconf/20184400077

Verevka, T,

Gutman, S & Shmatko, A 2019, 'Prospects for innovative development of world

automotive market in digital economy', ACM

International Conference Proceeding Series, article 3373320, https://doi.org/10.1145/3372177.3373320

Whelan, T, Atz, U, Van Holt, T & Clark, C 2021, 'ESG and financial

performance: uncovering the relationship by aggregating evidence from 1,000

plus studies published between 2015-2020', NYU STERN Center for Sustainable

Business, New York, pp. 520-536

Yue, S, Yang, M

& Dong, D 2024, 'Do enterprises adopting digital finance exhibit higher

values? Based on textual analysis', The

North American Journal of Economics and Finance, vol. 73, article

102181, https://doi.org/10.1016/j.najef.2024.102181

Zaytsev, A,

Rodionov, D, Dmitriev, N & Faisullin, R 2020, 'Building a model for

managing the market value of an industrial enterprise based on regulating its

innovation activity', Academy of

Strategic Management Journal, vol. 19, no. 4, pp. 1-13