The Impact of Patent Regulation Features on The Innovative Activities of Enterprises

Published at : 17 Jul 2025

Volume : IJtech

Vol 16, No 4 (2025)

DOI : https://doi.org/10.14716/ijtech.v16i4.7388

Lundaeva, KA & Gintciak, AM 2025, ‘The impact of patent regulation features on the innovative activities of enterprises’, International Journal of Technology, vol. 16, no. 4, pp. 1093-1103

| Karina A. Lundaeva | Peter the Great St. Petersburg Polytechnic University, 29 Polytechnicheskaya st., St. Petersburg, 195251, Russia |

| Aleksei M. Gintciak | Peter the Great St. Petersburg Polytechnic University, 29 Polytechnicheskaya st., St. Petersburg, 195251, Russia |

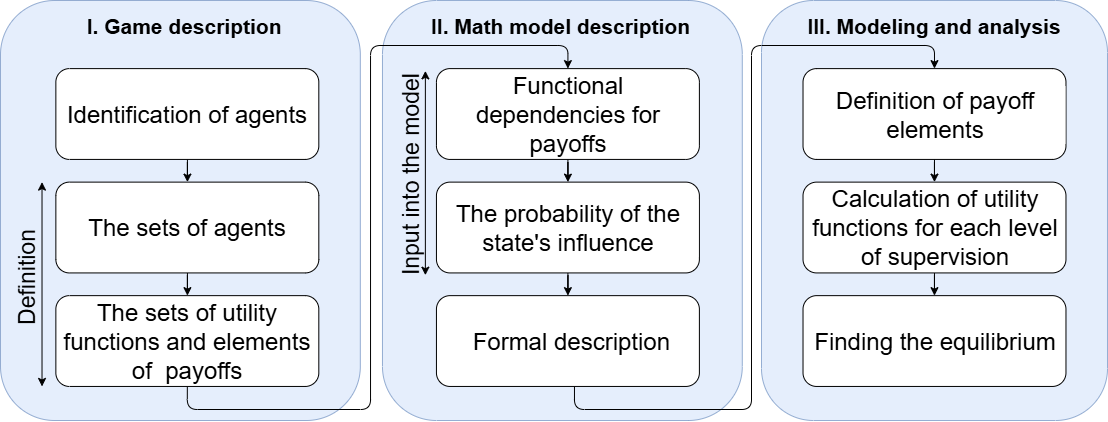

This study aimed to comprehensively examine the interactions between actors within the innovation system, focusing specifically on the disposition and utilization of intellectual property rights (IPRs). In order to achieve the stated objective, mathematical modeling, rooted in game theory was adopted to simulate these interactions to identify strategically stable behaviors among stakeholders. Essentially, the study led to the development of a game-theoretic model that described the interaction between IPR holders alongside respective followers. This model effectively considered the impact of public policy on IP protection as a factor in offense detection. The analysis conducted during the course of the investigation thoroughly examined various strategies for protecting IP, including the registration of utility model and invention patents as well as the use of smart contracts for IP registration. Within this context, the use of a smart contract, which is defined as a self-executing contract implemented in the blockchain, where respective terms and conditions are fixed by the parties directly through lines of code, was considered as an alternative strategy for protecting IP. Followers, on the other hand, were observed to adopt a spectrum of strategies, ranging from the acquisition of a license for the legitimate use of IP to imitating innovative processes. For each strategic pathway, a utility function was specified in order to account for innovation profits and costs. The values assigned to the components of these utility functions in line with the existing legislation governing patents in the Russian Federation for 2024. The results obtained from the investigation of the static model, which was specifically carried out to identify the equilibrium, showed that, with regard to the probability of detecting offenses and the amount of penalty, followers adopted different strategies depending on the level of supervision. For instance, when the level of supervision is low or medium, followers were observed to predominantly imitate innovations, and when it is high, the demographic tend to posseess a greater tendency to acquire a license. When supervision is average, the subgame equilibrium was characterized by the following combination: ({Smart contract}; {Imitation Innovation, Imitation Innovation, Imitation Innovation}). Under this equilibrium, the payoff profile was (571,687; 115,475). When supervision is low, the equilibrium remained unchanged, and the resulting payoffs for right holders and followers amounted to (571,687; 131,475), respectively. Simultaneously, the selection of an IP registration strategy through the utilization of a smart contract remains unaltered for rights holders. The novelty of the present study lies in the fact that it introduced additional factors of influence from the state and analyzed the choice of agents' strategies by checking the evolutionary stability of each equilibrium point at different values of payment elements.

Game equilibrium; Game theory; Intellectual property; Patent law

The evolution of innovation systems is typically identified by intricate, multidirectional processes of innovation generation, commercialization, and protection as objects of intellectual property (IP) (Rudskaya et al., 2022). As stated in a previous study, the management of these processes necessitated an integrated approach and interaction between the various actors within the innovation system, including academic institutions, businesses, financial institutions, and government agencies (Nurulin et al., 2023). Invariably, the transfer of innovation is a fundamental process in the enhancement of enterprise competitiveness in the context of technological development. It has also been reported to contribute significantly to the socioeconomic development of regions and countries (Nicodemus and Egwakhe, 2019). The advancement of the global digital economy has precipitated a pressing need to safeguard innovation as intellectual property (IP). This challenge invariably spans a multitude of industries, thereby emphasizing the imperative for a comprehensive study agenda to develop an effective system for the utilization and disposal of intellectual property rights (IPRs) (Khoirunisa et al., 2023; Zhang et al., 2023).

In a recent study, emphasis was placed on the organization of interaction between actors in innovation clusters with the aim of forming a national innovation ecosystem (Shmeleva et al., 2021). According to the exploration, examining the conditions and variables that influence the strategic behavior of the actors within the innovation ecosystem is essential to constructing an efficacious system of interaction.

The objective of this study is to enhance the efficacy of decision-making processes carried out by individuals who are engaged in the domain of patent law, particularly with regard to the administration and disposition of IPRs. The investigation results are expected to facilitate the enhancement of innovative activities within enterprises, which is closely correlated with increased patenting activity, the emergence of new IP assets in the innovation market, alongside respective subsequent successful commercialization. Participants in the innovation system, precisely innovators (IP right holders and their followers), are regarded as actors. Furthermore, the role of the regulatory body in the protection of IPRs is considered an external factor. This comprises the body's inclusiveness in legislative and executive aspects of IPRs. In order to analyze the influence of external and internal factors on the decision-making of system actors and to ascertain the strategic stability of each actor and the stability of the IPR management system as a whole, it is possible to employ game theory as a tool for modeling agent interaction and identifying respectively selected optimal strategies (Li et al., 2022). The game-theoretic model will allow for an analysis of how participants in innovation activities make decisions based on market conditions that determine the expected values of agents' payment elements, such as costs of IP registration, profits from intellectual activity, patent fees, and others. Accordingly, the game-theoretic model provides a quantitatively measurable description of interactions, enabling the identification of optimal strategies for agents and of an equilibrium state where participants have no incentives to alter respectively selected strategies.

The present study aims to develop a game-theoretic model for analyzing and evaluating the strategies of IPR holders alongside respective followers in the innovation market. It also aims to identify optimal strategies for the agents that maximize the benefits for participants in the patent regulation process, while particularly considering the specifics of patent legislation and the possibilities for protecting and managing IPRs.

The proposed model captures the interaction between patent law through analytical simulation with the aim of effectively determining the optimal strategies adopted by agents based on payment element values corresponding to the current conditions of patent legislation in the Russian Federation. Accordingly, the novelty of the proposed model lies in its ability to account for the uncertainty of the influence of regulatory authorities on the utility functions of enterprises. This influence invariably enhances the adequacy of the model, especially within the context of real patent regulation processes during innovation activities. A practical illustration of the model function in a real-world setting includes a situation where rights holders make decisions regarding the strategy for protecting a developed innovative technology. These decisions include evaluating the potential costs of securing and maintaining IP protection, as well as the risks associated with transferring rights to the development of enterprises interested in the IP object. Meanwhile, followers are presented with a strategic dilemma, whether to acquire a license for the development or to imitate the innovation independently.

The proposed model in this study was developed using the mathematical framework of game theory, which included the concepts of game-theoretic equilibrium and the method of backward induction. Accordingly, the concept of a one-shot sequential game-theoretic model was selected for analyzing the interactions between agents, where decisions are typically made sequentially rather than simultaneously. Within this framework, each iteration represents a decision point which includes the IP rights holder selecting a protection strategy, followed by the follower’s decision on how to utilize the IP. The model was designed around the management of a single IP object, with all payoff functions defined in relation to a single implementation. This section introduces a detailed description of the game-theoretic model, outlining the agents included, the full set of available strategies, and the corresponding utility functions as well as payoff matrix. To explore the strategies available to an innovative enterprise for protecting its IP, three distinct avenues were considered namely patenting the innovation as a utility model, patenting it as an invention (Michel-Schneider, 2022), and utilizing a smart contract for IP protection (Hauck, 2021). Accordingly, for followers, the strategic options include imitating the innovation (Butticè et al., 2020) or entering into a licensing agreement with the IP holder, which entails royalty payments (Vimalnath et al., 2022). The structure of the game was predicated on the assumption that agents acted in a predefined sequence. First, the IP rights holder selects a protection strategy, followed by the follower, who then selects a utilization strategy (Ho et al., 2022; Chen et al., 2021a).

In examining the influence of public authorities on patent regulation, both legislative and executive dimensions must be regarded as very important external factors. Within this context, legislative measures pertain to the legal framework that governs the duration of IP protection, the fees associated with registering and maintaining patents, the lifespan of IPRs, and the penalties imposed for violations. Meanwhile, executive measures refer to the practical enforcement mechanisms, including the intensity of regulatory oversight and the probability of detecting offenses (Smirnova et al., 2021; Morten and Duan, 2020). The detection of these forms of offenses invariably necessitates the imposition of further penalties, thereby reinforcing the deterrent effect of supervision. The behavior of followers, particularly the demographic’s decision to imitate innovations, has been observed to significantly influence the final payoff outcomes for all agents included. In effect, this has been reported to significantly alter the strategic landscape, as agents adjust respective strategies in response to evolving probabilities of detection and enforcement (Xiong et al., 2023; Gu et al., 2022; Shen et al., 2021). Similar to previous explorations, the present study adopted a Bayesian approach to capture the probabilistic and dynamic nature of state intervention (Geng et al., 2022; Cheng and Huang, 2020).

In line with the broader policy objectives for protecting IPRs and the structural needs of the model, several core variables were identified for constructing the utility functions of agents. The designations, assigned values, and descriptions of each payment element are systematically summarized in Table 1.

The following section offers a detailed explanation of the variables outlined in Table 1. Generally, beyond the initial registration costs, IPRs holders must account for the ongoing financial obligations required to maintain the legal validity of respective patents. The key obligation among these is the payment of annual fees, which have been reported to be very essential for ensuring that a patent remains enforceable throughout its designated term (Kireeva, 2022). These annual maintenance fees, applicable to both utility models and invention patents, are standardized but vary according to the number of years that have elapsed since the issuance of the patent. The specific calculations used to determine the fees for utility models and invention patents for a given year t are presented in the formulations below (Equations 1–2).

where k is the year in question from the year of the patent's inception.

Table 1 Elements of expected payments

The payoff to the rights holder from patenting a utility model or an invention in year t is defined as the difference between the total revenue generated from the sale of the IP over the specified period, denoted as R(t), and the cumulative costs associated with the patenting and maintenance of the patent up to year t. The specific formulation for calculating the payoff resulting from the patenting of a utility model is presented in Equation 3.

Market conditions are subject to change, and these changes potentially influence both demand and the total revenue, R(t). Therefore, it is very important that the revenue function accurately reflects the value of revenue in year t, accounting for the dynamics of innovation diffusion. To capture this behavior, the logistic function was adopted, as presented in Equation 4 (Sidorov et al., 2021; Rietmann et al., 2020).

The revenue generated from patenting the invention was calculated using the Equation 5.

During the calculation, it was assumed that when a smart contract is utilized as a method of IP protection, the right-holding enterprise incurred a one-time cost related to the registration of the smart contract (Staples et al., 2017). The utility function of the rights holder under the smart contract protection strategy was defined using Equation 6.

The game description outlined three distinct levels of state control over IP disposal ( denoted by condition i). Each level were associated with a different probability of detecting violations in cases of misuse. These probability values reflected varying degrees of regulatory oversight namely low, medium, and high supervision, all of which influenced the strategic decisions of agents based on the prevailing regulatory climate.

Both IPR holders and followers were observed to initially make respective strategies selection based on a priori probabilities P(wi). However, as the game unfolds, new evidences E were found, such as recorded instances of infringement detection, which invariably allowed for the recalibration of these probabilities using Bayes' theorem to derive the posterior probabilities P(wi|E) (Zhao and Li, 2020). This Bayesian updating process equipped agents with the capacity to refine each respectively selected strategy by providing the opportunity for rights holders to choose whether to intensify IP protection measures, while followers reassess the risks associated in imitation under evolving enforcement conditions.

The utility function guiding followers when making the decision to imitate an innovation incorporates expected revenues and associated costs, while also factoring in the probability of infringement detection and the severity of corresponding penalties. These probabilities are directly shaped by the regulatory posture of the government under each condition i, and are formally represented in Equation 7.

The utility function for followers when selecting the strategy of purchasing a license is presented is presented in Equation 8.

The aforementioned game rules can be employed to construct a game tree, as illustrated in Figure 1.

Figure 1 Game tree of the game model between intellectual property holders and followers. In the terminal nodes of the game tree, the utility functions of each agent were identified and labeled

The current section presents the results of a simulation conducted using a defined set of values corresponding to payment elements with the aim of showing the practical application of the proposed model in identifying optimal strategies for agents. These values were coresponded with the current regulatory framework established by the Patent Law of the Russian Federation. Specifically, the maintenance fees for patents on utility models and inventions, which were denoted as Pum(t) and Pinv(t) (Equations 1-2), were calculated based on the annual fee schedule prescribed by the Federal Service for Intellectual Property of the Russian Federation (see Table 2). The data was sourced through an analysis of Russian Federation Government Resolution No. 1151, which governs patent-related fees for legally significant actions. In this context, the relevant fees were categorized by type of patent law object, with an emphasis on payments required to maintain the validity of patents on inventions and utility models.

Table 2 Annual patent maintenance fees

In assigning values to the payment elements for the variables , M, and L, the figures were corresponded with the current data stipulated by existing patent legislation. The minimum patent grant fees, which were represented with Cum for utility models and Cinv for inventions, were calculated based on the provisions outlined in the current Patent Law of the Russian Federation.

To estimate the financial implications associated with registering a smart contract on behalf of the right holder, the average cost of registration on a widely used platform, such as Ethereum, was considered. According to Castillo et al. (2022), this cost ranged between $30 and $300 per transaction. Upon conversion into roubles, the upper bound of this range, which was approximately 27000 roubles, was adopted as the value of the payment element Csc.

Considering the proposed model, it was assumed that the value of year t Tum, as exceeding this threshold would render the strategy of patenting IP as a utility model inapplicable for the right holder. The complete set of payment element values used in the game is presented in Table 3.

Table 3 Values for payment elements

Recognizing that the parameter s determines the growth rate of the logistic function, it became very important to select a value that reflected a moderate and realistic pace of innovation diffusion within the market. Accordingly, the growth rate constant s was established by calibrating empirical diffusion data for each specific innovation to correspond with the logistic model (Parvin and Beruvides, 2021). In accordance with the objectives of this study, the value of s was fixed at 0.1, representing a moderate rate of growth. This choice invariably facilitated the simulation of a scenario in which the product progressively secured market share, eventually reaching its maximum revenue within a plausible timeframe. The solutions derived from the game-theoretic model were subsequently analyzed under three conditions representing varying levels of governmental supervision. These conditions corresponded to offense detection probabilities of w1 = 0.2, w2 = 0.6, and w3 = 0.9, which signify low, medium, and high levels of regulatory oversight, respectively. Furthermore, the associated a priori probabilities P(wi) for each level of supervision were 0.4, 0.4, and 0.2, respectively. Table 4 presents the results of the utility function calculations for agents under each sequentially selected strategy, expressed in rubles.

Table 4 Values of agents' utility functions

The simulation results for the time t = 9 years showed that the values of the payoffs depended on the designated level of government supervision and the corresponding probabilities of offense detection wi. Essentially, these values possess variations only when followers adopt the innovation imitation strategy. This was due to the fact that the payoff function Vf_im(t) integrated the probabilistic dimension of events, a feature not present in the utility functions associated with other strategies. Figure 2 shows the relationship between payoffs and strategy selection, reflecting the process of equilibrium identification (Hendrarini et al., 2022). The backward induction method was adopted to determine equilibrium outcomes under conditions of average regulatory supervision (Feinberg, 2021; Abapour et al., 2020).

The core concept of the proposed model lies in analyzing the game by working backward from the final stage (subgame) to identify the optimal strategies for each agent at every step. Initially, the utility function values for all possible strategic combinations were computed. Figure 2 presents the payoff profiles corresponding to each combination of agent strategies. At the outset, the follower’s strategy of innovation imitation was found to be the most advantageous, producing the highest payoff. Subsequently, the optimal strategy for the rights holder was identified, with the licensing strategy for the follower being excluded based on the outcomes derived from the final stage.

Figure 2 Finding the optimal solution for condition i = 2

The strategies selected by agents to maximize respective payoffs were highlighted in green. Accordingly, the subgame equilibrium was characterized by the following combination: ({Smart contract}; {Imitation Innovation, Imitation Innovation, Imitation Innovation}). Under this equilibrium, the payoff profile was (571,687; 115,475). When supervision is low and the probability of offense detection was given by w1, the equilibrium remained unchanged, and the resulting payoffs for right holders and followers amounted to (571,687; 131,475), respectively.

It is important to state that the identification of optimal strategies shifted under conditions of high supervision. In these cases, the equilibrium was attained when both agents adopted the following strategy profile: ({Smart contract}; {License agreement, License agreement, License agreement}). This led to the attainment of a payoff profile of (1,066,687; 103,687), meanwhile for moderate supervision, the payoff profile remained (571,687; 115,475).

When an equilibrium condition is under a high level of supervision, in contrast to previous results, the influence of IP policy on follower strategies becomes evident. In this scenario, the payoff from innovation imitation for followers, considering the high probability of offense detection and the obligation to pay a fine, was observed to fall below the payoff associated with obtaining a license. As a result, when the a priori probabilities shift toward stricter regulatory oversight, it becomes more advantageous for followers to engage in licensing agreements rather than pursue imitation, in order to maximize respective expected utility.

This outcome is in line with models that have demonstrated how enhanced enforcement mechanisms, such as stronger patent protections and a higher probability of violation detection, diminished the incentives for IP imitation by followers (Klein, 2020). The decline in the net benefit from imitation was observed to be primarily driven by the increased risk of incurring fines and litigation costs. Therefore, licensing becomes a more appealing strategy when the cost of acquiring usage rights is lower than the potential financial and legal repercussions of IP infringement.

The findings of the present study shows that, across all scenarios, rights holders consistently adopted an IP protection strategy based on smart contracts. This preference was observed to be an outcome of the demographic’s payoff structures, which was significantly influenced by the fixed revenue from the sale of innovative solutions R(t), set at a constant maximum value Rmax, and the associated costs of IP protection. Importantly, the financial cost of registering a smart contract was found to be lower than the cumulative expenses incurred through patent registration, which requires annual maintenance fees over the term of protection. Beyond the economic rationale, the adoption of smart contracts by rights holders is also motivated by the intrinsic advantages associated with the strategy, such as transparency, automation, and the immutability of contract terms. These features invariably foster greater trust between contractual parties and enhance the monitoring of compliance with IPRs. Within the broader framework of international innovation collaboration, smart contracts serve as a pragmatic and borderless mechanism, unencumbered by jurisdictional constraints, thereby streamlining cross-border IP protection.

A promising direction for future exploration include evaluating the strategic decisions of agents through the lens of evolutionary stability, particularly by examining whether identified equilibrium points qualify as evolutionarily stable strategies (Gu and Hang, 2022; Li and Xu, 2022). As proven in a previous investigation, numerical simulations can significantly show the manner in which changes in relevant parameters influence the dynamics of evolutionary games among three stakeholders. These forms of simulations can incorporate the state as an active agent, whose strategic behavior varies with the degree of offense supervision (Chen et al., 2021b). According to another study, dynamic modeling of offense severity aided the determination of appropriate fine levels, with the aim of fostering a stable cooperative environment for IP protection and utilization. Furthermore, introducing the state as a strategic actor can substantially enable the evaluation of conditions under which collaborative behavior is reinforced by added societal benefits, such as targeted subsidies and tax incentives, which may significantly increase government engagement in IP governance (Yang et al., 2018). Lastly, the intensity factor of patent infringement litigation and dispute resolution, alongside their respective impact on IPRs protection strategies and the utility functions of right holders, can be regarded as an executive aspect of state influence (Hu, 2023).

In conclusion, the game-theoretic model presented in this study enabled the evaluation of potential strategies for innovative enterprises, both from the perspective of right holders selecting IP protection strategies and followers choosing methods for leveraging innovation. The model took into account key aspects of IPRs protection, including the timing and forms of IP protection, as well as the intensity of state enforcement. This was achieved by introducing the probabilistic nature of offense detection across three distinct levels of supervision. To illustrate the outcomes, a statistical investigation of the model was conducted on a specific set of values pertaining to the current stipulations of the Patent Law of the Russian Federation. Subsequently, the equilibria were determined through the method of backward induction. It was observed that, for specific values of the payment profile at low and medium levels of supervision, followers selected the strategy of innovation imitation and right holders chose the strategy of protecting IP with a smart contract to achieve the greatest possible payoff. In circumstances where the level of supervision was high, followers were observed to predominantly select a strategy for license acquisition, while the right holders maintained respective originally selected strategy. Based on the observations made, smart contracts offered significant advantages for IP protection, especially for rights holders aiming to reduce cost and gain operational flexibility. However, the effective implementation of this strategy hinges on the careful formulation of contract terms and consideration of legal specifics. A smart contract must comprehensively detail all conditions for the transfer of IPRs, including the scope of rights granted, the license duration, the grounds for contract termination, the terms of royalty distribution, and the mechanism for imposing penalties for contract violations. Furthermore, these contracts must be designed with a focus on mitigating potential risks of disputes arising from the unlawful use of IP objects. In future explorations, the model proposed in this study can be adopted to identify optimal strategies under evolving IP protection regimes and to accommodate novel forms of IP utilization. The model can also be used to examine the influence of modifying the conditions of patent legislation by altering the level of fines for IP misuse or the extent of protection provided by the state.

The research is funded by the Ministry of Science and Higher Education of the Russian Federation (contract No. 075-03-2025-256 dated 16.01.2025).

Abapour, S, Nazari-Heris, M, Mohammadi-Ivatloo, B & Tarafdar Hagh, M 2020, 'Game theory approaches for the solution of power system problems: A comprehensive review', Archives of Computational Methods in Engineering, vol. 27, pp. 81-103, https://doi.org/10.1007/s11831-018-9299-7

Butticè, V, Caviggioli, F, Franzoni, C, Scellato, G, Stryszowski, P & Thumm, N 2020, 'Counterfeiting in digital technologies: An empirical analysis of the economic performance and innovative activities of affected companies', Research Policy, vol. 49, no. 5, article 103959, https://doi.org/10.1016/j.respol.2020.103959

Castillo, DVS, Co, CNB, Maranan, KGR, Quinio, DJ & Pedrasa, JRI 2022, 'Creducate: Blockchain-based academic record management and verification system built in the Solana network', In: TENCON 2022 - IEEE Region 10 Conference, pp. 1–6, https://doi.org/10.1109/TENCON55691.2022.9977896

Chen, J, Wei, Z, Liu, J & Zheng, X 2021a, 'Technology sharing and competitiveness in a Stackelberg model', Journal of Competitiveness, vol. 13, no. 3, pp. 5–20, https://doi.org/10.7441/joc.2021.03.01

Chen, J, Xiong, W, Xu, L & Di, Z 2021b, 'Evolutionary game analysis on supply side of the implement shore-to-ship electricity', Ocean & Coastal Management, vol. 215, article 105926, https://doi.org/10.1016/j.ocecoaman.2021.105926

Cheng, Z & Huang, N 2020, 'Risk assessment and decision-making of a listed enterprise's L/C settlement based on fuzzy probability and Bayesian game theory', Journal of Information Processing Systems, vol. 16, no. 2, pp. 318-328, https://doi.org/10.3745/JIPS.04.0156

Feinberg, Y 2021, 'Games with unawareness', The BE Journal of Theoretical Economics, vol. 21, no. 2, pp. 433–488, https://doi.org/10.1515/bejte-2018-0186

Geng, X, Lv, L, Wang, Y, Sun, R & Wang, X 2022, 'Evolutionary game research on green construction considering consumers’ preference under government supervision', International Journal of Environmental Research and Public Health, vol. 19, no. 24, article 16743, https://doi.org/10.3390/ijerph192416743

Gu, Q & Hang, L 2022, 'A game analysis-based behavioral interaction framework between governments and innovative enterprises for intellectual property regulation policies', Sustainability, vol. 14, no. 11, article 6732, https://doi.org/10.3390/su14116732

Gu, Q, Hang, L & Sun, S 2022, 'Behavioral game theory model in pollution control with additional supervision', Algorithms, vol. 15, no. 5, article 137, https://doi.org/10.3390/a15050137

Hauck, R 2021, 'Blockchain, smart contracts and intellectual property: Using distributed ledger technology to protect, license and enforce intellectual property rights', Legal Issues in the Digital Age, vol. 2, no. 1, pp. 17–41, https://doi.org/10.17323/2713-2749.2021.1.17.41

Hendrarini, N, Asvial, M & Sari, RF 2022, 'Wireless sensor networks optimization with localization-based clustering using game theory algorithm', International Journal of Technology, vol. 13, no. 1, pp. 213-224, https://doi.org/10.14716/ijtech.v13i1.4850

Ho, E, Rajagopalan, A, Skvortsov, A, Arulampalam, S & Piraveenan, M 2022, 'Game theory in defence applications: A review', Sensors, vol. 22, no. 3, article 1032, https://doi.org/10.3390/s22031032

Hu, H 2023, 'Study on the dilemma and improvement of the punitive damages system for intellectual property rights', Highlights in Business, Economics and Management, vol. 9, pp. 795-801, https://doi.org/10.54097/hbem.v9i.9262

Khoirunisa, R, Mushfiroh, A & Gamal, A 2023, 'The identification of challenges in innovation ecosystem of West Java, Indonesia using a systematic literature review', International Journal of Technology, vol. 14, no. 7, pp. 1408-1418, https://doi.org/10.14716/ijtech.v14i7.6662

Kireeva, I 2022, 'How much does it cost to protect your IPRs? Or consistency of different rates of IP state fees with national treatment and most favoured nation principles', Journal of Intellectual Property Law and Practice, vol. 17, no. 10, pp. 801-810, https://doi.org/10.1093/jiplp/jpac087

Klein, MA 2020, 'Secrecy, the patent puzzle and endogenous growth', European Economic Review, vol. 126, article 103445, https://doi.org/10.1016/j.euroecorev.2020.103445

Li, J & Xu, C 2022, 'Evolutionary game analysis of e?commerce intellectual property social cogovernance with collective organizations', Complexity, vol. 2022, no. 1, article 2380321, https://doi.org/10.1155/2022/2380321

Li, J, Xu, C & Huang, L 2022, 'Evolutionary game analysis of the social co-governance of e-commerce intellectual property protection', Frontiers in Psychology, vol. 13, article 832743, https://doi.org/10.3389/fpsyg.2022.832743

Michel-Schneider, U 2022, 'Patenting—a cost management perspective', In: Economics and Finance Conferences, International Institute of Social and Economic Sciences, Prague, article 12915571, https://doi.org/10.20472/EFC.2022.016.010

Morten, CJ & Duan, C 2020, 'Who's afraid of Section 1498? A case for government patent use in pandemics and other national crises', Yale Journal of Law and Technology, vol. 23, article 1

Nicodemus, T & Egwakhe, JA 2019, 'Technology transfer and competitive advantage: The managers’ perspective', Technology, vol. 11, no. 28, pp. 66-75, https://doi.org/10.7176/EJBM/11-28-08

Nurulin, YR, Skvortsova, IV & Konovalova, OA 2023, 'Innovation management models in the energy sector', International Journal of Technology, vol. 14, no. 8, pp. 1759-1768, https://doi.org/10.14716/ijtech.v14i8.6846

Parvin, AJ Jr & Beruvides, MG 2021, 'Macro patterns and trends of US consumer technological innovation diffusion rates', Systems, vol. 9, no. 1, article 16, https://doi.org/10.3390/systems9010016

Rietmann, N, Hügler, B & Lieven, T 2020, 'Forecasting the trajectory of electric vehicle sales and the consequences for worldwide CO2 emissions', Journal of Cleaner Production, vol. 261, article 121038, https://doi.org/10.1016/j.jclepro.2020.121038

Rudskaya, I, Kryzhko, D, Shvediani, A & Missler-Behr, M 2022, 'Regional open innovation systems in a transition economy: A two-stage DEA model to estimate effectiveness', Journal of Open Innovation: Technology, Market, and Complexity, vol. 8, no. 1, article 41, https://doi.org/10.3390/joitmc8010041

Shen, J, Gao, X, He, W, Sun, F, Zhang, Z, Kong, Y, Wan, Z, Zhang, X, Li, Z, Wang, J & Lai, X 2021, 'Prospect theory in an evolutionary game: Construction of watershed ecological compensation system in Taihu Lake Basin', Journal of Cleaner Production, vol. 291, article 125929, https://doi.org/10.1016/j.jclepro.2021.125929

Shmeleva, N, Gamidullaeva, L, Tolstykh, T & Lazarenko, D 2021, 'Challenges and opportunities for technology transfer networks in the context of open innovation: Russian experience', Journal of Open Innovation: Technology, Market, and Complexity, vol. 7, no. 3, article 197, https://doi.org/10.3390/joitmc7030197

Sidorov, S, Faizliev, A, Balash, V, Balash, O, Krylova, M & Fomenko, A 2021, 'Extended innovation diffusion models and their empirical performance on real propagation data', Journal of Marketing Analytics, vol. 9, pp. 99-110, https://doi.org/10.1057/s41270-021-00106-x

Smirnova, O, Strumsky, D & Qualls, AC 2021, 'Do federal regulations beget innovation? Legislative policy and the role of executive orders', Energy Policy, vol. 158, article 112570, https://doi.org/10.1016/j.enpol.2021.112570

Staples, M, Chen, S, Falamaki, S, Ponomarev, A, Rimba, P, Tran, AB, Weber, I, Xu, X & Zhu, J 2017, 'Risks and opportunities for systems using blockchain and smart contracts', Data61 (CSIRO), Sydney

Vimalnath, P, Tietze, F, Jain, A, Gurtoo, A, Eppinger, E & Elsen, M 2022, 'Intellectual property strategies for green innovations—An analysis of the European Inventor Awards', Journal of Cleaner Production, vol. 377, article 134325, https://doi.org/10.1016/j.jclepro.2022.134325

Xiong, Z, Wang, P & Wang, L 2023, 'Firms’ re-innovation after failure and institutional environment: An evolutionary game theoretical approach', Economic Research-Ekonomska Istraživanja, vol. 36, no. 1, pp. 885-905, https://doi.org/10.1080/1331677X.2022.2080743

Yang, Z, Shi, Y & Li, Y 2018, 'Analysis of intellectual property cooperation behavior and its simulation under two types of scenarios using evolutionary game theory', Computers & Industrial Engineering, vol. 125, pp. 739-750, https://doi.org/10.1016/j.cie.2018.02.040

Zhang, M, Huang, Y, Jin, Y & Bao, Y 2023, 'Government regulation strategy, leading firms’ innovation strategy, and following firms imitation strategy: An analysis based on evolutionary game theory', PLOS ONE, vol. 18, no. 6, article e0286730, https://doi.org/10.1371/journal.pone.0286730

Zhao, C & Li, J 2020, 'Equilibrium selection under the Bayes-based strategy updating rules', Symmetry, vol. 12, no. 5, article 739, https://doi.org/10.3390/sym12050739