Forecast of Stability of the Economy of the Russian Federation with the AI-System “Decision Tree” in a Cognitive Model

Corresponding email: mmiop@vstu.ru

Published at : 29 Dec 2023

Volume : IJtech

Vol 14, No 8 (2023)

DOI : https://doi.org/10.14716/ijtech.v14i8.6848

Lomakin, N., Kulachinskaya, A., Tsygankova , V., Kosobokova , E., Minaeva , O., Trunina , V., 2023. Forecast of Stability of the Economy of the Russian Federation with the AI-System “Decision Tree” in a Cognitive Model. International Journal of Technology. Volume 14(8), pp. 1800-1809

| Nikolay Lomakin | Volgograd State Technical University, Faculty of Economics and Management, Department of Management and Finance of Production Systems, Department of Economics and Entrepreneurship ave. V.I. Lenina, 2 |

| Anastasia Kulachinskaya | St. Petersburg Polytechnic University, Graduate school of industrial economics Polytechnicheskaya, 29, 195251, St. Petersburg, Russia |

| Vera Tsygankova | Volgograd State Technical University, Faculty of Economics and Management, Department of Management and Finance of Production Systems, Department of Economics and Entrepreneurship ave. V.I. Lenina, 2 |

| Ekaterina Kosobokova | Volgograd branch of the PRUE G.V. Plekhanov, Department of Economics st. Volgodonskaya, 11, Volgograd, 400066, Russia |

| Oksana Minaeva | Volgograd State Technical University, Faculty of Economics and Management, Department of Management and Finance of Production Systems, Department of Economics and Entrepreneurship ave. V.I. Lenina, 2 |

| Valentina Trunina | Volgograd State Technical University, Faculty of Economics and Management, Department of Management and Finance of Production Systems, Department of Economics and Entrepreneurship ave. V.I. Lenina, 2 |

Increased use of modern mathematical

algorithms based on artificial intelligence determined the relevance of this

study, which is important for predicting the sustainable development of the

country's economy in general and its banking sector in particular. To achieve

the purpose of the research, the presented work used methods such as

monographic, analytical, statistical, cognitive model, and artificial

intelligence system "Random Forest". The aim of the study is to prove

or disprove the hypothesis that, using a cognitive model, using the Random

Forest ML model, it is possible to obtain an accurate forecast of the value of

the "sustainability coefficient", reflecting the stability of the

domestic economy. The scientific novelty of the study is due to the fact that

the author's approach is proposed for indicating the crisis state of the

economy through the calculation and neural network forecasting by the machine

learning model "Random Forest" of the "Stability

Coefficient" of the economy, which is calculated as the quotient of dividing

the profit index of the banking system to the GDP growth index. The possibility

of practical application in the banking sector determines the practical

significance of the conducted scientific research since the approach proposed

by the authors regarding the formation of a forecast of the “sustainability

coefficient” can be successfully used to support managerial decision-making at

the strategic level in the banking system. A hypothesis was put forward and

proven that based on the use of a digital cognitive model and the Random Forest

ML system, a forecast of economic stability can be successfully generated.

Cognitive modeling; DL-model Random Forest; Formation of sustainability forecast; Sustainability of the country's economy

Increased use of modern mathematical algorithms based on artificial intelligence determined the relevance of this study, which is important for the purpose of predicting the sustainable development of the country's economy in general and its banking sector in particular. The authors proposed an AI system processing BigData to predict the financial risk in the real economy of Russia. A hypothesis that the neural network allows obtaining a forecast of the financial risk in Russia has been put forward and proved.

The scientific novelty of this study is

the proposal to use the "Sustainability Coefficient" of the economy

to determine its crisis state. The coefficient is calculated by dividing the

banking system profit index by the GDP growth index. To predict this crisis

state, a Random Forest machine learning model is employed. The practical

significance lies in the fact that the approach proposed by the authors for

forming a forecast of the "sustainability coefficient" can be used in

practice to support managerial decision-making.

The aim of the study is to prove or

disprove the hypothesis that, using a cognitive model, using the Random Forest

ML model, it is possible to obtain an accurate forecast of the value of the

"sustainability coefficient", reflecting the stability of the

domestic economy. In previous studies, the authors considered issues related to

identifying the main factors influencing the sustainability of an enterprise

and its bankruptcy using the Connan-Golder model (Lomakin

et al., 2023b). Previously,

the authors studied the cognitive model of financial stability of the domestic

economy (Lomakin et al., 2022).

Achieving the goal that was set in the

study required solving a number of problems, including: 1) studying the

theoretical aspects that determine the influence of the results of the banking

system on changes in GDP; 2) study of trends that are associated with the

development of artificial intelligence systems and their application in the

financial sector, 3) formation of a neural network model dataset; 4)

calculation of performance indicators and predictive value of an effective

feature based on the use of the ML Random Forest model. 5) analysis of the

obtained results.

Answering the question of what is new in

this topic, it should be noted that the authors recently studied a

correlation-regression model for analyzing overdue debts and an AI system for

predicting the financial risk of Russian commercial banks; the scientific

novelty of this study is to fill the gap by studying the patterns regarding the

sustainability of the economy based on the Random Forest DL model (Lomakin et al.,

2023a).

A hypothesis was put forward and proven

that, based on using a digital cognitive model and the Random Forest ML system,

a forecast of economic stability was generated. The work of many scientists is

devoted to the study of the problems of ensuring the sustainable development of

the domestic economy. They represent the increment of scientific knowledge, the

results of research presented in the works of Badvan N.L., Gasanov O.S. and

Kuzminova A.N., who are devoted to the study of issues of ensuring financial market

stability based on cognitive modeling (Badvan,

Gasanov, and Kuzminov, 2018). Research shows that estimating the size of

losses as a result of financial risk caused by volatility is important to

ensure sustainable development in conditions of market uncertainty. In

practice, risk calculation by the VAR method is widely used (Indah, Sari, and Wijaya, 2022).

Numerous scientists, both domestic and

international, have devoted their research to addressing the presented problem.

In particular, (Lomakin et al., 2016) explored issues related to risk monitoring,

utilizing neural networks and fuzzy algorithms. The multifaceted concept of

sustainable development is influenced by various factors. According to Dianov and Isroilo (2022), sustainable development

can be attained by formulating recommendations to enhance the efficiency of

management systems. Furthermore, Koshelev,

Dimopoulos, and Mazzucchelli, (2022) have contributed to the scientific

significance by developing an innovative strategy for an industrial cluster,

employing the method of complex real options.

The methodology of this study is based on

the use of a cognitive model. Modeling financial and economic stability based

on a cognitive model allows the development of an original approach to provide

support for managerial decision-making under conditions of uncertainty by

predicting the stability of the Russian economy. The practical significance of

the study is that the results of digital forecasting of the stability of the

Russian economy can be recommended for practice.

2.1. Analysis, modeling, study and generalization

To

achieve the purpose of the research, the presented work used methods such as

monographic, analytical, statistical, cognitive model, artificial intelligence

system "Random Forest". In the ML model, a machine learning algorithm

was used, an ensemble (set) of decision trees was formed, each tree having a

different architecture, generated a predictive value of the resulting feature,

and the algorithm embedded in the model selected the best tree and the best

forecast result According to Accenture experts, the application of artificial

intelligence systems has the potential to boost bank profits by 34%.

Additionally, utilizing cloud technologies with Big Data enables banks to

mitigate risks and enhance efficiency (Accenture, 2023).

Notably, in the banking sector, Sberbank stands out as it employs an artificial

intelligence system, enabling automated lending decisions through AI (Forbes,

2019).

To explain the

method in detail, please refer to the RF Random Forest method containing an

ensemble of decision trees. The tree structure includes “leaves” and

“branches”, and the edges (“branches”) of the tree represent attributes on

which the objective function depends. Objective function values are written in

"leaves," and attributes are written in other nodes. To classify some

features, you need to move from the top of the tree to the leaves and get

corresponding values. Classification decision trees are widely used in data

mining because their goal is to create a model that predicts the value of a

target variable based on several variables in the model's input.

In order for

the works in the article to be understood and reproduced by others, it is

important to also explain sample preparation. The research regarding the Random

Forest DL model was carried out in the Collab cloud service (Patent,

2023). When reproducing, please first make a copy of the page

and work on the copied version. The cognitive model is presented in the service

(Cognitive Model, 2023). The

dataset was generated using statistical data reflecting the development of the

economy and banking sector of Russia for the period 2010-2022 and is presented

here (Bank, 2023). Pre-processing before

measurement was reduced to replacing the names of the fields of the original

table with an abbreviation with a reduction in the length of names of analyzed

features included in the model. The model training workflow took place using

the Pandas, NumPy, Scikit-Learn and other libraries. Data collection during

measurements was carried out automatically in the cloud, which is presented in

the article in the form of screen forms.

2.2. Literature review

The study of problems related to the

stability of the financial and economic system is important in modern

conditions, which are characterized by the rapid development of Industry 4.0

technologies. The study of individual aspects of the problem is attracting more

and more attention from domestic and foreign scientists. A substantial number

of Western scientists have dedicated their studies to exploring issues related

to financial stability.

The results of the studies show that This

category of “economic sustainability” is a complex and multifaceted concept.

Many works by Russian researchers and foreign scientists are devoted to the

study of the problem of sustainability of economic systems. These problems are

the focus of attention in the works of economists, for example, Abdrakhmanova et

al. (2019) highlight the increasing relevance and significance of

studying the utilization of artificial intelligence systems and cyber-physical

systems in the contemporary context. This exploration is crucial for fostering

economic growth and sustainable development, particularly in mitigating

financial risks amid escalating uncertainties and market volatility. Abdalmuttaleb and Al-Sartawi (2021) reviewed the

latest research in the application of artificial intelligence for stable

financing and sustainable technologies.

As practice shows, the reliable operation

of the banking system is one of the key aspects of the economy's financial

stability in the context of large-scale implementation of digitalization of

business processes in the banking sector. Among the known problems associated

with ensuring financial stability, the most pressing is preventing the growth

of loan debt. It is often important to assess the creditworthiness, financial

condition, and stability of businesses. A team of authors led by M. Rybyantseva

reviewed various approaches to such an assessment and identified the most

effective of them (Rybyantseva et al., 2017).

In the works presented by the authors

Hengxu Lin, Dong Zhou, Weiqing Liu, and Jiang Bian, their own deep risk model

was proposed, which made it possible to obtain a solution for deep learning and

analysis of hidden risk factors. Scientists conducted experiments with data

obtained from the stock market. The developed model demonstrated high

efficiency since the method used made it possible to identify dispersion and

reduce the risk of the total portfolio, which had minimal dispersion (Lin et al.,

2021). Research by a group of authors, which included Ni Zhan, Sun, Y.,

Jakhar, A. and Liu, H. was aimed at solving issues in the development of

graphical models of financial time series in the process of selecting an

investment portfolio. The authors were various graphical models have been

proposed in order to form optimal portfolios (Zhan et al., 2021) Four criteria for

financial stability were proposed by Michael Foot as he came to a conclusion

that it occurs when “(a) the monetary system is stable; (b) employment is close

to full employment; c) there is confidence in the stability of key financial

institutions and markets; (d) there are no relative fluctuations in real estate

prices and financial resources within the economy that undermine (a) or (b)” (Foot, 2022).

3.1 Results

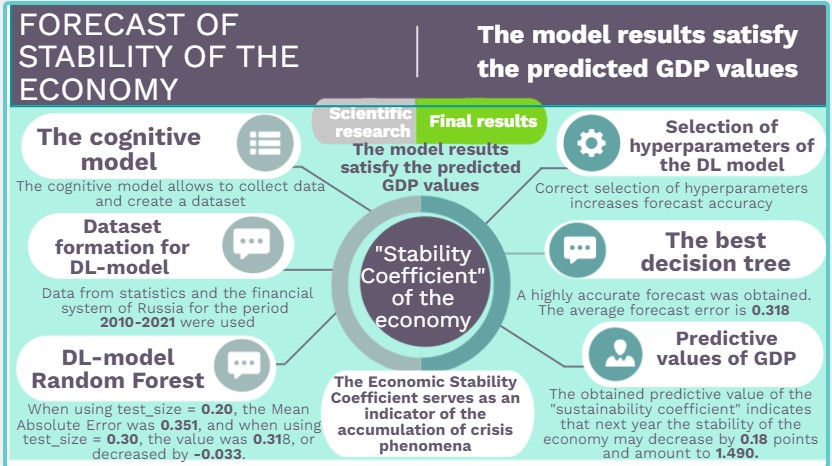

The research, the results of which are

presented in this article, was carried out using the Random Forest method, a

cognitive model (Figure 1).

The forecast of the “stability

coefficient” of the economy based on the DL model allows us to predict the

level of financial and economic stability in the country and provide support

for making strategic management decisions regarding achieving stability of the

Russian financial system in conditions of uncertainty and risk. Forecasting the

“sustainability coefficient” parameter of development is important for the

development of the banking system.

The cognitive model acts as a kind of

trigger, which, in turn, launches the methods as independent modular programs,

in particular, the Random Forest Machine Learning Model, which makes it

possible to obtain a predictive value of the stability of the economy.

The use of the Graphviz program, which is

a utility package that was proposed by AT&T laboratories for automatically

visualizing graphs based on their text descriptions, made it possible to

provide visualization of the Digital Cognitive Model. The package developed by

the companies is distributed as open source and is designed to work with

Windows and other operating systems.

Figure 1 Visualization of the cognitive model

Figure 2 The script for visualizing the cognitive

model based on the Graphviz (fragment)

The dataset for training the Random

Forest model is shown below (Table 1).

Table 1 Dataset of the neural network model

Random Forest (fragment)

|

Year |

Key_ rate |

Growth_ assets |

Share_ loans |

RTS |

USD |

Invest-ments |

Acco-unts |

Outflow |

Sigma_ profit |

Bank assets |

GDP |

Banks_ profit |

Coeff_ stability | |

|

2021 |

8.50 |

16.0 |

23.5 |

1609.7 |

73.7 |

21.2 |

38300 |

72.0 |

-108.5 |

120.0 |

131015.0 |

2400.0 |

1.8318 |

|

|

2020 |

4.25 |

16.0 |

17.8 |

1376.4 |

73.8 |

16.5 |

32300 |

53.0 |

-72.7 |

103.7 |

107315.3 |

1608.0 |

1.5699 |

|

|

2019 |

7.25 |

10.4 |

5.9 |

1549.4 |

61.9 |

20.6 |

3069 |

25.2 |

-77.5 |

92.6 |

109241.5 |

1715.0 |

1.5699 |

|

In this study, the data presented in the table was obtained manually,

but the process can be automated. The DL model, written in Python, was created

and trained in the Google Collab cloud service. Taking into account the

statistical data and the domestic financial system for the period 2010-2021,

the neural network model "Random Forest" was formed. The neural

network model data set includes the following parameters:

1)

Year – Year;

2)

Key rate at the end of the year - Key_rate;

3)

Growth of bank assets, % - Growth_assets;

4)

Share of overdue loans, % - Share_loans;

5)

RTS index – RTS;

6)

Dollar exchange rate, rub. – USD;

7)

Investments in fixed assets in GDP, % - Investments;

8)

Number of Russians with stock exchange accounts, thousand

people – Accounts;

9)

Capital outflow, billion dollars – Outflow;

10)Risk (VaR), banking system,

billion rubles - Sigma_profit;

11)Bank assets, trine. Rub. -

Bank assets;

12)GDP, billion rubles – GDP;

13)Profits of banks, billion

rubles - Banks_profit;

14)Stability factor (pofit /GDP)

- Coeff_stability.

Research has shown that

the Central Bank's key rate, expressing the cost of money, is an important

factor, representing the Central Bank's tool to ensure the stabilization of the

financial system and the real sector of the economy (Figure 3).

Figure 3 The influence of the factor’s dynamics

The proposed Economic

Stability Coefficient serves as an indicator of the accumulation of crisis

phenomena if its values are below the values of the GDP (Delta GDP) change

index, as can be seen in the graph. Based on the use of the

sklearn.model_selection library, a model was obtained in the training set of

which a training sample was randomly formed (Figure 4).

Figure 4 Training set for the DL model “Decision

Tree” (fragment)

A “decision tree” (also “classification tree” or “regression tree”) is

a machine learning-based algorithm. Noteworthy is the study of G. Eason, B.

Noble, and I. N. Sneddon regarding the product of Bessel functions (Eason, Noble, and Sneddon, 2022).

As

a result of the work of the neural network, the algorithm selected the best

decision tree from the resulting ensemble of 50 decision trees (Figure 5).

Figure 5 Schematic representation of the “decision tree”

There are two types of

decision trees that can be used for both classification and regression

problems. The application of random forest trees is presented in many works,

including G. Louppea nd others (Louppea et al., 2023).

The

classic variety is the binary classification tree (respectively regression) (Breiman 2022), which is a model with a pronounced

tree structure T from a random input vector (X1...Xp), taking its values in

(X1*...* Xp) = X in the random output variable

The tree can be

constructed from an N-sized training material, with a sample taken from

P(X1...Xp, Y) using a recursive procedure that identifies at each node t and

has a partition st=s*, for which the division of samples of node Nt into tL and

tR ensures the maximization of some measure i(t) (for example, the Gini index,

Shannon entropy or variance Y), where pL= NtL /Nt and pR = NtR / N (1).

In

general, for the sample under study, the accuracy of predicting the operation

of the model can be estimated using coefficients, and it differs if the

proportion of the test sample changes relative to the training one (Table 2).

Table 2

Forecasting quality when changing the share of the test sample

|

|

test_size = 0.20 |

test_size = 0.30 |

Deviation |

|

Mean Absolute Error: |

0.350 |

0.318 |

-0.032 |

|

Mean Squared Error: |

0.162 |

0.118 |

-0.043 |

|

Root Mean Squared Error: |

0.402 |

0.343 |

-0.059 |

When using test_size = 0.20, the Mean Absolute Error was 0.350555092,

and when using test_size = 0.30, the value was 0.317937701, or decreased by

-0.03261739. The predicted value of the economic stability coefficient was

1.49084815, which is 18.61522068% lower than the actual value of 1.832. The

obtained predictive value of the "sustainability coefficient"

indicates that next year, the stability of the economy may decrease by 0.18

points and amount to 1.49084815.

3.2. Discussion

Future research should use more

sophisticated artificial intelligence models. The integration of cyber-physical

systems with artificial intelligence enhances the promise of utilizing

robo-advisors, particularly within the financial sector. Katherine D'Hondt,

Rudy De Vinne, Eric Giesels, and Steve Raymond conducted research regarding the

use of the AI Alter Ego system in the field of robotic investments and

presented the concept "AI Alter Ego," shadow investors in robots (D'Hondt et al.,

2019).

Among the promising areas is the use of

deep neural networks in the banking sector. For example, Rusek et al. proposed

neural risk estimation in networks of untrusted resources (Rusek et al., 2022).

In addition, research into promoting green growth through innovative

engineering solutions (Ramakrishna et al.,

2023) as well as a hybrid closed-loop supply chain approach (Xu et al., 2023) appears promising.

It seems worthwhile to add limitations

and future research. For example, the issue of sustainability has not been

studied regarding enterprises and the entire sector of the economy, and not

just the dynamics of profits in the banking sector. In future research, it is

important to consider and identify patterns by identifying the contribution of

groups of enterprises (clusters) to the sustainability of the economy and the

dynamics of GDP. It seems advisable to sharpen your gap in existing research to

increase your contribution in the future. For example, it is important to study

the impact of shocks on the method of stabilizing the economy, which uses the

method of increasing the key rate by the Central Bank.

A

brief overview of the key stages of the research process includes such

important phases as the formation of a cognitive model, creation of a data set,

development and successful training of a random forest DL model based on

selected hyperparameters. The following results were obtained during the study.

A cognitive model was formed that contributed to the formation of a dataset for

the Random Forest deep learning neural network algorithm. The Random Forest DL

model was successfully generated. As a result of her work, a forecast of the

economic stability coefficient was obtained. Correct selection of

hyperparameters increases forecast accuracy. When using test_size = 0.20, the

Mean Absolute Error was 0.350555092, and when using test_size = 0.30, the value

was 0.317937701, or decreased by -0.03261739. That is, with an increase in the

proportion of the training sample, the accuracy of the forecast increases since

the Mean Absolute Error value decreased by -0.03261739. The best decision tree

showed high forecast accuracy. A highly accurate forecast was obtained. The

average forecast error is 0.317937701. The obtained predictive value of the

"sustainability coefficient" indicates that next year, the stability

of the economy may decrease by 0.18 points and amount to 1.49084815. The

expectation to see the results of the model and its practical application is

satisfied by the obtained predictive values of GDP, which opens up wide

opportunities for applying the cognitive model in practice, for example, to

provide management decision support. The model results satisfy the predicted

GDP values. It will be important for future research to leverage the

computational capabilities of more complex artificial intelligence models. The

widespread use of cyber-physical systems based on artificial intelligence will

make the use of robo-advisors even more promising. The integration of

cyber-physical systems with artificial intelligence will enhance the prospects

for the use of robo-advisors, especially in the financial sector.

The research is financed as part of the

project “Development of a methodology for instrumental base formation for

analysis and modeling of the spatial socio-economic development of systems

based on internal reserves in the context of digitalization” (FSEG-2023-0008).

Abdalmuttaleb, M.A., Al-Sartawi. M., 2021. Artificial

Intelligence for Sustainable Finance and Sustainable Technology. In: The International Conference On

Global Economic Revolutions, LNNS, Volume 423, pp. 15–16

Abdrakhmanova, G.I., Vishnevsky, S.A., Vasilkovsky,

K.O., Gokhberg, L.M., Demidkina, O.V., Demyanova, A.V., Kovaleva, G.G.,

Kotsemir, M.N., Kuznetsova, I.A., Ozerova, O-.K-.E., Polyakova, V.V., Ratay,

T.V., Ryzhikova, Z.A., Streltsova, E.A., Utyatina, K.E., Fridlyanova, S.Y.-U.,

Shugal, N.B., 2019. Digital Economy: A Brief Statistical Collection. National

Research University. High School of Economics. Available Online at https://issek.hse.ru/mirror/pubs/share/552091260.

pdf, Accessed on December 12,

2023

Accenture, 2023. Artificial intelligence in banking. Available

Online at

https://www.accenture.com/us-en/insights/banking/artificial-intelligence-inbangki

ng, Accessed on April 22, 2023

Badvan, N.L., Gasanov, O.S., Kuzminov, A.N., 2018. Cognitive

modeling of stability factors of the Russian financial market. Finance and credit, Volume 24(5), pp.

1131–1148

Bank, 2023. Bank en Stability. Available Online at https://docs.google.com/spreadsheets/d/1yxoEmm2

Vm1ZNV8uOgUqnWc3511_SqyhvceSxKOBImOk/edit?usp=sharing

Accessed on December 12, 2023

Breiman, L., 2022. Classification and Regression Trees. In: Chapman & Hall/CRC Boca Raton London New

York Washington, D.C.

Cognitive Model, 2023. Graphviz Visual Editor. Available Online at:

http://magjac.com/graphviz-visual-editor/ Accessed on December 12, 2023.

D'Hondt, C., De Winne, R.,

Ghysels, E. and Steve Raymond, 2019. Artificial Intelligence Alter Egos: Who

benefits from Robo-investing? Journal of

Empirical Finance, Volume 59, pp. 278–299

Dianov, S., Isroilov, B., 2022. Formation of effective

organisational management systems. Sustainable

Development and Engineering Economics 1, pp. 28–45

Eason, G., Noble, B., Sneddon, I.N., 2022. On certain integrals of

Lipschitz-Hankel type involving products of Bessel functions. Philosophical Transactions of the Royal

Society of London. Series A, Mathematical and Physical Sciences, Volume

247(935), pp. 529–551

Foot, M., 2023. Concept of Financial System Resilience. Available

Online at: https://studfile.net/preview/2452514/page:11/, Accessed on April 22,

2023

Forbes, 2023. How AI and Big Data Can Cut Banks’ costs by 20%.

Available Online at:

https://www.forbes.com/sites/tomgroenfeldt/2019/05/23/how-ai-and-big-data-can-cut-banks-costs-by-20/?sh=3b5f5a5d5c98,

Accessed on April 22, 2023

Indah, N.P., Sari, D.P., Wijaya, I.P.E., 2022. VAR calculation

based on the GARCH model (1.1), 2023. Available Online at:

http://abnsecurities.blogspot.com/2018/02/var-garch11.html, Accessed on

December 12, 2023

Koshelev, E., Dimopoulos, T., Mazzucchelli, E.S., 2021. Development of innovative

industrial cluster strategy using compound real options. Sustainable Development and Engineering Economics, Volume 2, pp.

80–97

Lin, H., Zhou, D., Liu, W., Bian, J., 2021. Deep Risk Model: A

Deep Learning Solution for Mining Latent Risk Factors to Improve Covariance

Matrix Estimation. In: Proceedings of

the Second ACM International Conference on AI in Finance, pp. 1–8

Lomakin, N., Kulachinskaya, A.,

Tudevdagva, U., Mogharbel, N., Lomakin, I., 2023a. Correlation-Regression Model

for Analysis of Overdue Debt and AI-System for Prediction the Finance Risk of

Russian Commercial Banks. In: International Scientific Conference “Digital

Transformation on Manufacturing, Infrastructure & Service", Cham: Springer Nature Switzerland, pp.

693–706

Lomakin, N., Maramygin, M., Kataev, A., Yurova, O.,

Lomakin, I., 2022. Cognitive Model of Financial Stability of the Domestic Economy

Based on Artificial Intelligence in Conditions of Uncertainty and Risk. International Journal of Technology.

Volume 13(7), pp. 1588–1597

Lomakin, N.I., Korotina, V.A., Rasumnyj,

A.S., Biryukov, A.R., 2016. Financial Risk Management Based on Neural Networks and

Fuzzy-Algorithms. In: 15th

Scientific And Practical Conference of The Teaching Staff of VPI (branch) of

Volgograd State Technical University (Volzhsky, January 25-29, 2016):

Collection of Abstracts. In 2 parts, Part 1 / ed. by S.I. Blaginina; VPI

(branch) VSTU. Volgograd. pp. 225–227

Lomakin, N.I., Sisinova,

I.A., Maramygin, M.S., Peskova, O.S., Shabanov, N.T., Pekarsky, N.V., 2023b.

Forecasting The Probability of Bankruptcy of an Enterprise Using The ML Model

“Random Forest” Through The Prism of Innovative Development. Fundamental Research. Volume 6, p. 27–35

Louppe, G., Wehenkel, L., Sutera, A., Geurts, P., 2023.

Understanding variable importances in forests of randomized trees. Available

Online at:https://proceedings.neurips.cc/paper/2013/file/e3796ae83

8835da0b6f6ea37bcf8bcb7-Paper.pdf,

Accessed on April 22, 2023.

Patent, 2023. 13 Programma DL-model for prognozing Bank's coeff

stability RFRegressor. Available Online at: https://colab.research.google.com/drive//1V7jjH62NXrqBaXwdhrVf8gyuMUNMlkUs#scrollTo=CgZUeQxldA6, Accessed on December 12, 2023

Ramakrishna, S., Kusrini, E., Wahyu, Nurhayati, R.W., Whulanza, Y.

., 2023. Advancing Green Growth through

Innovative Engineering Solutions. International Journal of Technology,

Volume 14(7), pp. 1402–1407

Rusek, K., Borylo, P., Jaglarz, P., Geyer, F., Cabellos, A.,

Cholda, P., 2023. RiskNet: Neural Risk Assessment in Networks of Unreliable

Resources. Journal of Network and Systems

Management, Volume 31(3), p. 64

Rybyantseva, M., Ivanova, E., Demin, S., Dzhamay, E., Bakharev,

V., 2017. Financial Sustainability of The Enterprise and The Main Methods of

Its Assessment. International Journal

of Applied Business and Economic Research, Volume 15, pp. 139–146

Xu, W., Luis, M., Yuce, B. A. ., 2023. Hybrid Method for The Closed-loop Supply Chain to Minimize Total Logistics Costs. International Journal of Technology, Volume 14(7), pp. 1449–1460

Zhan, N., Sun, Y., Jakhar, A. and Liu, H., 2021. Graphical Models for Financial Time Series and Portfolio Selection. In: ACM International Conference on A.I. in Finance (ICAIF '20)