Factor Influencing Continuation Intention of Using Fintech from the Users’ Perspectives: Testing of Unified Theory of Acceptance and Use of Technology (UTAUT2)

Published at : 31 Oct 2023

Volume : IJtech

Vol 14, No 6 (2023)

DOI : https://doi.org/10.14716/ijtech.v14i6.6636

Chen, C.F.-Y., Chan, T.J., Hashim, N.H., 2023. Factor Influencing Continuation Intention of Using Fintech from the Users’ Perspectives: Testing of Unified Theory of Acceptance and Use of Technology (UTAUT2). International Journal of Technology. Volume 14(6), pp. 1277-1287

| Caroline Fe-Yen Chen | Faculty of Applied Communication, Multimedia University, Persiaran Multimedia, 63100 Cyberjaya, Selangor, Malaysia |

| Tak Jie Chan | Faculty of Applied Communication, Multimedia University, Persiaran Multimedia, 63100 Cyberjaya, Selangor, Malaysia |

| Nor Hazlina Hashim | Department of Management and Marketing, Faculty of Business and Economics, Universiti Malaya, 50603, Wilayah Persekutuan Kuala Lumpur, Malaysia |

Fintech adoption has risen significantly in its use

and acceptance in Malaysia, as 84.2% out of the total population of 32.7

million in Malaysia are currently Internet users. The Fintech system has been

providing greater benefits to users more effectively and efficiently in this

fast-paced era, especially with the collaboration of three enormous e-wallet

companies (e.g., Touch’n Go, Boost, and Grab). However, numerous studies have

indicated that perceived technology security is a potential determinant that impacts

continuation intention due to the uncertainties and trust issues of using a

particular technology. Therefore, this study aims to investigate the factors

that contributed to the continuation intention of using Fintech applications

from the user’s perspective. The research uses the Unified Theory of Acceptance

and Use of Technology (UTAUT2) to guide the study by including perceived

technology security to expand the UTAUT2 theory. The study applied a

quantitative (survey) design and 366 valid fintech users were secure as the

respondents through purposive sampling. The results of the study indicated that

performance expectancy, facilitating conditions, hedonic motivation, and habit

have a positive and significant relationship with the continuance intention of

using the Fintech applications. However, social influence and perceived

technology security were not the determinants that contributed to the

continuance intention of Fintech applications. Conclusion, implications, and

future research suggestions were also discussed.

Continuation intention; Fintech applications; Perceive technology security; Unified Theory of Acceptance and Use of Technology 2; User’s perspective

Natural Financial technology (Fintech) has grown

spontaneously in recent years, leading to a fast-paced environment that allows

convenient, safe, and quick online financial services (Efimov, Koroleva, and Sukhinina 2021; Kang, 2018). According to Bommer, Rana, and Milevoj (2022),

Fintech is defined as the term used to describe any technology that delivers

financial services through software, such as online banking, mobile payment

apps, or cryptocurrency. Apart from that, Anifa et

al. (2022) mentioned that Fintech is about the latest technology

that tries to simplify the process of transactions and the use of monetary

services.

Fintech News Malaysia (2022) reported in their 2022 report that the total

population of Malaysia is 32.7 million, with a current Internet user

penetration rate of 84.2%. Consequently, in 2022, over 7.2 billion electronic

payment (e-payment) transactions were recorded in Malaysia, representing a 30%

increase compared to 2021 (Fintech News Malaysia,

2021; Fintech News Malaysia, 2022).

However, Ismail (2021) mentioned

that the continuity of e-wallet usage in Malaysia is still low and

unsatisfying. Moreover, mobile-based payment methods adoption and use are

rather slow in both developed and emerging countries (Talwar

et al., 2020). There have been various studies that focus on the

intention of users or consumers to the adoption of the Fintech system from the

Technology Acceptance Model (TAM) perspective (Ngo

and Nguyen, 2022; Phuong et al., 2022; Singh and Sharma, 2022; Candra, Nuruttarwiyah, and Hapsari, 2020). However, few of the

researchers recommended that future study to be conducted with the perspectives

of the Unified Theory of Acceptance and Use of Technology on predicting the

continuation intention of Fintech among users as the previous studies did not

cover this (Albugami and Zaheer, 2023; Bommer,

Rana, and Milevoj, 2022; Moorthy et al., 2022).

Based on the current literature, the researchers have

found out that the predicting factors that influence the continuation intention

of users toward the fintech system have become arguable, as Abbasia et al. (2022) stated that perceived

technology security has a significant relationship with the continuation

intention of users due to the uncertainties and trust issues of using a

particular system. Hence, Ghaisani, Kannan, and Basbeth (2022) found

that there is a significant relationship between perceived security and

cryptocurrency m-wallets continuation intentions. However, there are limited

existing studies that focus on perceived technology security as a determinant

in UTAUT2, which urged researchers to re-examine the study.

Besides, researchers have also found out that most of

the studies were conducted on the intention and behavior of the users (Ngo and Nguyen, 2022; Phuong et al., 2022; Singh and

Sharma, 2022; Leong,

Kwan, and Ming, 2021). However, there are

limited studies that were conducted focusing on the continuation intention of

Fintech among the users from the UTAUT perspective (Hassan

et al., 2023; Moorthy et al., 2022). Based on the discussion,

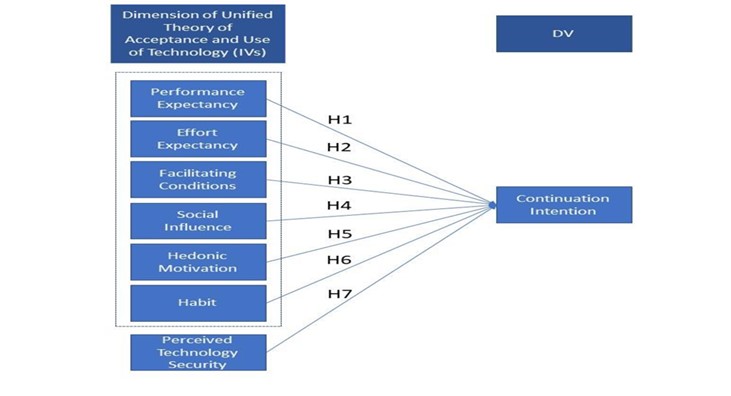

therefore, this study aims to test the predicting factors of the Unified Theory

of Acceptance and Use of Technology 2 (Performance Expectancy, Effort

Expectancy, Facilitating Conditions, Social Influence, Hedonic Motivation,

Habit) and Perceived Technology Security on the continuation intention of using

FinTech applications.

2. Literature Review

2.1. Relationship Between

Performance Expectancy and Continuation Intention

According to Gupta and

Arora (2020), performance expectancy suggests that using a specific

application can enhance productivity, and facilitate transaction activities

quickly. Additionally, various researchers have tested and found that

performance expectancy is a factor that positively influences users’ intention

to use a particular technology or service, as it can motivate individuals to

enhance their work performance and achieve their goals (Ngo

and Nguyen, 2022; Ahmad, Urus, and Nazri, 2021; Rahman, Ismail, and Bahri, 2020). Therefore, this study formulates the hypothesis:

H1: There is a positive relationship between performance expectancy and continuation intention.

2.2. Relationship Between Effort Expectancy and Continuation Intention

Past studies (Ahmad, Urus, and

Nazri, 2021; Leong, Kwan, and Ming,

2021; Winata and Tjokrosaputro, 2021) found that effort expectancy is

positively and significantly related to intention to use the Fintech system.

Furthermore, Razak, Bakar, and Abdullah (2017) findings showed that effort expectancy is a strong contributor to the

continuation intention of users. Therefore, based on the above discussion, it

formulated a hypothesis as below:

H2: There is a

positive relationship between effort expectancy and continuation intention.

2.3. Relationship Between Facilitating

Conditions and Continuation Intention

Additionally,

facilitating conditions are referred to as the system that individuals use when

they need it. Based on the existing literature, it was predicted that there is

a possibility of influence toward the continuation of Fintech among users.

Various existing studies mentioned that the relationship between facilitating

conditions and the intention of users was tested significantly (Kamarozaman and Zaidi, 2021; Ambarwati, Harja, and Thamrin, 2020). Likewise, Xie et al. (2021) stated that facilitating

conditions have a strong correlation with the adoption intention of users on

Fintech platforms, which hypothesized that:

H3: There is a positive relationship between

facilitating conditions and continuation intention.

2.4.

Relationship Between Social Influence and Continuation Intention

Besides, various results showed that

there is a significant relationship between social influence and the intention

to use Fintech (Leong,

Kwan, and Ming, 2021; Rahman, Ismail, and Bahri, 2020). Individuals positively influence their family members

and friends to use e-wallets during the pandemic (Angusamy

et al., 2023). Likewise, as supported by Chua,

Lim, and Khin (2020), it positively influences and increases public

awareness as e-wallet is compatible with user’s need and lifestyles. Therefore,

the below hypothesis is formed:

H4: There is a positive relationship

between social influence and continuation intention.

2.5. Relationship Between Hedonic

Motivation and Continuation Intention

Hedonic motivation has become one of the

factors that determine the technology acceptance of use as it is a pleasure

that the individual receives from using a particular system or technology.

Based on the existing findings of the researchers, it showed that hedonic

motivation and the intentions of the users are significantly related (Leong, Kwan, and Ming, 2021; Khatimah,

Susanto, and Abdullah, 2019). It was then tested that it was a highly

positive relationship between hedonic motivation and the intention of users on

e-wallets (Leong,

Kwan, and Ming, 2021). Therefore, the study

hypothesized that:

H5: There is a positive relationship

between hedonic motivation and continuation intention.

2.6. Relationship Between Habit and

Continuation Intention

Various past research mentioned the

positive relationship between habit and the intention of users (Chan et al., 2021; Nikolopoulou, Gialamas, and

Lavidas, 2021). Hence, it was shown by Nikolopoulou

et al. (2021) that the users’ experience and habit of using

mobile technologies in daily life have a significant relationship with the

adoption and continuous use of the system or technology. Indrawati and Putri (2018) mentioned that habit is

the most significant factor that influences the continuance Intention to use

Go-pay. Therefore, the hypothesis is formed:

H6: There is a positive relationship

between habit and continuation intention.

2.7. Relationship Between Perceived

Technology Security and Continuation Intention

Literature also showed that perceived

technology security has a significantly positive relationship with the

intention of using the Fintech system (Abbasia et

al., 2022; Ghaisani, Kannan, and Basbeth, 2022). Therefore, the

researchers predicted that perceived technology security is a determinant that

positively influences the continuation intention of Fintech. Rahman, Ismail, and Bahri (2020) stated that the

more comfortable the users felt, the faster they adopted a cashless payment

system. Therefore, this study hypothesized that:

H7: There is a positive relationship

between perceived technology security and continuation intention.

Figure

1 Proposed

conceptual framework

3.1. Research

Design

This research was conducted through a

quantitative method. Ahmad et al. (2019) highlighted

that quantitative research needs to be conducted with a structured

questionnaire and objective manner to obtain data to test for validity and

reliability.

3.2. Sampling

Technique

Researchers utilized

purposive sampling, which is selective, judgemental, or subjective sampling (Sharma, 2017), which depends on the judgment of

the researchers when it comes to specific criteria. Hence, to filter the valid

response, researchers have incorporated a screening question “Do you have

experience using the Fintech system?”. Those respondents who answered “No” will

be excluded from this study, as the study focused on continuance intention.

Additionally, since the researchers were not able to get the sampling frame for

the entire population, thus, G-power software was utilized. Therefore, the

minimum sample size with seven predictors, 0.15 effect size, and alpha (0.95)

is 153, but this study has 366 valid respondents. Hence, it is sufficient for

statistical analysis.

3.3. Measurement

A structured

questionnaire was utilized in this research, and it was divided into four

sections. Section A is the demographic questions of the respondents, such as

gender, nationality, age, education qualification, and race.

Subsequently, the

performance expectancy, facilitating conditions, social influences, hedonic

motivation, and perceived technology security instruments are adapted from the

studies of Boonsiritomachai and Pitchayadejanant

(2019). The facilitating conditions and effort expectancy items were

adapted from Venkatesh et al. (2003).

Followed by the social influences, habit and continuation intention instruments

are adapted from Venkatesh, Thong, and Xu (2012). Last but not least,

the items on perceived technology security were adapted from Salimon, Yusof, and

Mokhtar (2017).

The researcher used the 5-points Likert-type scale, which categorized with 1=

Strongly Disagree, to 5= Strongly Agree (Vagias,

2006).

3.4. Data Collection Procedures

This particular study was

conducted using an online questionnaire/survey via Google Forms. All

participant's information in this research was fully confidential and always

kept anonymous, and it will only be used for the research purpose. The data

collection was conducted from 14th December 2022 to 31st

March 2023, and a total of 390 responses were received. After filtering, there

are 366 valid responses to be used.

More

than half of the respondents are female (64.5%) and male respondents (35.5%).

The majority of the respondents are Malaysian (97.5%). Most of the respondents

are of age 20-29 years old (79.5%). This was followed by respondents of the age

below 20 years old (13.7%), which indicated that the respondents are young

adults and technologically savvy. Not to mention, Chinese respondents’

percentage is 53.3%, followed by Malay (26.8%) and Indian (15.8%).

Additionally, more than half of the respondents have a Bachelor’s degree

(65.3%), which showed that they are educated and able to make wise judgments.

4.1. Measurement Model

The convergent validity of the model is

verified by the factor loading, Composite Reliability (CR), and Average Variance

Extracted (AVE). To test the reliability and validity of the constructs, this

research utilized Cronbach’s alpha and CR. Tentama

and Anindita (2020) stated that CR needs to be higher than the

recommended value of 0.700. As shown in Table 2, all constructs have Cronbach’s

alpha values exceeding 0.700. Thus, the convergent validity is deemed

acceptable, with the AVE needing to be higher than the recommended value of

0.500 (Hair et al., 2022; Tentama &

Anindita, 2020). Hence, the criteria for the measurement model were

established.

This research assessed the discriminant validity using the Heterotrait-Monotrait Ratio of Correlations (HTMT) to check the discrimination validity of the constructs (Henseler, Ringle, and Sarstedt, 2015). According to Tian et al. (2023) and Kline (2015), the HTMT value between construct should not exceed 0.85 or 0.90. The results in Table 3 showed that all values of HTMT did not exceed the value of 0.85. Therefore, the discriminant validity was granted.

Table 2 Assessment

of measurement model

|

Construct |

Item |

Loadings |

Cronbach’s Alpha |

CR |

AVE |

|

Performance Expectancy (PE) |

PE1 |

0.829 |

0.842 |

0.894 |

0.679 |

|

|

PE2 |

0.858 |

|

|

|

|

|

PE3 |

0.789 |

|

|

|

|

|

PE4 |

0.818 |

|

|

|

|

Effort Expectancy (EE) |

EE1 |

0.807 |

0.879 |

0.917 |

0.734 |

|

|

EE2 |

0.893 |

|

|

|

|

|

EE3 |

0.885 |

|

|

|

|

|

EE4 |

0.838 |

|

|

|

|

Facilitating Conditions (FC) |

FC1 |

0.799 |

0.814 |

0.878 |

0.643 |

|

|

FC2 |

0.848 |

|

|

|

|

|

FC3 |

0.828 |

|

|

|

|

|

FC4 |

0.728 |

|

|

|

|

Social Influence (SI) |

SI1 |

0.775 |

0.866 |

0.908 |

0.713 |

|

|

SI2 |

0.806 |

|

|

|

|

|

SI3 |

0.894 |

|

|

|

|

|

SI4 |

0.895 |

|

|

|

|

Hedonic Motivation (HM) |

HM1 |

0.844 |

0.888 |

0.922 |

0.747 |

|

|

HM2 |

0.882 |

|

|

|

|

|

HM3 |

0.901 |

|

|

|

|

|

HM4 |

0.827 |

|

|

|

|

Habit (HB) |

HB1 |

0.869 |

0.858 |

0.902 |

0.697 |

|

|

HB2 |

0.869 |

|

|

|

|

|

HB3 |

0.755 |

|

|

|

|

|

HB4 |

0.842 |

|

|

|

|

Perceived Technology Security (PTS) |

PTS1 |

0.863 |

0.869 |

0.908 |

0.711 |

|

|

PTS2 |

0.832 |

|

|

|

|

|

PTS3 |

0.846 |

|

|

|

|

|

PTS4 |

0.831 |

|

|

|

|

Continuation Intention (CI) |

CI1 |

0.929 |

0.945 |

0.96 |

0.858 |

|

|

CI2 |

0.945 |

|

|

|

|

|

CI3 |

0.940 |

|

|

|

|

|

CI4 |

0.889 |

|

|

|

Table

3 Discriminant validity using HTMT criterion

|

|

CI |

EE |

FC |

HB |

HM |

PE |

PTS |

SI |

|

CI |

|

|

|

|

|

|

|

|

|

EE |

0.602 |

|

|

|

|

|

|

|

|

FC |

0.699 |

0.835 |

|

|

|

|

|

|

|

HB |

0.702 |

0.615 |

0.697 |

|

|

|

|

|

|

HM |

0.602 |

0.592 |

0.678 |

0.732 |

|

|

|

|

|

PE |

0.748 |

0.866 |

0.800 |

0.644 |

0.573 |

|

|

|

|

PTS |

0.397 |

0.388 |

0.489 |

0.640 |

0.684 |

0.367 |

|

|

|

SI |

0.410 |

0.349 |

0.569 |

0.528 |

0.669 |

0.384 |

0.648 |

|

4.2. Structural Model

Assessment

The structural model was performed using a bootstrapping procedure with a

resample of 5,000 to enhance the accuracy level of the estimation (Tian et al., 2023). The outcome of the path coefficients of the

PLS-SEM shows that the performance expectancy has a positive significant

relationship with the continuation intention of users on Fintech applications

(?1 = 0:401, t= 7.301, p < 0:05). Therefore, Hypothesis 1 is accepted.

Additionally, users’ continuation intention of Fintech is positively influenced

by effort expectancy (?2 = -0.112, t= 1.981, p < 0:05), thus maintaining

hypothesis 2. Likewise, facilitating conditions have a significantly positive

relationship with the continuation intention of the user on Fintech

applications (?3 = 0.179, t = 2.873, p < 0:05). Thus, supporting hypothesis

3. In addition, results showed that social influence has a non-significant

relationship with the continuation intention of users on Fintech applications

(?4 = -0.009, t = 0.196, p > 0:05). Therefore, hypothesis 4 was not supported.

Moreover, the habit of user’s continuation intention toward Fintech application

has a significantly positive relationship (?5 = 0.330, t = 6.395, p < 0:05).

Hence, hypothesis 5 is supported. Furthermore, users’ continuation intention of

Fintech application is significantly influenced by hedonic motivations (?6 =

0.179, t= 2.873, p < 0:05). Thus, hypothesis 6 is accepted. Likewise,

perceived technology security has a non-significant relationship with the

users’ continuation intention on Fintech applications (?7 = -0.057, t= 1.177, p

> 0:05). Therefore, hypothesis 7 was rejected.

Table 4

Hypothesis testing for direct path

|

Path |

Std. beta |

Std. errors |

T - value |

P |

LLCI (5%) |

ULCL (95%) |

D |

R2 |

f2 |

VIF |

|

H1: PE -> CI |

0.401 |

0.055 |

7.301 |

0.000** |

0.308 |

0.488 |

S |

0.590 |

0.152 |

2.575 |

|

H2: EE -> CI |

-0.112 |

0.057 |

1.981 |

0.024* |

-0.201 |

-0.016 |

S |

|

0.010 |

2.914 |

|

H3: FC -> CI |

0.179 |

0.062 |

2.873 |

0.002** |

0.077 |

0.280 |

S |

|

0.030 |

2.631 |

|

H4: SI -> CI |

-0.009 |

0.046 |

0.196 |

0.422 |

-0.085 |

0.068 |

NS |

|

0.000 |

1.808 |

|

H5: HB -> CI |

0.330 |

0.052 |

6.395 |

0.000** |

0.246 |

0.417 |

S |

|

0.152 |

2.575 |

|

H6: HM -> CI |

0.141 |

0.049 |

2.887 |

0.002** |

0.057 |

0.218 |

S |

|

0.020 |

2.471 |

|

H7: PTS -> CI |

-0.057 |

0.049 |

1.177 |

0.120 |

-0.137 |

0.024 |

NS |

|

0.004 |

1.898 |

** p-value < 0.01;

* p-value < 0.05; S= Supported; NS = Not Supported

LLCI= Lower Limit Confidence Interval;

ULCI = Upper Limit Confidence Interval

Figure 2 Path diagram of structural model

According to Shmueli et al. (2019), PLS-SEM is used to solve the apparent dichotomy between explanation and prediction. Moreso, Hair (2021) mentioned that variables can be replaced as the study continues to evolve by assessing out-of-sample prediction ability by retaining the sample. Therefore, Shmueli et al. (2019) stated that PLSpredict was performed to investigate the out-of-sample predictive power to assess the model's practical relevance. As shown in Table 5, Q² predicts that all indicators exceeded 0, and all of the RMSE in PLS-SEM analysis for users’ continuation intention on Fintech applications are more than the naïve LM value. Thus, these results showed that the model has weak predictive power.

Table 5

PLSpredict assessment

|

|

Q²predict |

PLS-SEM_RMSE |

LM_RMSE |

PLS-SEM-LM |

Interpretation |

|

CI1 |

0.517 |

0.661 |

0.669 |

-0.008 |

|

|

CI2 |

0.510 |

0.687 |

0.675 |

0.012 |

Weak |

|

CI3 |

0.441 |

0.729 |

0.702 |

0.027 |

|

|

CI4 |

0.466 |

0.751 |

0.740 |

0.011 |

|

4.3. Academic Implications

There is a limited study that focuses on

the continuation intention of users in UTAUT2 perspectives (Hassan et al., 2023; Moorthy et al., 2022),

which makes it rarely explored. The main contribution of this research is the

expansion of UTAUT2 by adding a new variable, which is perceived technology

security as a factor. Although the current study found it not significant, the

researcher believes this construct can be tested again in different settings,

which is strongly urged in numerous studies (Abbasia

et al., 2022; Ghaisani et al., 2022) and contributes to

information technology management scholarship.

4.4. Practical Implications

This research provides useful information and applications for the

government. Especially the Ministry of Finance Malaysia. As they mentioned, the

Malaysian government is currently collaborating with three enormous e-wallet

companies in Malaysia. Thus, the government could utilize the current trends by

motivating the older generation to adopt Fintech applications to generalize

Fintech applications in Malaysia.

Besides, there are a few implications that small and medium enterprises

(SMEs) or international companies could take into consideration on Fintech

applications. This research found that the majority of respondents agree and

are willing to use E-wallets such as Touch N Go to improve their pleasure (e.g.

Hedonic Motivation). By using discounts from the Fintech application, customers

are more willing to purchase the items that SMEs provide as it promotes the

satisfaction of users. Secondly, users' perspectives show a strong intention to

continue using Fintech in the near future due to the habit of using Fintech

applications daily. Therefore, SMEs should consider utilizing the benefits of

Fintech applications and follow the new trends by adopting Fintech applications

into their business strategy to enhance the efficiency and effectiveness of

doing transactions.

4.5. Limitations and

Suggestions for Future Research

This study has several limitations. Firstly, the questionnaire used in

this research was primarily answered by Malaysians. As a result, individuals

who are non-Malaysians but currently residing in Malaysia were not extensively

studied. Future research could consider including samples of non-Malaysians

living in Malaysia to further investigate user behavior regarding Fintech

acceptance. Such comparative studies could later help distinguish differences

in the intention to continue using Fintech applications between Malaysians and

non-Malaysians.

This study extended the UTAUT2 constructs and only focused on the

continuance intention to adopt the technology. Even with the addition of

perceived technological security, the framework was only able to explain the

variance by 59%. Thus, other variables can be incorporated in the future, such

as the design of the Fintech applications, technological self-efficacy,

technological stress, and demographic variables by testing the mediating and

moderating effects and contributing to the information technology management scholarship.

This

study provided insight into examining the influence of the Unified Theory of

Acceptance and Use of Technology 2 on the continuation intention of using

Fintech. This research finding shows that performance expectancy, effort

expectancy, facilitating conditions, hedonic motivation, and habit have a

significant and positive relationship with the continuation intentions of users

on Fintech applications. However, social influence and perceived technology

security do not have a significant relationship with the continuation intention

of the users to use Fintech applications.

Abbasia, G.A., Sandran, T., Ganesan, Y., Iranmaneshc, M., 2022. Go Cashless! Determinants of Continuance Intention to use E-wallet Apps: A Hybrid Approach using Partial Least Squares-Structural Equation Modeling (PLS-SEM) and Fuzzy Set Qualitative Comparative Analysis (fsQCA). Technology in Society, Volume 68, p. 101937

Ahmad, S., Urus, S.T., Nazri, S.N.F.S.M., 2021. Technology Acceptance of Financial Technology (Fintech) for Payment Services Among Employed Fresh Graduates. Asia-Pacific Management Accounting Journal, Volume 16(2), pp. 27–58

Ahmad, S., Wasim, S., Irfan, S., Gogoi, S., Srivastava, A., Farheen, Z., 2019. Qualitative v/s. Quantitative Research- A Summarized Review. Journal of Evidence Based Medicine and Healthcare, Volume 6(43), pp. 2828–2832

Albugami , M.A., Zaheer, A., 2023. Measuring E-Commerce Service Quality for the Adoption of Online Shopping During COVID-19: Applying Unified Theory and Use of Technology Model (UTAUT) model approach. International Journal of Technology. Volume 14(4), pp. 705–712

Ambarwati, R., Harja, Y.D., Thamrin, S., 2020. The Role of Facilitating Conditions and User Habits: A Case of Indonesian Online Learning Platform. The Journal of Asian Finance, Economics and Business, Volume 7(10), pp. 481–489

Angusamy, A., Kuppusamy, J., Balakrishnan, K. Tai, K.X., 2023. Effects of the Pandemic on the Adoption of E-wallets Among Young Adults in Malaysia. Journal of Information Technology Management, Volume 15(2), pp. 183–203

Anifa, M., Ramakrishnan, S., Joghee, S., Kabiraj, S., Bishnoi, M.M., 2022. Fintech Innovations in the Financial Service Industry. Journal of Risk and Financial Management, Volume 15(7), pp. 287

Bommer, W. H., Rana, S., Milevoj, E. 2022. A Meta-analysis of eWallet Adoption Using the Unified Theory of Acceptance and Use of Technology (UTAUT) Model. International Journal of Bank Marketing, Volume 40(4), pp. 791–819

Boonsiritomachai, W., Pitchayadejanant, K. 2019. Determinants Affecting Mobile Banking Adoption by Generation Y Based on the Unified Theory of Acceptance and Use of Technology Model modified by the Technology Acceptance Model Concept. Kasetsart Journal of Social Sciences, Volume 40(2), pp. 349–358

Candra, S., Nuruttarwiyah, F., Hapsari, I.H., 2020. Revisited the Technology Acceptance Model with E-trust for Peer-to-peer Lending in Indonesia (Perspective from Fintech Users). International Journal of Technology. Volume 11(4), pp. 710–721

Chan, T. J., Wok, S., Sari, N.N., Muben, M.A.H.A., 2021. Factors Influencing the Intention to Use Mysejahtera Application Among Malaysian Citizens During Covid-19. Journal of Applied Structural Equation Modeling, Volume 5(2), pp. 1–21

Chua, C.J., Lim, C.S., Khin, A.A., 2020. Consumer' Behavioural Intention to Accept of the Mobile Wallet in Malaysia. Journal of Southwest Jiantong University, Volume 55(1), p. 460

Efimov, E., Koroleva, E., Sukhinina, A., 2021. Competitiveness in the FinTech Sector: Case of Russia. International Journal of Technology. Volume 12(7), pp. 1488–1497

Fintech News Malaysia. 2021. Fintech Malaysia Report 2021: Fintech Reaches an Inflection Point in Malaysia. Fintech News Malaysia. Available online at: https://fintechnews.my/27070/malaysia/fintech-malaysia-report-2021/, Accessed on January 26, 2023

Fintech News Malaysia. 2022. Fintech Report 2022: Malaysia Charts a New Path for Fintech Growth. Fintech News Malaysia. Available online at: https://fintechnews.my/31945/malaysia/fintech-report-malaysia-2022/, Accessed on January 26, 2023

Ghaisani, N.P., Kannan, R., Basbeth, F., 2022. Consumers' Intention to Continue using Cryptocurrency Mobile Wallets in Malaysia. International Journal of Management, Finance and Accounting, Volume 3(2), pp. 1–19

Gupta, K., Arora. N., 2020. Investigating Consumer Intention to Accept Mobile Payment Systems Through Unified Theory of Acceptance Model: An Indian Perspective. South Asian Journal of Business Studies, Volume 9(1), pp. 88–114

Hair, J.J.F., 2021. Next-generation Prediction Metrics for Composite-based PLS-SEM. Industrial Management and Data Systems, Volume 121(1), pp. 5–11

Hair, J., Sarstedt, M.F., Ringle, C.M., Hult, G.T.M., 2022. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM) (3rd ed.). SAGE Publishing

Hassan, M.S., Islam, M.A., Yusof, M.F.B., Nasir, H., Huda, N., 2023. Investigating the Determinants of Islamic Mobile Fintech Service Acceptance: A Modified Unified Theory of Acceptance and Use of Technology 2 (UTAUT2) Approach. Risks, Volume 11(2), p. 40

Henseler, J., Ringle, C. M., Sarstedt, M., 2015. A New Criterion for Assessing Discriminant Validity in Variance-based Structural Equation Modeling. Journal of the Academy of Marketing Science, Volume 43(1), pp.115–135

Indrawati, I., Putri, D., 2018. Analyzing Factors Influencing Continuance Intention of E-Payment Adoption Using Modified Unified Theory of Acceptance and Use of Technology (UTAUT) 2 Model. In: 6th International Conference on Information and Communication Technology (ICoICT), pp.167–173

Ismail, I., 2021. E-wallet use in Malaysia Growing. Available online at: https://www.nst.com.my/opinion/columnists/2021/04/683345/e-wallet-use-malaysia-growing, Accessed on January 26, 2023

Kamarozaman, Z., Zaidi, F., 2021. The Role of Facilitating Condition in Enhancing User’s Continuance Intention. In: Journal of Physics Conference Series, Volume 1793(1), pp. 1–4

Kang, J., 2018. Mobile Payment in Fintech Environment: Trends, Security Challenges, and Services. Human-Centric Computing and Information Sciences, Volume 8(1), pp. 1–16

Khatimah, H., Susanto, P., Abdullah, N.L., 2019. Hedonic Motivation and Social Influence on Behavioral Intention of E-Money: The Role of Payment Habit as a Mediator. International Journal of Entrepreneurship, Volume 23(1), pp. 1–9

Kline, R.B., 2015. Principles and Practice of Structural Equation Modeling. In: Guilford Publications

Leong, M.Y., Kwan, J.H., Ming, L.M. 2021. Technology Readiness and Unified Theory of Acceptance and Use of Technology 2 (UTAUT2) UTAUT2 in E-wallet in a Developing Country. F1000 Research, Volume 10(863), pp. 1–13

Moorthy, K., Xsin, N.K., Salleh, N.M.Z.N., Ling, P.C., T’ing, L.C., 2022. Continuance intention to use e-wallets in Malaysia after outbreak of Covid-19. International Journal of Applied Business and Management Sciences, Volume 3(1), pp. 39–64

Ngo, H.T., Nguyen, L.T.H., 2022. Consumer Adoption Intention Toward Fintech Services in a Bank-based Financial System in Vietnam. Journal of Financial Regulation and Compliance, Volume 1(1), pp. 1358–1988

Nikolopoulou, K., Gialamas, V., Lavidas, K., 2021. Habit, Hedonic Motivation, Performance Expectancy and Technological Pedagogical Knowledge Affect Teachers’ Intention to use Mobile Internet. Computers and Education Open, Volume 2, p. 100041

Phuong, N.T.H., Thuy, N.D., Giang, T.L., Han, B.T.N., Hieu, T.H., Long, N.T., 2022. Determinants of Intention to use Fintech Payment Services: Evidence from Vietnam' Generation Z. International Journal of Business, Economics and Law, Volume 26(1), pp. 354–366

Rahman, M.M., Ismail, I., Bahri, S., 2020. Analysing Consumer Adoption of Cashless Payment in Malaysia. Digital Business, Volume 1(1), p. 100004

Razak, F.Z.B.A., Bakar, A.A., Abdullah, W.S.W., 2017. How Perceived Effort Expectancy and Social Influence Affects the Continuance of Intention to use E-government. A Study of a Malaysian Government Service. Electronic Government, An International Journal, Volume 13(1), pp. 69–80

Salimon, M.G., Yusof, R.Z.B., Mokhtar, S.S.M., 2017. The Mediating Role of Hedonic Motivation on the Relationship Between Adoption of E-banking and its Determinants. International Journal of Bank Marketing, Volume 35(4), pp. 558–582

Sharma, G., 2017. Pros and Cons of Different Sampling Techniques. International Journal of Applied Research, Volume 3(7), pp. 749–752

Shmueli, G., Sarstedt, M., Hair, J.F., Cheah, J.-H., Ting, H., Vaithilingam, S., Ringle, C.M., 2019. Predictive Model Assessment in Partial Least Squares- Structural Equation Modeling (PLS-SEM): Guidelines for using PLSpredict. European Journal of Marketing, Volume 53(11), pp. 2322–2347

Singh, A. K., Sharma, P., 2022. A study of Indian Gen X and Millennials Consumers’ Intention to use Fintech Payment Services During Covid-19 Pandemic. Journal of Modelling in Management, Volume 18(4), pp. 1177–1203

Talwar, S., Dhir, A., Khalil, A., Mohan, G., Islam, A.K.M.N., 2020. Point of Adoption and Beyond. Initial Trust and Mobile-payment Continuation Intention. Journal of Retailing and Consumer Services, Volume 55, p. 102086

Tentama, F., Anindita, W.D., 2020. Employability Scale: Construct Validity and Reliability. International Journal of Scientific and Technology Research, Volume 9(4), pp. 3166–3170

Tian, Y., Chan, T.J., Suki, N.M., Kasim, M.A., 2023. Moderating Role of Perceived Trust and Perceived Service Quality on Consumers’ use Behavior of Alipay E-wallet System: The perspectives of Technology Acceptance Model and Theory of Planned Behavior. Human Behavior and Emerging Technologies, Volume 2023, pp. 1–14

Venkatesh V., Morris M.G., Davis G.B., Davis, F.D. 2003. User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly, Volume 27(3), pp. 425–478

Venkatesh V., Thong J.Y.L., Xu, X., 2012. Consumer acceptance and use of information technology: Extending the Unified Theory of Acceptance and Use of Technology. Management Information Systems (MIS) Quarterly, Volume 36(1), pp. 157–178

Vagias, W.M., 2006. Likert-type Scale Response Anchors. Clemson International Institute for Tourism and Research Development, Department of Parks, Recreation, and Tourism Management. Clemson University

Winata, S., Tjokrosaputro, M., 2021. The Roles of Effort Expectancy, Attitude, and Service Quality in Mobile Payment users’ Continuance Intention. In: Proceedings of the Tenth International Conference on Entrepreneurship and Business Management 2021 (ICEBM 2021), Volume 653, pp. 121–126

Xie, J.L., Ye, L., Huang, L.Y., Ye, M., 2021. Understanding Fintech Platform Adoption: Impacts of Perceived Value and Perceived Risk. Journal of Theoretical and Applied Electronic Commerce Research, Volume 16(5), pp. 1893–1911