Build Operational Performance Matrix to Identify Product Survivability Using Throughput Accounting Principles

Published at : 17 Jul 2025

Volume : IJtech

Vol 16, No 4 (2025)

DOI : https://doi.org/10.14716/ijtech.v16i4.6437

Widjanarko, A & Supriatna, A 2025, ‘Build operational performance matrix to identify product survivability using throughput accounting principles’, International Journal of Technology, vol. 16, no. 4, pp. 1243-1252

| Alain Widjanarko | Department of Operations Management, Sekolah Tinggi Manajemen PPM, Menteng Raya 9 – 19, Jakarta, 10340, Indonesia |

| Ade Supriatna | Department of Industrial Engineering, Faculty of Engineering, Universitas Darma Persada, Taman Malaka Selatan Pondok Kelapa, Jakarta, 13450, Indonesia |

This research aimed to develop operational performance matrix using throughput accounting principles of XYZ company. The matrix developed strategies for prioritizing improvements and operational performance was formed by combining threshold zones calculated from throughput, inventory, and operating expense. In this context, the company was allowed to understand product performance in safe, comfortable, alert and danger zones. Each zone possessed different considerations, and the research was carried out in three stages. The first stage built three main components of financial reports using throughput accounting principles. The second stage prepared the thresholds of product based on productivity and inventory turnover, while the third stage evaluated operational performance. After testing the financial statement, operational performance of assessments and formal education services was categorized in the danger zone for 3 consecutive years. XYZ needs to improve survivability of product through better resource usage. This promoted product operational performance from danger to alert zone. An operational performance matrix to identify the survivability of a product based on financial statements has been successfully developed in this study. Practical application has also been demonstrated, which will open up opportunities to be tested in more companies.

Inventory turnover, Operating expense, Performance matrix, Productivity, Throughput accounting

Significant changes have been experienced since the declaration and outbreak of COVID-19. In this context, the pandemic has impacted business reduction and infrastructure disruption (Sydnor et al., 2017), supply chain interruption, postponed payment, and inability of workers to work (Silva et al., 2018). However, the impact can be different depending on the characteristics of the company (Chen et al., 2021). Different emergency management measures have been implemented to control business performance. This disaster requires company to downsize or close operations or workforce (Candra et al., 2021; Juergensen et al., 2020). Previous research showed that different challenges were faced in financial and operational aspects to sustain business.

Revenue is used as an indicator of sustainable business (Brouwer, 2012) and the loss resulting from the inability to compete is the primary reason for business failure (Mungal, 2014). Every decision is dominated by actions for maintaining the cash flow through increased revenue and reduced expense.

There has been a fundamental change in the business environment and company needs to re-identify performance components to be measured using standard costing, activity-based costing, theory of constraints, and throughput accounting. These methods do not need to compete but can be harmonized because of the similarities in objectives (Mehra et al., 2005). In addition, the expenditure of economic resources and activities can be measured (Cokins, 2001) to obtain the data required for understanding company performance (Parkhi et al., 2016).

Company performance is measured on a financial basis using throughput, inventory, and operating expense (Goldratt and Cox, 2004). Throughput is defined as revenue earned by a system through sales (Gusnardi, 2010) or values generated by the company (Widjanarko, 2020). Meanwhile, inventory represents the amount of money invested in physical goods that are intended for sale. Product is still in the form of inventory when money has not been generated (Kadhim et al., 2020; Widjanarka et al., 2018) even though there is a purchase agreement. In this context, company is expected to possess product preferred by customers to stay in business. Operating expense is incurred to meet demand with the right product and attract the necessary customers. This can be in the form of salaries and wages, rent, utilities, and any other cost that does not vary directly with units of product or service produced (Gupta and Boyd, 2008). Therefore, the research question is how can company quickly and easily understand product performance and formulate strategies to respond effectively?

Section 1 of the research reports the use of throughput, inventory, and operating expense as elements to analyse performance level of product. Section 2 describes the methodology that focuses on the application of throughput accounting, and introduces performance analysis indicators. Meanwhile, section 3 focuses on the analysis of operational performance from the financial statement and discusses the results. Section 4 presents a conclusion and identifies further research directions.

2.1. Performance

measurement

In a dynamic business environment, operational performance of product

needs to be assessed regularly. This may fluctuate from time to time, as showed by the financial performance. The primary and most visible indicator

of survivability is the ability to generate revenue. Product performance must

be understood and managed in a dynamic business environment (Hirsch, 2000). However, failure to make the right decisions and lack

of radical innovations can push a company over the edge into bankruptcy (Tatiana and Mikhail, 2020). Managers are aware of the critical issues and

challenges but are not taking proper actions (Bencsik, 2020). According to the American Bankruptcy Institute, the

number of bankruptcy filings increased by 26% compared to the last performance

with only a small amount of revenue generated (Miller and Berk, 2020).

A company must operate effectively and implement production cost reduction programs to overcome financial problems (Nadezhina et al., 2021; Hummel and Hörisch, 2020; Kim and Kim, 2010). Every action should be measured in terms of expenses and revenue, showing the need for performance measurement system focused on processes (Supriatna et al., 2020). This type of system improves operational performance with minimal focus and effort (Jukka, 2023; Lizarondo et al., 2014). Throughput accounting principles are often considered in answering the requests (?im?it et al., 2014). Previous research showed that there was a relationship between throughput accounting and other managerial accounting (Al-Zu’bi and Khamees, 2014; ?im?it et al., 2014; Utku et al., 2008; Lea and Min, 2003). Therefore, this research aims to develop a simple tool for assessing performance of product using throughput accounting principles, which can act as a warning system. The question addressed is related to the use of the tool in assessing product operational performance and the role in assisting management to make proper decisions.

2.2. Throughput

accounting

Management needs

tools to better understand product performance since several conditions show difficulty in improving financial

performance (Kadhim et al., 2020; Gupta and Boyd, 2008; Pretorius, 2004). In this

context, throughput accounting is less complex than other cost accounting (Islam, 2015). The variable has been designed to be a

short-term method and long-term decision-making can be supported when combined

with other accounting information. Additionally, throughput accounting is

performance measurement method proposed by Goldratt at the beginning of the

1980s, where production costs depend on product and resources (Garrison, 2010). The attention of the management is only focused on

product with high profitability in the bottleneck process. The production is

carried out through the transformation of labour and capital, which are

optimized for maximum results (Woodhead and Berawi, 2020). Throughput accounting provides better decisions for

system optimization when compared to other conventional costing (Pretorius, 2004). For short-term decision-making, the variable is used

to determine product mix based on market demand (Islam, 2015). Meanwhile, the misuse of capital can also be minimized

in finite activities (Kadhim et al., 2020) to measure the efficiency and effectiveness of

performance based on revenue and costs.

The three components used to achieve performance objectives within a

certain period are throughput, inventory,

and operating expense. Performance indicators that show the ability to maintain

cash flow are productivity and inventory turnover (Goldratt and Cox, 2004). Productivity is measured by comparing the company's

throughput with the operating expense incurred. Meanwhile, inventory

turnover affects the flow of money within the company and determines the level of survivability. The money flowing into the

company is directly proportional to the level of survivability and respond to

susceptibility.

The

examination of throughput, inventory, and operating expense is reportedly

implemented in the manufacturing industry (Fontenelle and Sagawa, 2021; Sheu et al., 2003).

Optimizing profits can be obtained through product mix based on customer demand

and throughput accounting (Islam, 2015).

The

company obtain

new product mixes that are more profitable and provide increased revenue using the method.

In addition,

throughput is estimated on each product as the difference between price and

material costs (Elsukova, 2015).

A manufacturing company in Russia found that three products made a loss in the financial statements even

though

a positive profit level was

obtained in a certain period.

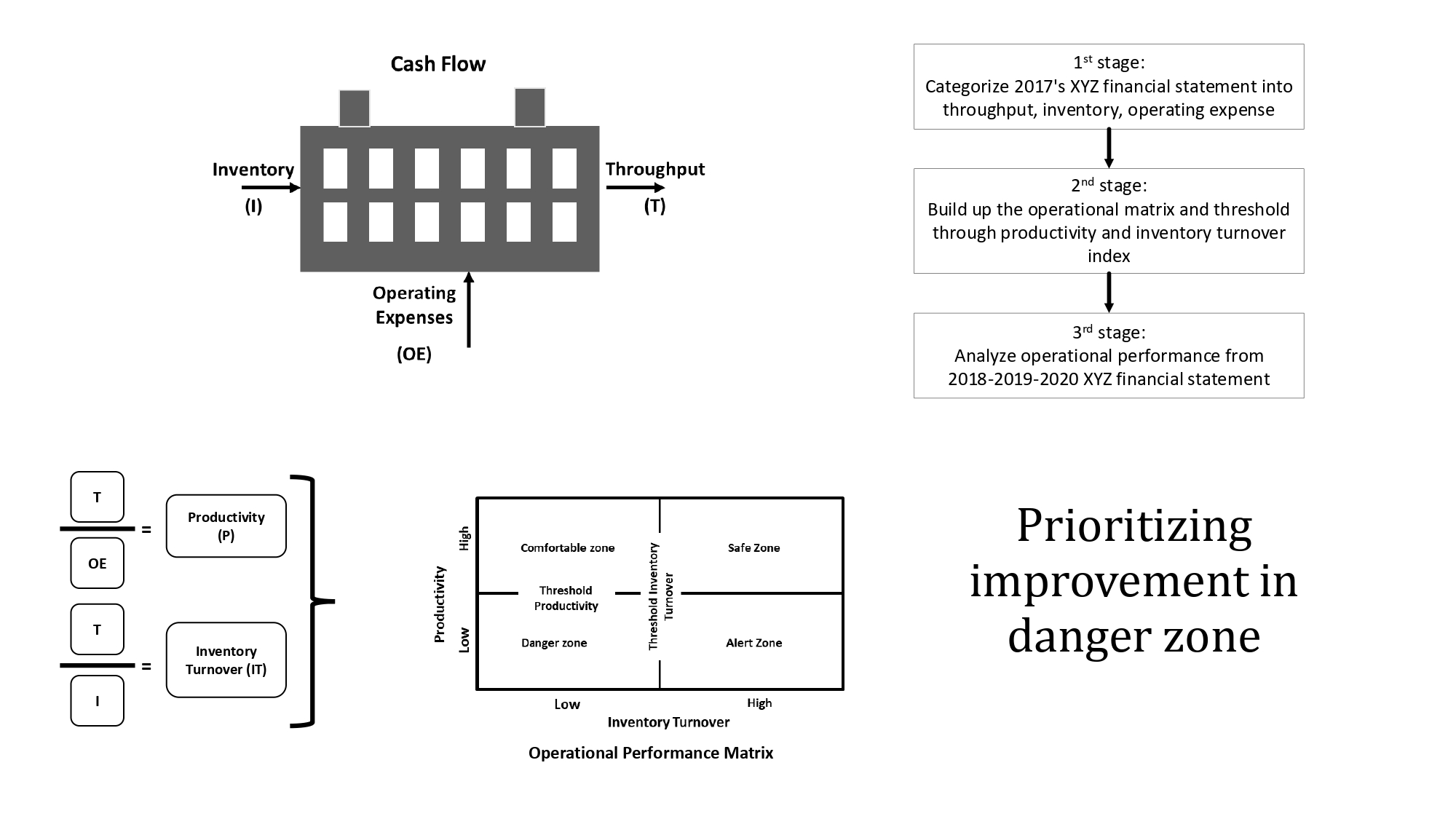

Figure 1 Research

Framework

Throughput accounting is the fastest-growing method used in empirical

investigations (Islam, 2015; Mehra et al., 2005). However, most research is carried out in the

manufacturing industry (Fontenelle and Sagawa, 2021; Sheu et

al., 2003). This research tries to

apply throughput accounting principles to service company and has been grouped into three stages as shown in

Figure 1. In

the first stage, 2017

financial statement elements are grouped into monetary variables to identify throughput, inventory,

and operating expense. For the second stage, the threshold is obtained as

operational performance. In this context, the two

times two performance matrix was developed to easily

understand product's performance position and analyse the survivability. For the third stage,

the 2018, 2019 and 2020

financial statements are

used to test the tool and

identify the zone of each XYZ product.

2.3. Operational performance matrix

The

two times two performance matrix is

developed from

productivity and inventory turnover. Productivity is obtained from throughput and

operating expense while inventory turnover is calculated from throughput and

inventory. These elements are also used to identify the baseline with four performance zones, namely safe, comfort, alert, and danger.

The

safe zone shows

that the company has ideal conditions where productivity and inventory turnover

cross the threshold. Company still has high survivability and maintains susceptibility for a long

time. Meanwhile, company needs to

keep pace and focus on

the future. The comfort zone shows a high productivity with low inventory turnover

below threshold. This condition provides short survivability because the

company cannot maintain the

susceptibility. In addition, the

voice of the customer must be understood to

maintain loyalty. The alert zone reports

low productivity with a high inventory turnover

across the threshold. Even though susceptibility can be defended, the level of

survivability is inefficient.

Uniqueness in product should also be created to add

value more than others. The danger zone shows

that the

elements are below the threshold. Previous

research reported that serious efforts were required to maintain

a business and

make different products. The level of

vigilance should be increased within a comfort-alert zone to prevent the

danger zone.

Figure 2 shows performance matrix, where X-axis and Y-axis represent inventory turnover and productivity, respectively. The threshold line divides

the square into a two-by-two matrix,

which has four types of zones:

1.

In the safe zone, inventory turnover and productivity yield a

high ratio.

2.

In the comfort

zone, inventory turnover has a low ratio while productivity obtains a high ratio.

3.

In the alert zone,

inventory turnover has a high ratio while productivity obtains a low ratio.

4.

In the danger zone,

inventory turnover and productivity result in a low ratio.

Thresholds and operational performance ratios are formed from monetary

variables (Goldratt and Cox, 2004).

Figure 2

Operational Performance Matrix

2.4. Materials

This research uses the financial statements of service company XYZ to verify the matrix. Table 1 shows the financial statement and threshold from 2017 until 2020. Other financial statements are analysed to

determine annual performance fluctuation.

XYZ, founded in 1967, is one of the oldest business

schools and has made significant contributions to management fields such as

marketing, human resources, operation, strategy, and finance. A wide range of

services is offered within the business school. Public training, company training,

consulting and assessment are services developed during the 54 years of

establishment. In providing the services, XYZ is supported by 100 and 200 professional and operational staff. The business model is less

complicated but has a variety of services.

Table 1 XYZ’s

Financial Statement** (in USD)

|

|

|

2020 |

2019 |

2018 |

2017 |

|

Throughput |

|

|

|

| |

|

|

Assessment Centre |

2,959,085 |

4,237,759 |

3,733,334 |

3,733,148 |

|

|

Public Training |

1,894,289 |

3,397,053 |

2,797,532 |

2,372,991 |

|

|

In-House Training |

2,447,893 |

3,016,642 |

2,500,705 |

1,824,894 |

|

|

Formal Education |

2,602,088 |

2,830,939 |

3,068,504 |

2,830,939 |

|

|

Consulting Services |

741,781 |

1,037,607 |

758,610 |

693,780 |

|

Inventory |

|

|

|

| |

|

|

Assessment Centre |

193,713 |

207,584 |

226,337 |

182,271 |

|

|

Public Training |

393,172 |

368,151 |

397,666 |

260,604 |

|

|

In-House Training |

259,676 |

208,107 |

238,568 |

148,758 |

|

|

Formal Education |

399,180 |

468,895 |

420,033 |

389,083 |

|

|

Consulting Services |

111,431 |

87,700 |

118,055 |

76,062 |

|

Operating expense |

|

|

|

| |

|

|

Assessment Centre |

2,230,375 |

2,945,953 |

2,908,184 |

2,486,532 |

|

|

Public Training |

497,169 |

1,174,982 |

970,522 |

941,510 |

|

|

In-House Training |

478,956 |

1,031,778 |

869,407 |

711,840 |

|

|

Formal Education |

1,790,689 |

2,052,740 |

1,776,818 |

1,597,866 |

|

|

Consulting Services |

271,786 |

341,498 |

278,843 |

267,365 |

**Already classified using

throughput accounting principles

Every service provided contributes to revenue and expenses. Revenue is earned from clients who have received services, while expenses are incurred to produce the services required by customers. In this context, XYZ has financial statement to evaluate performance. Revenue and expense elements are obtained from the statement and classified into throughput, inventory, and operating expense. Direct fixed and direct costs are described by throughput, inventory, and operating expense. Meanwhile, other income, working capital, assets, debt, and taxes mentioned in the statement are excluded from the analysis.

From the financial statements, a matrix is made for each

product, assessment centre, public training, in-house training, formal

education, and consulting services. In this context, the service compares

operational performance on an annual basis.

3.1. Assessment service

Infrastructure is required in the provision of the service. Assessment is performed using a classroom equipped with Closed Circuit

Television (CCTV). Clients who want to be assessed, need to come to XYZ and

follow some processes in classroom. The behaviour within the classroom is monitored and the process requires a lot of resources. However, the COVID-19 pandemic has brought global

changes in many aspects. To prevent the spread of the disease, social distancing and stay away from the crowd protocols are established. The assessment process needs to be changed

following the health protocol. From demand perspective,

the pandemic

causes company to

postpone the need for assessment services.

Figure 3

shows that the service performance index assessment in 2020 tends to be the

worst compared to previous years. Assessment services in 2019 and 2018 also did

not perform well

due to low productivity and

turnover inventory.

Figure 3 Assessment’s Performance Matrix

3.2. Public Training

Public

training has a standard learning schedule and topics, offering certifications

outside bachelor, master, and doctorate. In this context, demand is obtained from various customer segments and XYZ must compete with many similar providers in providing the services. The variable has decreased since COVID-19 outbreak and the condition occurs in all training service providers. To

follow health protocols, many customers postpone

the need for training that requires mobilization and meetings. In early 2020,

XYZ started using virtual training mechanisms to

serve training demand. Despite declining revenues, virtual training methods

reduce operating expense. Figure 4 shows public training operational

performance based on productivity and turn-on-inventory. In 2019, performance tends to be the best in productivity and

inventory turnover.

Figure 4 Public Training’s Performance Matrix

3.3. In-House Training

This service offers certifications instead of degrees

but does not have a learning schedule. In this context, training is customized based on the demands of the customers.

Even though there are

limited competitors, XYZ cannot

serve because the competence does not match the demand.

The demand for In-house

training has decreased since pandemic and customers are expected to

avoid onsite training. In-house and public training share the virtual training mechanisms. Performance of the

service was similar to public training and the best result was

achieved in 2019. See Figure 5.

Figure 5 In-House Training’s Performance Matrix

The service offers bachelor’s, and master's degrees, and follows regulations issued by the Ministry of Education. In this context, the demand for the services is relatively stable and unchanged. However, Figure 6 shows that formal education does not exceed the threshold. Compared to other years, 2019 had the worst performance.

Figure 6 Formal Education’s Performance

Matrix

Consulting provides services to company rather than individuals since the demand is random and difficult to predict.

Figure 7 shows the best consulting performance in 2019.

In other years, the service's performance tends to be slightly better on

productivity.

Figure 7 Consulting’s Performance Matrix

3.6. Discussion

This research proposes throughput

accounting to set up company performance

baseline and promote

accurate management concerns. To

understand performance position, a baseline must be prepared based on previous

throughput accounting and expressed

as a threshold zone.

Table 2 shows that performance index from assessment and

formal education is below the threshold. This product has low survivability and the priority strategy is used to leverage

productivity or inventory turnover (Thirumalai et al., 2022). XYZ is expected to review the resources and increase inventory

turnover rather than productivity.

For long-term survivability, optimizing resource usage is an appropriate method for minimizing susceptibility to changes in the industrial environment. In the post-pandemic era, the market is more careful in spending money. Additionally, the increase in service rates is susceptible to being rejected (Wirjodirdjo et al., 2021). Product performance index will be above the threshold without changing its service rates when resource usage is increased.

Table 2 XYZ’s Product

Performance Index

|

|

2017 (as Threshold) |

2018 |

2019 |

2020 |

|||||||||||

|

|

Productivity (P) |

Inventory Turnover (IT) |

P |

IT |

Zone |

P |

IT |

Zone |

P |

IT |

Zone |

|

|||

|

Assessment Centre |

1.5 |

20.5 |

1.3 |

16.5 |

Danger |

1.4 |

20.4 |

Danger |

1.3 |

15.3 |

Danger |

|

|||

|

Public Training |

2.5 |

9.1 |

2.9 |

7.0 |

Comfortable |

2.9 |

9.2 |

Safe |

3.8 |

4.8 |

Comfortable |

|

|||

|

In-House Training |

2.6 |

12.3 |

2.9 |

10.5 |

Comfortable |

2.9 |

14.5 |

Safe |

5.1 |

9.4 |

Comfortable |

|

|||

|

Formal Education |

1.8 |

7.3 |

1.7 |

7.3 |

Danger |

1.4 |

6.0 |

Danger |

1.5 |

6.5 |

Danger |

|

|||

|

Consulting Services |

2.6 |

9.1 |

2.7 |

6.4 |

Comfortable |

3.0 |

11.8 |

Safe |

2.7 |

6.7 |

Comfortable |

|

|||

Note: “Danger” is an indication for priority improvements

In conclusion, a tool was

developed to analyse operational performance of product. This tool could be

used when the components of the financial statements have been classified into

throughput, operating expense, and inventory. The three components were used to

measure productivity and inventory turnover index of product. In this context,

the management was able to improve product. This was tested in a service

company with a variety of products. Formal assessments and education performed

poorly compared to other products, and improvements were prioritized to obtain

product out of danger zone. Therefore, XYZ did not use resources optimally with

several product in the comfort zone. The

limitations certainly came from financial information which was only based on

data from a service company. As a recommendation, information should be

expanded from several industries. Further research must be carried out to

produce a better understanding of matrix performance. In this context, the

tangible benefits of throughput accounting in measuring costs and evaluating

company performance must be considered.

The authors are grateful to the referees and editor-in-chief for the insightful comments and recommendations to improve the quality of the manuscript. In addition, the authors express gratitude to the Sekolah Tinggi Manajemen PPM and Universitas Darma Persada for the support provided.

Al-Zu’bi, ZMF

& Khamees, BA 2014, 'Activity-based costing vs theory of constraints: An

empirical study into their effect on the cost performance of NPD initiatives', International

Journal of Economics and Finance, vol. 6, no. 12, pp. 157-165, https://doi.org/10.5539/ijef.v6n12p157

Bencsik, A 2020,

'Challenges of management in the digital economy', International Journal of

Technology, vol. 11, no. 6, pp. 1275–1285, https://doi.org/10.14716/ijtech.v11i6.4461

Brouwer, N 2012,

'Cash flow related indicators of business sustainability', Journal of

Economic and Financial Sciences, vol. 5, no. 1, pp. 229–246, https://hdl.handle.net/10520/EJC137458

Candra, S,

Ayudina, M & Arashi, MA 2021, ‘The impact of online food applications

during the Covid-19 pandemic’, International Journal of Technology. vol.

12, no. 3, pp. 472-484, https://doi.org/10.14716/ijtech.v12i3.4195

Chen, J, Huang,

J, Su, W, Štreimikien?, D, & Baležentis, T 2021, 'The challenges of

COVID-19 control policies for sustainable development of business: Evidence

from service industries', Technology in Society, vol. 66, article 101643, https://doi.org/10.1016/j.techsoc.2021.101643

Cokins, G 2001,

'A management accounting framework', Journal of Corporate Accounting and

Finance, vol. 13, no. 1, pp. 73–82, https://doi.org/10.1002/jcaf.1210

Elsukova, TV

2015, 'Lean accounting and throughput accounting: An integrated approach', Mediterranean

Journal of Social Sciences, vol. 6, no. 3, pp. 83–87, http://dx.doi.org/10.5901/mjss.2015.v6n3p83

Fontenelle, AO

& Sagawa, JK 2021, 'The alignment between management accounting and lean

manufacturing: Rhetoric and reality', Journal

of Business and Industrial Marketing, vol. 36, no. 8, pp.

1322-1343, https://doi.org/10.1108/JBIM-04-2020-0216

Garrison, RH

2010, 'Managerial accounting', Issues in Accounting Education, vol. 25,

no. 4, pp. 792-793, https://doi.org/10.2308/iace.2010.25.4.792

Goldratt, EM

& Cox, J 2004, Goal: A process of ongoing improvement, 3rd edn, The

North River Press, Great Barrington, MA

Gupta, MC &

Boyd, LH 2008, 'Theory of constraints: A theory for operations management', International

Journal of Operations and Production Management, vol. 28, no. 10, pp.

991-1012, https://doi.org/10.1108/01443570810903122

Gusnardi 2010,

'TOC: Tinjauan teori (TOC: A theoretical review)', Jurnal Pendidikan Ekonomi

dan Bisnis, vol. 2, no. 3, pp. 336–345

Hirsch, ML 2000,

Advanced management accounting, Thomson Learning

Hummel, P &

Hörisch, J 2020, 'The hidden power of language: How “value creation accounting”

influences decisions on expenditures, cost reductions and staff costs', Sustainability Accounting, Management and

Policy Journal, vol. 11, no. 1, pp. 187-206, https://doi.org/10.1108/SAMPJ-04-2018-0111

Islam, KMA 2015,

'Throughput accounting: A case study', International

Journal of Finance and Banking Research, vol. 1, no. 2, pp. 19-23, https://doi.org/10.11648/j.ijfbr.20150102.11

Juergensen, J,

Guimón, J & Narula, R 2020, 'European SMEs amidst the COVID-19 crisis:

Assessing impact and policy responses', Journal

of Industrial and Business Economics, vol. 47, no. 3, pp. 499-510, https://doi.org/10.1007/s40812-020-00169-4

Jukka, T 2023,

'Does business strategy and management control system fit determine

performance?', International

Journal of Productivity and Performance Management, vol. 72, no. 3,

pp. 659-678, https://doi.org/10.1108/IJPPM-11-2020-0584

Kadhim, HK,

Najm, KJ & Kadhim, HN 2020, 'Using throughput accounting for cost

management and performance assessment: Constraint theory approach', TEM Journal, vol. 9, no. 2,

pp. 763-769, https://doi.org/10.18421/TEM92-45

Kim, S &

Kim, SW 2010, 'The trade?off of service quality and cost: A system dynamics approach', Asian Journal on Quality, vol.

11, no. 1, pp. 69-78, https://doi.org/10.1108/15982681011051831

Lea, BR &

Min, H 2003, 'Selection of management accounting systems in Just-In-Time and

Theory of Constraints-based manufacturing', International

Journal of Production Research, vol. 41, no. 13, pp. 2879-2910, https://doi.org/10.1080/0020754031000109134

Lizarondo, L,

Grimmer, K, & Kumar, S 2014, 'Assisting allied health in performance

evaluation: a systematic review', BMC

Health Services Research, vol. 14, no. 572, pp. 1-12, https://doi.org/10.1186/s12913-014-0572-7

Mehra, S, Inman,

RA & Tuite, G 2005, 'A simulation-based comparison of TOC and traditional

accounting performance measures in a process industry', Journal of Manufacturing Technology

Management, vol. 16, no. 3, pp. 328-342, https://doi.org/10.1108/17410380510583635

Miller, H &

Berk, CC 2020, 'JC Penney could join a growing list of bankruptcies during the

coronavirus pandemic', CNBC.com,

viewed 15 May 2020, (https://www.cnbc.com/2020/05/15/these-companies-have-filed-for-bankruptcy-since-the-coronavirus-pandemic.html)

Mungal, A 2014, The impact of cash management on

profitability and sustainability of small retail businesses in the Tongaat

area, KwaZulu-Natal, Durban University of Technology

Nadezhina, O,

Zaretskaya , V, Vertakova, Y, Plotnikov, V & Burkaltseva, D 2021, 'European

integration risks in the context of the COVID-19 pandemic', International Journal of Technology,

vol. 12, no. 7, pp. 1546-1556, https://doi.org/10.14716/ijtech.v12i7.5396

Parkhi, S,

Tamraparni, M & Punjabi, L 2016, 'Throughput accounting: An overview and

framework', International

Journal of Services and Operations Management, vol. 25, no. 1, pp.

1-20, https://doi.org/10.1504/IJSOM.2016.078068

Pretorius, P

2004, 'Long term decision making using throughput accounting', In: 2004 IEEE Africon. 7th Africon Conference

in Africa (IEEE Cat. No.04CH37590), pp. 861-866, https://doi.org/10.1109/AFRICON.2004.1406810

Sheu, C, Chen,

MH & Kovar, S 2003, 'Integrating ABC and TOC for better manufacturing

decision making', Integrated

Manufacturing Systems, vol. 14, no. 5, pp. 433-441, https://doi.org/10.1108/09576060310477834

Silva, ME,

Pereira, SCF & Gold, S 2018, 'The response of the Brazilian cashew nut

supply chain to natural disasters: A practice-based view', Journal of Cleaner Production,

vol. 204, pp. 660-671, https://doi.org/10.1016/j.jclepro.2018.08.340

im

it, ZT,

Günay, NS & Vayvay, Ö 2014, 'Theory of Constraints: A literature review', Procedia - Social and Behavioral Sciences,

vol. 150, pp. 930-936, https://doi.org/10.1016/j.sbspro.2014.09.104

Supriatna, A,

Singgih, ML, Widodo, E & Kurniati, N 2020, 'Overall equipment effectiveness

evaluation of maintenance strategies for rented equipment', International Journal of Technology,

vol. 11, no. 3, pp. 619-630, https://doi.org/10.14716/ijtech.v11i3.3579

Sydnor, S,

Ballard, K, Cooper, L & Brown, B 2017, 'Analysis of post-disaster damage

and disruptive impacts on the operating status of small businesses after

Hurricane Katrina', Natural

Hazards, vol. 85, no. 3, pp. 1637–1663, https://doi.org/10.1007/s11069-016-2652-y

Tatiana, B &

Mikhail, K 2020, 'Problems of competitive strategy choice according to industry

and regional factors', International

Journal of Technology, vol. 11, no. 8, pp. 1478-1488, https://doi.org/10.14716/ijtech.v11i8.4531

Thirumalai, S,

Lindsey, S & Stratman, JK 2022, 'You cannot be good at everything: Tradeoff

and returns in healthcare services', International

Journal of Operations and Production Management, vol. 42, no. 3,

pp. 357-383, https://doi.org/10.1108/IJOPM-06-2021-0407

Utku, BD,

Cengiz, E & Ersoy, A 2008, 'Comparison of the Theory of Constraints with

the traditional cost accounting methods in respect to product mix decisions', Journal of Yasar University,

vol. 3, no. 11, pp. 1627-1661

Widjanarka, A,

Wirjodirdjo, B, Pujawan, IN, & Baihaqi, I 2018, 'Coalition in utilization

capacity in container transportation services', International Journal of Applied Science and Engineering,

vol. 15, no. 2, pp. 95-104, https://doi.org/10.6703/IJASE.201810_15(2).095

Widjanarko, A

2020, 'Improvement with Theory of Constraints (Theory of Constraint untuk

pembenahan di masa depan)', SWAOnline,

viewed 17 May 2022, (https://swa.co.id/read/261056/theory-of-constraint-untuk-pembenahan-di-masa-depan)

Wirjodirdjo, B, Ghiffary Budianto, A, Widjanarka, A, Pujawan, IN & Maflahah, I 2021, ‘Carrier and freight forwarders strategies to utilize the immobile shipping capacity of freight forwarders and maximize profits’, International Journal of Technology, vol. 12, no. 4, pp. 876-886, https://doi.org/10.14716/ijtech.v12i4.4413

Woodhead, R & Berawi, MA 2020, 'Value creation and the pursuit of multi factor productivity improvement', International Journal of Technology, vol. 11, no. 1, pp. 111-122, https://doi.org/10.14716/ijtech.v11i1.3364