Impacts of COVID-19 on the Automotive Industry in Vietnam

Corresponding email: info@javihi.net

Published at : 28 Jul 2023

Volume : IJtech

Vol 14, No 5 (2023)

DOI : https://doi.org/10.14716/ijtech.v14i5.6383

Long, N.D.B., Mackechnie, I., Ooi, P.T., Huy, N.N., Hao, T.T.B., Duong, L.T.H., 2023. Impacts of COVID-19 on the Automotive Industry in Vietnam. International Journal of Technology. Volume 14(5), pp. 972-981

| Nguyen Duc Bao Long | 1. Charisma University, School of Business, #44 Salt Mills Plaza, Grace Bay, Providenciales, TKCA 1ZZ, Turks and Caicos Islands, 2. Nguyen Tat Thanh University, 300A Nguyen Tat Thanh Street, Ward 13, |

| Ian Mackechnie | Charisma University, School of Business, #44 Salt Mills Plaza, Grace Bay, Providenciales, TKCA 1ZZ, Turks and Caicos Islands |

| Pit Tatt Ooi | Oxford Journal of Technology, Arts, Sciences and Knowledge, 11, Cangkat Minden Jalan 1, 11700 Gelugor, Pulau Penang, Malaysia |

| Nguyen Ngoc Huy | Ho Chi Minh City University of Banking, Graduate School, 36 Ton That Dam Street, Nguyen Thai Binh Ward, District 1, Ho Chi Minh City, Vietnam |

| Tran Thi Bich Hao | University of Economics Ho Chi Minh City, Graduate School, 59C Nguyen Dinh Chieu Street, District 3, Ho Chi Minh City, Vietnam |

| Le Thi Hai Duong | Hong Bang International University, School of Economics and Business, 215 Dien Bien Phu Street, Ward 15, Binh Thanh District, Ho Chi Minh City, Vietnam |

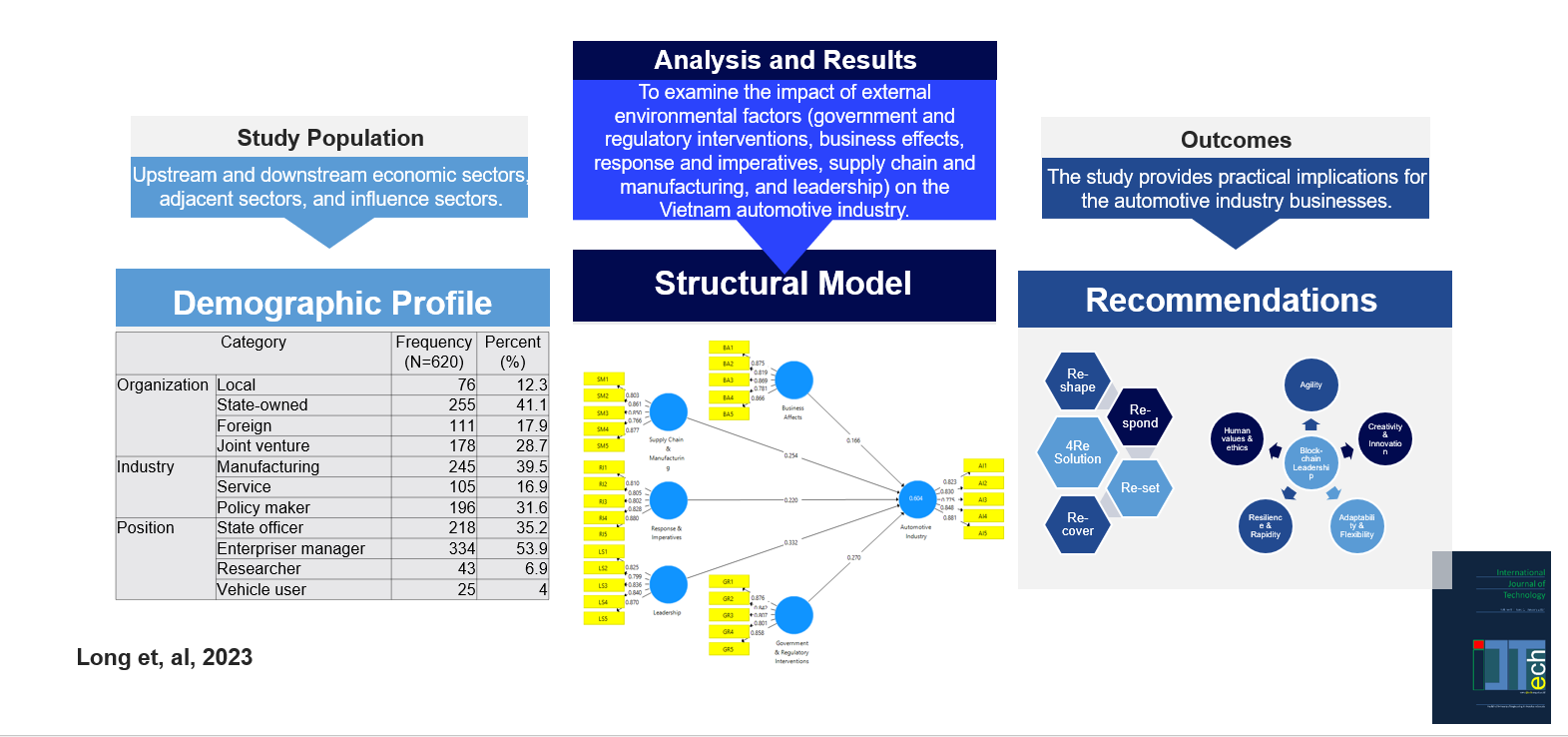

This study aimed to determine the impact of COVID-19 on the automotive

industry in Vietnam. Another objective was to promote some potential recovery

scenarios after economic shocks. Finally, the study examined a solution to

overcome COVID-19 and lead Vietnam’s automotive industry towards the “new

normal.” Qualitative research was used in conjunction with questionnaires and

document reviews to achieve the above objectives. In the qualitative stage,

in-depth interviews were conducted with 32 experts in the industrial sector to

explore the impact of COVID-19 on the automotive industry in Vietnam.

Structural Equation Modelling (SEM) with Partial Least Squares (PLS) and

Statistical Package for the Social Sciences (SPSS) were used to explore and

measure the impact of factors affecting the automotive industry with 620

respondents for a study regarding the industry that prevents the author from

having more actionable recommendations. The findings revealed that five

identified factors, which are business effects, supply chain and manufacturing,

response and imperatives, leadership, government, and regulatory intervention,

could be components of the impact of COVID-19 on the automotive industry in

Vietnam. Two recommendations that were pointed out include conducting the 4RE

Solution and applying the integration Block-chain leadership model to help

Vietnam overcome the crisis and take this pandemic as a chance to restructure

for a renewed automotive industry.

4RE Solution (Respond, Reset, Recover, and Reshape); Block-chain leadership; COVID-19 response; Resilience; Vietnam automotive industry

Introduction

In March 2020, the WHO declared COVID-19 a global pandemic, intensifying

the IMF's worries about a global economic downturn (Van Barneveld et

al., 2020).

Researchers and marketers are equally interested in COVID-19 due to its

severe business-related effects on the global automotive sector. By supplying

the need for transportation and fostering the growth of ancillary sectors, the

automotive industry greatly contributes to the promotion of national economic

development (Long, Tan, and Tran, 2015). Numerous automotive companies have

placed a high priority on addressing the decline in demand caused by health

issues. Consequently, to understand and illustrate the challenges faced in

enhancing the automotive sector, it is crucial to focus on studying the impacts

of COVID-19, along with other relevant factors.

The automotive industry plays an important role in many developed economies.

However, the sector has been dealing with serious issues because of the rising

demand for electric vehicles even before the pandemic started (Kaitwade, 2021). The automobile business is

crucial for the global economy and the wealth that results in many ways,

including ties to other industries, employment, and the economy. Despite the

challenging situation, OEMs that can quickly deploy their COVID-19 response and

take action will be better off after the occurrence and more resilient going

ahead (Accenture, 2020). COVID-19 has had

varying degrees of economic impact on the industrial structure of countries and

economies. The unprecedented pandemic, COVID-19, has brought about an external

shock that is compelling the automotive sector to reassess its operations and

address emerging challenges. The immediate and significant impact of COVID-19

on the globally interconnected automotive industry is expected to lead to an

upsurge in Merger and Acquisition (M&A) activities. This increase is driven by the growing

opportunities for strategic alliances and consolidation within the sector,

particularly for private equity players.

Automotive OEMs and players have been particularly badly impacted, which

has led to changes in the macroeconomic climate, organizational structures,

innovative thinking, and consumer behaviours (Hausler

et al., 2020). According to the decline in the Manufacturing

Production

Index

(MPI) in April 2020, which was about 82% per year, COVID-19 measures had the

most pronounced negative impact on Thailand’s manufacturing sector. The

industries with the greatest negative effects were the automotive, petroleum

and petroleum products, malts and malt beverages, air conditioning systems, and

sugar (UNIDO, 2020).

The COVID-19 pandemic

has resulted in a semiconductor shortage, affecting the automobile industry in

Vietnam (MOIT, 2022). The COVID-19 pandemic

poses risks to Vietnam’s automotive sector and businesses due to its dynamic

nature. Understanding the industry’s current state is crucial for developing

effective recovery plans. This study aims to analyze the impact of COVID-19 on

Vietnam’s automobile sector, which plays a vital role in the country’s economic

growth.

The study proposed to

answer several research questions related to the automotive industry in Vietnam

during COVID-19. The questions encompass various aspects of the industry, such

as its current status, the impact factors of COVID-19 on the automotive

industry, potential recovery scenarios, recommendations for overcoming the

crisis, and strategies to leverage the impacts of COVID-19 as an opportunity

for development.

Literature Review

2.1. Impact Factors of COVID-19 on the Vietnam

Automotive Industry

2.1.1. Business Effects

The

automotive industry has faced significant challenges during the COVID-19

pandemic. Suppliers with liquidity problems may destabilize the entire global

automotive manufacturing ecosystem, leading to disastrous effects (Deloitte, 2020). Thai businesses face a scarcity

of raw materials due to lockdowns and other restrictions (UNIDO, 2020). Original Equipment Manufacturers

(OEMs) had to halt production due to a lack of parts, decreased workforce, and

quarantine procedures (Accenture, 2020). The

decline in sales, politically-enforced production closures, layoffs, and

reduced output have resulted in a general decline in consumer confidence,

revenue, and profitability. Additionally, the pandemic has caused a sudden and

widespread slowdown in economic activity, forcing workers to stay at home and

supply lines to deteriorate. The closure of production facilities in Europe is

anticipated to have a significant impact on approximately 14 million jobs,

including both direct and indirect employment. Additionally, about 50% of

contract employees are facing imminent and long-term risks as a result of these

closures (ILO, 2020). Despite the

challenges, the pandemic presents opportunities for the industry to reevaluate

its underperforming global markets and vehicle segments and take steps toward

sustainable recovery.

2.1.2. Supply and Demand

The 2020

coronavirus outbreak strained OEMs and auto parts suppliers. Anticipated

declines in new vehicle sales reduced revenue and disrupted production and

supply (UNIDO, 2020). The interconnected

nature of the industry’s supply chain forced OEMs and component suppliers to

halt or delay production, increasing the risk of a capital crisis. Prolonged

disruptions to consumer demand may trigger a global recession, impacting automaker

revenues and profitability (Deloitte, 2020).

2.1.3. Manufacturing

and Supply Chain

The

automotive sector is undergoing transformative changes driven by connected

vehicles, autonomous driving, shared mobility, and electrification (Long, Huy, and Van, 2022). The COVID-19 pandemic

has exacerbated challenges, impacting supply chains, manufacturing, and demand.

Studies have examined the pandemic’s effects on logistics flow through Italian

ports (Caballini, Ghiara, and Persico, 2022)

and organizations’ response to disruptions in product-based service supply

chains (Gatenholm and Halldorsson, 2022).

Big data analytics has shown promise in enhancing supply chain resilience

compared to other Industry 4.0 technologies. This research informs investment

decisions and explores the potential of underutilized enabling technologies.

The pandemic highlights the need for resilience and adaptability in the

automotive industry amidst technological and economic shifts (Spieske and Birkel, 2021).

2.1.4. Response and Imperatives

Young

businesses are more susceptible to negative consequences during a crisis

compared to established ones. The family-oriented nature of SMEs amplifies the

detrimental effects of COVID-19 on their operations. Family firms perceive

themselves as operationally vulnerable to external shocks like the pandemic,

hindering their ability to adapt to changing conditions (Garcia-Perez-de-Lema, Madrid-Guijarro, and Durendez, 2022).

This may lead to accelerated strategic decisions to exit unprofitable markets

and vehicle segments, resulting in significant output reductions.

2.1.5. Leadership

The

leadership practices for adapting to the COVID-19 pandemic will focus on the

agility of business leaders to sense, anticipate, and adapt to a rapidly

changing VUCA (Volatile, Uncertain, Complex, and Ambiguous) world. Modern

leaders will need to be able to adapt to overcome obstacles that develop as a result

of any unanticipated crisis that affects the firm as well as foresee other

challenges that may arise in the future. To adapt to VUCA, Long et al. (2022) suggested Blockchain

leadership with the following skill set. “In order to develop multiple competencies

in digital literacy, critical thinking, negotiation, innovation,

decision-making, conflict handling, cross-culture communication, cross-culture

management, multi-generation management, business strategy, supply chain

management, accounting and finance, emotional intelligence and global

economics, leaders should be exposed to a variety of different learning

experiences in the key areas of STEM (Science, Technology, Engineering,

Mathematics) and managing global organizations.” (Long

et al., 2022).

2.1.6. Government Policy

According to research by the United Nations Thailand, tax rate

reductions or deferrals and reduced social contributions are the most preferred

government support measures for auto firms in Thailand. Lowering operating

costs, such as rent and electricity bills, and improving loan terms are also

favored. The study recommends targeted support programs for micro and small

businesses, extended tax exemptions and loan deferrals, and employee retention

initiatives. Leveraging industrial development facilities, repurposing

manufacturing, and embracing the fourth industrial revolution are also advised (UNIDO, 2020).

2.2. Literature Gap

The COVID-19 pandemic is one of the worst automotive industry disruptions and has challenged practitioners, policymakers, and scholars to improve its performance. Another thinking is that considering the crisis as a chance offers new opportunities for automotive manufacturers. The crisis offers a positive opportunity that offers firms a chance to break past experiments and replace them with new approaches. Recent technological progress, especially Industry 4.0, indicates possibilities to mitigate business effects, supply chain and manufacturing, response and imperatives, leadership, and government and regulatory intervention risks during the COVID-19 pandemic. However, the literature lacks an analysis of the link between the aforementioned factors. Based on a categorization of it, the research presents a comprehensive framework analyzing the current scenario while illustrating the relationship between both areas.

This quantitative

research utilized a Likert-scale survey with 620 respondents from various

sectors, including the auto industry, to examine the relationship between

variable factors and Vietnam’s automotive industry. The study employed

Smart-PLS 3.0 and SPSS 20 for correlation analysis, construct quality

measurement, discriminant validity, crosstabulation, and path coefficients

analysis. Long et al. (2022) proposed

Blockchain leadership with characteristics such as agility, creativity,

innovation, rapidity, flexibility, and resilience to navigate the VUCA

environment. Another study highlighted Vietnam's industry components, including

supporting industries, supply base, human resources, research and development,

and government policy (Long, Tan, and Tran, 2015).

The research framework aimed to assess the relationship between dependent and

independent variables within the proposed framework.

Five hypotheses have

been developed for this research:

- H1: There is a significant positive

relationship between Vietnam’s automotive industry during COVID-19

and business

effects.

- H2: There is a significant positive

relationship between Vietnam’s automotive industry during COVID-19

and supply

chain and manufacturing.

- H3: There is a significant positive

relationship between Vietnam’s automotive industry during COVID-19

and response

and imperatives.

- H4: There is a significant positive

relationship between Vietnam’s automotive industry during COVID-19

and

leadership.

- H5: There is a significant positive relationship between Vietnam’s automotive industry during COVID-19

and government and regulatory interventions.

Figure 1 Vietnam automotive industry

during COVID-19 theoretical framework

4.1 Demographic Profile

The study included 620 individuals from

various organizations, industries, positions, and recovery scenarios. The

diverse demographic profile of the study population indicates a varied

representation of stakeholders with different perspectives and experiences in the

automotive industry.

Table 1 Demographic Profile

4.2 SPSS and PLS Structural Model Results

4.2.1. Construct Quality Measurement

Factor loadings in Table 2 range from above 0.775 to 0.869, indicating components

converged satisfactorily. Composite Reliability (CR) values of all constructs are greater than 0.7, demonstrating that they

are adequate according to the standards and complete all the minimum

requirements of the specific items.

Table 2 Construct Quality Measurement

4.2.2. Convergent and Discriminant Validity

The minimum acceptable Average Variance Extracted (AVE) is 0.50 or higher. All AVE

values are higher than the critical threshold value of 0.50, providing support

for the measures’ convergent validity.

Table 3 Convergent and Discriminant Validity

4.2.3.

Scenario Crosstabulation

Table

4 summarizes the scenario choices of state officers, enterprise managers,

researchers, and vehicle users. Scenario 2 (Realistic) was the most selected

scenario, with 242 respondents, followed by Scenario 4 (Other), with 184

respondents. Scenario 1 (Optimistic) was selected by 64 respondents, while

Scenario 3 (Pessimistic) was selected by 130 respondents. Scenario 3 was more

popular among researchers, while Scenario 4 was more popular among enterprise

managers. Vehicle users only selected Scenario 3. Overall, Scenario 2 was the

most popular, followed by Scenarios 4, 3, and 1.

Table 4 Scenario Cross Tabulation

4.2.4.

Hypothesis Results

R2

Adjusted to measure the model’s explanatory power is used and interpreted in

the same way as for the regression analysis. The analysis revealed that the

structural model explained 60.1% of the variation in the automotive industry,

suggesting that the structural model provided an adequate explanation. The Q2

value estimated the structural model’s predictive relevance for each endogenous

construct. Table 5 also shows that the Q2 values of the automotive industry (0.390)

variable were over zero. This result confirmed the model’s predictive power is

suited for the endogenous latent variable. The f2 function value indicates the

extent of influence that a factor has when it is removed from the model. In

this case, the effect size f2 values for leadership and government and

regulatory interventions are 0.216 and 0.164, respectively. These values, being

greater than 0.15, indicate a moderate level of influence within the model.

Effect size f2 value of 3 construct business effects, response and imperatives,

supply chain, and manufacturing is smaller than 0.15 demonstrating a low level

of influence in the model. Table 5 shows that other indices also have the

goodness index, such as the VIF ( Variance Inflation Factor) value of all

variables in the model being less than 3, so there is no multicollinearity

problem. To assess the overall explanatory power of the structural model, the

variance explained by the independent variables, and the strength of its paths,

each hypothesis corresponds to a specific path within the structural model.

Table 5 Path Coefficients

Results in Table 5 demonstrate the connection

between the automotive industry in Vietnam and its impact factors during the COVID-19

pandemic. Results indicate that five hypotheses in the conceptual model are

fully supported. All constructs are significantly related to Vietnam’s

automotive industry. Variable leadership has the highest significant and

positive relationship (O = 0.332, P<0.01) with Vietnam automotive industry.

Government and regulatory interventions (O = 0.270, P<0.01), supply chain

and manufacturing (O = 0.254, P<0.01), response and imperatives (O = 0.220,

P<0.01), business affects (O = 0.166, P<0.01) respectively have a

significant positive relationship with Vietnam automotive industry.

4.3 Discussion

During the COVID-19

pandemic, leadership in response to the crisis is the most important factor.

Apply Integration Block-chain leadership Model helps Vietnam overcome the

crisis (Mean = 3.7) (Dr. Ly Tracy Trang – Nhon Hoa Company Limited).

Leadership’s priority is to reset the supply chain and operational excellence

and the second priority is to renew the sales model and supply chain resilience

(Mean = 3.55). Responsive and intelligent leadership is necessary (Mean = 3.5).

Government and regulatory

interventions influence Vietnam’s automotive industry during COVID-19. Vietnam

should have more policies supporting the automotive industry during the crises

(Mean = 3.11). The guidance or supporting policies for the sector is limited

and not on time. Co-ordinance among the Government, Ministry, and Enterprisers

during the COVID-19 pandemic is limited, leading to the Vietnam automotive

industry commit difficulty (Mean = 3.09). Government support is expected to

reduce the impact of taxes and duties and to help enterprises and the workforce

in the financial field. During committing world century crisis, the leading

role of the government is essential, including the regulation intervention of

guidance and supporting policies of tax/duties as well as financial issues (Dr.

Tran Van Ai–vice chairman of Nguyen Tat Thanh University) and industry 4.0 implementation

is important (Anh et al., 2022).

To achieve the best, it is a

good idea to apply foreign support such as governmental support, policy, and

upper-tier contractor. To be specific, shut down orders from the government and

upper-tier contractors. Many OEMs announced a short-time work and overtime

reduction; some restarted their production plants, while others shifted to

producing medical equipment. “The greater the negative impact on investment and

financing, the greater SMEs’ demands for policies aimed at improving the

competitiveness of companies.” (Garcia-Perez-de-Lema,

Madrid-Guijarro, and Durendez, 2022).

Supply chain and manufacturing are the most

important factors in the automotive industry, but not during crises. Recovery

of the automotive supply chain will take time (Mean = 3.67). Rebound in export

and import of countries will affect (Mean = 3.65). The just-in-time principal

is not appropriate in crisis time. A restart will be complex, cost-intensive,

and time-consuming. OEMs need to take immediate action to address

interruptions, bolster operations to boost future resilience, and get ready for

the “new normal” Cross-functional: A corporate control tower offers prompt and

practical responses to a situation that is rapidly changing. Rebuild the

industry needs to adopt Immersive Technology (ImTech) to get to the “New

Normal” era (Baroroh and Agarwal, 2022). COVID-19

caused unimaginable world manufacturing and supply chains. Many factories

closed, and motor vehicles were not able to be assembled (Mr. Tran Van Tuan –

Director of HD Bank Binh Duong Province Branch).

Business components of the automotive industry

comprise parts and components, manufacturing, workforce, capital resources, and

sales, which are affected in many aspects. During the COVID-19 pandemic, there

were limitations on automotive parts (Mean = 3.32). Manufacturing shut down in

many places. Workforce capital liquidation declined (Mean = 3.56), and sales

dropped (Mean = 3.33). Purchase of a motor vehicle is not a priority during a

pandemic (Mr. Ho Lu Lam Tran – Javihi Hi-tech R&D Center).

The potential recovery scenarios for the crisis

were presented in four concepts: optimistic, realistic, pessimistic, and other.

State officers tend to be optimistic and realistic, while enterprise managers

and researchers tend to be somewhat realistic and pessimistic. Some respondents

even presented the worst-case scenario for recovery.

These findings have

significant implications for managers in the automotive industry, highlighting

the importance of adopting the Block-chain leadership Model and implementing

the 4RE Solution (Respond, Reset, Recover, and Reshape) to navigate the current crisis and strategically reshape the

industry in Vietnam. Future research should aim to replicate these findings in

larger and more diverse samples, explore additional external factors

influencing the automotive industry’s performance, and investigate their impact

on specific areas such as supply chain management, innovation, and customer

satisfaction. Overall, this study provides valuable insights and

recommendations for practitioners in the automotive industry, enabling them to

make informed decisions and formulate strategies to address external factors

and enhance performance. Additionally, policymakers can leverage these findings

to develop effective policies that support the industry’s growth and

resilience.

Accenture, 2020. COVID-19:

Managing Automotive Industry Impact. Available online at: https://www.accenture.com/us-en/insights/automotive/coronavirus-automotive-rapid -response, Accessed on June 07, 2023

Anh, T.D., Binh, T.D., Long, N.D.B.,

Ai, T.V., Tan, K.S., Van, N.T.L., 2022. Strategic Vision for the

Implementation of the Industrial Revolution 4.0 in the Vietnamese Context. International

Journal of Technology, Volume 13(5), pp. 958–968

Baroroh, D.K., Agarwal, A., 2022. Immersive

Technologies in Indonesia Faces. International Journal of

Technology, Volume 13(3), pp. 633–642

Caballini, C., Ghiara, H., Persico, L., 2022. Analysis of the Impacts of COVID-19

on Selected Categories of Goods Passing Through the Ports of Genoa

and Savona, Italy. Case Studies on Transport Policy, Volume 10(2), pp.

851–869

Deloitte, 2020. Understanding COVID-19’s

Impact on The Automotive Sector, Deloitte United States. Available

online at: https://www2.deloitte.com/us/en/pages/about-deloitte/articles/COVID-19/COVID-19-impact-on-automotive-sector.html, Accessed on June 07, 2023

Garcia-Perez-de-Lema, D., Madrid-Guijarro, A., Durendez, A., 2022. Operating, Financial, and Investment Impacts of COVID-19

in SMEs: Public Policy Demands to Sustainable Recovery Considering the Economic Sector Moderating Effect. International

Journal of Disaster Risk Reduction, Volume 75, p. 102951

Gatenholm, G., Halldorsson, A., 2022. Responding to Discontinuities

in Product-based Service Supply Chains in the COVID-19 Pandemic: Towards Transilience. European

Management Journal, Volume 41(3), pp. 425–436

McKinsey, 2020. The Impact of COVID-19

on Future Mobility Solutions. Available online at:https://www.mckinsey.com/~/media/McKinsey/Industries/Automotive%20and%20Assembly/Our%20Ins

ights/The%20impact%20of%20COVID-19%20on%20future%20mobility%20solutions/The-impact-of-COV

ID-19-on-future-mobility-solutions-vF.ashx, Accessed

on June 08, 2023

International Labour

Organization (ILO), 2020. COVID-19 and the Automotive Industry. Available

online at: http://www.ilo.org/sector/Resources/publications/WCMS _741343/lang--en/index.htm, Accessed on June

08, 2023

Kaitwade, N., 2021. COVID-19 Shatters Global Automotive Industry; Sales of Metal Powder Take a Nosedive Amid Wavering Demand. Metal Powder

Report, Volume 76(3), pp. 137–139.

Long, N.D.B., Ooi, P.T., Le, T.V., Thiet, L.T.,

Ai, T.V., An, L.Q., Hudson, A., Tan, K.S., Van, N.T.L., 2022. Leading in the

Age of the Fourth Industrial Revolution – A Perspective

from Vietnam. International Journal of Technology, Volume 13(5), pp.

949–957

Long, N.D.B., Huy, N.N., Van, N.T.L., 2022. Vietnam

Automotive Business at a Crossroads: A Jump to Future Technology. In: Oxford Journal

of Technology, Arts, Sciences, and Knowledge

Long, N.D.B., Tan, K.S., Tran, H.L.L., 2015. Vietnam

Automotive Industry Toward 2018. International Journal of

Business and Management Studies, Volume 4(2), pp. 191–204

Ministry of Industry and

Trade (MOIT), 2022. The Automotive Industry was Hardest Hit by Supply Chain Disruptions During the Covid Pandemic. Available Online at: http://moit.gov.vn/tin-tuc/doanh-nghiep/nganh-cong-nghiep-o-to-bi-anh-huong-nang-ne-nhat-boi-su-gian-doan-chuoi-cung-ung-trong-dai-dich-covid.html, Accessed on June 08, 2023

Spieske, A., Birkel, H., 2021. Improving Supply Chain Resilience Through Industry 4.0: A Systematic Literature Review Under the Impressions of

the COVID-19 Pandemic. Computers and Industrial

Engineering, Volume 158, p. 107452

United Nations Industrial

Development Organization (UNIDO), 2020. Impact Assessment of COVID-19

on Thai Industrial Sector. Available online at: https://thailand.un.org/en/50830-impact-assessment-COVID-19-thai-industrial-sector, Accessed on June 08, 2023

Van Barneveld, K., Quinlan, M., Kriesler, P., Junor, A., Baum, F., Chowdhury, A., Anis, J., Junankar, P.R., Clibborn, S., Flanagan, F., Wright, C.-F., Friel, S., Halevi, J., Rainnie A.-L., 2020. The COVID-19 Pandemic: Lessons on Building More Equal and Sustainable Societies. The Economic and Labour Relations Review, Volume 31(2), pp. 133–157

World Health Organization (WHO), 2020. Coronavirus disease (COVID-19) Pandemic Available Online at: https://www.who.int/emergencies/diseases/novel-coronavirus-2019, Accessed on June 08, 2023

Accenture, 2020. COVID-19:

Managing Automotive Industry Impact. Available online at: https://www.accenture.com/us-en/insights/automotive/coronavirus-automotive-rapid-response, Accessed on June 07, 2023

Anh, T.D., Binh, T.D., Long, N.D.B.,

Ai, T.V., Tan, K.S., Van, N.T.L., 2022. Strategic Vision for the

Implementation of the Industrial Revolution 4.0 in the Vietnamese Context. International Journal of Technology, Volume 13(5), pp. 958–968

Baroroh, D.K., Agarwal, A., 2022. Immersive Technologies in Indonesia Faces. International Journal of Technology, Volume 13(3), pp. 633–642

Caballini, C., Ghiara, H., Persico, L., 2022. Analysis of the Impacts of COVID-19 on Selected Categories of Goods Passing Through the Ports of Genoa and Savona, Italy. Case Studies on

Transport Policy, Volume 10(2), pp. 851–869

Deloitte, 2020. Understanding

COVID-19’s Impact on The Automotive Sector, Deloitte United States. Available online at: https://www2.deloitte.com/us/en/pages/about-deloitte/articles/COVID-19/COVID-19-impact-on-automotive-sector.html, Accessed on June 07, 2023

García-Pérez-de-Lema, D., Madrid-Guijarro, A., Duréndez, A., 2022. Operating, Financial, and Investment Impacts of COVID-19 in SMEs:

Public Policy Demands to Sustainable Recovery Considering the Economic Sector Moderating Effect. International Journal of Disaster Risk Reduction, Volume 75, p. 102951

Gatenholm, G., Halldórsson, Á., 2022. Responding to Discontinuities in Product-based Service Supply Chains in the

COVID-19 Pandemic: Towards Transilience. European Management Journal, Volume 41(3), pp. 425–436

International Labour

Organization (ILO), 2020. COVID-19 and the Automotive Industry. Available online at: http://www.ilo.org/sector/Resources/publications/WCMS

_741343/lang--en/index.htm, Accessed on June 08, 2023

Kaitwade, N., 2021. COVID-19 Shatters Global Automotive Industry; Sales of Metal Powder Take a Nosedive Amid Wavering Demand. Metal Powder Report, Volume 76(3), pp.

137–139.

Long, N.D.B., Huy, N.N., Van, N.T.L., 2022. Vietnam Automotive Business at a Crossroads: A

Jump to Future Technology. In: Oxford Journal of

Technology, Arts, Sciences, and Knowledge

Long, N.D.B., Ooi,

P.T., Le, T.V., Thiet, L.T., Ai, T.V., An, L.Q., Hudson, A.,

Tan, K.S., Van, N.T.L., 2022. Leading in the Age of the

Fourth Industrial Revolution – A Perspective

from Vietnam. International Journal of Technology, Volume 13(5), pp. 949–957

Long, N.D.B., Tan,

K.S., Tran, H.L.L., 2015. Vietnam Automotive Industry Toward 2018. International Journal of Business and Management Studies, Volume 4(2), pp. 191–204

McKinsey, 2020. The Impact of COVID-19 on Future Mobility Solutions. Available online at: https://www.mckinsey.com/~/media/McKinsey/Industries/Automotive%20and%20Assembly/Our%20

Insights/The%20impact%20of%20COVID19%20on%20future%20mobility%20solutions/The-impact-of-COVID-19-on-future-mobility-solutions-vF.ashx, Accessed on June 08, 2023

Ministry of Industry and

Trade (MOIT), 2022. The Automotive Industry was Hardest Hit by Supply Chain Disruptions During the Covid Pandemic. Available Online at:

http://moit.gov.vn/tin-tuc/doanh-nghiep/nganh-cong-nghiep-o-to-bi-anh-huong-nang-ne-nhat-boi-su-gian-doan-chuoi-cung-ung-trong-dai-dich-covid.html, Accessed on June 08, 2023

Spieske, A., Birkel, H., 2021. Improving Supply Chain Resilience Through Industry 4.0: A Systematic Literature Review Under the Impressions of the COVID-19 Pandemic. Computers and Industrial Engineering, Volume 158, p. 107452

United Nations Industrial

Development Organization (UNIDO), 2020. Impact Assessment of

COVID-19 on Thai Industrial Sector. Available online at: https://thailand.un.org/en/50830-impact-assessment-COVID-19-thai-industrial-sector, Accessed on June 08, 2023

Van Barneveld, K.,

Quinlan, M., Kriesler, P., Junor, A., Baum, F., Chowdhury, A., Anis, J.,

Junankar, P.R., Clibborn, S., Flanagan, F., Wright, C.-F., Friel, S., Halevi,

J., Rainnie A.-L., 2020. The COVID-19 Pandemic: Lessons

on Building More Equal and Sustainable Societies. The Economic and Labour

Relations Review, Volume 31(2), pp. 133–157

World Health Organization (WHO), 2020. Coronavirus disease (COVID-19) Pandemic Available Online at: https://www.who.int/emergencies/diseases/novel-coronavirus-2019, Accessed on June 08, 2023