The Impact of Sustainability Disclosures on Value of Companies Following Digital Transformation Strategies

Corresponding email: sgrishunin@hse.ru

Published at : 27 Dec 2022

Volume : IJtech

Vol 13, No 7 (2022)

DOI : https://doi.org/10.14716/ijtech.v13i7.6194

Grishunin, S., Naumova, E., Burova, E., Suloeva, S., Nekrasova, T., 2022. The Impact of Sustainability Disclosures on Value of Companies Following Digital Transformation Strategies. International Journal of Technology. Volume 13(7), pp. 1432-1441

| Sergey Grishunin | National Research University, Higher School of Economics, 20 Myasnitskaya Ulitsa, Moscow, 101000, Russia |

| Eugenia Naumova | National Research University, Higher School of Economics, 20 Myasnitskaya Ulitsa, Moscow, 101000, Russia |

| Ekaterina Burova | Peter the Great St. Petersburg Polytechnic University, 29 Politechnicheskaya Ulitsa, St. Petersburg, 195251, Russia |

| Svetlana Suloeva | Peter the Great St. Petersburg Polytechnic University, 29 Politechnicheskaya Ulitsa, St. Petersburg, 195251, Russia |

| Tatyana Nekrasova | Peter the Great St. Petersburg Polytechnic University, 29 Politechnicheskaya Ulitsa, St. Petersburg, 195251, Russia |

Sustainable growth is

the key global priority, and environmental, social and governance (ESG)

objectives have become the main point of attention in companies’ digital

transformation strategies. ESG and digital transformation reinforce each other

as they aim to improve efficiency and meet stakeholders inside and outside the

company. This is true for telecommunication companies, where disruptive

technologies such as artificial intelligence, big data or cloud computing are

reshaping the industry. Assessment of the impact of sustainability disclosures

on companies’ value is a task of high interest for academics and practitioners

from telecommunication companies. ESG disclosure serves as a key channel to

inform investors about the efficiency of ESG risk management and control

practices of the firm and thus can impact the firm’s financial performance and

market value. However, there are numerous controversies in the academic

literature on this topic and a lack of research specifically for the

telecommunication industry. We closed the research gaps and investigated the

impact of ESG disclosure on Tobin-Q of 93 US-listed telecommunication service

companies between 2011-2021. We found that aggregated ESG disclosure score

positively impacted telecoms’ Tobin-Q. Among individual ESG disclosure pillars,

only corporate governance positively influenced Tobin-Q, while the impact of

environmental and social pillars was statistically insignificant. We also found that CEO duality significantly

and negatively impacted Tobin-Q. The presence of the corporate social responsibility

(CSR) committee, greater gender diversity and a higher percentage of

independent directors on the board positively affected the value of the

telecoms. The result of the study can be applied in developing ESG rating

methodologies for telecommunication companies. They can also assist telecom

companies’ managers and stakeholders to identify key value drivers of the ESG

agenda.

Corporate governance; ESG disclosure; ICT; Sustainable development; Tobin Q

In the

last decade, the global telecommunication industry has changed significantly

and enabled a lot of digital innovations. These changes have been driven by the

rapid dissemination of high-speed internet, mobile devices, big data, cloud

technologies, over-the-top media services or 5G generation mobile networks (Santoso et al., 2019). The industry has

reformatted into the info-communication space (ICT), where telecommunication

and IT are intertwined to provide customers with a large variety of services: from “traditional” voice and data

transmission to different kinds of digital services and users

applications.

These new opportunities

come with challenges which mute the market value of companies in the industry (Mohammad &

Wasiuzzaman, 2021). One of these challenges

is the dissemination of environmental, social and governance (ESG) investing.

Investors are ready to provide long-term funding only to those companies that

follow the principles of sustainable development. Moreover, studies showed that

the successful integration of sustainable practices could affect the firms’

value (Schramade, 2016). The GSMA, the

mobile operators’ industry association, conducted research which showed that

ESG reduced companies’ capital cost and positively influenced stock prices

(GCMA, 2020).

ICTs communicate with

stakeholders on ESG issues via ESG disclosure. The latter reduces the

informational asymmetry between stakeholders and the management; improves

the firm’s reputation and demonstrates commitment to sustainability (Porter et al.,

2019). Ultimately, the quality

of ESG disclosure affects the market value of the firm. (Fatemi et al., 2017; Friede et

al., 2020). However, there are numerous controversies in the literature.

There is evidence that ESG disclosure had a neutral or even negative impact on

a company’s cost of capital or performance (Dhaliwal et. al., 2011; Atan et al., 2018; Buallay et al., 2020). There is a lack of research on this topic in the ICT

industry.

2. Literature review

2.1. Importance of ESG agenda and practices in info-communication industry

ESG is an important measure of sustainable corporate development and an extension of the socially responsible investment concept (Rodionov, et al., 2018; Koroleva et al., 2020; Nekhili et al., 2021; Khorin & Krikunov, 2021). Companies in the ICT industry can impact global sustainability via complex, indirect effects on energy consumption, data privacy and security as well governance and transparency (Berawi, 2020). The carbon emissions in ICT come mainly from power consumption and bandwidth usage and currently exceed 0.8 gigatons. In 2021 the industry used approximately 4% of total global power demand. This share can increase to 10% by 2025. The shift toward green info-communication is now observed by adopting energy-efficient and renewable energy technologies (Mohanty & Moreira, 2014). Social factors which should be of concern in ICT firms are workplace conditions, diversity, employee engagement and belongingness. This is due to harmful stereotypes and a lack of digital confidence on the part of women. Others issues such as human rights violations at ICT companies’ vendors or leakages of private data of consumers. ICT firms following the best ESG practices demonstrated better financial performance (Sutherland, 2016). Corporate governance is the most influential factor for ICTs; its impact on the firms’ performance can reach around 60% (Rittenhouse et al., 2011).

2.2. Review of academic and practical literature

a) Impact of ESG pillars on firms’ value

The outcome of studies which have tested the impact of the

following ESG agenda on the value of the firms is controversial. Some argue

that the firms which follow good ESG practices improve their non-financial

indicators such as consumer and supplier satisfaction, market acceptance,

employees’ management skills etc. (Atan et al., 2018; Mohammad & Wasiuzzaman, 2021). As for G-component, many studies showed that good

governance increased investors’ confidence. This positively affects the firm’s

value (Siagian et al., 2013;

Miroshnychenko et al., 2017). In some

cases, E-pillar harmed the firm’s value, indicating that ESG activities’

payoffs did not exceed their costs (Verbeeten et

al., 2016). Several industrial studies have found either a negative or a

nonsignificant association between ESG performance and firm value or

performance (Fisher-Vanden & Thorburn, 2008; Horváthová, 2010). The results significantly varied among

industries.

b) The relationship between ESG disclosure and firms’ value

and performance

Many papers stated that companies engaged in high-quality

ESG disclosures were associated with lower systematic and idiosyncratic risks.

That should result in higher market value. This effect is the most pronounced

for the listed firms in developed markets (Porter et al., 2019). Firstly, a firm’s ESG disclosure is a predictor of its

ESG score: firms with positive ESG performance would report their ratings

fully, and those with negative ESG performance would choose to report

minimally. ESG disclosure is associated with a competitive advantage, a

society-oriented product offering and a high reputation (Cho & Patten,

2007). However, there are

controversies in research. Cai and He (Cai & He, 2014) found a positive correlation between following ESG

practices and companies' values using 20 years of data from 1992 to 2011 (Cai &

He, 2014). Dhaliwal et al. examined

the relationship between ESG disclosure and the equity cost of capital in an

international sample of 31 countries. They found a negative association between

ESG disclosure and the cost of equity capital (Dhaliwal

et al., 2014). Plumee et al., found no significant association between

the overall level of voluntary ESG disclosure and the value of the firm, its

component cash flows, or its cost of capital (Plumlee et al.,

2015). Fatemi (Fatemi, 2018) showed that ESG disclosure, per se,

decreases firms' valuation.

2.3. Conclusion from the literature review

There is no generally accepted framework which explains the

contradictions in the literature. The gaps are the lack of research which

explored different patterns of ESG practices and disclosure in various

industries and how they impacted firms’ performance. Some papers used short

datasets. Conversely, the research indicated a U-shaped relationship between

the impact of ESG practices and value (Trumpp & Günther, 2017). This confirms that investments made in ESG bring results

only in the future.

3.1. Development of the research hypotheses

Due

to the conflicting results found in the literature, the hypotheses are as

follows:

H1:

In the telecommunication sector, firm value is positively associated with ESG

disclosure

H2:

In the telecommunication sector, the value of the company is positively

associated with E-component disclosure

H3:

In the telecommunication sector, the value of the company is positively

associated with S-component disclosure

H4:

In the telecommunication sector, the value of the company is positively

associated with G-component disclosure

H5:

Selected components of E, S or G components of disclosures have a significant

impact on the financial performance of telecommunication companies

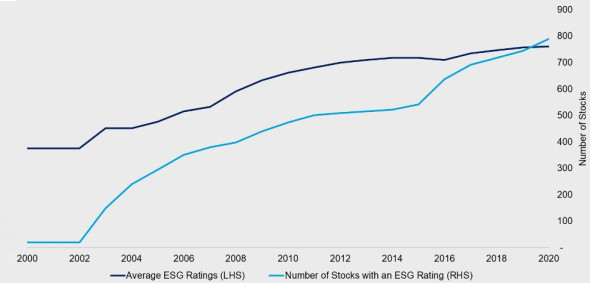

3.2. The data

We used the annual panel data for telecoms listed on the USA stock

exchanges between 2011-2021. The period covers almost the entire history of the

development of ESG financing and the availability of ESG disclosure ratings (Ivashkovskaya & Mikhailova, 2020). We chose the US financial

market due to its high liquidity and long history of listing of telecoms. The

screening of the companies was performed on Capital IQ. We applied the

following selection criteria: the firm’s earnings before interest, taxes,

depreciation and amortization (EBITDA) are greater than 0; and the total

enterprise value (TEV) is greater than 0. The screening resulted in a dataset

of 306 companies, from which the top 100 were chosen by their market value. We

used Bloomberg ESG disclosure scores (the ESG score and E, S and G components

scores) as a proxy for the quality of ESG disclosure. It tracks about 800

different disclosure metrics that cover all aspects of ESG, from emissions to

shareholder rights. The companies in the ranking are ranked from 0 to 100, with

100 being the best score. We normalized the Blomberg ESG disclosure score to

[0;1].

The dependent variable is the Tobin Q metric (TQ) which represents the sum

of market capitalization, total liabilities, preferred equity and minority

interest divided by total assets. It is a good proxy for the firm value and

allows investors to assess the justification of an investment in a firm: if its

market value is higher than the accounting value (that is, q-Tobin > 1),

then the investment is justified and vice versa (in the case when q-Tobin <

1). Tobin Q is a good indicator of investors’ expectations. This metric is the

most widespread in studies of the impact of sustainable practices on financial

results (Nirino et al., 2021). The set of

independent variables consists of complex ESG scores, individual E, S and G

scores and control variables: (1) debt ratio; (2) tangibility; and (3) return

on assets (ROA) (Table 1). ROA was chosen as it is an indicator to assess the

quality of the company's management, namely the efficiency of the use of

capital. The tangibility ratio measures the importance of non-financial capital

in creating value and indicates a firm’s internal competitive advantage.

Telecoms with a smaller proportion of tangible assets grow faster (Lei et al., 2018). The debt ratio measures financial leverage. The

studies showed that leverage is positively related to a firm’s value as the

returns earned

Table 1 Dependent

variables and their descriptive statistics.

|

Calculation |

Notation |

Expected sign |

Mean |

Standard deviation |

Minimum |

Maximum | |

|

ESG score |

Bloomberg |

ESGit |

“+” |

0.882 |

0.323 |

0 |

0.96 |

|

E score |

Bloomberg |

Eit |

“+” |

0.748 |

0.435 |

0 |

0.92 |

|

S score |

Bloomberg |

Sit |

“+” |

0.806 |

0.396 |

0 |

0.93 |

|

G score |

Bloomberg |

Git |

“+” |

0.882 |

0.323 |

0 |

0.97 |

|

ROA |

Net income/Average assets |

ROAit |

“+” |

0.061 |

0.179 |

-0.32 |

5.320 |

|

Tangibility ratio |

Net fixed

assets/Total assets |

TANGit |

“-“ |

0.790 |

0.092 |

0.220 |

0.990 |

|

Leverage |

Debt/Equity |

DEBTit |

“+” |

0.395 |

0.403 |

0 |

9.860 |

Source: calculated by authors

For all our analyses, Variance Inflation Factor (VIF) is below 10, signifying no sign of multicollinearity and the correlation between the dependent variables is below 0.4.

3.3. The model

The regression

model to test the H1 is as follows:

The regression model to test H2-H4 is as follows:

To regression model to test H5 is as follows:

where: fit – factors describing some

individual components of ESG disclosure score (see Results section); K – the

number of explanatory variables. For our panel data, we used three methods

based on which it is possible to estimate the relationship between Tobin Q and

dependent variables: pooled OLS regression, fixed effect (FE) linear model and

random effect (RE) linear model. To select the best model between fixed and random effect specifications, we used Durbin–Wu–Hausman

test.

Table 2 shows the

results of the estimation of regressions (1) and (2). The constant is not

significant for all specifications, and thus, it is not shown in the table. The

Durbin–Wu–Hausman test and c Breusch-Pagan

LM test confirm that the fixed effect (FE) estimator is the most efficient.

Thus, the study focuses on the FE estimators to explain the results. According to the F-statistic value, all

models have the predictive capability: p-values are lower than 1%, meaning that

the null hypothesis of all regression coefficients being equal to zero is

rejected.

Table 2 shows that the ESG disclosure score is significant at 10% confidence level. A positive sign means that ESG disclosure increases the market value of telecommunication firm. Thus, the hypothesis H1 is confirmed. On the one hand, this conclusion agrees with those of (Servaes & Tamayo, 2012) but on the other hand, this outcome contradicts the finding of (Buallay & Marri, 2022; Velte, 2017) who found a negative relationship between Tobin Q and sustainability disclosure. We explain this by the differences in explored markets, sample size and timespan. Additional further research is necessary to explore these contradictions.

Table 2 The results of the

estimation of regressions (1) and (2)

|

Variable |

Pooled OLS |

FE |

RE |

Pooled OLS |

FE |

RE |

|

ESG |

0.117* (0.116) |

0.149* (0.088) |

0.152* (0.089) |

|

|

|

|

E |

|

|

|

-0.056 (0.161) |

-0.274 (0.167) |

-0.217 (0.160) |

|

S |

|

|

|

0.054 (0.204) |

0.102 (0.163) |

0.089 (0.182) |

|

G |

|

|

|

0.169* (0.175) |

0.273** (0.136) |

0.244* (0.137) |

|

Debt ratio |

0.914*** (0.094) |

0.984*** (0.092) |

0.964*** (0.089) |

0.916*** (0.945) |

1.006*** (0.093) |

0.978*** (0.090) |

|

Tangibility |

-1.582*** (0.458) |

-2.073*** (0.549) |

-1.996*** (0.508) |

-1.567*** (0.460) |

-2.046*** (0.549) |

-1.970*** (0.508) |

|

ROA |

1.669*** (0.212) |

0.476*** (0.160) |

0.629*** (0.161) |

1.673*** (0.212) |

0.470*** (0.160) |

0.623*** (0.161) |

|

Observations |

1 034 |

1 034 |

1 034 |

1 034 |

1 034 |

1 034 |

|

R-squared |

0.140 |

0.306 |

0.146 |

0.140 |

0.309 |

0.148 |

|

p-value (F-test

robust) |

0.0023 |

0.001 |

0.036 |

0.0024 |

0.000 |

0.039. |

|

p-value Hausmann

test |

|

|

0.1588 |

|

|

0.1645 |

|

Breusch-Pagan LM

test. (F p-value_ |

0.000 |

|

|

0.0000 |

|

|

***, **, * indicate the value

is significant at 1%, 5% and 10% level

Source: author’s calculation

The individual disclosure pillars: environmental (E)

and social (S) are both statistically insignificant in influencing the Tobin’s

Q. Therefore, hypotheses H2 and H3 are rejected. Conversely, governance pillar

(G) is significant at a 5% confidence level. Hence, hypothesis H4 is confirmed.

These results coincide with that of (Rittenhouse

et al., 2011), that the share of corporate performance (G-factors)

in the investors' expectations of ICT companies equalled around 60%. This is

also confirmed by practical studies, for example (Derue,

2021), which state that unlike investors in other industries with the

severe influence of environmental factors (oil and gas or metals and mining) or

social factors (e.g. banking or mining) the impact of these factors in

telecommunication sector (especially in large established corporates) is

marginal. Moreover, the insignificance of these factors may be explained by the

fact that these factors have a more significant impact on the value of the firm

in markets with weak development of financial institutions (Ge & Liu, 2015), but we studied the US market

Conversely, the governance has a first-order impact on telecommunication

companies as it increases investors’ confidence, which results in larger firm’s

value (Siagian et al., 2013). All control

variables are significant at 1%, and signs of the variables coincide with the

previous findings and our expectations. The higher the company’s profitability,

the higher its market value and the increase in the company’s leverage also

positively affect its value. Tangibility has an opposite effect, it negatively

and significantly decreases Tobin Q. This agrees with the findings of (Lei et al., 2018). These results indicate that the model is correctly

specified.

Let’s now test the H5. G-factor appeared to be the only ESG pillar influencing the Tobin-Q of telecommunication firms. For our research, we selected first-order G-impact factors (Table 3) cited in the literature (Velte, 2017; Malik & Makhdoom, 2016). To get information about individual corporate governance practices we used data from the Refinitive Thomson Reuters terminal.

Table 3 G-factors considered in the research and their descriptive statistics

|

Variable |

Calcu-lation |

Notation |

Expected sign |

Mean |

Standard deviation |

Minimum |

Maximum |

|

Independence policy |

0/1 |

IPit |

“+” |

0.522 |

0.5 |

0 |

1 |

|

Percentage of independent director in the board |

% |

NEDit |

“+” |

59.098 |

31.242 |

0% |

100% |

|

CEO Chairman Duality |

0/1 |

CDit |

“-“ |

0.524 |

0.5 |

0 |

1 |

|

Existence of Corporate Social Responsibility (CSR) Board committee |

0/1 |

CSRit |

“+” |

0.74 |

0.439 |

0 |

1 |

|

Women in board |

% |

WBit |

“+” |

11.422 |

12.072 |

0% |

100% |

`Source:

calculated by authors

For all our analysis, Variance Inflation Factor (VIF) is below 10, signifying

moderate multicollinearity and the correlation between the dependent variables

is below 0.2.

Among the studies that examined the impact of the mentioned individual

corporate governance factors on financial indicators, controversial estimates

were obtained. The high presence of independent directors on the board usually

positively influences Tobin-Q (Malik &

Makhdoom, 2016). Impact of Board diversity on firm value can be either positive (Smith et al., 2006) or negative (Adams & Ferreira, 2009). The empirical evidence of

the relationship between CEO duality and policy independence is also

inconclusive. For example, Harris and Helfat (Harris

& Helfat, 1998) in a literature review, showed that out of 13

studies, three indicated negative effects, while ten exhibited either positive

or absence of effects. The results of

the estimation of regression (3) are presented in the Table 4.

The

Durbin–Wu–Hausman test confirms that the fixed effect (FE) estimator is the

most efficient; thus, the study focuses on the FE estimators to explain the

results. Moreover, p-values in F-test were lower than 1%, meaning that the null

hypothesis of all regression coefficients being equal to zero is rejected.

Table 4 The results of

estimation of regressions (1) and (2) for G factor in telecoms firms

|

Variable |

Pooled

OLS |

FE |

RE |

|

Independence

policy |

-0.078 (0.059) |

-0.008 (0.023) |

0.039 (0.065) |

|

Percentage

of independent directors in the board |

0 (0.002) |

0.001* (0.001) |

0.002* (0.001) |

|

CEO

Chairman Duality |

-0.053 (0.042) |

-0.045*** (0.017) |

-0.088* (0.046) |

|

Existence

of Corporate Social Responsibility (CSR) Board committee |

-0.119* (0.062) |

0.04* (0.021) |

0.053 (0.048) |

|

Women

in board |

0.011*** (0.002) |

0.007*** (0.001) |

-0.053 (0.048) |

|

Constant |

0.194 (0.589) |

0.174 (0.489) |

0.201 (0.514) |

|

Observations |

1 034 |

1 034 |

1 034 |

|

R-squared |

0.121 |

0.180 |

0.115 |

|

p-value (F-test

robust) |

0,0000 |

0,00031 |

0,000573 |

|

p-value Hausmann

test |

|

|

1,0 |

|

Breusch-Pagan LM

test. (F statistics p-value)* |

0,00000 |

|

|

***, **, * indicate the value

is significant at 1%, 5% and 10% level, standard errors are stated in

parenthesis

Source: author’s calculation

Therefore,

hypothesis H5 is partially confirmed as factors of corporate governance affect

the value of telecommunication companies. CEO duality has a significant (at a

1% level) and negative impact on a company’s value. This result suggests that

if these posts are separated, the investment attractiveness of the

telecommunication company increases. This result coincides with that of (Rhoades et al., 2001). Consequently, Tobin Q for

companies in which CSR committees exist is higher than for those organizations

without a committee. Thirdly, greater gender diversity increases the market's

assessment of the company's prospects reflected in Tobin Q. This result

coincides with (Smith et al.,

2006). Lastly, the percentage of independent directors has a significant (but

only at a 10% level) but the marginal effect on Tobin Q. This finding agrees

with that having a moderate number of independent directors can increase a

firm’s value. On the contrary, firms with “supermajority-independent boards can

be less profitable than their counterparts. Moreover, independent directors can

give little value to telecommunication companies because in this industry

director’s technical expertise can be more valuable than their outsider status.

We closed the research gaps and investigated

the impact of ESG disclosure on Tobin-Q of US-listed telecommunication service

companies between 2011-2021. We showed that the ESG disclosure score positively

affects the value of the company. Among individual ESG disclosure pillars, only

corporate governance positively affects Tobin-Q and is statistically

significant (at a 5% level). Environmental and social pillars are both

statistically insignificant in influencing Tobin Q of the telecoms. We also

identified individual corporate governance factors which influence the value of

telecoms. We found that CEO duality significantly and negatively impacts a

company’s value. On the contrary, the presence of corporate social

responsibility (CSR) committee, greater gender diversity on the Board and the

percentage of independent directors on the Board positively affect the value of

the telecoms. The study’s limitations are the following: (1) it does not

address the issue of the U-shaped link between the value of the firm and ESG

disclosures; (2) the limited number of years used in modelling. These

limitations will be addressed in further studies. Also, further research

directions include exploring the impact of ESG disclosures on both companies’

performance and value in various industries in emerging markets.

The research was partially funded by the Ministry of

Science and Higher Education of the Russian Federation under the strategic

academic leadership program ‘Priority 2030’ (agreement 075-15-2021-1333, dated

30 September 2021).

Adams,

R.B., Ferreira, D., 2009. Women In the Boardroom and Their Impact

on Governance and Performance. Journal of financial economics. Volume

94(2), pp. 291–309

Atan,

R., Alam, M., Said, J., Zamri, M., 2018.

The Impacts of Environmental, Social, and

Governance Factors on Firm Performance: Panel study of Malaysian companies. Management of

Environmental Quality an International Journal. Volume 29(2), pp. 182–194

Berawi,

M.A., 2020. Managing Nature 5.0: The role of Digital Technologies in the Circular Economy.

International Journal of Technology. Volume 11(4), pp. 652–655

Buallay, A., Marri, M., 2022.

Sustainability Disclosure and Its Impact on Telecommunication and Information

Technology Sectors' Performance: Worldwide Evidence. International Journal

of Emergency Services. Volume 11(3), pp. 379–395

Cai,

L., He, C., 2014. Corporate Environmental Responsibility

and Equity Prices. Journal of Business Ethics. Volume 125(4), pp.

617–635

Cho,

C., Patten, D., 2007.

The Role of Environmental Disclosure as Tools of Legitimacy: A Research Note. Accounting,

Organizations and Society. Volume 32(7-8), pp. 639–647

Derue

V., 2021.

Putting ESG To Work: A Case Study in the

Telecom Sector. AXA Investment Management White Paper. Available at

https://www.axa-im.co.uk/document/1453/view, Accessed on August

08, 2022

Dhaliwal,

D.S., Li, O.Z., Tsang, A., Yang, Y.G.,

2014. Corporate Social Responsibility Disclosure and the Cost of

Equity Capital: The Roles of

Stakeholder Orientation and Financial Transparency. Journal of

Accounting and Public Policy. Volume 33,

pp. 328–355

Ge,

W., Liu, M., 2015. Corporate Social Responsibility and the Cost of

Corporate Bonds. Journal of Accounting and Public Policy. Volume 34(6), pp.

597–624

Khorin,

A., Krikunov, A., 2021. ESG Risk Factors and Value Multiplier of Telecommuncaiton Companies. Journal of

Corporate Finance Research. Volume 15(4),

pp. 56–65

Mohammad,

WMW., Wasiuzzaman, S., 2021. Environmental, Social and Governance (ESG)

Disclosure, Competitive Advantage and Performance of Firms in Malaysia. Cleaner Environmental Systems. Volume 2, p. 100015

Fatemi,

A., Glaum, M., Kaiser, S., 2018. ESG Performance and Firm Value: The Moderating

Role of Disclosure. Global Finance Journal. Volume 38, pp. 45–64

Friede,

G., Busch, T., Bassen, A., 2015. ESG and Financial Performance: Aggregated

Evidence from

More Than 2000 Empirical Studies. Journal of Sustainable Finance &

Investment. Volume 5(4), pp. 210–233

Fisher-Vanden,

K., Thorburn, K., 2008. Voluntary Corporate Environmental

Initiatives and Shareholder Wealth. Journal of Environmental Economics and

Management. Volume 62(3), pp. 430–445

Harris,

D., Helfat, C.E., 1998. CEO Duality, Succession, Capabilities and

Agency Theory: Commentary and

Research Agenda. Strategic Management Journal. Volume 19(9), pp. 901–904

Horváthová,

E., 2010. Does Environmental Performance Affect

Financial Performance? A Meta-Analysis. Ecological Economics. Volume

70(1), pp. 52–59

Ivashkovskaya,

I., Mikhailova, A., 2020.

Do Investors Pay Yield Premiums on Green Bonds? Journal of Corporate Finance

Research. Volume 14(2), pp. 7–21

Koroleva,

E., Baggieri, M., Nalwanga, S., 2020.

Company Performance: Are Environmental, Social, and Governance Factors

Important? International Journal of Technology. Volume 11(8), pp. 1468–1477

Lei,

J., Qiu, J., Wan, C., 2018.

Asset Tangibility, Cash Holdings, and

Financial Development. Journal of Corporate Finance. Volume 50, pp. 223–242

Malik,

M.S., Makhdoom, D.D., 2016. Does Corporate Governance Beget Firm

Performance in Fortune Global 500 Companies? Corporate Governance

International Journal of Business in Society. Volume 16(4), pp. 747–764

Miroshnychenko,

I., Barontini, R., Testa, F., 2017.

Green Practices and Financial Performance: A Global Outlook. Journal of

Cleaner Production. Volume 147, pp. 340–351

Mohanty,

S., Moreira, A.C., 2014. Sustainability in Global

Telecommunication. IEEE Potentials. Volume 33(5), pp. 29–34

Nekhili,

M., Boukadhaba A.,

Nagati, H., Chtioui, T., 2021.

ESG Performance and Market Value: the

Moderating Role of Employee Board Representation. The International Journal

of Human Resource Management.

Volume 32(14), pp. 3061–3087

Nirino,

N., Santoro, G., Miglietta, N., Quaglia, R., 2021.

Corporate Controversies and Company's Financial Performance: Exploring the

Moderating Role of ESG Practices. Technological Forecasting

and Social Change, Volume 162, p. 120341

Plumlee,

M., Brown, D., Hayes, R.M., Marshall, R.S., 2015.

Voluntary Environmental Disclosure Quality and Firm Value: Further Evidence. Journal

of Accounting and Public Policy . Volume 34, pp. 336–361

Porter,

M., Serafeim, G., Kramer, M., 2019. Where ESG Fails. Institutional

Investor, 2019. Available at https://www.institutionalinvestor.com/article/b1hm5ghqtxj9s7/Where-ESG-Fails, Accessed on August

08, 2022

Ratnikova,

T., Furmanov, K., 2014. Analysis of Panel Data 2014. HSE Publishing House,

Moscow, p. 375

Rhoades,

D.L., Rechner, P.L. Sundaramurthy, C., 2001. A Meta-Analysis of Board Leadership Structure and Financial Performance: Are “Two Heads Better

Than One”? Corporate Governance: An International Review . Volume 9(4),

pp. 311–319

Rodionov,

D., Konnikov, E., Konnikova, O., 2018. Approaches to Ensuring the Sustainability

of Industrial Enterprises of Different Technological Levels. The

Journal of Social Sciences Research. Volume 3, pp. 277–282

Rittenhouse,

G., Goyal, S., Neilson, D.T., Samuel, S., 2011. Sustainable Telecommunications.

In: 2011 Technical Symposium at ITU Telecom World. International Telecommunication

Union, Geneva, pp. 19–23

Santoso,

H., Abdinagoro, S.B., Arief, M., 2019.

The Role of Digital Literacy in Supporting Performance Through Innovative Work

Behavior: The Case of Indonesia’s Telecommunications Industry . International

Journal of Technology. Volume 10(8), pp. 1558–1566

Servaes, H., Tamayo, A., 2012.

The Impact of Corporate Social Responsibility on Firm Value. The Role opf

Cutomer Awareness. Management Science. Volume 59(5), pp. 1045–1061

Smith,

N., Smith, V., Verner, M., 2006. Do Women in Top Management Affect Firm

Performance? A Panel Study Of 2,500 Danish Firms. International Journal of Productivity

and Performance Management. Volume 55(7), pp. 569–593 Journal

of Sustainable Finance & Investment. Volume 6

Schramade.

W., 2016. Integrating ESG Into Valuation Models and

Investment Decisions: The Value-Driver Adjustment Approach. Journal of Sustainable Finance & Investment. Volume 6, http://dx.doi.org/10.2139/ssrn.2749626

Sutherland,

E., 2016. Corporate Social Responsibility: The Case

of the Telecommunications Sector. Info.

Volume 18(5), pp. 24–44

Trumpp, ?., Günther, T., 2017. Too Little or Too Much? Exploring U-Shaped Relationships

Between Corporate Environmental Performance and Corporate Financial Performance.

Business Strategy and the Environment . Volume 26, pp. 49–68

Velte,

P., 2017. Does ESG Performance Have an Impact on Financial Performance? Evidence from Germany. Journal of Global

Responsibility. Volume 80(2), pp. 169–178

Verbeeten,

F.H., Gamerschlag, R., Moller, K., 2016.

Are CSR Disclosures Relevant for Investors? Empirical Evidence from Germany. Management

Decision. Volume 54(6), pp. 1359–1382

Siagian,

F., Siregar, S., Rahadian, Y., 2013.

Corporate Governance, Reporting Quality, and

Firm Value: Evidence from Indonesia. Journal of Accounting in Emerging

Economies. Volume 3(1), pp. 4–20