Integration of Structural and Evolutionary Approaches to Assessment of Structural Changes in Industrial Sector Russian Economy

Published at : 27 Dec 2022

Volume : IJtech

Vol 13, No 7 (2022)

DOI : https://doi.org/10.14716/ijtech.v13i7.6191

Shevchenko, I., Razvadovskaya, Y., 2022. Integration of Structural and Evolutionary Approaches to Assessment of Structural Changes in Industrial Sector Russian Economy. International Journal of Technology. Volume 13(7), pp. 1578-1587

| Inna Shevchenko | Southern Federal University, 105/42 Bolshaya Sadovaya Str.Rostov,-on-Don, 344006, Russia |

| Yuliya Razvadovskaya | Southern Federal University, 105/42 Bolshaya Sadovaya Str.Rostov,-on-Don, 344006, Russia |

Industrial

economic changes in the economy are a complex and multi-level dynamic process

characterized in different periods by a certain balance between modernization

and innovative development. This involves the redistribution of key industrial

resources in various industries and sectors of the economy in certain

proportions. This study attempts to assess industrial changes in the Russian

economy from the standpoint of structural and evolutionary approaches using

empirical data from 1889 to 2018. These data characterize not only the

quantitative parameters of the structural dynamics but also the qualitative,

evolutionary characteristics of the economic system. Unlike previous studies,

this article focuses on the following features. Firstly, a scientific

justification is made for integrating of structural and evolutionary

approaches, which together make it possible to assess the causal relationships of

processes leading to economic transformations, including industrial changes.

Secondly, within the framework of the study, the authors formulate a hypothesis

about the relative invariance of structural changes. The empirical analysis of

data on the distribution of resources of the Russian industry in the

ultra-long-term period, the results of modeling structural changes at the macro

level, based on the integration of structural and evolutionary approaches, as

well as the application of the provisions of the resource concept, allow the

authors to formulate several statements. Contrary to the estimated judgments

that structural shift is irreversible, this article confirms that in certain

time periods, individual elements of the system to the parameters of the system

characteristic of the period before the start of structural changes. The

authors conclude that one of the key factors of the inertia of structural

changes is the evolutionary parameters of the system.

Evolutionary changes; Industrial changes; Relative invariance; Shift; Structural dynamics

The industrial landscape is being defined by the fourth wave of progress, the basic concept of which is based on the growing convergence of various new technological areas - digital manufacturing, nanotechnology, biotechnology, and the development of new materials - and their complementarity in production (UNIDO, 2019). In this case, we are talking about advanced production, which refers to "smart" factories and, in general, "smart" industry. The new industry format involves the use of the industrial Internet of Things, technologies for analyzing large amounts of data, advanced robotics, the artificial intelligence of cloud computing, and additive production. At the same time, new technologies arise based on traditional industrial production, which is the basis for the modernization and technological development of the economy. On the one hand, the success of new technologies depends on the current economic conditions, the level of technological development, and the institutional characteristics of the industry. On the other hand, the implemented industrial policy is one of the most important conditions for the transformation of industry and the transition to a new type of technological development of the economy. In modern studies, two fundamental approaches to analyzing economic transformation processes and industrial changes can be distinguished, the difference of which lies in the assessing economic systems and factors that determine the quantitative and qualitative changes in its elements over time. Structural and evolutionary approaches to assessing the dynamics of economic processes arose almost simultaneously in the early 1980s in the studies of L. Pasinetti and R. Nelson (Garbellini & Wirkierman, 2010; Nelson & Winter, 2002) in connection with the need for scientific justification of the uneven and disproportionate dynamics of economic changes. Common within the framework of these approaches is going beyond the issues of the equilibrium state of the economic system. However, these approaches are distinguished by the view of the economic system as an "adaptive, developing system, with continuously emerging new elements (Scazzieri, 2018)" in the framework of the evolutionary approach and "a structurally invariant system, the elements of which arise as a result of structural changes that determine evolutionary dynamics (Scazzieri, 2018)" from the point of view of the structural approach. Under the evolutionary approach, newly emerging structures are seen as continuously evolving, and their complementarity arises from historical or evolutionary linkages. From this point of view, the economy is characterized by a high degree of interdependence of its elements, with developed mechanisms of positive feedback (Tatiana & Mikhail, 2020). The key thesis of the evolutionary approach is the assumption that the previous development of the system determines economic dynamics, and the historical conditions for the development of any economic system affect the promising type of evolutionary dynamics. Within the framework of the structural approach, the key point is that the emergence of new elements of the economic system is due to the asymmetry between the existing elements of the system, as well as the direction of structural transformation, within which certain macroeconomic and sectoral proportions should be formed. Despite the obvious differences between the presented approaches, as well as the available assessments regarding the alternativeness of their application for the study of economic dynamics, this article attempts to assess the industrial transformation of the Russian economy by integrating the provisions of the evolutionary and structural approaches and substantiating their complementary nature.

The purpose of this article is to assess the structural dynamics of

industrial changes in the Russian economy in the long term, including through

the integration of structural and evolutionary approaches. A comparison of

structural and evolutionary approaches is presented in Table 1.

The

structural approach involves stages of transformation of the economic system or

directions of evolutionary change, which depend on parameters such as

technological progress or the level of capital accumulation. The rules of

transformation of the industrial system are determined not only by sectoral,

structural proportions but also by such characteristics as the level of

technology and innovation, the maximum possible level of capital accumulation,

its concentration, proportions in the distribution of resources such as labor

and capital. Nevertheless, within the framework of the structural approach, the

process of structural transformation is decisive, which depends to a certain

extent on the evolutionary characteristics of the economy, in contrast to the

evolutionary approach, which assumes that the process of development is

predetermined by the historical characteristics of the economic system, which

contribute to the structural transformation or make it impossible. Despite these

differences in evolutionary and structural approaches, the application of the

historical context of the development of the economic system, which is used in

various aspects, is common to them. In this regard, this study attempts to

assess industrial changes in the Russian economy from the standpoint of

structural and evolutionary approaches using an array of data for the period

from 1889 to 2018, characterizing not only the quantitative parameters of

structural dynamics but also the qualitative, evolutionary characteristics of

the economic system. At the same time, the integration of the approaches used

is ensured, among other things, by applying a structural approach to the

analysis of evolutionary parameters of economic dynamics in the ultra-long-term

period. Unlike previous studies, this article focuses on the following

features. First, there is a scientific justification for integrating structural

and evolutionary approaches, which together allow for the

causal relationships of processes leading to economic changes. Secondly, within

the framework of the approaches used, a justification is made for the limited

invariance of structural changes.

Table 1 Typology of structural and

evolutionary approaches

|

Parameters |

Structural approach |

evolutionary approach |

|

The

economic system is considered as |

structurally

invariant system, the elements of which arise as a result of structural

changes that determine evolutionary dynamics |

adaptive,

evolving system, with continuously emerging new elements |

|

The

role of technological progress and innovation in the process of structural

change |

determining |

is secondary to the

evolutionary parameters of the system |

|

Dynamics

Modeling Methods |

production

function, model of structural shifts, balance methods |

evolutionary

models, including the Lotka-Volterra model |

|

Economic

dynamics depends on |

parameters of asymmetry

between elements of the current system |

prior development |

|

The

main task within the framework of the approach |

substantiation

of the disproportionate dynamics of economic changes |

|

|

The

degree of interconnection between the elements of the system |

Average |

High |

|

Structural

invariance |

Unlimited |

limited

by prior development (relative) |

2.1. Research method

and data

To model the dynamics of

structural changes in the Russian economy, which determine the trends of

industrial transformations, calculations will be made in the article. The

calculations will make it possible to obtain absolute and relative indicators

of structural dynamics in the extractive and manufacturing sectors of the

Russian industry. For this purpose, it is expedient to calculate the mass of

the structural shift, the index of the structural shift, and the rate of the

structural shift. The mass of a structural shift is defined as the difference

between the shares of a structural indicator in the current and base periods.

The main difference between this indicator and simple statistical indicators is

that “the content of the concept of the mass of a structural shift is a certain

set of economic entities with given economic interests and needs, the form is a

change in quantitative indicators in physical and value terms over a certain

period of time» (Krasil’nikov, 2000).

The calculation of the structural shift mass index is carried out according

to the formula:

(1)

? – the mass of structural shift in the

industry,

? – the value of the indicator in the current

period,

?_0 – the value of the indicator in the base

period.

The calculation of this indicator

provides an assessment of the absolute indicators of structural changes in the

sectors of the industrial sector of the economy. The assessment of the relative

indicators of structural changes is provided by the calculation of the index of

structural shifts, which is the ratio of the mass of the structural shift to

the base value of the indicator for a certain period of time.

(2)

I – structural shift index expressed in relative

terms,

The structural shift index

provides comparability of structural changes in the industry and provides

identification of those periods in which shifts were more intense, determines

time lags, identify the correlation between different indicators. Also, with

the help of indices, it is possible to compare various indicators, in our case,

indicators that characterize capital and labor resources in structural changes.

To assess the intensity of

structural changes, the rate indicator is used, which reflects the change in

the structural indicator per unit of time. The structural shift index is

calculated as the ratio of the mass or structural shift index to a certain

period. Using this indicator, it is possible to determine the asynchrony of

shifts, compare various structural shifts, including between industries, and

identiy structural shifts’ inertia. The calculation is made according to the

formula:

(3)

V – speed of structural shift,

? – structural shift time.

Within this study’s framework, the structural

shift rate is determined by the ratio of the structural shift index to the

shift period, which in most cases is five years.

It is assumed that at different

stages of the technological development of the economy, the intensity and speed

of structural changes will be uneven both within a particular industry and in

an intersectoral aspect. Since the evolutionary parameters of the economy

influence these indicators. At the same time, the unevenness of structural

changes both in time and intersectoral aspects will be determined by the

limited invariance of structural changes. It is also necessary to separately

highlight such a parameter as inertia, the strength of which can vary

significantly both in different economies and in industries, even though, in

general, inertia is an ntrinsic property of socio-economic systems of any

level. In this regard, the study of the evolutionary dynamics of industrial

changes through the assessment of indicators of structural changes will make it

possible to identify the parameters of the inertia of the economic system, as

well as to identify the factors that determine the trends of inertia.

2.2. Theoretical fundamentals

The

Oxford Structural Transformation Guide treats such categories as

"structural transformation" and "structural change" as

synonyms. Structural transformation, or structural change, involves the

movement of productive resources (natural resources, land, capital, labor

resources, inventions) from low-productivity to high-productivity economic

activities (Monga & Lin, 2019). Note that structural

transformation, or structural changes, is the process by which you change the

shape or type of the structure. Under this approach, a steady process of

structural change can provide permanent static and dynamic effects to the

economy.

We consider it appropriate to

consider the structural shift as a reversible phenomenon. Historical analysis

of trends in industrial change suggests that such processes and anti-shift are

possible that lead the system to its original state, which in parameters

corresponds to the state characteristic before structural changes occur. So,

for example, deindustrialization caused by a series of negative industrial

shifts in fact, leads the system to its original state, including in terms of

industrial output, employment in certain industries, and many others (Varlamova & Larionova, 2020).

On the one hand, industrial shifts in the export-import structure are determined by the internal characteristics of the distribution of resources, the model of industrial changes, and on the other, are influenced by structural shifts occurring in the world economy. Industrial changes in the technological structure are also determined by the internal potential of the technological development of industries, the technological structure of production, and the dynamics of scientific and technological progress at the global level (Surjandari et al., 2022). Studying such shifts becomes an even more urgent task in the context of industrial changes provided by protectionist measures to support domestic industry (Ha-Joon, 2012; Shafaeddin & Pizarro, 2007; Williamson, 2004).

Based on the assumption that the structural shift is aimed at changing the proportions in a certain structure, the emerging contradiction within the industrial shift is represented by two processes: the process of expansion from the point of view of the shift and the process of contraction from the point of view of the anti-shift. As part of the industrial transformation of the economy, the shift will be represented, for example, by an increase in the share of enterprises and types of economic activity in high-tech production, an increase in the share of the active part of the capital, and the share of highly skilled labor. The anti-shift is determined by the reduction in the share of low-tech industries, the share of the passive part of fixed capital, and, accordingly, the share of low-tech labor.

Thus, analysis of structural change phenomena such as structural shift, anti-shift, structural crisis allows us to conclude that structural shift is a reversible phenomenon. That is, it is possible to change the proportions of the structure to the state of the previous structural shift. Such a phenomenon as anti-shift involves the movement of elements of the structure or the entire structure in the direction opposite to a given vector of structural changes. An important conclusion is the invariance of structural changes, including the presence of a certain set of options for structural changes in specific historical conditions. Nevertheless, it should be noted that in a particular historical period, the set of options for structural changes is limited, allowing us to assume the limited invariance of structural changes.

3.1. Results

The data show that there are divergent trends as well as individual periods with the highest structural shifts. It should be noted that for all the indicators under consideration, there is a significant structural shift between 1990 and 1997, which is associated with the transformational processes of the domestic economy, a deep decline in industrial production, and inflationary processes. The latter determines the high values of mass, index, and rate of structural shift over a given period. Therefore, it is considered inappropriate to use them to analyze structural changes in the system of industrial development of the economy (Table 2).

Table 2 Mass, index and rate of structural shift by

indicators of turnover, fixed capital and profit of industrial enterprises of

Russia for the period from 1885 to 2018 (million rubles)

|

Period |

Mass of

structural shift |

Structural Shift Index |

Speed

of structural shift |

||||||

|

T |

FC |

P |

T |

FC |

P |

T |

FC |

P |

|

|

1889-1885 |

478 |

216 |

45 |

0.35 |

0.36 |

0.38 |

0.07 |

0.07 |

0.08 |

|

1894-1890 |

480 |

244 |

63 |

0.26 |

0.29 |

0.37 |

0.05 |

0.06 |

0.07 |

|

1899-1895 |

1 392 |

803 |

102 |

0.54 |

0.67 |

0.39 |

0.11 |

0.13 |

0.08 |

|

1904-1900 |

404 |

321 |

-18 |

0.09 |

0.15 |

-0.05 |

0.02 |

0.03 |

-0.01 |

|

1909-1905 |

780 |

471 |

69 |

0.17 |

0.19 |

0.20 |

0.03 |

0.04 |

0.04 |

|

1928-1910 |

12 488 |

7 060 |

202 |

2.27 |

2.40 |

0.45 |

0.13 |

0.13 |

0.11 |

|

1934-1929 |

19 636 |

17 530 |

- |

0.70 |

1.54 |

- |

0.14 |

0.31 |

- |

|

1985-1960 |

300 000 |

388 000 |

29 200 |

1.50 |

4.85 |

0.82 |

0.10 |

0.19 |

0.05 |

|

1997-1990 |

1625400000 |

2957555 |

90174700 |

2709 |

4.90 |

1137.13 |

387.00 |

0.70 |

162.45 |

|

2002-1998 |

5161000 |

1894252 |

452514 |

3.02 |

0.48 |

-51.59 |

0.60 |

0.10 |

-10.32 |

|

2007-2003 |

12114360 |

7605083 |

2304037 |

1.43 |

1.16 |

3.75 |

0.29 |

0.23 |

0.75 |

|

2012-2008 |

13512488 |

14573657 |

1635095 |

0.55 |

0.84 |

0.69 |

0.11 |

0.17 |

0.14 |

|

2018-2013 |

27299980 |

28670306 |

5768797 |

0.67 |

0.79 |

1.85 |

0.13 |

0.16 |

0.37 |

T – turnover of

industrial enterprises, FC – fixed capital of industrial enterprises, P- profit

of industrial enterprises.

The dynamics of the

structural shift mass show positive trends in the analyzed parameters for the

entire period, with the highest growth rate from 1960 to 2018 (Figure 1). The

highest rates of structural changes in the value of fixed capital are typical for

the period from 1998 to 2018. It should be noted that if the mass of structural

shift indicator shows multiple indicators increases, then the structural shift

index indicates the presence of multidirectional trends in the analyzed

indicators. Maximum values of the structural shift index in terms of turnover

of industrial enterprises are observed in 1928-1910, 2002-1998, 2007-2003.

To

assess the strength of structural changes, and the presence of inertia

tendencies in the dynamics of structural shifts, the rate of structural shift

is estimated, which is presented by calculations in Table 3. On the one hand,

the inertia of a structural shift is rather difficult to assess since. for a

qualitative assessment, the calculations must be supplemented by analysis and

comparison with the institutional characteristics of the economy taken by

political decisions. On the other hand, assessing the relative rate of

structural shift allows for determining the intensity of structural changes,

which is relatively low in terms of such indicators as the cost of fixed

capital and the turnover of industrial enterprises. The analysis of the rate of

a structural shift, firstly, allows us to conclude that the dynamics of

structural changes are characterized by inertia in all the analyzed indicators.

Secondly, the speed of structural change confirms the existence of a structural

crisis in the transformational period of the economy.

Modeling

of structural shifts in terms of mass, index, and speed in terms of the

distribution of the value of fixed capital between the active and passive parts

of fixed capital is carried out for the period from 2003 to 2018, which is

associated with limited statistical data. There are significant changes in the

distribution of active and passive parts of fixed capital. If for the period

from 2003 to 2007 the cost of groups is almost equivalent, then in the period

from 2008 to 2018 there is a significant (almost 2 times) excess of the cost of

machines and equipment over the cost of buildings and structures. In relative

indicators, namely, the structural shift index, the difference is not so

significant, while the most intense changes in the passive part of the capital

are characteristic of the period from 2003 to 2007, for the active part of the

capital - from 2013 to 2018. Similar dynamics are observed to the rate of

structural shift. At the same time, it should be noted that the rate of

structural shift according to the indicator in question is high. In general,

this can be seen as a positive trend since the growth of labor investment,

which is characterized, among other things, by an increase in the cost of

machinery and equipment, is decisive within the framework of the trends of new

industrialization.

The

changes in mass, index, and rate of structural shifts in the years of the first

three five-year plans from 1928 to 1938, as well as in the period from 2003 to

2018, show slight changes in investment in industry and investment in fixed

assets. The rate of a structural shift in the second period decreases relative

to the period from 1928 to 1933. Nevertheless, the structural shift index for

the period from 1928 to 1938 is higher than in the period from 2008 to 2018.

Similar

dynamics can be traced to the rate of structural shift. If in the first period,

according to the indicator of investment in industry, the rate of structural

shift is 0.27 and 0.21, then in the period from 2008 to 2018, 0.08. The

exceptions are the index, and the rate of structural shift between 2003 and

2007, and are 1.77 and 0.35, respectively

The

distribution of the structural shift in terms of the employed in industry by

manufacturing and mining industries indicates that both in terms of the mass of

the structural shift, and in terms of the index and rate of the structural

shift, the highest values are observed in the manufacturing industry. The

structural shift index for the period from 1900 to 1908 for the manufacturing

industry was 0.26 in relation to 0.17 for the mining industry, and 0.28 to 0.09

for the period from 1908 to 1913. At the same time, the difference in the rate

of structural shift between the manufacturing and mining industries is smaller:

0.03 and 0.02 for the period from 1900 to 1908, 0.06 and 0.02 for the period

from 1908 to 1913.

The

structural shift in the number of employees in the industry from 1992 to 2018

is negative. The maximum value of the structural shift index is observed from

1999 to 2014 and is -85.61; for comparison, this indicator in 2013-2018

amounted to -0.07. The rate of the structural shift in this period, except

1999-2004, is not high, and is in the range of values from -0.01 to -0.07.

However, it should be noted that over the entire period, the rate of structural

shift has a negative orientation.

The

index and the speed of structural shift in the average monthly accrued wages

are characterized by a positive direction and have higher values. But the

indicator of the number of people employed in the industrial sector of the

economy is not. From 2003 to 2007, the structural shift index is 1.10, which is

significantly higher than the negative indices in terms of the number of

employees. It is necessary to take into account the fact that this indicator is

calculated without taking into account the rate of inflation, so the data

obtained can be overestimated.

The analysis of data on structural shifts in the use of key resources in the industrial sector of the economy provides several conclusions. Firstly, at the present stage of economic development, the most significant structural changes of a positive orientation are observed from 2003 to 2007 in almost all analyzed indicators characterizing the use of resources in the industrial sector of the economy. Secondly, the highest positive values of structural changes are characteristic of such an indicator as wages, against the background of high negative shifts in the indicator employed in the industrial sector of the economy.

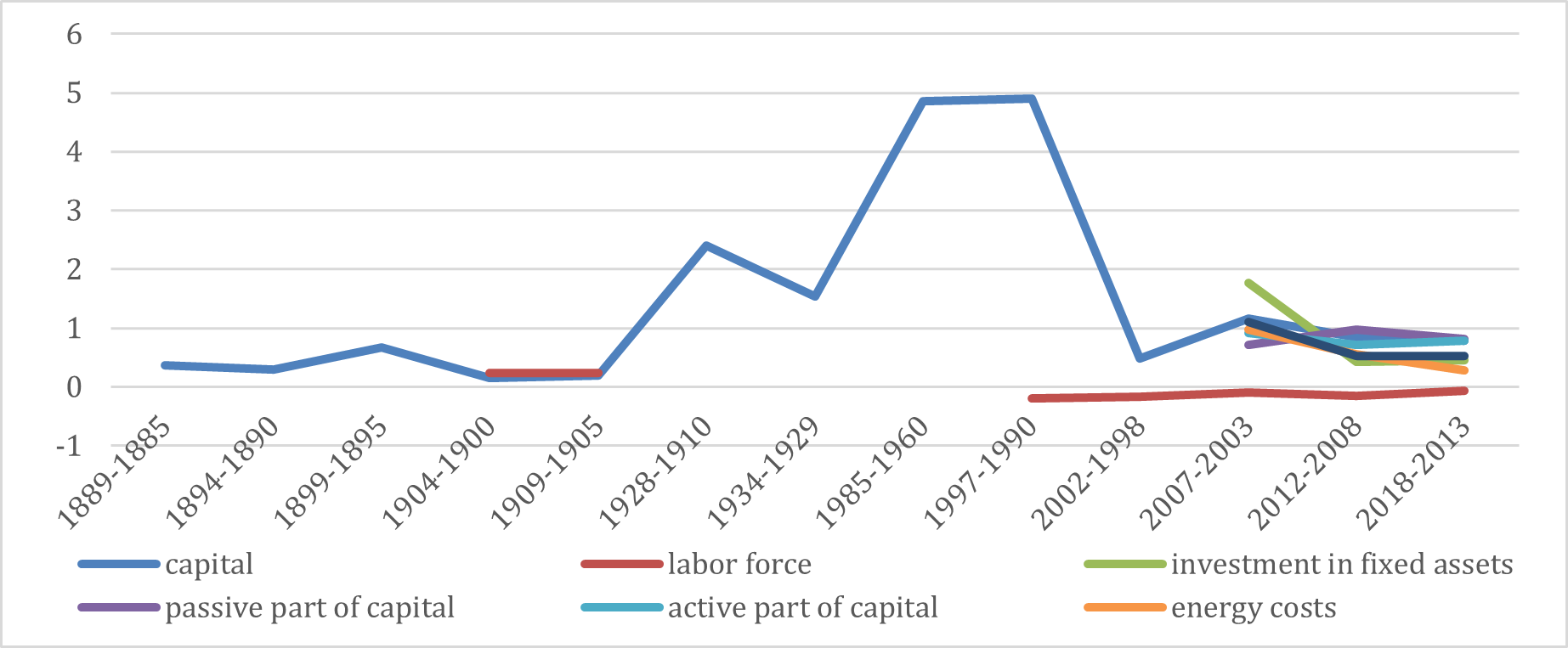

Figure 1 Structural shift index for the period from 1885 to

2018 (labore force - 1913-1900 and 1913-1908, 1995-1992, 1999-1995, 2004-1999,

investment in fixed assets - 1933-1937 / 1932-1928)

As a positive trend, we can consider the growth of

the structural shift index in terms of the active part of capital against the

background of the decline in the index in the passive part of capital. The

downward trend is the decline in the fixed capital value index (Figure 2). It

can be assumed that a significant structural shift in this indicator from 1905

to 2002 can compensate for the decline in the structural shift index in the

subsequent period. However, data on the level of depreciation of fixed assets

indicate the need for an increase in fixed investment and, accordingly, a

positive increase in the index and the rate of structural shift.

The highest rate of structural change is observed

for the period 1985-2002 in terms of the value of fixed capital, as well as for

investments in fixed capital in 2003-2007. The analyzed data indicate a

decrease in the rate of a structural shift in the analyzed indicators from 2003

to 2018, which can generally indicate slowing dynamics of structural changes in

sectors of the industrial sector of the economy. According to figure 2, the

index of structural shift in terms of fixed capital value repeats the dynamics

of the curve describing the stages of industrial development: the phase of

primary industrialization, the phase of industrialization and

deindustrialization of the Russian economy and structural changes aimed at

increasing the industrial potential of industrial sectors.

3.2. Discussion

The main conclusion that

made it possible to obtain the approach used in this article is that in the

Russian economy, one of the key characteristics of industrial changes is

inertia, which manifests itself in a low rate of structural changes according

to the main criteria of the industry. At the same time, one of the main reasons

for such dynamics is the evolutionary component of the development of the

domestic economy. Although the rate of structural changes increases, such

dynamics is more likely to be associated with the influence of general

macroeconomic trends, as well as restrictions in the process of changing the

qualitative characteristics of resources in the short term. The data obtained

also confirm the formulated hypothesis that the structural shift is a reversible

phenomenon. Modeling structural changes over a long time in terms of indicators

characterizing both quantitative and qualitative characteristics of the

resources of the Russian industry indicates that in certain periods there is a

return of individual elements of the system to the system parameters

characteristic of the period before the start of structural changes. The use of

indicators that characterize the qualitative characteristics of the resources

of Russian industry, such as the structure of fixed capital, and wages, makes

it possible to more comprehensively assess the dynamics of structural changes,

as well as to substantiate the relativity of the invariance of structural

changes. The integration of structural and evolutionary approaches in the

framework of studies of structural changes in the Russian economy has made it

possible to obtain results that differ from previous studies. Unlike previous

studies, including Hyytinen and Maliranta, Mondelaers, in this article, results

are obtained that describe qualitative changes in the economy, including

changes in the technological and resource components.

This study substantiates that the integration

of structural and evolutionary approaches to assessing industrial changes makes

it possible to determine both the range of changes and the options for changes.

The structural approach makes it possible to determine the range of structural

changes depending on the policy in specific historical conditions. The

evolutionary approach, in turn, provides an understanding of the set of options

for changes depending on the structural characteristics of the system, as well

as the parameters of the institutional environment. The article obtained

significant theoretical results, confirmed by empirical analysis. But

additional studies of the features of structural dynamics are needed. One of

the main areas of further research may be the assessment of structural changes

at the level of individual industries, as well as enterprises of the industrial

sector of the economy, according to indicators characterizing the change in

economic and technological parameters of production under the influence of

macro shifts. At the same time, an important component of such a study, in our

opinion, is taking into account the institution of ownership in the

distribution of resources of Russian industry, as well as an empirical

assessment of the evolutionary conditions for the functioning of domestic

companies.

Garbellini, N., Wirkierman, A.L., 2010. Pasinetti’s Structural Change and Economic Growth: a conceptual excursus. Munich Personal RePEc Archive

Ha-Joon, C., 2012. Kicking Away the Ladder: Neoliberalism and the ‘Real’ History of Capitalism. In: Developmental Politics in Transition: The Neoliberal Era and Beyond, Kyung-Sup, C., Fine, B., Weiss, L., (ed.). Palgrave Macmillan, Hampshire, United Kingdom, pp. 43–50

Krasil’nikov, O.J., 2000. Structural Shifts in the Economy of Modern Russia. Saratov: Publishing House Scientific Book

Monga, C., Lin, J.Y., 2019. The Oxford Handbook of Structural Transformation. UK: Oxford University Press

Nelson, R.R., Winter, S.G., 2002. Evolutionary Theorizing in Economics. The Journal of Economic Perspectives, Volume 16, pp. 23-46.

Scazzieri, R. 2018. Structural dynamics and evolutionary change. Structural Change and Economic Dynamics, Volume 46, pp. 52-58.

Shafaeddin, M., Pizarro, J., 2007. From Export Promotion to Import Substitution; Comparative Experience of China and Mexico. Munich Personal Repec Archives. Paper 6650. Germany: University Library of Munich.

Surjandari, I., Zagloel, T.Y.M., Harwahyu, R., Asvial, M., Suryanegara, M., Kusrini, E., Kartohardjono, S., Sahlan, M., Putra, N., Budiyanto, M.A., 2022. Accelerating Innovation in The Industrial Revolution 4.0 Era for a Sustainable Future. International Journal of Technology, Volume 13(5), pp. 944–948

Tatiana, B., Mikhail, K., 2020. Problems of Competitive Strategy Choice According to Industry and Regional Factors. International Journal of Technology, Volume 11(8), pp. 1478–1488

United Nations Industrial Development Organization (UNIDO), 2019. Industrial Development Report 2020. Industrialization in the Digital Age. Overview. Vein.

Varlamova, J., Larionova, N. 2020. Labor Productivity in the Digital Era: A Spatial-Temporal Analysis. International Journal of Technology, Volume 11(6), pp. 1191-1200

Williamson, J., 2004. A Short History of the Washington Consensus. In: Fundación CIDOB for a Conference from the Washington Consensus Towards a New Global Governance, Barcelona, (September 2004)