Utilizing Building Information Modelling in the Tax Assessment Process of Apartment Buildings

Corresponding email: maberawi@eng.ui.ac.id

Published at : 27 Dec 2022

Volume : IJtech

Vol 13, No 7 (2022)

DOI : https://doi.org/10.14716/ijtech.v13i7.6188

Berawi, M.A., Sari, M., Salsabila, A.A., Susantono, B., Woodhead, R., 2022. Utilizing Building Information Modelling in the Tax Assessment Process of Apartment Buildings. International Journal of Technology. Volume 13(7), pp. 1515-1526

| Mohammed Ali Berawi | 1. Department of Civil Engineering, Faculty of Engineering, Universitas Indonesia, Depok, 16424, Indonesia 2. Center for Sustainable Infrastructure Development (CSID), Universitas Indonesia, Depok, 1 |

| Mustika Sari | Center for Sustainable Infrastructure Development (CSID), Universitas Indonesia, Depok, 16424, Indonesia |

| Adinda Alya Salsabila | Center for Sustainable Infrastructure Development (CSID), Universitas Indonesia, Depok, 16424, Indonesia |

| Bambang Susantono | Center for Sustainable Infrastructure Development (CSID), Universitas Indonesia, Depok, 16424, Indonesia |

| Roy Woodhead | Sheffield Business School, Sheffield Hallam University, Sheffield, S1 1WB, United Kingdom |

The increasing demand for

vertical residential development, particularly in urban areas, contributes to

regional income growth through the collection of building taxes. In Indonesia,

the vertical building is one of the non-standard objects applying an individual

tax building assessment based on the building component cost list (BCCL) table

in determining the value of the payable tax. However, the existing assessment

system still cannot show the actual value of the building due to its

limitations. Consequently, the building tax assessment process is ineffective

and inefficient regarding assessment time and value accuracy. This study investigates the utilization of

Building Information Modelling (BIM) in the assessment process of building

taxation, considering a high-rise apartment building in Indonesia as the case

study. The findings show that compared to the existing system, the final

building value used as the basis in the tax assessment can be generated more

accurately, involving a detailed calculation of dimensions and variations of

building materials. It can be concluded that BIM’s capability to recognize

building objects, extract quantity, and calculate automatically can help

improve the objectivity of the assessment results and time efficiency in the

tax assessment process.

Apartment; Building Information Modeling; Tax assessment

The high

rate of urbanization has increased the demand for housing in urban areas.

However, this growth faces some challenges regarding physical infrastructure

development, one of which is limited land availability (Qin

& Wang, 2019; Habibi & Asadi, 2011). Some major cities in

developing countries develop residential buildings in a vertical direction as

one of the strategies to meet the housing needs of city inhabitants (Lau, 2011; Wong,

2004). In addition to solving the housing demand problem, these developments

also bring a stream of income for regional governments through the tax on

buildings (Berawi et al., 2021; Cho & Choi, 2014).

Based on the Law of the Republic of Indonesia Number 28 of 2009 concerning Regional Taxes and Levies, a vertical housing unit is indicated as a tax object, the tax imposition of which is determined through an individual assessment scheme. This building tax assessment is based on the building component cost list (BCCL), carried out by involving several documents, such as Tax Object Notification Letters, Tax Object Notification Letters’ Attachments, and Tax Object Worksheets. This assessment process needs to be conducted at least every three years to renew the selling value of the building (Asher, 2002). However, assessments are only done for new tax objects due to limited resources (Anwar, 2019).

Implementing the individual

building tax assessment reports used by the appraisers from relevant agencies

in the BCCL method is expected to enable the assessment results to be followed

by performing the steps of the appraisal process. However, this assessment

method has not fully answered the needs of appraisers or surveyors in following

and reconstructing the assessment process because, in reality, the delivery of

assessment results is still limited to verbal descriptions, writing, and images

(Hendriatiningsih et al.,

2019; Haldenwang et al., 2015). Furthermore, assessment using 2D

images lacks accurate projection for the 3D physics of a building (Rajabifard et al., 2018;

Shojaei et al., 2013).

3D visualization has been widely

known to have the ability to show better accuracy in understanding and interpreting

data, as well as displaying a more solid form, improving the delivery of

information from existing physical buildings (Seipel et al., 2020; Hassan

et al., 2008). Previous studies have supported

this statement; Atazadeh et al. (2016) demonstrate how 3D digital data

associated with various complex ownership spaces can be visualized and managed

by developing a prototype Building Information Modelling (BIM) model for a

multi-story building. Moreover, Atazadeh et al. (2021) also proposed a prototype BIM

model showcasing that land administration and its registry information can be

mapped into a 3D BIM environment.

Correspondingly, the building information’s

completeness and disclosure from the 3D visualization can be utilized to

improve the accuracy of the individual building tax assessment reports (Isikdag et al., 2014). On top

of that, an assessment system with a high-speed updating process is required to

support the accuracy of tax revenue assessment. Therefore, this study attempts

to investigate the solution to the need for a relatively faster and more

accurate updating process of building tax assessments by utilization of BIM

technology. The fifth dimension of BIM was employed, which has the capability

of design planning, cost estimation, and scheduling of a construction project (Kisel, 2021).

Previous studies have also

explored the use of BIM-based 3D visualization in various areas of building

cost estimation. El Yamani et al. (2019) demonstrated the potential of BIM

as an emerging technology to improve the housing valuation system based on the

hedonic approach, arguing that 2D applications are limited in communicating the

complexity of a 3D building structure. Furthermore, Sladi?

et al. (2020) proposed a more efficient process

model for building a public registry in Serbia incorporating BIM-based 3D

information. On the city scale, Arcuri et al. (2020) developed an automated calculation of the depreciated

reconstruction cost (DRC) by integrating geographic information systems (GIS)

technology and BIM 5D. However, minimal studies have been found to have

compared the calculation of building valuation between the manual and BIM-based

assessment methods. This study is expected to contribute to building valuation

and tax assessment literature.

This study was

conducted in two steps to obtain its research objective, adopting both

qualitative and quantitative approaches. In the first step, the qualitative

method was carried out through a literature study and in-depth interviews with

experts to identify the variables from individual building tax assessments that

can be integrated into BIM. Accordingly, the second step used the quantitative

approach to utilize the BIM application as an alternative for apartment

building tax assessments. The variables identified in the first step were used

to perform cost calculations and BIM model prototyping, applied to the case

study, an apartment building in Jakarta, Indonesia, called the MS apartment.

The information from the BIM

model is used as the basis for the building value calculation, conducted in

several steps as implemented in Hendriatiningsih et al. (2019):

1) Determining the construction work type based on data from the construction work unit, completed with material composition and coefficients.

2) Specifying the cost of work types based on the volume calculated from the BIM model

3) Selecting the building facilities’ procurement cost from the information in BIM.

4) Calculating the building’s Replacement Cost New

(RCN), an estimate of the construction cost based on current labor and material

prices for new construction of the same usability, size, and design. The construction work

units issued by the Indonesian Ministry of Public Works were used to determine

the price of building materials for each building component. The value obtained

from the RCN calculation is then reduced by the depreciation value to get the

final building value. The process is explained in Figure 1.

5) Calculating the

depreciation value (DV) using the Straight Line Method (SLM), based on the number of months computed using the following Equation (1):

|

|

6)

Calculating the building’s practical

life (BPL) as one factor of physical depreciation, using Equation (2) below:

|

|

7) Calculating the final value of the building that becomes the building’s Sales Value of the Tax Object (SVTO), which is calculated using Equation (3).

|

|

|

1) The

apartment building’s tax assessment reports were obtained from the Office of

Regional Tax and Levy Service at the sub-district level, where the apartment is

located

2) Building

historical data of the case study in the form of geometric and non-geometric

data obtained from the project construction service company

3) Field

survey data are taken from surveys and field documentation to supplement

building information

Finally,

in-depth interviews were conducted to validate and obtain feedback from

building tax professionals

Figure 1 Research Workflow

3.1. Building Components for Tax

Assessment Integrated into BIM

The literature study conducted to determine the variables of building tax assessments that can be integrated into BIM examines the literature discussing the use of 3D variables in property valuation. The variables obtained are classified into indoor and outdoor variables. However, it was found that the BIM model is more suitable for reviewing indoor variables because it has semantic and geometric capabilities at the scale of building elements (Zhao, 2017; Domínguez et al., 2011). Therefore, the 3D building variables modeled in BIM significantly affect the building value for tax assessment were focused on indoor variables. It is in line with previous research on 3D modeling for property valuation, stating that 3D building variables considered in tax assessments were indoor structural variables, namely property geometry, size, level, cost, and quality. In contrast, the outdoor building variable is generally used for land tax assessment (Yamani et al., 2021; Arcuri et al., 2020).

Moreover,

a comparison between the data structure of the Tax Object Notice and the BIM

model in Autodesk Revit was carried out to identify 3D building components for

tax assessment handled in BIM applications. The specified building components

and the identity data in the BIM model are summarized in Tables 1 and 2,

respectively.

Table 1 Building Components for

Tax Assessment in BIM Autodesk Revit

|

Building Components |

|||||

|

1 |

Air

terminals |

11 |

Basement Floor Area |

21 |

Gate |

|

2 |

Ceilings |

12 |

Flooring |

22 |

Hot

water system |

|

3 |

Communication

devices |

13 |

Roof |

23 |

Sewage

treatment system |

|

4 |

Electrical

power |

14 |

Structural

column material |

24 |

Artesian Aquifer |

|

5 |

Genset

equipment |

15 |

Exterior

wall material |

25 |

Reservoir |

|

6 |

Fire

protection |

16 |

Interior

wall material |

26 |

Swimming Pool |

|

7 |

Lightning

rod |

17 |

Exterior

wall coating material |

27 |

Tennis Court |

|

8 |

Number

of building floors |

18 |

Interior

wall coating material |

28 |

Road Pavement |

|

9 |

Number

of basements |

19 |

Type

and number of lifts |

29 |

Sound System |

|

10 |

Building

area |

20 |

Type

and number of escalators |

30 |

TV System |

Table 2 Components’ Identity Data

in BIM Autodesk Revit

|

Identity Data |

|||||

|

1 |

Area |

6 |

High |

11 |

Type |

|

2 |

Cost |

7 |

ID Material |

12 |

Volume |

|

3 |

Count |

8 |

Length |

13 |

Work Breakdown Structure |

|

4 |

Family |

9 |

Level |

14 |

Width |

|

5 |

Family and Type |

10 |

Material: Name |

15 |

Total Cost (Customize) |

3.2. Utilizing

BIM for Tax Assessment of Apartment Building

3.2.1. Developing

3D Model in BIM for Property Value

Historical data of the

investigated apartment building, results of field surveys, and additional data

collected were then inputted as the basis for developing a 3D model in Autodesk

Revit as the BIM tool used in this study. In the early modeling stages, the BIM

model’s objectives and detail need to be defined. In this study, BIM modeling

is intended to estimate the RCN of a building; therefore, the approach used is

the BIM 5D, which can estimate building costs (Reizgevi?ius et al., 2018). The accuracy of the information used and the

model’s ability to meet this objective need to be adjusted to a specific Level

of Development (LOD) (Latiffi et al., 2015). Therefore, the LOD 300 was used in this

study for its ability to define the approximate quantity, size, shape, and

location, making its model components expressed with the correct dimensions in

a precise position.

The BIM model development

was started by determining the constituents of building information, which

include the main building components, material components, facility components,

datum elements, and annotation elements. Consequently, data on the determined

components and features were then collected from the 2D and 3D technical

drawing documents of the MS Apartment project. The identities of building

components used in the BIM modeling in this study include the size data of the

building components, work unit price analysis, Material ID, and the WBS code.

Building component size data were obtained automatically from the BIM model

quantity extraction results. Meanwhile, the identity data for analysis of work

unit prices, Material IDs, and WBS codes used were generated from the MS

Apartment project documents.

In the BCCL assessment, the structural component of a building has become an integral part of the main building; therefore, the structure’s modeling for the building valuation was not carried out in this study. Furthermore, there was a lack of information obtained for facility components. Consequently, the values for the main structure and facility components used as the assumption were adopted from the assessment reports manually submitted in the BCCL method. Hence, the comparative data in this study was conducted for the value of building components consisting of inner wall materials, inner wall cladding, outer wall materials, outer wall cladding, ceilings, roof coverings, and ceiling coverings. Figure 2 shows the process of developing the BIM model.

Figure 2 The Process of 3D Modeling in BIM Revit

The BIM model was developed

starting from the building components, such as walls, floors, and the roof

system, followed by the identity data. The 3D model of three apartment floors

being developed in BIM with its identity data is shown in Figure 3.

Figure 3 Inputting identity data to the

floor components of the 3D model in BIM Revit

Moreover, the BIM 5D can estimate building costs through automatic quantity extraction in Revit and can be used to display information on the take-off material from 3D models. The non-graphical data from the 3D model was extracted and generated as tabular data, which was then exported into a spreadsheet application. Figure 4 shows the information display generated for the floor material from the third basement to the ground floor.

Figure 4 Information display for the

floor material in BIM Revit

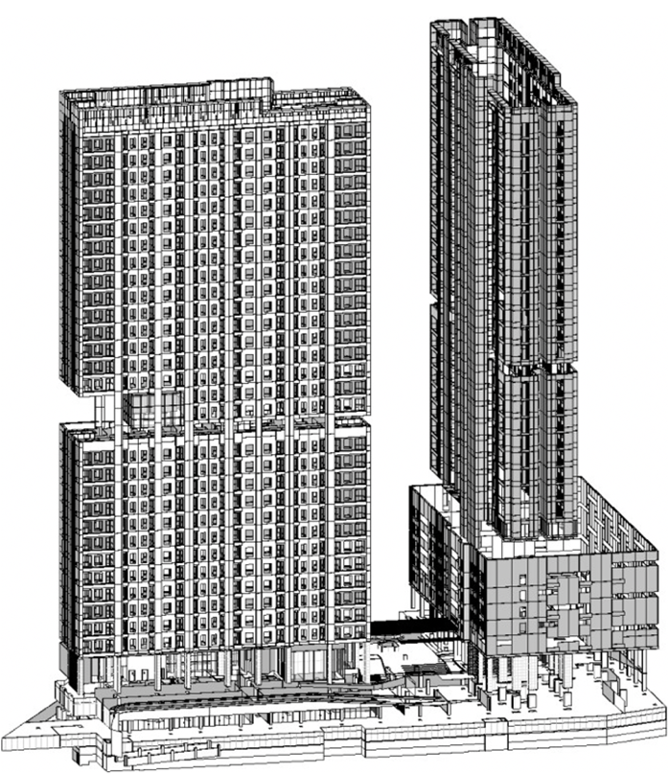

Figure 5 shows the 3D model fully developed in BIM 5D. The utilization of a BIM-based 3D model in calculating the building value based on its geometric form in the model and the cost aspect is discussed in the next section.

Figure 5 3D Model of MS

apartment building developed

in BIM Revit

3.2.2. Comparative

Analysis of Property Value Between BIM-based and Manual Methods

The building component costs in the BIM

method were calculated based on their volume on the BIM 3D model. The comparative analysis of the building

component costs from both the BCCL and BIM-based calculations is detailed in

Table 3 below.

Table 3 The Calculation of Building

Component Cost

|

BCCL |

|

BIM |

||

|

Material Name |

Total Cost |

|

Material Name |

Total Cost |

|

Interior

Wall Material |

|

Interior

Wall Material |

||

|

Half Brick Wall |

IDR

8,234,284,604 |

|

75mm lightweight brick |

IDR 3,899,640,972 |

|

|

100mm lightweight brick |

IDR

5,354,063,067 |

||

|

|

125mm lightweight brick |

IDR

734,828,187 |

||

|

|

6mm Calciboard |

IDR

29,900,811 |

||

|

|

GRC |

IDR

31,536,741 |

||

|

|

9mm Gypsum |

IDR

14,200,268 |

||

|

|

9mm Gypsum WR |

IDR

810,925 |

||

|

Interior

Wall Coating Material |

|

Interior

Wall Coating Material |

||

|

Paint |

IDR

868,624,750 |

|

Interior Paint |

IDR

1,588,205,928 |

|

|

Oil Paint |

IDR

305,409,148 |

||

|

|

Ceramics |

IDR

27,074,143 |

||

|

|

Homogeneous Tiles 1 |

IDR

28,531,748 |

||

|

|

Homogeneous Tiles 2 |

IDR

7,006,202,673 |

||

|

|

Homogeneous Tiles 3 |

IDR

39,906,667 |

||

|

Granite |

IDR

329,440,860 |

|

Metal Ceiling |

IDR

106,887,500 |

|

|

Teracota |

IDR

426,462,636 |

||

|

|

Andesite |

IDR

221,935,248 |

||

|

|

Marble |

IDR

2,683,915,511 |

||

|

|

Artificial Wood |

IDR

218,917,455 |

||

|

Exterior

Wall Material |

|

Exterior

Wall Material |

||

|

Precast Concrete |

IDR

36,029,657,496 |

|

Precast Concrete |

IDR

15,562,370,996 |

|

|

8mm GRC Panel |

IDR

6,998,061,906 |

||

|

Exterior

Wall Coating Material |

|

Exterior

Wall Coating Material |

||

|

Paint |

IDR

3,146,615,010 |

|

Exterior Paint |

IDR

659,703,270 |

|

Ceiling |

|

Ceiling |

||

|

Gypsum |

IDR

25,129,980,120 |

|

9mm Gypsum |

IDR

9,419,550,533 |

|

|

9mm Gypsum WR |

IDR

2,739,888,661 |

||

|

|

Skimcoat |

IDR

533,879,627 |

||

|

|

Aluminium Composite |

IDR

279,303,712 |

||

|

|

Metal Ceiling 1 |

IDR

7,202,301,600 |

||

|

|

|

|

Metal Ceiling 2 |

IDR

482,104,714 |

|

Roof |

|

Roof |

||

|

Concrete |

IDR

357,347,956 |

|

Concrete |

IDR

1,105,887,724 |

|

Flooring |

|

Flooring |

||

|

Cement |

IDR

469,759,360 |

|

Andesite |

IDR

1,393,777,170 |

|

Loka Marble |

IDR

1,410,347,500 |

|

Coral

Stone |

IDR

16,084,813 |

|

Stone CERAMICS |

IDR

7,388,719,632 |

|

Cement |

IDR 698,769,837 |

|

|

Ceramics 1 |

IDR

153,310,189 |

||

|

|

Ceramics 2 |

IDR

43,764,400 |

||

|

|

Floor

Hardener 1 |

IDR

221,489,592 |

||

|

|

Floor

Hardener 2 |

IDR

455,135,570 |

||

|

|

Homogeneous

Tiles 1 |

IDR

8,028,604,946 |

||

|

|

Homogeneous

Tiles 2 |

IDR

56,977,275 |

||

|

|

Homogeneous

Tiles 3 |

IDR

5,328,471 |

||

|

|

Pebble

Stone |

IDR

414,315 |

||

|

|

Artificial

Wood |

IDR

27,092,428 |

||

|

|

Marble |

IDR

506,883 |

||

|

|

Gutter

Grill |

IDR

17,261,100 |

||

Table 4 compares the

component costs of the building’s RCN value used as a constituent of the

building tax expected value and the existing BCCL method.

Table 4 Comparison of

Apartment’s RCN Value between BCCL and BIM-Based Methods

|

No. |

Building

Component |

Building’s

RCN Value | |

|

BCCL Method |

BIM-Based Method | ||

|

1 |

Main

components |

IDR 253,933,278,610 |

IDR 253,933,278,610 |

|

2 |

Interior

wall material |

IDR 8,234,284,604 |

IDR

10,064,980,971 |

|

3 |

Interior

wall coating material |

IDR 1,198,065,610 |

IDR

12,653,448,657 |

|

4 |

Exterior

wall material |

IDR 36,029,657,496 |

IDR

22,560,432,902 |

|

5 |

Exterior

wall coating material |

IDR 3,146,615,010 |

IDR

659,703,270 |

|

6 |

Ceiling |

IDR 25,129,980,120 |

IDR 20,506,915.28 |

|

7 |

Roof |

IDR 357,228,478 |

IDR 1,105,887,723.79 |

|

8 |

Flooring |

IDR 9,268,826,491 |

IDR 11,524,303,089 |

|

9 |

Sanitation |

IDR 42,216,015,504 |

IDR 42,216,015,504 |

|

10 |

Plumbing |

IDR 16,431,360,218 |

IDR 16,431,360,218 |

|

11 |

Supporting facilities |

IDR 90,604,103,440 |

IDR 90,604,103,440 |

|

|

RCN

Value (before depreciated) |

IDR 486,549,415,582 |

IDR 461,775,969,523.14 |

From the table above, the

values of the main structural and facility components produced in both methods

are the same since they are not included in this research. Meanwhile, the

material elements are composed of interior walls, exterior walls, ceilings,

roofing, and floorings; therefore, there are differences between the values of

the two methods.

There

is a difference in the value of the new replacement costs, particularly in the

material of building components investigated in the study. This difference in

the material components’ values was influenced by the detailed calculations of

dimensions and building material variations of the BIM model compared to the

BCLL method, as well as differences in the analysis of the unit price of work

used. The comparative analysis shows that in the BCCL method, element

variables, building element quantity variables, and quality variables are still

general and do not describe the actual condition of building components.

The

value generated in the BIM method shows results that better describe the actual

condition of the building compared to the BCCL method, which has limitations in

reviewing building elements, quantities of the building elements, and the

quality of the building elements. These limitations were evidenced by the

presence of material not included in the BCCL method’s list of tables;

therefore, it cannot be considered in the building value calculation.

For

example, the BCCL method can only review one type of interior wall material

(half brick wall) with building area information (outside the basement) of

42,098 square meters used as the component quantity assumption. In contrast,

the BIM-based method can show that the interior wall elements are composed of

75 mm, 100 mm, 150 mm lightweight brick, Calciboard, GRC, 9 mm gypsum, and 9 mm

gypsum WR.

Furthermore,

through its ability to perform quantity extraction through the material

take-off feature, the BIM method can display the quantity calculation of each

material in more detail and more accurately, following the actual conditions of

the MS apartment, which applies to other building elements. For example, the

roof cover material in the BCCL method was calculated at 271.5 square meters,

while it was estimated at 658.819 square meters from the 3D model of the BIM

method.

In

addition, the factor affecting the difference in the values ??produced by the

two methods is the work unit price analysis used. The BCCL method uses a work

unit price table issued by the Provincial Tax and Levy Agency that was compiled

using a quantitative survey approach to building models representing each

group. While in the BIM-based method, the work unit price analysis comes

directly from the 3D model of MS Apartment developed from its project

documents.

Accordingly, the cost of the facility component of

the MS apartment is IDR 90,604,103,440, based on the data obtained

from the Office of Regional Tax and Levy Service. The

construction of the MS apartment will be completed in 2022, so it is not

renovated yet; hence the renovation year = 0 years. If the assessment process

is carried out in 2022, therefore, based on a calculation using Equation (1),

the apartment has no depreciation value (IDR 0). After being depreciated, the

building value was added with the cost of supporting facilities components that

do not need to be depreciated, amounting to IDR 18,704,648,024. The building’s

value used as a constituent of the building tax payable value compared with the

existing BCCL method is shown in Table 5.

Table 5 Comparison of

Apartment’s Final Value between BCCL and BIM Methods

|

No. |

Cost

Component |

Building

Value |

|

|

BCCL Method |

BIM Method |

||

|

1 |

RCN Value

(before depreciated) |

IDR 486,549,415,582 |

IDR 461,775,969,523.14 |

|

2 |

Depreciation

Value |

IDR 0 |

IDR 0 |

|

3 |

Supporting

Facilities |

IDR 18,704,648,024 |

IDR 18,704,648,024 |

|

|

Final

Value |

IDR

505,254,063,606 |

IDR

480,480,617,547.14 |

The final value for the

building as the tax object generated from the BIM method is much lower than the

building value obtained from the calculation using the BCCL method. It occurred

due to the inaccurate material area calculated in the BCCL method; hence, the

building material cost was generated higher than the actual condition of the

building material. Moreover, the BCCL’s limited building material variety

corresponding with the material used in the physical building also causes the

building value discrepancy from both approaches.

The

calculation result from the case study shows that the BIM method does not

increase the building’s final value calculated in the conventional method;

however, it produces accurate cost calculation for each building component that

corresponds to the building’s physical condition. This statement is backed up

by two practitioners from the Provincial Tax and Levy Agency and Provincial

Revenue Agency interviewed at the end of this study. Both practitioners stated

that BIM 5D has considerable potential as an alternative tax assessment,

particularly at the quantity survey stage, tax notices filing, and BOQ

analysis. It is owing to BIM 5D’s ability to show the accurate size of building

components and generate the costs for building components. With its real-time

concept, the BIM 5D could objectively display the actual condition of the

building. Moreover, the time needed to prepare the building values for tax

assessment can be accelerated by automatically reading the information in the

BIM model.

BIM’s ability to extract quantities can save

time by eliminating manual quantity survey and BOQ analysis activities and

reducing calculation errors that might occur if done manually. BIM’s ability to

perform 3D visualization also provides convenience for surveyors and taxpayers

by displaying a more perspective and actual form to increase the accuracy of

delivering building information. In addition, the utilization of BIM can

increase the objectivity of building values where the components calculated in

the BIM method can be generated in detail. In addition, the value of the

building developed by the 5D BIM method can avoid the consequences of

generalizing the building components.

The current

tax assessment method for vertical buildings, such as apartments, is still

conducted manually, which involves a generalization of the building’s work unit price, quantity survey through manual measurement, and reports

with building component lists that still cannot accurately picture the actual

components in the building. This conventional method resulted in inaccurate

property values and inefficient building tax assessment. This paper attempted

to develop a technology-driven approach for the valuation process of an

apartment through a case study. The result of this study shows that the 3D

model created in Autodesk Revit as the BIM application completed with building

information and identity data can be utilized to efficiently estimate the apartment

property value used as the constituent

of the building tax payable, with a more accurate result. The proposed

BIM-based building tax assessment method can be implemented with the support of

integrated cooperation between taxpayers and the authorities involved.

Therefore, further research needs to examine the suitability of existing

regulations and develop policies for adopting the proposed method.

The authors would like to thank The

Ministry of Education, Culture, Research, and Technology of Indonesia for

supporting this research through the Higher Education Basic Research Scheme

(PDUPT) 2023 Funding.

Anwar,

M.K., 2019. Analisis Tingkat

Akurasi Penetapan Nilai Jual Objek Pajak Bumi Terhadap Nilai Pasar dengan

Metode Assessment Sales Ratio (Studi Kasus di Kecamatan Purworejo Kota Pasuruan

Tahun 2017) (Analysis of the Accuracy

Level of Determining the Selling Value of Lan).

Master's Thesis, Graduate Program, Universitas Brawijaya,

Indonesia

Arcuri, N., De Ruggiero, M., Salvo, F.,

Zinno, R., 2020. Automated

Valuation Methods Through the

Cost Approach in a BIM and GIS Integration

Framework for Smart City Appraisals.

Sustainability (Switzerland), Volume 12(18), 1–16

Asher, M.G., 2002. The Role of Property Tax in Fiscal Decentralization in

Indonesia. Policy and Society, Volume 21(2), pp. 26–41

Atazadeh, B., Kalantari, M.,

Rajabifard, A., Ho, S., Champion, T., 2016.

Extending a BIM-based Data Model to

Support 3D Digital Management of

Complex Ownership Spaces. International Journal of Geographical Information

Science, Volume 31(3), pp.

499–522

Atazadeh, B., Olfat, H., Rajabifard,

A., Kalantari, M., Shojaei, D.,Marjani, A.M., 2021.

Linking Land Administration Domain Model and BIM Environment

for 3D Digital Cadastre in Multi-Storey Buildings. Land Use Policy, Volume 104 , p. 105367

Berawi, M.A., Leviakangas, P.,

Muhammad, F., Sari, M., Gunawan, Yatmo, Y.A., Suryanegara, M., 2019. Optimizing

Search and Rescue Personnel Allocation in Disaster Emergency Response Using

Fuzzy Logic. International Journal of Technology. Volume 10(7), pp. 1416–1426

Berawi, M.A., Suwartha, N., Salim,

A.V., Saroji, G., Sari, M., 2021.

Developing Mobile Application for Land Value Capture Scheme to Finance Urban

Rail Transit Projects. International Journal of Technology, Volume 12(7), pp. 1448–1457

Cho, S.C., Choi, P.P.S., 2014. Introducing Property Tax In China as an Alternative

Financing Source. Land Use Policy, Volume 38, pp. 580–586

Domínguez, B., García, A.L., Feito,

F.R.,2011). Semantic and Topological

Representation of Building Indoors: An Overview.

In: Joint ISPRS Workshop on 3D City Modelling and Applications

and the 6th 3D GeoInfo, 3DCMA 2011

El Yamani, S., Ettarid, M., Hajji, R., 2019. Building Information

Modeling Potential for an Enhanced Real Estate Valuation Approach based on the

Hedonic Method. WIT Transactions on the Built Environment, Volume 192, pp. 305–316

Habibi, S., Asadi, N., 2011. Causes, Results and

Methods of Controlling Urban Sprawl.

Procedia Engineering, Volume 21, pp. 133–141

Haldenwang, C. von, Elfert, A.,

Engelman, T., Germain, S., Sahler, G., Ferreira, A.S., 2015. The Devolution of the Land and Building Tax in

Indonesia. The German Development Institute/ Deutsthes Institut Fur

Entwicklungspolitik (DIE).

https://www.idos-research.de/en/studies/article/the-devolution-of-the-land-and-building-tax-in-indonesia/

Hassan, M.I., Ahmad-Nasruddin, M.H.,

Yaakop, I.A., Abdul-Rahman, A., 2008.

An Integrated 3D Cadastre–Malaysia as an Example. The International Archives

of the Photogrammetry, Remote Sensing and Spatial Information Sciences, Volume XXXVII, pp. 121–126

Hendriatiningsih, S., Hernandi, A.,

Saptari, A.Y., Widyastuti, R., Saragih, D., 2019. Building Information Modeling (BIM) Utilization for 3D Fiscal Cadastre. Indonesian Journal of Geography,

Volume 51(3), pp. 285–294

Isikdag, U., Horhammer, M., Zlatanova,

S., Isikdag, U., Horhammer, M., Zlatanova,

S., 2014. Semantically Rich 3D

Building and Cadastral Models for Valuation. In: Proceedings of 4th International Workshop on 3D Cadastres,

November 2014, 35–54

Kisel, T., 2021. Cost Efficiency of

Building Information Modeling use at the Stage of Real Estate Object

Maintenance. International Journal of Technology, Volume 12(7), pp. 1468–1478

Latiffi, A.A., Brahim, J., Mohd, S.,

Fathi, M.S., 2015. Building

Information Modeling (BIM): Exploring Level of Development (LOD) in

Construction Projects. Applied Mechanics and Materials, Volume 773–774, pp. 933–937

Lau, S.S.Y., 2011. Physical Environment of Tall Residential Buildings: The Case of Hong Kong. In High-Rise Living in Asian Cities. Springer Science-Business Media

Qin, P., Wang, L., 2019. Job Opportunities, Institutions, and the Jobs-Housing

Spatial Relationship: Case Study of Beijing. Transport Policy, Volume 81, pp. 331–339

Rajabifard, A., Atazadeh, B.,

Kalantari, M., 2018. A Critical

Evaluation of 3D Spatial Information

Models for Managing Legal

Arrangements of Multi-Owned Developments

in Victoria, Australia. International Journal of Geographical Information

Science, Volume 32(10), pp. 2098–2122

Reizgevicius, M., Ustinovi?ius, L.,

Cibulskien?, D., Kutut, V., Nazarko, L., 2018.

Promoting Sustainability Through Investment in Building Information Modeling

(BIM) Technologies: A Design Company Perspective. Sustainability

(Switzerland), Volume 10(3), p. 600

Seipel, S., Andrée, M., Larsson, K.,

Paasch, J.M., Paulsson, J., 2020.

Visualization of 3D Property Data and Assessment of the Impact of Rendering

Attributes. Journal of Geovisualization and Spatial Analysis, Volume 4(2)

Shojaei, D., Kalantari, M., Bishop,

I.D., Rajabifard, A., Aien, A., 2013. Visualization Requirements For 3D Cadastral Systems. Computers,

Environment and Urban Systems, Volume 41, pp. 39–54

Sladic, D., Radulovi?, A.,Govedarica,

M., 2020. Development of Process Model for Serbian Cadastre. Land Use Policy, Volume 98, p. 104273

Wong, K.M.G., 2004. Vertical Cities as a Solution For Land Scarcity: The Tallest

Public Housing Development in Singapore. Urban

Design International, Volume 9(1), pp. 17–30

Yamani, S. El, Hajji, R., Nys, G.A.,

Ettarid, M. Billen, R., 2021. 3D Variables Requirements for

Property Valuation Modeling Based on the Integration of Bim and Cim. Sustainability

(Switzerland), Volume 13(5), pp. 1–22

Zhao, X., 2017. A Scientometric Reviewof

Global BIM Research: Analysis and

Visualization. Automation in Construction, Volume 80, pp. 37–47