Research of the Efficiency of Mining and Metallurgical Enterprises Based on the Environmental, Social, and Governance Risk Rating in the Context of Digital Transformation

Corresponding email: eskelinen.ilona@gmail.com

Published at : 27 Dec 2022

Volume : IJtech

Vol 13, No 7 (2022)

DOI : https://doi.org/10.14716/ijtech.v13i7.6181

Pishchalkina, I., Pishchalkin, D., Suloeva, S., 2022. Research of the Efficiency of Mining and Metallurgical Enterprises Based on the Environmental, Social, and Governance Risk Rating in the Context of Digital Transformation. International Journal of Technology. Volume 13(7), pp. 1442-1451

| Ilona Pishchalkina | Peter the Great St. Petersburg Polytechnic University, St. Petersburg, Polytechnicheskaya, 29, 194064, Russia |

| Denis Pishchalkin | Peter the Great St. Petersburg Polytechnic University, St. Petersburg, Polytechnicheskaya, 29, 194064, Russia |

| Svetlana Suloeva | Peter the Great St. Petersburg Polytechnic University, St. Petersburg, Polytechnicheskaya, 29, 194064, Russia |

In

recent years, there has been a significant increase in interest in the

low-carbon, “greener” economies from investors and the public sector. To assess

companies' compliance in terms of Environmental, Social, and Governance (ESG)

criteria, Rating Agencies have developed ESG risk ratings, which allow for

determining the effectiveness of enterprises in terms of ESG. The article is

intended to research the efficiency of mining and metallurgical enterprises

based on compilations of ESG risk ratings of leading international Rating

Agencies. The authors briefly described the most recognized global ESG rating

methodologies and compared the top 5 ESG ratings. The results of the

qualitative assessment of ESG ratings formed this top-5 list. The current

situation in the formation of rating ratings was described. In accordance to

open data sources, the ratings of mining and metallurgical enterprises were

collected, then ranged (based on an expert assessment) and highlighted the

divergence of ESG ratings with explanations of these discrepancies. This study

revealed a significant correlation between ESG ratings of leading Rating

Agencies and assessed the efficiency of mining and metallurgical enterprises

based on compilations of these ratings. Based on the graphical analysis, there

is a correlation between the ESG ratings of the different Rating Agencies since

when the enterprises are ranked from the best to the worst, the graph has a

distinct direction of values from the lower left corner to the upper right

corner.

Ecological risk; ESG rating; Mining and metallurgical enterprise; Sustainability; Vertical integration

In modern conditions, digital transformation

impacts the activities on the activities of mining and metallurgical

enterprises. It helps to identify previously unnoticed relationships, which

increases the efficiency of comparing parameters. The main advantage of

companies that actively use modern technologies is the efficiency and

reasonableness of their business decisions, considering risks. Thanks to the

development of digital technologies, it has become possible to analyze big data

in real-time, produce machine learning and apply the potential of Artificial

Intelligence (Pishchalkina et al., 2021; Segura-Salazar & Tavares,

2018). Moreover, data collection from

industrial sensors and controls, more accurate accounting of resource

consumption, and big-data creation allow enterprises

Due to the

growing interest in responsible investments in line with sustainable development,

there is an exceptionally active process of creating and calculating

Environmental, Social, and Governance (ESG) ratings (Danilov

et al., 2021). ESG investing has also recently garnered interest

from the public sector, which has expressed support for ways to help transition

financial systems toward low-carbon, "greener" economies (OECD, 2020). The development of the ESG criteria

system has contributed to the creation of ESG-

Related investment products

formed the public perception of companies and the ways of annual reports and

ESG disclosure. ESG standards allow an investor and other stakeholders to

consider non-financial factors and more accurately determine which companies

need to be financed in the long term (Giese et al.,

2021; Hübel & Scholz, 2020; IMF,

2019).

The ESG

rating refers to non-credit ratings and represents the opinion of rating

Companies regarding the compliance of the current practice and strategy of the

rated Entity with the goals of sustainable development, including environmental

protection and restoration, social responsibility, and the development of

corporate governance to achieve these goals. In the process of assigning an ESG

rating, the rating Agency takes into account the assessment of the risks of the

rated Entity in the fields of ecology, social development, and corporate

governance, takes into account compliance with international standards and the

specifics of national regulation (NCR, 2022).

The works (Ovechkin, 2021; Friede et al., 2015) assess the positive impact of

ESG on the financial success of companies, which is stable over a long period.

Other studies (Filbeck et al., 2019; Brogi & Lagasio, 2018; Forcadell & Aracil, 2017; Dellaportas

et al., 2012) describe

that firms should disclose information about their activities in the field of

sustainability, as this can increase their reputation and, as a result, the

value of such firms. In addition, some researchers (Sassen

et al., 2016; Salama et al., 2011) claim that firms with a high level of ESG

are characterized by less financial risk. In this paradigm, the presence of an

ESG-related risk premium is due to the fact that a high risk of performance

characterizes companies with low ESG levels.

The mining and

metallurgical industry are key sectors of the modern global economy (Korneeva, 2016). It incorporates enterprises

engaged in the extraction, enrichment, and processing of ferrous and

non-ferrous ores and is a type of heavy industry that poses a negative impact

on the environment. Such impact may cause reputational damage to this type of

enterprise if their management does not take swift and preventive

counter-actions (Blinova et al., 2022; Rybak et al., 2021). In addition, the metallurgical

industry is now influenced by some downward trends, including high depreciation

of fixed assets, strict environmental requirements for products, an

insufficient supply of the domestic market, and high production costs of

metals.

And metal products, a high level of concentration

in production, and underdevelopment of the system of small and medium-sized

enterprises (Pishchalkina, 2021). For

example, such companies as Anglo American (Anglo

American, 2021), Glencore Plc (Glencore,

2021), Vale S.A. (Vale, 2021), China

Hongqiao (China Hongqiao, 2021), Norilsk

Nickel (Nornickel, 2021),

RUSAL (RUSAL, 2021), EVRAZ (EVRAZ, 2021), Severstal (Severstal,

2021) are largely diversified. And vertically integrated enterprises

that sell commodities and precious metals on the world markets. Companies that

occupy the best positions at the industry-specific ESG ratings have competitive

advantages due to compliance with international environmental, social and

corporate governance requirements. Therefore, metallurgical enterprises are

presented in international ESG ratings, and these values can be found in such

Rating Agencies as Sustainalytics (Morningstar), Vigeo-Eiris (Moody's),

RobecoSAM (S&P Global), CDP (CDP Worldwide), MSCI (Morgan Stanley Capital

International), ISS (Institutional Shareholder Services Inc.) and etc. Since

2018 and until currently, there have been more than 600 ESG ratings and

rankings existing globally, and the number of ESG frameworks and standards,

rankings, and ratings continues to grow (SustainAbility,

2020).

The study aims to research the efficiency of mining and metallurgical

enterprises based on compilations of ESG risk ratings of leading international

Rating Agencies. To

achieve this goal the following objectives are attained in the article:

(1) describe the essence and relevance of ESG risk rating; (2) determine

and characterize the most reliable and in-demand ESG rating methodologies

recognized by the international community; (3) make an expert assessment and

range ESG ratings of the enterprises under consideration; (4) highlight the divergence

of ESG ratings and explain the reasons for the discrepancies.

This article focuses

on the importance of ESG ratings, analysis of methodologies recognized by the

international community, and their divergences. In addition, we considered the

ability of mining and metallurgical companies to use an ESG-driven approach to

managing their sustainable development.

Data were

collected through Rating Agencies databases, sustainability reports, and

non-financial statements (CDP, 2022; MSCI, 2022; S&P Global,

2020; OECD, 2020; Sustainalytics, 2018) of 8 mining and

metallurgical companies. The authors conducted research using comparative

analysis (identifying the features of the existing ESG ratings and identifying

the most reliable) and an expert analytical method for comparing ratings of

mining and metallurgical enterprises of different Rating Agencies. The expert

analytical technique applied in this study complies with the three-step

analysis: (1) form the scale of normalization ratings; (2) range of the

companies' ESG

ratings; (3) illustrate the extent of divergence between the different Rating

Agencies.

The scale

of normalization ratings is necessary to bring the assessments of various

Rating Agencies to a single assessment (Table 1). Normalization allows hiding

the inversion of the rating scale such as Sustainalytics to exclude incorrect

interpretation of meaning ESG ratings.

Table 1 Normalized numerical scale for dependent variable

|

Scoring |

S&P |

CDP |

Sustainalytics |

MSCI |

|

5 |

100-80 |

A:A- |

0-10 |

AAA:AA |

|

4 |

80-60 |

B:B- |

10-20 |

A |

|

3 |

60-40 |

C:C- |

20-30 |

BBB |

|

2 |

40-20 |

D:D- |

30-40 |

BB |

|

1 |

20-0 |

F |

40+ |

B:CCC |

After normalization

of the numerical scales of ESG ratings, a graph was constructed reflecting the

discrepancy between the ratings of different Rating Agencies, allowing

visualization deviations of values.

3.1. Overview of international

ESG risk ratings

Events

and problems are significant for the ESG assessment in cases where they may

have a significant negative impact on the organization's operating activities,

cash flows, legal or regulatory responsibilities. Its access to capital,

reputation, or relationships with key stakeholders and society as a

whole–directly or through the value chain. As a rule, to assess ESG risks, the

materiality of events or problems related to ESG factors is analyzed,

considering their likely impact on the financial activities of the

organization, including the potential impact of external environmental and

social factors (Koroleva et al., 2020).

There are

several reasons for using ESG ratings: provide information or data material to

investment performance; supplement the organization's other research on

corporate ESG risk or performance; provide credible and quality source of

information on corporate ESG performance; Entity derives reputational benefit

from using ESG ratings; growing demand by key stakeholders to use ESG ratings;

required by organization to integrate ESG ratings into investment analysis and

decision-making (SustainAbility, 2020).

Factors

determining ESG rating quality include several criteria: quality of

methodology; disclosure of methodology; experience or competence of the

research team; credibility of data sources; corporate and stakeholder

involvement in the evaluation process; common usage by investors and

stakeholders; focus on relevant or material issues (S&P Global, 2020).

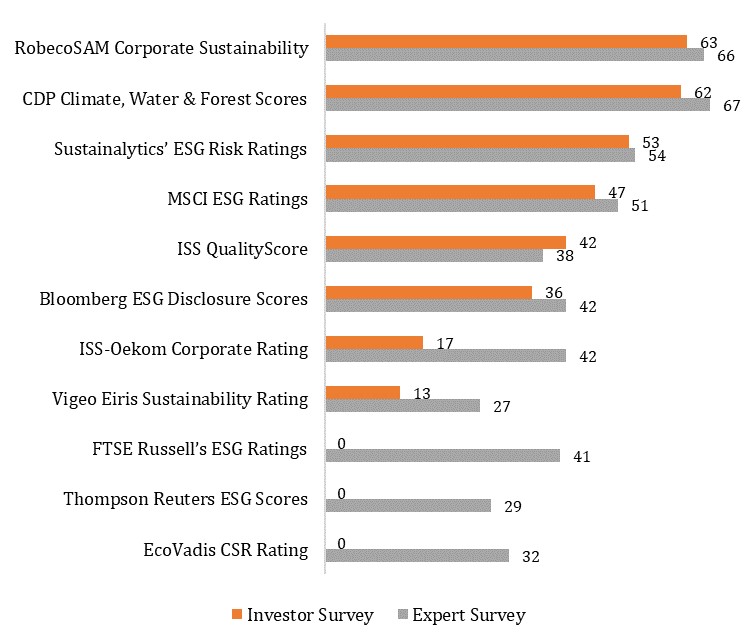

According to the results of the qualitative assessment of existing ESG ratings by the agency Rate the Raters 2020 Report (SustainAbility, 2020), the number of respondents from experts and investors who rated the quality of ratings as high or very high in percentage proportion is shown in Figure 1.

Figure 1 Qualitative assessment of ESG ratings, %

The ratings presented in Figure 1 have one

thing in common–they are all based on three issues: Environmental, Social and

Governance Indicators.

The main difference between the ratings is that each Agency independently

determines the methodology of ESG risk ratings. Moreover, the work (Berg et al., 2019)

describes that decision-makers receive «noisy» information from Rating

Agencies. The ambiguity around ESG ratings represents a challenge for

decision-makers trying to contribute to an environmentally sustainable and

socially just economy. On the other hand, using and subscribing to more than

one ESG rating has tangible benefits for investors (SustainAbility, 2020).

Subscribing to multiple can help stakeholders and investors to fill the gaps if

one rating provides more data on a given sector or geographic region or if one

rating has a smaller coverage than another.

The authors selected

the top-5 ESG ratings for further consideration and comparison of features (see

Figure 1). The analysis of these ratings is based on the wide literature

sources, such as the original sources of the methodologies presented by the

Rating Agencies themselves (MSCI, 2022; CDP, 2022; Framework ESG, 2021; S&P

Global, 2020; Sustainalytics, 2018; Dorfleitner, 2015) and the detailed

information was presented in Table 2.

Table 2 Comparison of the top-5 ESG ratings

|

Name |

Short description |

Scoring |

Companies scored |

|

RobecoSAM

(S&P Global) |

The Agency has its own methodology for Corporate

Sustainability Assessment (CSA), which is the strictest and most prestigious

rating. It is the longest-running sustainability

benchmark, assessing the largest global companies on ESG performance |

0-100, with 100 – best performance |

7 500 |

|

CDP

Climate, Water & Forest Scores |

The Agency is based only on companies' questionnaires and

runs a global disclosure system comprised of the world's most comprehensive

collection of self-reported environmental data |

A to D– (F, if a company is invited and chooses not to

respond) |

> 9 600 |

|

Sustainalytics'

ESG Risk Ratings |

The Agency is one of the most useful and highest-quality ratings. The rating measures a company's exposure

to how well a company manages those risks versus industry-specific ESG risks |

0 (negligible) – 100 (severe) |

12 000 |

|

MSCI

ESG Ratings |

The Agency uses the leveraging machine learning,

Artificial Intelligence (AI), and natural language processing augmented with

analysts, MSCI researches and rates companies on a ‘scale according to their

exposure to industry-material ESG risks and their ability to manage those

risks relative to peers |

AAA (leader) to CCC (laggard) |

9 800 |

|

ISS

Quality Score |

The Agency is an authoritative source of ESG information

for corporate investors and measures the scope and depth disclosure. Sector allocation and factor selection reflect leading

disclosure frameworks and standards, such as the Sustainability Accounting

Standards Board (SASB) standards, the Global Reporting Initiative (GRI) and

the Task Force on Climate-related Financial Disclosures (TCFD) |

1 to 10 (decile). which 1 – is low risk, 10 – is high risk |

4 700 |

The

conducted comparison of ESG ratings showed that the ratings are based on

different methodologies in structuring ratings and divergence between scoring

approaches. In this regard, the analysis of ESG ratings and related results

highlights the difficulties investors face and how these ratings may differ

(fundamentally) depending on the rating source. As a result of the analysis,

common trends and significant differences in the methodologies for assigning

the ESG rating of companies were identified.

3.2. Ranking of mining and metallurgical companies' ESG ratings

Substantially

different results from major ESG rating providers (as opposed to credit rating

performance) could create market uncertainty among institutional investors,

fund managers, and non-qualified investors as to what constitutes a high ESG

rated company (Pyykkö

et al., 2021). Suppose the approach to unification of ratings is not changed. In that

case, the existing subjectivity in assessments may undermine investor

confidence in ESG assessments, the main ESG indices, and portfolios created

based on these products. It is necessary to clarify how the factors and

indicators of subcategories E, S, and G, their weight and subjective assessment

affect the total ESG scores. This will allow users and issuers to understand

and compare methodologies and results. Such transparency is especially

justified if rating Agencies' assessments continue to differ widely (Alexandrov, 2021; Egorova

et al., 2021).

In this

study, the authors analyzed and compared the methods and methodologies of

calculating ESG ratings that are most relevant and significant for companies

providing non-financial reporting on the sustainable development of companies.

Based on open sources of information and data from Rating Agencies such as

S&P, CDP (Climate change ratings), Sustainalytics and MSCI have collected

the values of mining and metallurgical companies' ESG ratings. ISS Quality

Score was excluded due to the lack of sufficient data from the selected

companies. To compile the final results of ranking ESG ratings for 8

international mining and metallurgical enterprises (Anglo

American, 2021; Vale, 2021; Glencore, 2021; Severstal, 2021; EVRAZ, 2021; RUSAL,

2021; Nornickel, 2021; China Hongqiao, 2021), Table 3 was formed.

Companies based on

their ratings were grouped into five subgroups, according to those scores,

indexes, ratings, and places that they received from Rating Agencies. For each

company, a place in the 4 main ESG rating suppliers was determined. Then, a set

of occupied places in each rating was determined for each company. According to this set of places, the final

position was determined according to the methodology, where the ranking took

place from 1st to 8th place. The method involved

selecting the number of times the company occupied a certain place in the

relevant ratings. The more often a company has ranked higher in the ratings,

its final rank will be higher. If the companies scored the same score, the number

of the best ratings from such companies was considered.

Table 3 Ranged ratings of mining and metallurgical enterprises

for 2021Y

|

Range |

Name |

S&P |

CDP |

Sustainalytics |

MSCI |

|

1 |

Anglo American |

78 |

A- |

23 |

AA |

|

2 |

Severstal |

48 |

B |

31.4 |

B |

|

3 |

Vale

S.A. |

63 |

A- |

39.1 |

CCC |

|

4 |

EVRAZ |

52 |

C |

38.9 |

B |

|

5 |

RUSAL |

n/a |

A- |

30.3 |

B |

|

6 |

Glencore

Plc. |

42 |

F |

36 |

BBB |

|

7 |

Norilsk

Nickel |

44 |

D |

43.9 |

?? |

|

8 |

China

Hongqiao |

19 |

F |

50 |

B |

Thus, the analysis showed that, in

general, mining and metallurgical companies do not occupy the highest positions

in the ESG ratings as it possible. Increasingly, this is due to the technology

of production of metallurgical products, which has a strong impact on the

environment and social capital. In addition, the spread of Rating Agencies'

values indicates insufficient consistency of assigned ratings. According to the

Agency's research (S&P Global, 2021), the mining and

metallurgical industry has the most influential ESG factors: waste and

pollution (70% of companies affected); climate transition risks (50% of

companies affected); social capital (40% of companies affected) and health and

safety (40% of companies affected). At the same time, no meaningful concentration

of factors emerges for the governance of metals and mining companies. However,

governance structures indicate some financial sponsorship, mostly in more

stable downstream metals processing and distributing.

Next, we normalize the ratings of different Agencies received by companies to form the distribution of these values. The scale of normalization is given in Table 1. Normalized ratings for the 8 companies are sorted by average ratings and presented in Figure 2. Each of the 4 rating Agencies is plotted in a different color.

Figure 2 Distribution of normalized ratings

The resulting distribution of normalized

value indicates that it is difficult to interpret the assigned ratings due to

data outliers, but there is a correlation. Mining and metallurgical companies

should carry out work on interaction with rating agencies for more detailed

disclosure of information and bringing the assigned ratings to the smallest

spread of values. Also, the ratings may differ due to the different risk levels

taken into account per the developed methodology of each rating Agency. All

these factors testify to the lack of reliability of the ESG ratings (Danilov et al.,

2021): (1) discrepancy in measurements (most significant for hard-to-quantify

factors such as human rights and product safety); (2) differences in the

set of factors taken into account when compiling ratings; (3) “rater effect”,

when Rating Agencies tend to give high ratings to a company that already has

high ratings in other categories. The results obtained to expand the scope of research on the

efficiency of mining and metallurgical enterprises based on ESG risk ratings.

In general,

mining and metallurgical companies negatively impact the environment and the

health of people living in industrial areas. However, increasing investor

interest in "green" companies leads to strengthening environmental

programs and improving the quality of people's lives. The conducted research is based

on compilations of ESG risk ratings of leading international Rating Agencies,

allowing a more objective assessment of the global vertically integrated mining

and metallurgical enterprises. The proposed approach eliminates methodological

differences by normalizing the ratings and bringing the ratings under

consideration to a single scoring scale. In any case, there is a correlation

between all ratings despite the differences in ratings. In addition, the ranged

ratings of mining and metallurgical enterprises made it possible to identify

the industry leaders in terms of ESG parameters. The results obtained can be used

for further research on the study of the efficiency of mining and metallurgical

enterprises based on compilations of ESG risk ratings. Further

research is to analyze the specificities of ESG evaluation methodologies of leading

international Rating Agencies and determine the most influencing factors on the

summary ESG ratings of these companies.

The

research is partially funded by the Ministry of Science and Higher Education of

the Russian Federation under the strategic academic leadership program

'Priority 2030' (Agreement 075-15-2021-1333 dated 30.09.2021).

Alexandrov, A.V., 2021.

Analysis of Foreign and

Domestic Sustainable Development Ratings (ESG) of the World’s Leading Oil and

Gas Companies. Assessment of the Impact of the ESG Rating on the Capitalization

of the Company. Economic sciences, Volume 204, pp.

44–53

Anglo American, 2021.

Annual report 2021 Anglo American. Available Online at https://www.angloamerican.com/~/media/Files/A/Anglo-American Group/PLC/investors/annual-reporting/2021/aa-annual-report-full-2020.pdf,

Accessed on August 23, 2022

Berg, F., Koelbel,

J.F., Rigobon, R., 2019. Aggregate Confusion: The Divergence of ESG Ratings. Forthcoming Review of Finance, pp. 1–48

Blinova, E.,

Ponomarenko, T., Knysh, V., 2022. Analyzing the Concept of Corporate

Sustainability in the Context of Sustainable Business Development in the Mining

Sector with Elements of Circular Economy. Sustainability.

Volume 14(13), pp. 1–30

Brogi, M., Lagasio, V.,

2018. Environmental, Social, and Governance and Company Profitability: Are Financial

Intermediaries Different. Corporate

Social Responsibility and Environmental Management, Volume 26(3), pp. 576–587

CDP, 2022. CDP Scoring

Methodologies 2022. Available Online at https://www.cdp.net/en/guidance/guidance-for-companies,

Accessed on August 10, 2022

China Hongqiao, 2021. Annual

report 2021 China Hongqiao Group. Available Online at:

http://en.hongqiaochina.com/Uploads/File/2022/04/13/E1378-AR.20220413163757.pdf,

Accessed on August 23, 2022

Danilov, Yu.A.,

Pivovarov, D.A., Davydov, I.S., 2021. Sustainable Finance Ratings. Russian Economic Development, Volume 28

(4), pp. 25–33

Dellaportas, S.,

Langton, J., West, B., 2012. Governance and account-ability in Australian

charitable organisations: Perceptions from CFOs. International Journal of Accounting and Information Management,

Volume 20(3), pp. 238–254

Dorfleitner, G.,

Halbritter, G., Nguyen, M., 2015. Measuring the Level and Risk of Corporate

Responsibility–An Empirical Comparison of Different ESG Rating Approaches. Journal of Asset Management, Volume 16, pp.

450–466

Egorova, S., Kistaeva,

N., Kulachinskaya, A., Nikolaenko, A., Zueva, S., 2021. Development of Methods

for Assessing the Impact of Environmental Regulation on Competitiveness. International Journal of Technology.

Volume 12(7), pp. 1349–1358

EVRAZ, 2021. Annual Report

2021 EVRAZ. Available online at https://ar2021.evraz.com/en, Accessed on August

23, 2022

Filbeck,

A., Filbeck, G., Zhao, X., 2019. Performance Assessment of Firms

Following Sustainalytics ESG Principles. The Journal of Investing, Volume 28(2),

pp. 7–20

Forcadell, F.J.,

Aracil, E., 2017. European Banks' Reputation for Corporate Social

Responsibility. Corporate Social

Responsibility and Environmental Management, Volume 24(1), pp. 1–14

Framework ESG, 2021.

Making sense of ESG ratings and rankings. Available Online at https://frameworkesg.com/wpcontent/uploads/2021/10/FWESG_RatingsRankings2021.pdf?fbclid=IwAR0qJtvQicWXA1KDZoWdOq808Od3CZ6MpC5dogk2RlUeBDdVzp1JzHwjj6E,

Accessed on August 23, 2022

Friede, G., Busch, T.,

Bassen, A., 2015. ESG and Financial Performance: Aggregated Evidence From More

Than 2000 Empirical Studies. Journal of

Sustainable Finance & Investment, Volume 5(4), pp. 210–233

Giese, G., Nagy, Z.,

Lee, L.-E., 2021. Deconstructing ESG Ratings Performance: Risk and Return for

E, S, and G by Time Horizon, Sector, and Weighting. The Journal of Portfolio Management, Volume 47 (3), pp. 94–111

Glencore, 2021. Annual report 2021 Glencore. Available

Online at:

https://www.glencore.com/.rest/api/v1/documents/ce4fec31fc81d6049d076b15db35d45d/GLEN-2021-annual-report-.pdf

Accessed on August 23, 2022

Hübel, B., Scholz, H.,

2020. Integrating Sustainability Risks in Asset Management: The Role of ESG Exposures and ESG Ratings. Journal

of Asset Management, Volume 21(1), pp. 52–69

International Monetary

Fund (IMF), 2019. Global Financial Stability Report: Lower for

Longer. Available Online at

https://www.imf.org/en/Publications/GFSR/Issues/2019/10/01/global-financial-stability-report-october-2019,

Accessed on August 25, 2022

Korneeva, D.V., 2016.

Tasks and Tools of Competition Policy in the Russian Metallurgy Over the Past

Quarter Century. Bulletin of the Moscow

University, Series 6. Economics. Volume 3, pp. 35–67

Koroleva, E., Baggieri,

M., Nalwanga, S., 2020. Company Performance: Are Environmental, Social, and

Governance Factors Important? International

Journal of Technology. Volume 11(8), pp. 1468–1477

MSCI, 2022. MSCI ESG

Ratings Methodology. Available Online at

https://www.msci.com/documents/1296102/21901542/ESG-Ratings-Methodology-Exec-Summary.pdf,

Accessed on August 10, 2022

National Credit Ratings

(NCR), 2022. Methods for Determining Financial Instruments Conformity to

Sustainable Finance Criteria. Available Online at

https://ratings.ru/upload/iblock/8ad/ESG_methodology_170322.pdf, Accessed on

August 25, 2022

Nornickel, 2021. Annual

Report 2021 Nornickel.

Available Online at https://ar2021.nornickel.ru/, Accessed on August 23, 2022

OECD, 2020. ESG

Investing: Practices, Progress and Challenges. Available Online at

https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf,

Accessed on August 25, 2022

Ovechkin, D.V., 2021.

Responsible Investment: Impact of ESG Rating on Firms' Profitability and Expected Return on

the Stock Market. Scientific Journal of NIU ITMO. The

series "Economics and Environmental Management", Volume 1, pp.

43–53

Pishchalkina, I., 2021.

Development of a Reference Model of a Modern Mining and Metallurgical Enterprise. Organizer of production, Volume 29(4), pp. 25–34

Pishchalkina, I.., Tereshko,

E.K., Suloeva, S.B., 2021. Quantitative Risk Assessment of

Investment Projects Using Digital Technologies. Economics, Volume 14

(3), pp. 125–137

Pyykkö, H., Hinkka, V.,

Uotila, T., Palmgren, R., 2021. Foresight-driven Approach to Support the Proactive

Adaptation of Future Sustainability Related Regulatory Frameworks: European

Port Cluster Study. International Journal

of Technology. Volume 12(5), pp. 914–924

RUSAL, 2021. Annual Report 2021 RUSAL.

Available Online at https://rusal.ru/upload/iblock/91c/9bfpx677dtz6sv6x38r7to0zh37pv5cy.pdf,

Accessed on August 23, 2022

Rybak, J., Gorbatyuk,

S.M., Bujanovna-Syuryun, K.C., Khairutdinov, A.M., Tyulyaeva, Y.S., Makarov,

P.S., 2021. Utilization of Mineral Waste: A Method for Expanding the Mineral

Resource Base of a Mining and Smelting Company. Metallurgist, Volume 64, pp. 851–861

S&P Global, 2020.

Methodology for the Analysis of Environmental, Social and Management Risks.

Available Online at

https://www.spglobal.com/_assets/documents/ratings/ru/pdf/esg_evaluation_analytical_approach_russian.pdf,

Accessed on August 10, 2022

S&P Global, 2021.

ESG Credit Indicator Report Card: Metals and Mining. Available Online at

https://www.sustainalytics.com/esg-rating/vale-sa/1008752471?, Accessed on

August 10, 2022

Salama, A., Anderson,

K., Toms, J.S., 2011. Does Community and Environmental Responsibility Affect

Firm Risk: Evidence from UK Panel Data 1994–2006. Business Ethics: A European Review, Volume 20 (2), pp. 192–204

Sassen, R., Hinze, A.,

Hardek, I., 2016. Impact of ESG Factors on Firm Risk in Europe. Journal of Business Economics, Volume

86(8), pp. 867–904

Segura-Salazar, J.,

Tavares, L.M., 2018. Sustainability in the Minerals Industry: Seeking a

Consensus on Its Meaning. Sustainability, Volume 10, 38 pp.

Severstal, 2021. Annual

Report 2021 Severstal.

Available Online at

https://severstal.com/upload/iblock/190/Annual_Report_2021_RUS.pdf, Accessed on

August 23, 2022

SustainAbility, 2020.

Rate the Raters 2020: Investor Survey and Interview Results. Available Online

at https://www.sustainability.com/thinking/rate-the-raters-2020/, Accessed on

August 23, 2022

Sustainalytics, 2018.

The ESG Risk Ratings Moving up the Innovation Curve. Available Online at https://connect.sustainalytics.com/hubfs/INV%20-%20Reports%20and%

20Brochure/Thought%20Leadership/SustainalyticsESGRiskRatings_WhitePaperVolumeOne_October%202018.pdf,

Accessed on August 09, 2022

Vale S.A., 2021. Annual

report 2021 Vale S.A. Available Online at http://www.vale.com/EN/investors/information-market/annual-reports/20f/Pages/default.aspx,

Accessed on August 23, 2022