An Evaluation of the State of the Top-Priority and Socially Important Industries of Russian Regions: an Analysis Based on Digital Tax Calculator Data

Corresponding email: viktorova_ng@spbstu.ru

Published at : 17 May 2024

Volume : IJtech

Vol 15, No 3 (2024)

DOI : https://doi.org/10.14716/ijtech.v15i3.6163

Victorova, N., Vylkova, E., Naumov, V., Pokrovskaia, N., 2024. An Evaluation of the State of the Top-Priority and Socially Important Industries of Russian Regions: an Analysis Based on Digital Tax Calculator Data. International Journal of Technology. Volume 15(4), pp. 732-742

| Natalia Victorova | Peter the Great St.Petersburg Polytechnic University, St. Petersburg, 195251, Russia |

| Elena Vylkova | North-West Institute of Management, branch of RANEPA, St. Petersburg, 199178, Russia |

| Vladimir Naumov | North-West Institute of Management, branch of RANEPA, St. Petersburg, 199178, Russia |

| Natalia Pokrovskaia | Saint Petersburg State University, St. Petersburg, 199034, Russia |

The

paper uses the data of digital tax burden calculator of Russia’s Federal Tax

Service to study the determinants of the total tax burden and average salary on

the example of St. Petersburg for year 2020 with enterprises broken down by

size and types of economic activity and with the focus on top-priority and

socially important industries. Therefore, this study aims to

provide a mathematical substantiation

for the need to improve state support measures provided

for top-priority or socially important types of activities in

the region using

taxation means and methods. The objectives set

were achieved using

simulation modeling.

The dependent variables that

characterize the state support of the top-priority and socially important types

of activities are the rate of tax burden (excluding mineral tax and excise

taxes) and the size of the average salary. Moreover,

two analyses were conducted

sequentially to achieve the objectives. The first was a two-way analysis of variance of the relationship

between the average salary and the size of the organization or industry as well as the dependence of tax burden

on the same factors. The second was a one-way analysis of the

variance of the tax burden and

average salary depending on different types of activities as well as the scale of the

enterprise. The results of the one-way analysis were refined through regression methods based on dummy variables. It

was observed that there were no

considerable differences between the average salary and total tax burden in

top-priority or

socially important sectors compared to the other industries in

the economy. The trend was the

evidence of insufficient support provided by the state and the

need to introduce additional

preferences.

Digital tax calculator; Priority industry; Socially important industry; Tax burden

Sustainable development of territories is the problem with many aspects (Zaborovskaya, Kudryavtseva, and Zhogova, 2019), which depend on the conditions in various regions (Shestak, Shcheka, and Klochkov, 2020; Skripnuk, 2020), including their industry specifics (Gamidullaeva et al., 2022; Rodionov, Konnikov, and Konnikova, 2018). Advancements in digital technologies (Victorova et al., 2021; Rytova et al., 2020) are observed to be significantly transforming the set of tools used for the sustainable development of regions (Kudryavtseva, Skhvediani, and Berawi, 2020). Meanwhile, the crises and global challenges (Borisov and Popova, 2022; Pinskaya, Steshenko, and Kermen, 2021) are affecting the initial objective and method to achieve the development (Leksin and Porfiryev, 2017). This shows the need to determine the appropriate methods of improving the state policy aimed at the developing any given territory. An example of relevant policy implemented is the stimulation of the top-priority or socially important industries in a region through public-private partnerships (Berawi et al., 2021). However, the measurement of the effectiveness of the support requires selecting relevant indicators and assessment criteria.

The success of

regional socioeconomic development depends on a variety of factors.

These include tax burden and average salary, which signal the economic

capabilities of the territory and its population for implementing social

projects and meeting social needs. It is generally believed that an

increase in tax burden worsens the possibility of socioeconomic development

while a higher average salary provides a positive influence.

In order to

substantiate the stated position, the findings of modern publications

concerning 1) tax burden as an

indicator of state regulation and 2) average salary to represent the success of

economic entities in a top-priority or socially important sector of the economy

are briefly reviewed and summarized.

1) Scientific studies have been discussing various aspects of tax burden since the early 20th century. In the

1970s, scholars started to profoundly compare the tax burden in

different countries. This was observed in the application of GDP (Karagianni, Pempetzoglou, and Saraidaris, 2012; Jedrzejowicz,

Kiss, and Jirsakova, 2009) and different types of effective rates (Celikay, 2020; Shevlin, Shivakumar, and Urcan, 2019) as indicators. Meanwhile, the

average effective rates are determined in taxing many factors such

as capital, consumption, labor, and others (Wu, Wang, and Peng, 2024). The general idea is to determine the ratio of the calculated taxes to

the taxation base and a specific methodology is devised to select the data for

the numerator and denominator (Nicodeme,

2007; Carey and Rabesona, 2003). Similarly, the tax burned is also estimated for territories

inside the country (Dang, Fang, and He, 2019).

Few studies were observed

to have considered tax burden as a measure of possibilities of business in a

region such as Latin America (Hallerberg,

and Scartascini, 2017),

Russia (Victorova et al., 2020), and other countries (Celikay, 2020; Park, 2020; Jedrzejowicz, Kiss, and

Jirsakova, 2009; Nicodeme, 2007). Only a few publications compared industry-specific taxation of different businesses (Rota-Graziosi, and Sawadogo, 2022; Carey and Tchilinguirian,

2000) while other studies

frequently focused on discussing the factors of production rather than a

specific industry (Karminskaya and

Islamutdinov, 2021) or

the situation of a specific company (Pan,

Huang, and Jin, 2024; Berawi et al., 2022). This leads to the conclusion that there is no

comprehensive study on the problems related to tax burden.

2) Another indicator of the socioeconomic development of a

region is the average salary size which has also been widely covered in many

publications by economists. The review of relevant literature showed two areas

considered quite problematic. Firstly, the analysis and assessment of the

impact of average monthly salary on the socioeconomic development of a

territory as a whole, and second, the effect on the development of top-priority

or socially important types of activities in the territory.

The study by Karminskaya and

Islamutdinov (2021) can be referred as an example of the first group of

research. The scholars focused on econometric analysis of the impact of human

capital, specifically in higher and vocational education, on the economic

development of a region. The results showed that a higher average monthly

salary was one of the key factors of the development. The concept has also been

proposed to represent the competitiveness of a territory. For example, Shavandina et al. (2021) discussed the context in RF

municipalities while Wojtasiak-Terech

and Majerowska (2019) analyzed the Polish case using taxonomic methods and suggested a

composite competitive indicator for each province.

An example of the second group of research is Volkov et al. (2022) which proposes to increase the average salary

indicator in the context of attracting young personnel in the agro-industrial

complex of a region. Cantillo et

al. (2022) also

showed the effect of salary on the jobs selected based on manpower in the

formal or informal sector of the economy in the Caribbean region of Columbia.

The scholars concluded conclude that the

attractiveness of a formal job depended directly on the pay raise in this

sector to a level not less than the minimum wage in the region.

The average salary of formal employees was found to be part of the

factors affecting the development of franchising in Brazilian towns (Melo et al., 2021). This was confirmed through a simulation

conducted using a multiple regression method to prove the connection between

the analyzed indicators.

Junusbekov et al. (2020) made an important conclusion concerning the

change in the form of labor remuneration in Kazakhstan using a statistical

analysis to determine the data dynamics of average salary in all regions of the

country. Chinese scholars, Liu et

al. (2021), also provided a

non-conventional and quite interesting observation in the process of discussing

the problem of market diversification in regions with private foreign

subsidiaries. The results showed that average salary was an influential but

insignificant parameter on Tobin’s Q.

The summary showed that several scientists have focused on indicators such as the size of tax burden and average salary to assess the impact of the state regulating function on the development of a region as a whole and concerning the top-priority or socially important industries. However, there was no comprehensive approach to apply these two indicators for assessment in contemporary studies. Therefore, the goal of this study was to analyze and evaluate the effect of the state policy on top-priority or socially important types of activities in a region using official digital resource data. It was also used to provide recommendations on the improvement of state support measures for the identified economic sectors using tax methods. Two hypotheses were formulated and the first was that tax burden and the average salary were influenced by the type of enterprise (its size) operating in the top-priority or socially important sectors of the region. The second was to confirm the impact on similar indicators of the industry specifics.

The

study was conducted using tax burden calculator data obtained from the RF

Federal Tax Service. This source is normally used to calculate the tax burden

for organizations based on the percentage of the earnings and the average

salary. The four measurements often used include the tax period, region in

Russia, industry, and scale of activity. Therefore, the simulation was

conducted using some factors characterizing the state support for top-priority

or socially important types of activity as the dependent variables. These

include tax burden, excluding those related to mineral and excise, and the

level as well as the average salary and the size.

1. Tax period selection: The data

covered up to the date of the study using those available for 2018, 2019, and

2020.

2. Region selection: The region

selected is St. Petersburg which is a federal city in Russia. The preference

for the region at the initial stage was due to the status as the home to

enterprises engaging in a wide range of activities and producing socially

significant products, works, and services. It was also selected due to the

presence of legally established priorities for the development of certain

sectors of the economy considered significant for both the region and the

country as a whole with a focus on the year 2020.

3. Industry selection: The activities classified as top-priority or

socially important in the economic sectors of regions in Russia. Some have been

listed in scientific literature but those identified in St. Petersburg

legislation include the production of food, clothing, machinery, and equipment

not otherwise classified, manufacture of other vehicles and equipment, erection

of buildings, specialized construction works, information technology,

employment and recruitment, as well as health care. The preference for socially

important activities was due to their critical importance in providing basic

human needs. Moreover, top-priority activities were selected for this study

based on the St. Petersburg legislation and these include others not listed

among socially important ones.

4. Scale of activity

differentiation: The types of enterprises considered independently included

micro-enterprise (revenue up to 30 million rubles), micro-enterprise (revenue

from 30 to 120 million rubles), small business (revenue from 120 to 500 million

rubles), small business (revenue from 500 to 800 million rubles), medium-sized

enterprise (revenue from 800 to 2000 million rubles), and large enterprise

(over 2000 million rubles). When the results were described, the scale of

activity was characterized based on earnings. This indicator was used in the

Tax Calculator Database and was also considered in the tax burden. Therefore,

the differentiation of the business based on the size of revenue was

specifically suitable for this study. After an observation with gaps had been

excluded, a dataset of 63 observations was considered to be used.

The summary of the results for the two-factor

dispersion analysis is presented in this section. Those related to average

salary are presented in Figure 1 while those for total tax burden are in Figure

2.

Figure 1 Average salary response

Figure 2 Tax burden response

The first model showed a

significant difference in the average salary for the two factors under

consideration based on Fisher's criterion but only found in the first factor

for the second model. The two-way analysis of variance also confirmed the

existence of a statistical difference in average wages and tax burden for the

observed groups with different types of enterprises and activities. Moreover,

significant differences were also identified in the average tax burden but only

based on the type of activity.

One-way analysis of variance results for the

tax burden related to the "type of activity" factor are presented in

Figures 3 and 5. It was observed that the

type of activity affected the average value of the cumulative load with a

significance level of < 0.001. One-factor dispersion analysis results for

the average salary on the “type of activity” factor are presented in Figures 4

and 6.

Figure 3 Assessed marginal means for tax burden based on industry

Figure 4 Assessed marginal averages for average salary based on industry

Figure 5 Criteria for intergroup effects of tax burden based on industry

Figure 6 Criteria for intergroup effects of average salary based on industry

The

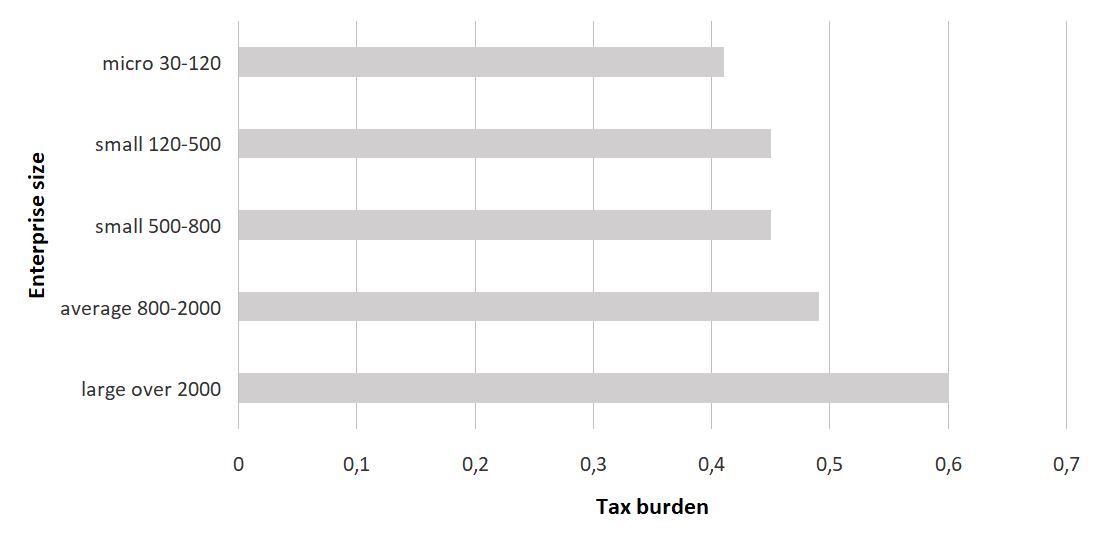

results of a one-way analysis of variance for the tax burden on the

"enterprise scale" factor are presented in Figures 7 and 9. It was

observed that the statistical hypothesis about the difference in the average response

value depending on the analyzed factor.

The results of the one-factor dispersion

analysis for tax burden on the “type of activity” factor are presented in

Figures 8 and 10. It was discovered there were no statistically significant

differences in the average value of the tax burden.

Figure 7 Assessed marginal averages

of average salary based on enterprise size

Figure 8 Assessed marginal averages of tax burden based on enterprise size

Figure 9 Criteria for intergroup effects for average salary based on the scale of

activity

Figure 10 Criteria for intergroup effects for tax burden based on the scale of

activity

The summary of the results

obtained from a one-way analysis of variance is presented in the following

Table 1. The presence of the factor effect was represented by yes while the

absence was stated as no.

Table 1 Results of one-way analyses of variance

|

Factor |

Response |

|

|

Average Salary |

Tax burden |

|

|

Scale of activity (Type) |

Yes/yes |

No/no |

|

Type of activity (Industry) |

No/no |

Yes/yes |

The hypotheses were further analyzed to solve the

problems of nonparametric analysis of variance using the Kruskal-Walli’s test

and the results were presented in the table through the "/" sign. The

consistency observed in the results as well as the assumptions on the normal

law of response distribution according to the Shapiro-Wilk test for the first,

second, and fourth models were used to confirm the conclusions provided.

The table showed that the

average salary value was predetermined by the scale of the enterprise while the

tax burden for top priority or socially significant areas of activity depended

on the specific type of activity. However, there were no significant

differences in wages based on the type of activity and in total tax burden

based on the type of enterprise. This showed the provision of insufficient

state support primarily required by small and medium-sized enterprises.

The third stage focused on using regression analysis and dummy variables to investigate the changes in average response level in line with the level of the factors for the two scenarios. The results showed significant differences in the average response values depending on the scale of the enterprise as well as in tax burden based on the type of activity. This was due to the fact that the variance and regression analyses were special cases of a linear stochastic model. Moreover, the values generated for the dummy variables represented the contrast of each factor level with the base. It was also observed that the variables were only in the unit values in the generated encoding scheme. Therefore, the coefficients in the regression model were used to show the main effect of the corresponding level on the base. The results obtained from the multiple linear regression model of the dependence of average wages on the scale of the enterprise are summarized in the following Figure 11.

The "Average"

enterprise type was used as the base level through alphabetical ordering.

Therefore, the average salary level for the enterprise was recorded to be

60,567 rubles while those considered to be large had 34,195 rubles. This showed

that the average was 94,760 rubles and the lowest level was observed among

microenterprises. The results further showed that four out of the six

coefficients in the model were significantly different from zero. Moreover, the

good quality of the model was supported by the value of the coefficient of

determination, the Fisher's criterion, as well as confirmation of the normal

distribution of residuals according to the Shapiro test.

The summary of the tax burden response to the type of activity is presented in Figure 12. The results showed that clothing production was adopted as the base level and the tax burden was 8%. Therefore, the lowest was found in food production with 0.08 + 0.07 = 0.15 which was approximately 15%. The quality of the model was also confirmed by the value of the corresponding metrics and the results of the tests conducted on the hypotheses based on the normal distribution of residuals according to the Shapiro test.

Figure 12 Summary of the response to the tax burden based on

the type of activity

An

increase in average salaries based on the scale of business was substantiated

by the financial capabilities of enterprises. This showed that the earnings

from sales of products, services, and works as well as the type of activity

could increase the financial potential of an enterprise in covering all

expenses necessary for statutory activity, including wages. Moreover, official

salaries tended to grow when insurance premiums were designed for the types of

activities considered important for the state. For example, the IT field has an

insurance premium rate incentive of 7.6% compared to the usual 30% for other

categories of payers. The reduction in the insurance premium burden was also

observed to have converted all wages into official turnover.

The

lack of significant differences between the salary and total tax burden of

top-priority or socially important economic sectors compared to the other

sectors shows that the support being provided by the state is insufficient and

additional tax preferences should be introduced. It is specifically proposed

that the rate of insurance premiums be reduced and the income tax paid by

employees be reimbursed, in line with the method applied for enterprises in the

IT sector. The changes are expected to affect all the IT companies in every

region of the country. Therefore, the list of top-priority or socially

important types of economic activity is required to be selected carefully.

The

effectiveness of using only tax instruments as support for the sector by the

state compared to other forms of incentives is considered debatable. For

example, Iranian scientists (Ghazinoory

and Hashemi, 2020) proved

that direct government financing of high-tech firms, specifically those related

to small and medium-sized businesses, was more effective than tax incentives.

Meanwhile, Chinese scholars (Wang, Yuan,

and Xu, 2022) also analyzed the impact of government subsidies and preferential tax policies

on mobile phone recycling activities and concluded that tax incentives led to

an increase in production and profits. The variation in these results shows the

need for a more in-depth on the impact of both tax and other government support

instruments on the development of top-priority or socially significant sectors

of the economy in the region.

In

conclusion, the hypotheses formulated were only confirmed partially and this

was observed from the first hypothesis which was true

only for the average salary in the region which was affected by the size of the

enterprise. The second hypothesis was also confirmed for only one of the

analyzed indicators which was observed from the dependence of tax burden on

industry specifics. However, the limitations of the study included the lack of

special tax regimes for IT companies, the specifics of St. Petersburg as a

region of Russia, and the regional structure of the country as a whole. The

digital calculator of tax burden provided the data used in formulating

well-reasoned recommendations on the improvement of state support measures for

the top-priority or socially important types of activities. Moreover, tax

methods were used based on the assessment and analysis of the effects of the

state policy on the development of the selected economic sectors. Future study

on St. Petersburg can be continued in the context of longer time horizons. It

is also recommended that a similar study be extrapolated to other Russian

regions and territorial entities of different countries. Furthermore, the

methodological approach described in this study can be applied to other Russian

regions and territories of foreign states. The purpose of these individual

scientific studies is to provide detailed substantiation and concretization of

proposals for tax innovations in top-priority or socially important sectors of

a territorial entity.

The study was financed as part of

the "Development of a methodology for instrumental base formation for

analysis and modeling of the spatial socio-economic development of systems

based on internal reserves in the context of digitalization" project

(FSEG-2023-0008).

| Filename | Description |

|---|---|

| R1-IE-6163-20230918124232.pdf | --- |

Berawi, M.A., Putri, C.R., Sari, M., Salim,

A.V., Saroji, G., Miraj, P., 2021. Infrastructure Financing Scheme Towards

Industrial Development. International

Journal of Technology, Volume 12(5), pp. 935–945

Berawi, M.A., Sari, M., Salsabila, A.A.,

Susantono, B., Woodhead, R., 2022. Utilizing Building Information Modelling in

the Tax Assessment Process of Apartment Buildings. International Journal of Technology, Volume 13(7), pp. 1515–1526

Borisov, G.V., Popova, L. V., 2022. Russian

intra-industry trade: Trends in recent decades. St Petersburg University Journal of Economic Studies, Volume 38

(2), pp. 153–185

Cantillo, T., Cantillo, V., Garcia, L.,

Cantillo-Garcia, V., 2022. Uncovering the Wage Differential Between Formal and

Informal Jobs: Analysis from the Colombian Caribbean region. Latin American Economic Review, Volume

31, pp. 1–25

Carey, D., Rabesona, J., 2003. Tax Ratios

on Labour and Capital Income and on Consumption. OECD Economic Studies, Volume 2002 (2), pp. 129–174

Carey, D., Tchilinguirian,

H., 2000. Average Effective Tax Rates on Capital, Labour and Consumption. OECD Economics Department Working Papers,

No. 258, OECD Publishing, Paris

Celikay, F., 2020. Dimensions of Tax Burden: a

Review on OECD Countries. Journal of Economics, Finance and Administrative

Science, Volume 25(49), pp. 27–44

Dang, D., Fang, H., He, M., 2019. Economic

Policy Uncertainty, Tax Quotas and Corporate Tax Burden: Evidence from China. China Economic Review, Volume 56, p.

101303

Gamidullaeva, L., Shmeleva, N., Tolstykh, T.,

Shmatko, A., 2022. An Assessment Approach to Circular Business Models Within an

Industrial Ecosystem for Sustainable Territorial Development. Sustainability, Volume 14(2), p. 704

Ghazinoory, S., Hashemi, Z., 2020. Do Tax Incentives and Direct Funding

Enhance Innovation Input and Output In High-Tech Firms? The Journal of High Technology Management

Research, Volume 32(1), p. 100394

Hallerberg, M., Scartascini, C., 2017. Explaining Changes In Tax Burdens In Latin America: Do Politics

Trump Economics? European Journal of Political

Economy, Volume 48, pp. 162–179

Jedrzejowicz, T., Kiss,

G., Jirsakova, J., 2009. How to Measure Tax Burden in an Internationally

Comparable Way? NBP Working Papers,

Volume 56, p. 35

Junusbekov, M., Ydyrys, S., Munassipova, M.,

Almukhambetova, B., Zhetibayev, Z., 2020. Salary Structure

Optimization in Business Sector Organizations: A Case Study of

Kazakhstan. Academy of Entrepreneurship

Journal, Volume 26 (2), pp. 1–71

Karagianni, S., Pempetzoglou, V., Saraidaris,

A., 2012. Tax Burden Distribution and GDP Growth: Non-Linear Causality

Considerations in The USA. International Review of

Economics & Finance, Volume 21 (1), pp. 186–194

Karminskaya, T., Islamutdinov, V., 2021.

Influence Of Higher and Vocational Education on The Economic Development of The

Khmao-Yugra Region. Economy of

Region, Volume 17(2), pp. 445–459

Kudryavtseva, T., Skhvediani, A., Berawi, M.A.,

2020. Modeling Cluster

Development Using Programming Methods: Case of Russian Arctic Regions. Entrepreneurship and Sustainability,

Volume 8 (1), pp. 150–176

Leksin, V., Porfiryev, B., 2017. Socio-Economic

Priorities for the Sustainable Development of Russian Arctic Macro-Region. Economy of Region, Volume 4, pp. 985–1004

Liu, Y., Gong, J.-W., Yu, T., Jin, M., 2021.

Impact of Governance Structure of Private Multinational Enterprises on

Corporate Performance: Based on the Moderating Effect of the Diversification of

Enterprises' Regional Market. Journal of

Northeastern University, Volume 42 (2), pp. 290–299

Melo, P.L.D.R., Borini, F.M., Isaac, V.R.,

Correa, V.S., 2021. Regional Development and The Institutional Environment for

Franchise Chains: Frontiers of Small and Medium-Sized Cities. Competitiveness

Review: An International Business Journal, Volume 33(2), pp. 419–440

Nicodeme, G., 2007. Comparing Effective

Corporate Tax Rates. Frontiers in Finance

and Economics, Volume 4 (2), pp. 102–131

Pan, C., Huang, Y., Jin, L., 2024. Natural Disasters and Corporate Tax Burden: Evidence From

Chinese Energy Sector. Energy Economics, Volume 130, p. 107322

Park, S.H., 2020. Tax Burdens in Japan and South

Korea: Measurement Using Average Effective Tax Rates. Social Science Japan Journal, Volume 23 (1), pp. 37–64

Pinskaya, M., Steshenko, Y., Kermen, 2021. Tax Support During Coronavirus

Crisis: Whom To Help? Voprosy Ekonomiki, Volume 2021(5), pp. 129–144

Rodionov, D., Konnikov, E., Konnikova, O., 2018. Approaches to Ensuring the

Sustainability of Industrial Enterprises of Different Technological Levels. Journal of Social Sciences Research,

Volume 3, pp. 277–282

Rota-Graziosi, G., Sawadogo, F., 2022. The Tax Burden on Mobile Network Operators In Africa. Telecommunications Policy, Volume 46 (5), p. 102293

Rytova, E., Verevka, T., Gutman, S., Kuznetsov, S.,

2020. Assessing the

Maturity Level of the Digital Government of Saint Petersburg. International Journal of Technology,

Volume 11(6), pp. 1081–1090

Shavandina, I., Ilicheva, O., Kutaeva, T.,

Shamin, A., Kozlov, V., 2021. Social and Economic Development of Municipal

Areas in the Russian Federation. Lecture

Notes in Networks and Systems, Volume 205, pp. 831–843

Shestak, O., Shcheka, O.L., Klochkov, Y., 2020.

Methodological Aspects of Use of Countries Experience in Determining he

Directions of The Strategic Development of The Russian Federation Arctic

Regions. International Journal of

System Assurance Engineering and Management, Volume 11, pp. 44–62

Shevlin, T., Shivakumar, L., Urcan, O., 2019.

Macroeconomic Effects of Corporate Tax Policy. Journal of Accounting and Economics. Volume 68 (1), p. 101233

Skripnuk, D., 2020. Analysis of The Regional

Modernization Processes in a Global Context With an Example of The Russian

Northern Regions. International

Journal of System Assurance Engineering and Management, Volume

11, pp. 100–110

Victorova, N., Rytova, E., Koroleva, L.,

Pokrovskaia, N., 2020. Determinants of Tax Capacity for a Territory (The Case of the Russian

Federal Districts). International Journal

of Technology, Volume 11(6), pp. 1255–1264

Victorova, N., Vylkova, E., Naumov, V.,

Pokrovskaia, N., 2021. The Interrelation between Digital and Tax Components of

Sustainable Regional Development. International

Journal of Technology, Volume 12(7), pp. 1508–1517

Volkov, V.I., Zueva, O.N.,

Nabokov, V.I., Nekrasov, K.V., 2022. Problems Of Providing Qualified

Personnel for The Agricultural Complex of The Region. In: Proceedings of the IOP Conference

Series: Earth and Environmental Science, Volume

949(1), p. 012062

Wang, G., Yuan, M., Xu, H.,

2022. The Impact of Subsidy and Preferential Tax Policies on

Mobile Phone Recycling: a System Dynamics Model Analysis. Waste Management. Volume

152, pp. 6–16

Wojtasiak-Terech, A., Majerowska, E., 2019. The

Competitiveness of Regions in Poland in 2009–2016. In: Springer

Proceedings in Business and Economics. International Conference on Finance and

Sustainability, ICFS 2019, pp. 237–248

Wu, H., Wang, L., Peng, F., 2024. Does It Pay

to Be Green? The Impact of Emissions Reduction On

Corporate Tax Burden. Journal of Asian Economics, Volume 91, 101707

Zaborovskaya, O., Kudryavtseva, T.,

Zhogova, E., 2019. Examination of Mechanisms of Regional Sustainable

Development Strategy as Exemplified by the Leningrad Region. International Journal of Engineering and

Advanced Technology, Volume 9(1), pp.

5065–5076