Forecasting the Timing of the Emergence of a Dominant Design: The Case of the Projectors

Published at : 25 Jan 2024

Volume : IJtech

Vol 15, No 1 (2024)

DOI : https://doi.org/10.14716/ijtech.v15i1.6068

Masuda, K., Haruyama, S., 2024. Forecasting the Timing of the Emergence of a Dominant Design: The Case of the Projectors. International Journal of Technology. Volume 15(1), pp. 138-153

| Koji Masuda | Graduate School of Science and Technology for Innovation, Yamaguchi University, 2-16-1 Tokiwadai, Ube, Yamaguchi, 755-8611, Japan |

| Shigeyuki Haruyama | Graduate School of Innovation and Technology Management, Yamaguchi University, 2-16-1 Tokiwadai, Ube, Yamaguchi, 755-8611, Japan |

The timing of

market entry is important for companies to achieve commercial success. The

relationship between good market entry timing and the emergence of a dominant

design was discussed. However, the dominant design was assumed to be known only

in retrospect. In this study, targeting the projector industry, we demonstrate

that the timing of the emergence of the dominant design can be forecast in

advance by deriving the time relationship between product launch and patent

application. The emergence of dominant designs and the timing of their

emergence were identified based on the analysis of product trends in the

market. The timing of the patent application that the dominant design will

emerge was forecast based on the analysis of technology trends using patent

information. The cycle type of the projector industry was considered, and the

time lag between patent application and product launch was inferred. This study

provides a useful insight into the dominant design.

Dominant design; Patent analysis; Process innovation; Product innovation; Projector

Companies are expected to create innovations to survive and maintain competitiveness in the market (Berawi, 2021). They comprehend their customers' needs, develop new products that fulfill the desired value, and subsequently introduce these products to the market. When customers find satisfaction in the value of the product, the company, in turn, captures value (Kotler and Armstrong, 2011). In this way, commercial success is achieved.

The market entry of innovative products significantly

changes the competitive environment (Gerken, Moehrle, and Walter, 2015) and requires firms to

improve their business, product, and process development (Taleb and Pheniqi, 2023). The timing of a new

market entry is a strategic decision for firms, and its timeliness is crucial

to forming a competitive advantage (Tatiana and Mikhail, 2020; Suarez, Grodal, and Gotsopoulos, 2015).

Several researchers have studied the order of entry for first movers and latecomers, and a variety of findings are known: whether early or late entry is more advantageous depends on firm-specific characteristics (Lieberman and Montgomery, 1988); newcomers are more likely to gain market share with early entry, while incumbents are more likely to perform better if they wait while newcomers test the markets (Mitchell, 1991); early entry during the growth phase of the industry life cycle is helpful for survival, but is detrimental during the maturity phase (Agarwal, Sarkar, and Echambadi, 2002). However, these studies are based on relative time order - earlier or later.

In contrast, with respect to the specific time, several previous studies

disclose the timing of entry. Entry was particularly advantageous during a

window just before the emergence of a dominant design (Christensen, Suarez, and Utterback, 1998). The firms that

ended up capturing the new market appeared just when the dominant design was

about to emerge (Markides

and Geroski, 2004). In the concept of a dominant category, firms that enter during the time

window between the emergence of the dominant category and the emergence of a

dominant design tend to perform better than firms that enter during other

phases (Suarez,

Grodal, and

Gotsopoulos, 2015). A good time for market entry is when. At

least, it’s common knowledge that it precedes the emergence of a dominant

design (Baum et

al., 1995; Suarez and Utterback, 1995).

Suppose the

timing of market entry can be identified early and with high probability. In

that case, companies will be closer to commercial success by developing and

implementing strategies to coincide with the timing of market entry.

The emergence of a dominant design and the timing of

its emergence

What is a dominant

design? Utterback

(1994) defined that a dominant design was the one that won the allegiance of the

marketplace. Anderson

and Tushman (1990) defined a dominant design as a single configuration or a narrow range of

configurations that accounted for over 50 percent of new product sales or new

process installations and maintained a 50 percent market share for at least

four years. Moreover, Koski and Kretschmer (2007) stated that horizontal and vertical innovations that

were imitated widely by competitions form a dominant design. Thus, the

emergence of a dominant design is a situation in which a certain design is

widely recognized in the market at a certain time, and the timing itself is

nothing other than the timing of its emergence.

The emergence of a

dominant design is analyzed from the perspective of markets and products. Utterback (1994) discussed the

emergence of dominant designs from the entries and exits of firms in the market

for eight cases, including the manual typewriter and automobile industries. Srinivasan, Lilien, and Rangaswamy (2006)

constructed case histories for each product category’s evolution for 63

office products and consumer durables and then identified if and when a

dominant design emerged. Koski and Kretschmer (2007) discussed the dominant design in mobile telephony

based on the development of design and features from product information.

Similarly, Cecere,

Corrocher, and

Battaglia (2015) analyzed the

emergence of the dominant design in smartphones by focusing on the evolution of

product characteristics. Huenteler et al. (2016) showed the emergence of dominant designs for solar PV

by market share of different designs and for wind power by the share of firms

with different designs active in the market. The number of firms, product

development and evolution, and share of designs, which previous researchers

used as factors in their analysis, are observed as a result after firms and

products have appeared on the market. Dominant designs can only be known in

retrospect (Anderson

and Tushman, 1990), and it is doubtful that they can be recognized except in retrospect (Utterback, 1994).

On the other hand,

from the perspective of technology and invention, there are prior studies

concerning the emergence of a dominant design that focuses on patent

information. Clymer

and Asada (2008) demonstrated the emergence of dominant designs for each firm based on the

number of patents in nine categories for inkjet printers. Brem, Nylund, and Schuster (2016) evaluated whether a

dominant design existed in a certain patent class during a certain year,

focusing on the percentage of patents that cited the same patent in a patent

class. Ishii, Kaminishi, and Haruyama (2021), Ishii et al. (2019) illustrated the

emergence of dominant designs by investigating the innovation of products and

processes using the number of patents from Japanese patent classification for

inkjet printers and projectors.

It is generally

accepted that patents represent a significant indicator of research and

development activities and innovation for companies (Rocheska et al., 2017; Griliches,

1998). Inventions are filed as patents, generally published after 18 months, and

some are granted. An innovative product is developed using the invention,

offered to the market, and positioned as a dominant design through wide market

recognition. Therefore, if it takes several years to several decades from the

time when analyzable published patent information is available to when the

dominant design emerges, we believe that we can forecast the emergence of the

dominant design and the timing of its emergence with high probability during

this period.

In the previous study, the analysis of patent information indicated the emergence of a dominant design, but it has not been specifically verified whether a dominant design had really emerged in the market. Ishii, Kaminishi, and Haruyama (2021) identified the emergence of a dominant design in a product launched three years after the timing of the emergence forecast by the patent analysis, one of which was the world's first laser light source projector. However, whether the product is appropriate as the emergence of dominant design in light of the definition by the previous researchers has not been fully discussed.

The purpose of this study is to answer the question of whether the timing of the emergence of a dominant design cannot be forecast. If so, companies can gain a competitive advantage and increase their chances of commercial success by entering the market before the timing of its emergence. The analysis proceeds as follows. From the market and product perspectives, we identify whether a dominant design emerged and when it emerged. Next, from the technology and invention perspectives, we apply patent analysis to forecast the emergence of the dominant design and the timing of its emergence. We then use the actual identified results and the forecast results to clarify the issues and consider their validity.

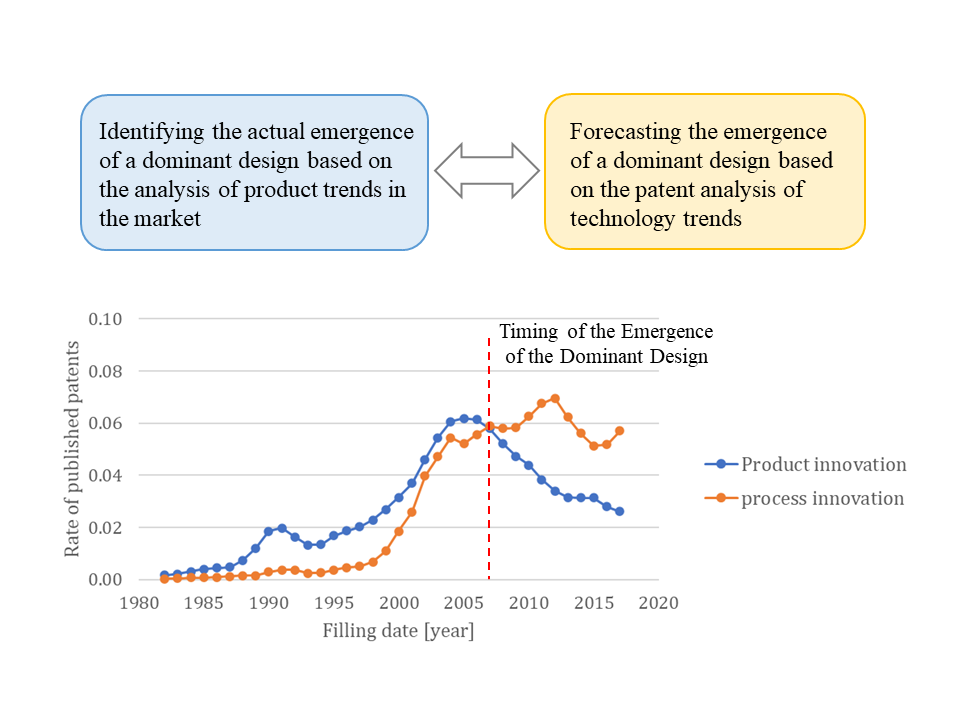

The analysis was

conducted in three steps: selecting a product category, identifying the actual

emergence of a dominant design based on the analysis of product trends, and

forecasting the emergence of a dominant design based on the analysis of

technology trends. Figure 1 shows the three-step process in this study. In the

first step, a product category that has reached the mature stage of its product

life cycle was selected as the analysis target. This is because it can be

assumed that a dominant design has already emerged. In the next step, a large

number of products introduced to the market by each company were investigated,

and their product trends were analyzed. Based on the trend analysis, the

emergence of a dominant design was identified, i.e., the product attributes

that were widely recognized in the market and the timing of its emergence. In

the last step, some patent information on the product was extracted, and their

technology trends were analyzed. Based on the trend analysis, the timing of the

emergence of a dominant design was forecast.

3.1.

Selecting a product category

Focusing on the

projector industry, we considered the specific segment to be analyzed. When

trying to identify product attributes that were widely recognized in the

market, product type and brightness were thought to have a particularly large

impact on product design in projectors. These two product perspectives, along

with market share information, were used to select the segment.

Figure 1 Three-step process for forecasting the timing

of the emergence of a dominant design

3.2.

Identifying a

dominant design based on the perspective of markets and products

Koski and Kretschmer (2007) discussed the emergence of a dominant design

from the perspective of vertical and horizontal innovation, focusing on the

design and features of cellular handsets. In the product category of projectors

selected above, we considered that product selection at the time of purchase

was influenced by the average acceptability of all users, whereas

consumer-oriented products such as cell phones emphasize the preferences of

individual users. In this analysis, we focused on the design and features

related to the core benefits that the product category provides to its users,

with particular attention to the perspective of vertical innovation.

In this section, the following procedure was

used for the analysis. First, we selected product attributes that represent

fundamental and essential design features from the user's viewpoint. Second,

the coefficient of variation and coverage were evaluated as indicators

according to the characteristics of the attributes, and the evolution of their

attributes was analyzed. Third, the actual emergence of a dominant design as a

product category was identified based on when each attribute was a dominant

design.

The

attributes were divided into quantitative and binary attributes. The

quantitative attributes were evaluated based on whether the coefficient of

variation (CV) was homogeneous, and binary attributes (presence or absence of

attributes) were evaluated based on whether the coverage was sufficiently high.

As a criterion to determine whether the attribute reached a dominant design,

i.e. whether the attribute was widely recognized in the market, a threshold of

0.8 was set for the coverage, considering that an attribute that was installed

in 80% of the products was sufficiently recognized in the market. Given a

binomial distribution with "installed" as 1 and "not

installed" as 0, the coefficient of variation is 0.5 when 80% of the

products were equipped with the attribute. The threshold of the coefficient of

variation was set to 0.5, which was equivalent to the threshold of the

coverage.

3.3. Forecasting a dominant design based on the perspective

of technology and patents

To

derive the timing of the emergence of a dominant

design quantitatively based on patent information, we returned to the figure of

"The Dynamics of Innovation" by Utterback (1994)

and redefined the timing of its emergence. Utterback (1994) stated

that the emergence of dominant design shifts the competitive emphasis from

product innovation to process innovation and that the market acceptance of

product innovation and the emergence of dominant design are hallmarks of a

transition phase. In light of this context and the figure, we considered the

boundary between the fluid phase and the transitional phase, where the curves

of product innovation and process innovation crossed, to be the timing of the

emergence of a dominant design.

Methods for

separating patent applications into product innovation and process innovation

were disclosed, such as using the Japanese patent classification (Ishii, Kaminishi, and Haruyama, 2021;

Ishii et al., 2019) and using claim categories (Wittfoth, Berger, and Moehrle, 2022). It was also

mentioned that text mining, a variation of data mining that extracts

information from structured data, was effective for analyzing large amounts of

data, such as patent information (Surjandari, Naffisah, and Prawiradinata, 2015). Masuda and Haruyama (2021) pointed out that a

clear perspective on forecasting technology trends was provided by using the

approach that separates published patents into product and process inventions

by performing text mining on the title of inventions.

To

predict the timing of the emergence of a dominant design, we applied Masuda and Haruyama (2021) approach, wherein patent applications were

categorized into product and process inventions. The intersection point of

these two curves was then derived.

In this section, the following procedure was used for the analysis. First, the patent population for the projector under analysis was collected using the patent database of the Japan Patent Office (JPO). Second, the patent population was then divided into two subpopulations, product inventions and process inventions, using Masuda and Haruyama's approach (Masuda and Haruyama, 2021). Third, the crossing point was derived from these two curves, and the timing of the emergence of a dominant design was forecast.

According to the method

described in Section 3, the timing of the actual emergence of the dominant

design in the product category was identified. The timing of the emergence was

forecast based on the patent analysis of the product.

4.1.

Selecting a product

category

Table 1 shows the

product types and their main applications. The product types were segmented

into three main categories: business and education, home, and mobile. The

installation and usage methods differ by product type, which limits the size

and weight of the product and influences the product design. In addition, the

resolution of the required image display panel (e.g., liquid crystal display

panel) tends to differ depending on the application, and the choice of the

image display panel and its controller influences the product design.

Table

1 Segmentation

of projectors in terms of product types

|

Product

types |

Main

applications |

|

Business

and Education |

Corporate

and educational products for presentation use in offices and educational

facilities, mainly for projecting still images |

|

Home |

Consumer

products for home theater use, mainly for projecting moving images |

|

Mobile |

Specialized

lightweight products for portable use |

Brightness is one of the fundamental attributes of

projectors and is required to ensure visibility according to the space and

situation in which the projector is used. Table 2 shows the brightness required

for different applications. The brightness was segmented into three categories,

with the central range of brightness set at 2,000 - 4,000 lumens. Projectors

tend to be equipped with high-power light sources depending on the brightness,

which increases the size and weight of the product and has a significant impact

on the product design.

|

Brightness |

Main

applications |

|

< 2000

lumens |

Relatively

dark rooms or small spaces (e.g. home or mobile applications) |

|

2,000 -

4,000 lumens |

Bright and medium-sized spaces, such as general meeting rooms or

classrooms |

|

> 4,000 lumens |

Larger space, such as large conference rooms or halls |

According to market research, the volume share of

Japanese manufacturers in the global market for the projector industry in the

2010s exceeded 50%. We assumed that the product trends among Japanese

manufacturers roughly reflect global market trends. In the analysis of product

trends described below, we focused on the products launched by Japanese

manufacturers in the Japanese market and analyzed the product information on

their websites. For the analysis of technology trends, we focused mainly on

patent information from the Japan Patent Office (JPO), where patent

applications of Japanese manufacturers are filed.

In the Japanese market in

the early 2010s, the volume of the business and education category accounted

for approximately 80% of all projectors, of which the volume of the 2,000 -

4,000 lumens brightness category accounted for approximately 85%. This product

category was regarded as the main category of the projector industry and was

selected to be analyzed in this study. The volume of this product category

slowly increased, peaked in 2016, and decreased since then. We considered that

the projector industry had reached the maturity stage of its product life cycle

and that a dominant design already emerged.

4.2. Identifying a dominant design by product trends

4.2.1. Selecting some attributes

Brightness was selected as an

attribute for the design aspect. The rationale behind this lies in the limited

product category of brightness (2,000 - 4,000 lumens). When the price remains

constant, there is a tendency to favor brighter products. As a result,

brightness is considered a fundamental attribute in the context of vertical

innovation. In the business and education category, size, weight, and

resolution are not considered important attributes for selecting a product.

Since business and education projectors are always installed in meeting rooms

and classrooms or suspended from ceilings, size, and weight do not have much

influence on product selection. Similarly, resolution has no impact if it is

sufficient for business and education applications. Some users purchase

higher-priced products due to their smaller size, lighter weight, and higher

resolution, but they are limited.

Next, we consider the features aspect. The main role of projectors is to

project image information input from a PC or other device onto a screen. A

D-subminiature (D-sub) connector that supports analog signals is necessary

basic equipment for inputting image information to the projector. A

high-definition multimedia interface (HDMI) connector supports digital signals.

Especially for business and education applications, it is essential to have a

universal serial bus (USB) type-A connector that allows image information to be

input from a USB memory device without a PC, and a wired and/or wireless local

area network (LAN) connection that allows remote input of image information and

remote control of the projector. For projection onto a screen, manual and/or automatic

keystone correction (KC) to correct for image distortion is a fundamental

feature, especially vertical KC, since the projector is usually installed

squarely facing the screen, not at an angle. Horizontal KC is only required for

special installations.

The following fundamental and essential attributes were selected as

required for business and education projectors: brightness, various connectors

(D-Sub, HDMI, USB type-A), LAN connection, and vertical KC. For each of these

attributes, we quantitatively analyzed the evolution of the coefficient of

variation and the coverage to evaluate the emergence of a dominant design.

4.2.2. Actual emergence of a

dominant design

We examined the

products launched in the Japanese market between 2000 and 2017 by the top three

Japanese manufacturers of volume share in the early 2010s, EPSON, NEC, and

HITACHI, to analyze product trends. The volume share of these three companies

in the global market was approximately 40%. The number of 2,000 - 4,000 lumens

business and education projectors listed from each manufacturer's website was

344 in total (EPSON: 143 products (EPSON, 2022), NEC: 121 products (NEC, 2022), HITACHI: 79 products (HITACHI, 2022). Figure 2 shows the product trends of each company. The first products

were first launched in 2000, and the number of products peaked in 2011.

Figure 2 Product trends of each

company

For each attribute,

the analysis was conducted after 2003, when the number of products reached

double digits. Figure 3 shows the mean value and the coefficient of variation

(CV) for the brightness of products launched each year. A three-year simple

moving average was used for smoothing. The reason for using a three-year period

was to remove one-year-level irregularities while minimizing the effects of

five-year-level long-term fluctuations to obtain the timing of the emergence of

a dominant design on an annual basis. The mean value was approximately 2,500

lumens in 2003, increasing monotonically to approximately 3,500 lumens in 2016.

The calculated coefficient of variation decreased monotonically, without peaks,

and their heterogeneity was not observed. Here, CV is calculated by dividing

the standard deviation of the brightness of the projectors divided by their

mean brightness each year. The CV remained homogeneous since 2003, with a value

less than half of the threshold of 0.5. Brightness, a fundamental attribute of

the design aspect, became the dominant design at an early stage.

Figure 3 Mean value and the

coefficient of variation (CV) for brightness

Figure 4(a) shows the

three-year simple moving averages of the coverage of the D-Sub connector, HDMI

connector, and USB type-A connector, which are the image information input

equipment. The coverage of each feature is calculated as the number of products

equipped with the feature divided by the total number of products. The D-sub

connector remained at the coverage of 1.0 since 2003 and was an analog input

connector equipped as a fundamental feature of this product category from the

early stage. The HDMI connector, a digital input connector that enables

simultaneous transmission of digital images and audio, spreads to flat-panel

TVs and optical disc devices, then to projectors. The coverage of HDMI

connectors rapidly increased, exceeding 0.8 in 2011 and reaching 1.0 in 2013,

as they eliminated the need for audio cables. The USB type-A connector coverage

gradually increased, exceeding 0.8 in 2013.Figure 4 The coverage: (a) D-sub,

HDMI and USB Type-A connectors; (b) LAN connection and Vertical/Horizontal KCs

Figure 4(b) shows the

three-year simple moving averages of the coverage of LAN connection and

vertical/horizontal keystone corrections. The LAN connection coverage increased

gradually and reached 0.8 in 2012. The coverage of vertical keystone correction

remained at 1.0 since 2003, indicating that it became a fundamental feature

early on. In contrast, the coverage of horizontal keystone correction exceeded

0.8 in 2015. We assume that the equipment of this feature was delayed because

the feature is not used in the normal installation of the projector (i.e.

installed squarely against the screen) and is required only for limited users.

The attributes for

the features aspect are summarized below. The D-sub connector

and vertical KC achieved full coverage with a rating of 1.0 in 2003,

establishing each as the dominant design. The HDMI connector, USB type-A

connector, and LAN connection became the dominant design in 2011, 2013, and

2012, respectively, when they reached the threshold of coverage.

The attributes of

design and features consist of the fundamental attributes that were available

early on: brightness, D-sub connector, and vertical keystone correction, and

the essential attributes that became dominant design at approximately the same

time from 2011 to 2013: HDMI connector, USB type-A connector, and LAN

connection. Since each attribute was the dominant design in 2013, the dominant

design as the product category was formed at this time.

4.3.

Forecasting the timing of the

emergence of a dominant design through patent analysis

Patents published by the JPO were used in this

patent analysis. The database of published patents on projectors was generated

using two search queries: the theme code of 2K203, which is an original

Japanese patent classification, and the publication date from 1/1/1981 to

12/31/2020. The database contains approximately 30,000 patents with a search

date of 3/2022.

In discussing a dominant design, we focused on

granted patents in that companies ensure the protection and utilization of

inventions to contribute to the development of industry (JPO, 1959) and bring their

products to the market.

Approximately 11,000 patents

granted by the search date were extracted from the database. The period from

the filing date to the registration date was calculated for each patent. Figure

5 shows the mean (M) and standard deviation (SD) of the period. The period

decreased monotonically, and M+3*SD was approximately 7.2 years as of

2014-2015. As of 2022, the search date, most of the patents filed by 2015 will

have been granted. Therefore, when conducting a patent analysis using

granted patents, the effective filing date is up to m2015. Furthermore, based

on the market information shown in Section 4.1, the dominant design is

considered to have emerged before 2016, so information on patent applications

up to 2015 is sufficient.

Figure 5 The period from the filling

date to the registration date

In the subsequent analysis, granted patents for

which patent applications were filed by 2015 were extracted from the database

and used as the population. The population consisted of approximately 9,900

patients. The population was separated according to whether the title of the

invention contained a noun phrase consisting of a process innovation-related

keyword and the word method, generating two sub-populations. The former was

process inventions, and the latter was product inventions (Masuda and Haruyama, 2021).

Since innovation output can be related to the number of patents (Watanabe, Tsuji, and Griffy-Brown, 2001; Crepon, Duguet, and Mairessec,

1998), we replaced process

innovation with process inventions and product innovation with product

inventions to measure the extent of innovation.

Figure 6 shows the

trends of product innovation and process innovation, normalized to 1 for the

total number of patents granted by 2015 for product inventions and process

inventions, respectively. This figure corresponds to that of “The Dynamics of

Innovation” by Utterback

(1994). Here, a three-year simple moving average was used for smoothing. Product

innovation peaked around 2005, and as product innovation decreased, process

innovation increased, peaking in 2012 and decreasing thereafter. This indicated

a shift from product innovation to process innovation. The crossing point of

the two curves was in 2007-2008. This timing of patent application forecasts

the timing of the emergence of the dominant design.

Figure 6 The trends in product and

process innovations by granted patents

Discussion

In Section 4.2, we

showed the actual emergence of the dominant design in the market and the timing

of its emergence based on the product trend. In Section 4.3, we showed the

timing of patent application, forecasting the emergence of the dominant design

based on the technological trend from the patent analysis. In relation to these

two results, what is the time lag

between filing a patent application and introducing a product to the market?

Combining the results of previous studies and this study, we discussed the

cycle type of the projector industry and estimated its time lag.

Then, although there is

no doubt that the emergence of a dominant design is the result of a market

response, we examined whether it was possible to forecast the emergence of the

dominant design in advance, i.e., whether the forecast of the timing of its emergence

by patent analysis was valid compared to the fact of the timing of its

emergence in the market.

In Section 3.3, we

showed how to find the trends of product innovation and process innovation,

which are a type of technology trend, using Japanese patents, and accordingly,

we depicted these trends in Figure 6 in Section 4.3. We examined whether the

method used in this study is also applicable to non-Japanese patents.

5.1.

Time lag between patent application and product launch on the market

There was a positive

relationship between patents and new product announcements (Artz et al., 2010), and patents were a

useful information source for anticipating perspective products (Gerken, Moehrle, and Walter, 2015). Specifically, there

are previous studies on the time lag between patent applications and product

launches. As an example for one industry, Gerken, Moehrle, and Walter (2015) observed that the

time lag between patent filing and market launch was approximately 30 months on

average and up to 56 months for 13 different automotive parts and components. Ernst (1997) also showed a time

lag of 2 to 3 years from patent application to sales increases for 50 machine

tool manufacturers. As an example for many industries, Napolitano and Sirilli (1990) surveyed 157

inventions for various product groups and found that the time lag between

patent application and productive use was 32% within one year, 64% within two

years, the 96th percentile within five years, and the longest within

six years. Suzuki

(2011) also surveyed 2,398 randomly selected Japanese patents and reported that

the time lag between patent application and product or manufacturing use was 19

months on average, 60 months at the 95th percentile, and 24 years at

the longest.

It was noted that the

companies’ environment influenced the time lag between patent disclosure and

market launch, and one of the factors was the cycle type of an industry (Gerken, Moehrle, and Walter, 2015). In the studies by Gerken, Moehrle, and Walter (2015) and Ernst (1997), automotives and

machine tools are durable goods. Although their survey samples were not very

large, the two results were relatively close, with an average time lag of

approximately 2.5 years and 56 months at the longest. The studies by Suzuki (2011) and Napolitano and Sirilli (1990) were cross-industry

analyses, and their survey samples were large and included a mixture of durable

and non-durable goods. According to these two results, the time lag was

approximately 20 months on average, 5 years at the 95th percentile,

and 6 - 24 years at the longest. The comparison of average time lags supports

the point that durable goods have a longer application lag than non-durable

goods (Pakes

and Schankerman, 1984). Projectors are one of the durable goods, and the

time lag can be inferred to be approximately 5-6 years up to the 95th percentile,

based on the above previous studies.

Furthermore, we

considered the cycle type of the durable goods industry. Srinivasan, Lilien, and Rangaswamy (2006)

surveyed 63 office products and consumer durables. They indicated the time

between product introduction and the emergence of a dominant design was 6.50

years on the mean and 4.94 years on the standard deviation for the 30 products

in which the dominant design emerged. From these mean and standard deviation

values, the 90th percentile was calculated to be approximately 13

years. Further scrutiny of

their findings involved examining three office input/output products similar to

projectors: dot matrix printers, fax machines, and photocopiers, revealing an

average time span of 12 years for these products.

Based on the analysis

of product trends in this study, the time between the product launch and the

emergence of the dominant design was 13 years, since the product launch was in

2000 from Figure 2, and the timing of the emergence of the dominant design was

in 2013. Compared to the study by Srinivasan, Lilien, and Rangaswamy (2006), the time for

projectors was close to the 90th percentile time for the 30 products

and close to the meantime for three office input/output products. Hence, we can

infer that the cycle type of projectors is slower than that of the durable

goods industry. By adding this consideration of the cycle type to the results

of previous studies on the time lag between patent application and product

launch, we can assume that the cycle type of projectors is slower than that of

other durable goods and that the time lag between patent application and

product launch is approximately 5-6 years.

5.2. Is it impossible to forecast the timing of the emergence of the dominant

design?

Product trends analysis indicated that the timing of the emergence of the dominant design was in 2013. The granted patent analysis suggested that the timing of patent applications forecasting the emergence of the dominant design was 2007-2008. Previous studies show that the time lag between patent application and product launch can be approximately 5-6 years. The three results are well related. This means that for the product category of business and education projectors, the timing of the emergence of the dominant design can be forecast based on the patent application information in 2007-2008 without waiting for 2013, when the emergence of the dominant design is recognized in the market. However, as shown in Figure 5, in the case of projectors, the period from the filing date to the registration date of patents is approximately four years on average, so that by the time granted patents become available for analysis, dominant designs will have emerged. Therefore, it is preferable if published patents can be analyzed instead of granted patents.

We attempted to verify this by extracting published patent applications filed by 2018 from the database, considering that it typically takes 1.5 years from application to publication. This subset was used as the population and analyzed in a manner similar to that outlined in Section 4.3. Figure 7 shows the three-year simple moving average trends of product and process innovations, normalized to 1 for the total number of published patents by 2018 for product and process inventions, respectively. Since the dynamics in Figure 7 were very similar to the case of the granted patent in Figure 6, we believe that substitution with published patents is feasible. The crossing point of the two curves was in 2007.

Figure 7 The trends of product and process innovations by

published patents

Figure 8 shows the

ratio of granted patents to patent applications derived from the database. The

ratio increased gradually, and no large fluctuation was observed at the

one-year level; the large fluctuation after 2016 was due to the relationship

between the period from filing to registration and the search date, as

mentioned above. Although the ratio varies from industry to industry, provided

that the ratio does not fluctuate significantly from year to year, it is

possible to substitute published patents for granted patents to conduct such

trend analysis as in this study.

Figure 8 The Ratio of granted patents to patent applications

Arundel and Kabla (1998) found that only four

sectors, including precision instruments, had patent propensity rates for both

product and process innovations combined that exceeded 50%. Since office

input/output products are a type of precise instrument, we believe that this is

one of the factors that contribute to the good relationship between product

trends and patent trends for projectors. In the product category of business and

education projectors, the emergence of dominant design in the Japanese market

was in 2013, and their sales reached their peak in 2016. The results of this

study support the argument that the dominant design would spark increased

demand and that product-class sales would peak after their emergence (Anderson and Tushman, 1990).

5.3. Applicability of this method to

non-Japanese patents for finding the trend of technology

As shown in Section

3.3, this study used the method to divide the invention population into

subpopulations of product inventions and process inventions (Masuda and Haruyama, 2021). In this method, a

set of keywords related to process innovation, such as production,

manufacturing, and quality improvement, are extracted, and process inventions

are separated by whether the title of the invention contains a sequence of

words that combines these keywords with the word "process.” This is based

on Article 2(3) of the Japan Patent Act (JPO, 1959), which basically

classifies inventions into product and process inventions. Therefore, in this

study, the JPO patent database was used, and a text mining algorithm was

applied to Japanese text.

We have examined

whether this method is applicable to non-Japanese patents. Both the Manual of

Patent Examining Procedure in the United States Patent and Trade Office (USPTO, 2023) and the Guidelines

for Examination in the European Patent Office (EPO, 2023) state that there are

only two basic types of claims that constitute inventions: product claims and

process claims. As can be seen from the title of the invention in US patents

and EP patents, it is very likely that process inventions can be separated by the

inclusion of a sequence of words combining the above keywords and the word

“method.” In addition, since words are separated by spaces in English text, it

is easier to perform text mining than in Japanese text, and the accuracy of the

analysis is higher.

In this study, when generating the population

for the analysis of Japanese patents, we utilized the theme code, a unique

patent classification in Japan, as a search query. Since the theme code is

indirectly related to the International Patent Classification (IPC), it is

possible to generate a population that is almost similar to the population

generated by the theme code by combining the IPC. Naturally, expansion to other patent

classifications, such as the Cooperative Patent Classification (CPC), is also possible.

Based on the above,

it is likely that the patent analysis method for non-Japanese patents will be

quite similar to that for Japanese patents. This method may not be limited only

to Japanese patents.

In this study, using projectors as the target of analysis, we identified

the product attributes in which the dominant design emerged and the timing of

its emergence based on the product trend in the market. Then, we conducted the

patent analysis as the technology trend and derived the timing of patent

application to forecast the timing of the emergence of the dominant design by

using published patents. Furthermore, we considered the cycle type of the

projector industry and inferred the time lag between the filing of a patent

application and the introduction of a product. Although the emergence of a dominant design

is known only when a design is widely recognized in the market, we clarified

that there are industries in which the timing of the emergence of the dominant

design can be forecast in advance using patent information, one of the

indicators of innovation. It is important for companies to strategically

identify the timing of market entry to achieve commercial success, and this

study provides one useful insight for identifying such timing. It should be noted that even if the emergence

of dominant designs from patent analysis is forecast, it does not necessarily

mean that dominant design will actually emerge in the market. However, it is

meaningful to show the possibility of forecasting the emergence of dominant

designs and the timing of their emergence in the market based on technology

trends. This allows companies to prepare for dominant designs that will emerge.

In other words, it is a strategic guide. The emergence of a dominant design for all

industries and products is not forecast. Since patent analysis is performed

after patent information is published and generally available, it is impossible

to forecast the emergence of a dominant design for a product whose time lag between

patent application and product launch

is shorter than 18 months. Therefore, it can be effectively applied to

industries where the cycle type is relatively slow.

Agarwal, R., Sarkar, M.B., Echambadi, R., 2002. The Conditioning Effect of Time on Firm Survival: An Industry Life Cycle Approach. Academy of Management Journal, Volume 45(5), pp. 971–994

Anderson, P., Tushman, M.L., 1990. Technological Discontinuities and Dominant Designs: A Cyclical Model of Technological Change. Administrative Science Quarterly, Volume 35(4), pp. 604–634

Artz, K.W., Norman, P.M., Hatfield, D.E., Cardinal, L.B., 2010. A Longitudinal Study of The Impact of R&D, Patents, and Product Innovation on Firm Performance. Journal of Product Innovation Management, Volume 27(5), pp. 725–740

Arundel, A., Kabla, I., 1998. What Percentage of Innovations Are Patented? Empirical Estimates for European Firms. Research Policy, Volume 27(2), pp. 127–141

Baum, J.A.C., Korn, H.J., Kotha, S., 1995. Dominant Designs and Population Dynamics in Telecommunications Services: Founding and Failure of Facsimile Transmission Service Organizations, 1965-1992. Social Science Research, Volume 24(2), pp. 97–135

Berawi, M.A., 2021. Philosophy of Technology Design: Creating Innovation and Added Value. International Journal of Technology, Volume 12(3), pp. 444–447

Brem, A., Nylund, P.A., Schuster, G., 2016. Innovation and De Facto Standardization: The Influence of Dominant Design on Innovative Performance, Radical Innovation, and Process Innovation. Technovation, Volume 50, pp. 79–88

Cecere, G., Corrocher, N., Battaglia, R.D., 2015. Innovation and Competition in The Smartphone Industry: Is There A Dominant Design? Telecommunications Policy, Volume 39, pp. 162–175

Christensen, C.M., Suarez, F.F., Utterback, J.M., 1998. Strategies for Survival in Fast-Changing Industries. Management Science, Volume 44, pp. 207–220

Clymer, N., Asaba, S., 2008. A New Approach for Understanding Dominant Design: The Case of The Inkjet Printer. Journal of Engineering and Technology Management, Volume 25(3), pp. 137–156

Crepon, B., Duguet, E., Mairessec, J., 1998. Research, Innovation and Productivity: An Econometric Analysis at The Firm Level. Economics of Innovation and New Technology, Volume 7(2), pp. 115–158

EPO, 2023. Guidelines for Examination in The European Patent Office. Available Online at https://new.epo.org/en/legal/guidelines-epc, Accessed on August 28, 2023

EPSON, 2022. Support & Download: Business Projectors. Available Online at https://www.epson.jp/support/support_menu/ks/15.htm, Accessed on March 19, 2022

Ernst, H., 1997. The Use of Patent Data for Technological Forecasting: The Diffusion of CNC-Technology in The Machine Tool Industry. Small Business Economics, Volume 9(4), pp. 361–381

Gerken, J.M., Moehrle, M.G., Walter, L., 2015. One Year Ahead! Investigating The Time Lag between Patent Publication and Market Launch: Insights from A Longitudinal Study in The Automotive Industry. R&D Management, Volume 45(3), pp. 287–303

Griliches, Z., 1998. Patent Statistics as Economic Indicators: A Survey. In: R&D And Productivity: The Econometric Evidence. Chicago, USA: University of Chicago Press, pp. 287–343

HITACHI, 2022. Projectors: Support Site. Available Online at: https://proj-support.maxell.co.jp/jp/index.html, Accessed on March 19, 2022

Huenteler, J., Schmidt, T.S., Ossenbrink, J., Hoffmann, V.H., 2016. Technology Life-Cycles in The Energy Sector - Technological Characteristics and The Role of Deployment for Innovation. Technological Forecasting and Social Change, 104, pp. 102–121

Ishii, Y., Kaminishi, K., Haruyama, S., 2021. A Study of Identifying Trends in Projector Using F-Term Codes from Japanese Patent Applications. International Journal of Integrated Engineering, Volume 13(7), pp. 324–331

Ishii, Y., Oktavianty, O., Phuc, N.H., Kaminishi, K., Haruyama, S., 2019. Study on Time Emergence of Dominant Design of Inkjet Printer and NC Machine by Using F-Term in Japanese Patent. Journal on Innovation and Sustainability RISUS, Volume 10(3), pp. 158–165

Japan Patent Office (JPO), 1959. Patent Act: Chapter I, Article 1. Japan Patent Office (JPO), Japan

Koski, H., Kretschmer, T., 2007. Innovation and Dominant Design in Mobile Telephony. Industry and Innovation, Volume 14(3), pp. 305–324

Kotler, P., Armstrong, G., 2011. Principles of Marketing. 14th Edition. Upper Saddle River, New Jersey, USA: Prentice Hall, Pearson Education, Inc.

Lieberman, M.B., Montgomery, D.B., 1988. First?Mover Advantages. Strategic Management Journal, Volume 9, pp. 41–58

Markides, C.C., Geroski, P.A., 2004. Fast Second: How Smart Companies Bypass Radical Innovation to Enter and Dominate New Markets. Hoboken, New Jersey, USA: Jossey-Bass, John Wiley & Sons, Inc.

Masuda, K., Haruyama, S., 2021. Forecasting Technology Trends Based on Separation of Product Inventions and Process Inventions: The Technology S-Curve. IOP Conference Series: Materials Science and Engineering, Volume 1034(1), p. 012123

Mitchell, W., 1991. Dual Clocks: Entry Order Influences on Incumbent and Newcomer Market Share and Survival When Specialized Assets Retain Their Value. Strategic Management Journal, Volume 12, pp. 85–100

Napolitano, G., Sirilli, G., 1990. The Patent System and The Exploitation of Inventions: Results of A Statistical Survey Conducted in Italy. Technovation, Volume 10(1), pp. 5–16

NEC, 2022. Projectors: Old Products. Available Online at https://jpn.nec.com /products/ds/projector/old/index.html, Accessed on March 19, 2022

Pakes, A., Schankerman, M., 1984. The Rate of Obsolescence of Patents, Research Gestation Lags, and The Private Rate of Return to Research Resources. In: R&D, Patents, and Productivity, University of Chicago Press, Chicago, USA, pp. 73–88

Rocheska, S., Nikoloski, D., Angeleski, M., Mancheski, G., 2017. Factors Affecting Innovation and Patent Propensity of SMEs: Evidence from Macedonia. TEM Journal, 6(2), p. 407

Srinivasan, R., Lilien, G.L., Rangaswamy, A., 2006. The Emergence of Dominant Designs. Journal of Marketing, 70(2), pp. 1–17

Suarez, F.F., Grodal, S., Gotsopoulos, A., 2015. Perfect Timing? Dominant Category, Dominant Design, and The Window of Opportunity for Firm Entry. Strategic Management Journal, Volume 36(3), pp. 437–448

Suarez, F.F., Utterback, J.M., 1995. Dominant Designs and The Survival of Firms. Strategic Management Journal, Volume 16(6), pp. 415–430

Surjandari, I., Naffisah, M.S., Prawiradinata, M.I., 2015. Text Mining of Twitter Data for Public Sentiment Analysis of Staple Foods Price Changes. Journal of Industrial and Intelligent Information, Volume 3(3), pp. 253–257

Suzuki, J., 2011. Nihon Kigyo no Kenkyu Kaihatsu Katsudo kara Syogyoka he no Ragu Kozo no Bunseki (Analysis of The Lag Structure from The Research and Development Activities to Commercialization of Japanese Firms). RIETI Discussion Paper Series 11-J-002, The Research Institute of Economy, Trade and Industry, Japan

Taleb, M., Pheniqi, Y., 2023. Does Innovation Ambidexterity Moderate the Relationship between Intellectual Capital and Innovation Performance? Evidence from Morocco. International Journal of Technology, Volume 14(4), pp. 724–748

Tatiana, B., Mikhail, K., 2020. Problems of Competitive Strategy Choice According to Industry and Regional Factors. International Journal of Technology, Volume 11(8), pp. 1478–1488

USPTO, 2023. Manual of Patent Examining Procedure (MPEP). Available Online at: https://www.uspto.gov/web/offices/pac/mpep/index.html, Accessed on August 28, 2023

Utterback, J.M., 1994. Mastering The Dynamics of Innovation. Harvard Business School Press, Boston, Massachusetts, USA

Watanabe, C., Tsuji, Y.S., Griffy-Brown, C., 2001. Patent Statistics: Deciphering A ‘Real’ Versus A ‘Pseudo’ Proxy of Innovation. Technovation, Volume 21, pp. 783–790

Wittfoth, S., Berger, T., Moehrle, M.G., 2022. Revisiting The Innovation Dynamics Theory: How Effectiveness- and Efficiency-Oriented Process Innovations Accompany Product Innovations. Technovation, Volume 112, p. 102410