Initial Analysis on Predictors of Mosque Cooperatives Performance: A Co-operator's Perspective

Corresponding email: norzarina.yatim@mmu.edu.my

Published at : 19 Oct 2022

Volume : IJtech

Vol 13, No 5 (2022)

DOI : https://doi.org/10.14716/ijtech.v13i5.5856

Salim, A.S.A., Yatim, N.M., Said, A.M.A., Masuod, S., Mustafa, M.A., Ismail, H., 2022. Initial Analysis on Predictors of Mosque Cooperatives Performance: A Co-operator's Perspective. International Journal of Technology. Volume 13(5), pp. 1075-1089

| Abdullah Sallehhuddin Abdullah Salim | Faculty of Management, Multimedia University, Cyberjaya,63100, Malaysia |

| Norzarina Md Yatim | Faculty of Management, Multimedia University, Cyberjaya,63100, Malaysia |

| Al Mansor Abu Said | Faculty of Management, Multimedia University, Cyberjaya,63100, Malaysia |

| Shukor Masuod | Faculty of Business, Multimedia University, Ayer Keroh, 75450, Malaysia |

| Mohd Ariff Mustafa | Faculty of Accountancy, Universiti Teknologi MARA Melaka Campus, Alor Gajah 78000, Malaysia |

| Hishamuddin Ismail | Faculty of Business, Multimedia University, Ayer Keroh, 75450, Malaysia |

Performance is a crucial aspect of any organization,

including mosque co-operatives. Mosque co-operatives are expected to show good

financial and non-financial performance. Mosque co-operatives need to ensure

sustainable financial performance to continue benefiting the socio-economic

well-being of the members and community. Besides, the strong financial

performance of mosque co-operatives provides additional support to mosque institutions'

activism. Hence, a question arises on the determinants of mosque co-operatives'

financial and non-financial performance. Therefore, this study attempts to

examine the predictors of performance from the perspective of mosque

co-operators through the lens of Intellectual Capital Theory. The study found

that the top three predictors of performance for mosque co-operatives are board

members' competencies, spirituality, managers' competencies, and stakeholders'

support, indicating the essentials of human capital, relational capital, and

spiritual capital. This study provides initial insights to regulators,

policymakers, and co-operators in enhancing the performance of religious-based

co-operatives.

Cooperatives; Co-operators; Intellectual capital; Mosque; Performance

One of the key performance indicators of Malaysian National Cooperative Policy 2 (NCP 2: 2011-2020) is to register 16,000 co-operatives by 2020 (MCSC, 2011). Among the initiatives taken to meet the target is the setting up of 6025 mosque co-operatives. There are three objectives of mosque co-operatives highlighted by the Malaysian Cooperative Societies Commission (MCSC) that are (i) to enhance the socio-economic of mosque co-operatives' members through economic activities, (ii) to mobilise resources, i.e. financial capital and human capital of mosque co-operatives members, and (iii) to create job opportunities for co-operative mosque members and their families (MCSC, 2016). Based on the latest statistic by the Ministry of Entrepreneurship Development and Cooperatives (MEDAC, 2021), at the end of 2019, there were 446 mosque co-operatives nationwide with 300 of them categorized as active, 69 non-active, and 77 dormant. The record showed 30,515 mosque co-operative total members and generated an aggregate income of RM 15.37 million. While the figures indicated promising prospects, they also revealed multiple areas of improvement requiring greater attention and focus.

In the Mosque Cooperatives Strategic Development Plan 2017-2020, the review sub-section identified factors leading to poor performance of mosque co-operatives, namely the mosque co-operatives' structure, support from members and community, and internal governance (MCSC, 2016). Even though the review was not prepared based on the intellectual capital framework, the findings revealed that mosque co-operatives operate as small scaled businesses and operations, offer less diversified products and services, and experience a lack of funding. Therefore, this factor is regarded as structural capital. Moreover, the report showed that mosque co-operatives suffered low support from members regarding purchasing products or services, poor attendance in programmes, including mosque co-operatives' Annual General Meeting (AGM), and a lack of awareness of members' rights and rights duties (MCSC, 2016). Therefore, this factor is considered relational capital. Besides, mosque co-operatives are without proper internal control mechanisms due to the incompetence of board directors' members; hence, the situation indicates human capital concern. Thus, this study is carried out to explore determinants of performance through an intellectual capital framework based on mosque co-operators' perspectives.

Literature Review

2.1. The Underlying Theory: Intellectual Capital Theory

Sveiby (1997) considers

that intellectual capital consists of human capital, relational capital, and

structural capital. The first element represents knowledge, competence and the

intellect of the employees. Structural capital refers to organisational

systems, culture, practices and processes, while relational capital represents

relationships with customers, sponsors, and distributors. In Bontis (2001), intellectual

capital is the sum of human and structural capital. Human capital consists of

employee efficiency and the firm's culture and values.

In contrast, structural

capital refers to the intangible assets owned by the firms, such as the use of

software, databases, trademarks and work process, which support the employees

in performing their tasks and also includes the relationship built with the

customers. Extending this concept, Zaytsev et al. (2020) argued that value-added intellectual capital is the

sum of value-added structural capital, human capital and physical capital.

However, while Intellectual Capital Theory has progressed significantly in the

literature on organisational performance, there is still an indecisive

classification of capital. As a majority of studies classified capital into

structural capital, relational capital, and human capital; some studies like Khyakin and Toechkina (2021), Khalique et al. (2020), Khalique et al. (2018), Khalique and Mansor (2016), Khalique et al. (2013), and Khalique et al. (2011), and Ramezan (2011). offered suggestions for enhancement of

categorisation, such as introducing a new type of capital like physical

capital, spiritual capital, service capital, technological capital, and social

capital.

In the context of

co-operatives, Intellectual Capital Theory has been explicitly deployed by

researchers like Khan et al. (2016) examined the impact of structural, relational and

human capital on co-operatives' performance. The study specifically refers to

human capital as the employees' skills and abilities, which could increase the

firm's efficiency in providing consumer services, which could be gained through

training and education. Structural capital refers to the stored knowledge which

lies within the firm and will remain even if the employees leave the firm. This

is such as databases, work processes and others. Finally, relational capital refers

to the firm's relationship with its customers since a good relationship with

the customers may help the firm to meet the consumers' demands and thereby

sustains its revenues and profits.

Meanwhile, some studies

did not specifically deploy the Intellectual Capital Theory in explaining

co-operatives' performance; however, they highlighted the element of

Intellectual Capital Theory in driving co-operatives' performance, such as

relational capital and human capital. For example, a study by Yaacob et al. (2012) found

that active members' participation contributes to the co-operatives' success.

Besides, Othman et al. (2013) highlighted the essential of co-operatives to continuously encourage the

involvement of members in the decision-making process to maintain its.

Additionally, Othman et al. (2014) supported that loyalty of the members, and their active participation is

vital for the survival of the co-operatives sector since it could help the

co-operative increase their efficiency.

2.2. Dual Performance Objectives of Co-Operatives

Hind

(1999) and Kaur (2006) argued that a co-operative's performance measures

financial and non-financial indicators due to dual objectives that drive the

existence of co-operatives, i.e., economic and social goals. Despite such

objectives, co-operative faces a challenge in the dynamic business world. It

needs to deal the typical objective of a co-operative is to maximise the

benefits to its members and ensure that their needs are met with the

competition and must be able to operate like other business entities in order

to continue offering benefits to its members (Rajaratnam

et al., 2009). Therefore, traditional analysis ratios like

profitability, efficiency, liquidity, and leverage widely measure a

co-operative's financial performance (Hind, 1999).

On the other hand,

co-operative performance is also examined through non-financial performance

perspectives. It is referred to as offering performance information in

non-monetary terms (Kaur, 2006). Studies by Hind (1999) and Mayo (2011) have argued that member-based organisations should prioritise

co-operatives' non-financial performance more than financial performance. The

non-financial performance usually includes governance, social responsibility

initiatives towards members, their families, and society, compliance with

established regulations, service delivery quality, and customer or members'

satisfaction. In the context of mosque co-operatives, the Department of Islamic

Development Malaysia (JAKIM, 2010) also described the contribution toward mosque

institutions' well-being in terms of activism enhancement, infrastructure

well-being, and good governance. In a similar vein, Sallehhudin

et al. (2017) categorised mosque co-operatives' performance

into two dimensions: financial performance and non-financial performance. The

financial performance consists of common financial ratio indicators, while

non-financial performance covers good governance, corporate social

responsibility, members, customer satisfaction, and contribution to mosque

institutions' well-being.

2.3.

Intellectual Capital Component – Structural Capital

2.3.1. Co-Operative

Characteristics

Rajaratnam

et al. (2009) proposed several organisational or physical

characteristics as determinants of co-operatives' success. These include size,

types of function provided, and diversification of activities. An assessment by

Ward and McKilliop (2005) found that the size of co-operatives' assets significantly influences

credit co-operatives' financial performance. Besides, a more substantial credit

co-operative had a lower cost to income-percentage and enjoyed economies of

scale than a smaller credit co-operative. Earlier, Trechter

(1996) used the number of members as an indicator to

measure co-operatives' size.

A type of function

provided by a co-operative was also found to influence the co-operative's

financial performance (Ward & McKillop, 2005). The study showed that co-operatives offering credit

and agriculture-related functions are financially well-off than co-operatives

providing other types of operations. Besides, Mustapa

et al. (2013) showed that giving shariah-compliant products

determines the credit co-operatives' success. Additionally, Noordin et al. (2011) evidenced

that consumer, credit, agriculture, services, and transportation function

co-operatives perform better than other functions provided by co-operatives.

Furthermore, offering a variety of functions to members and societies leads to

the diversification of co-operatives' activities.

Diversification of

activities enables co-operatives to carry out multiple business segments, thus

reducing the risk of relying on a part only. Besides, diversification of

activities facilitates cooperation to fulfil various needs of its members.

Hence, it significantly influences the performance of co-operatives (Carr et al., 2008). In

addition, by diversifying its activities, the co-operative can increase its

membership, size, and resources (Trechter, 1996). Carr et al. (2008) found that a performing co-operative diversifies its

activities, but these activities are integrated or concentrated on a set of

core activities. Indeed, the diversification strategy of mosque co-operatives

is strongly highlighted through Mosque Cooperatives Strategic Development Plan

2017-2020 (MCSC, 2016). It

expects more co-operatives to enrol in high-value economic sectors viz;

tourism, healthcare sector, plantation sector, agriculture sector, properties

sector, wholesale and retail, and financial service. A similar emphasis is

echoed in the Malaysia Cooperative Transformation Plan 2021-2025 by the

Ministry of Entrepreneurship Development and Cooperative (MEDAC, 2021). Concerning the cost

of operations, studies like Bryunis et al. (2001) and Boyer et al. (2008) evidenced that cost of operation has a significant

influence on co-operative financial performance. A low operating cost and

prudent spending allow co-operative and adequate financial records to generate

higher income and enable the co-operative to benefit its members sustainably.

2.3.2.

Internal Control and Supervision

Noordin et al. (2011) identified adequate internal supervision and

control as one of the success determinants of co-operative performance.

Internal supervision and control concern co-operatives' internal monitoring

aspects such as risk management and records or document control. Adequate

internal supervision and control allow a co-operative to proactively prepare

and safeguard its survival during unprecedented events or facing risks

threatening situations. In the study, Noordin

et al. (2011) measured

adequate internal supervision and control by looking into co-operative internal

control policies, spending and investment policies, and accurate financial

accounting and reporting policies. The study indicated that a performing

co-operative has accurate financial reports and records, but more efforts are

needed to improve internal control and risk management programs, especially

investment and spending policies.

Besides,

Zakaria et al. (2021) found the importance of

palatable governance practices towards more excellent performance among oil

palm co-operatives in Malaysia. The good governance aspect encompasses clear

responsibility of board governance, management, employees, and members, sound

management system and practices, and proper audit and control. Additionally, Chareonwongsak (2017) highlighted the importance of structural

elements such as apparent board authority and function, composition, meeting

quality, transparency in the evaluation process and compensation setting

process and financial compensation as predictors of co-operatives performance

in Thailand.

2.4. Intellectual Capital Component – Relational

Capital

2.4.1. Members' Support

Rajaratnam et al. (2009) emphasised members' support

as the determinant of co-operatives' performance, particularly members'

participation and education. However, a previous investigation by Lluch et al. (2006) confirmed that co-operative members' active

involvement significantly influences co-operative performance. In addition, Bryunis et al. (2001) suggested that sufficient capital gathered

from members contributes to co-operative success. Besides, Amini and Ramezani (2008) identified members'

education as a determining factor in co-operative performance. Hence,

continuous education to members, in terms of enhancing their awareness of

members' rights and responsibilities, needs to be given extra focus.

Similarly,

Noordin et al. (2011) evidenced that performing

co-operative members consistently attend the co-operative's Annual General

Meetings, provide sufficient capital, and consume products or services from

their co-operatives. Khan

et al. (2016) also

supported members in determining the performance of co-operatives in Malaysia. Additionally,

Abdul-Rahman and Zakaria

(2018) also

cited the lack of members' support as one of the factors causing the poor

performance of mosque co-operatives in the state of Selangor.

2.4.2. Stakeholders' Support

Like

other co-operatives, mosque co-operatives also require support from various

stakeholders to success financial and non-financially. Indeed, the MCSC is the

regulator and an enabler for co-operative sectors in the country. It monitors

co-operative registration, members' satisfaction, and compliance with rules and

regulations among co-operatives as a regulator. As an enabler, it provides

financial and non-financial assistance to co-operatives. Financial aid includes

funding, working capital, grants, discounts, rebates, and advance financing. It

also offers technical and know-how advice to co-operatives. In the context of

mosque co-operatives, it also plays a leading role. In this aspect, Noordin et al. (2011) discovered that a performing co-operative received

a wide range of support vis-a-vis technical, financial, material and moral

support from the MCSC and other federal and state government-based agencies.

Another important stakeholder is the National Industrial Association for

Co-operatives (ANGKASA), which provides assistance to mosque co-operatives. It

has launched initiatives to assist new mosque co-operatives, such as research

and development, managerial consultancies, and financing programs. It also

holds an annual conference for mosque co-operatives board members and managers

to equip them with the latest information and economic opportunities. It also

works alongside the Institute of Cooperative Malaysia (IKM) in providing

knowledge, training, and learning opportunities to mosque co-operative officials.

In

Malaysia, a mosque is administered by a mosque committee, commonly appointed by

the community or congregation. The list then is endorsed by state religious

authorities since the Federal Constitution's Ninth Schedule states that, among

other things, the administration of Malay customs and mosques comes under the

purview of the state government (Sulaiman

et al., 2007). There

are two critical organs in each state's administration of Islamic affairs – the

Islamic Religious Council (IRC) and the Islamic Religious Department (IRD). The

former is for policymaking, while the latter is for implementing policies

through programs and procedures. Abdul-Rahman

and Goddard (1998) evidenced a different working culture among state Islamic Religious

Councils, influencing the organisation's productivity and performance. Mosque

co-operative is closely connected to mosque institutions; thus, to succeed,

mosque co-operatives need support from the mosque committee, the state IRC and

IRD (Norwahi, 2014; Othman et al.,

2014). Additionally, Abdul-Rahman and Zakaria (2018) found that the lack of

support from mosque committees and state Islamic religious authority

contributed to the lack of performance among mosque co-operatives in

Selangor.

2.5. Intellectual Capital Component – Human Capital

2.5.1. Board Members'

Competencies

The

co-operatives' board members must acquire several skills, competencies, and

experience. Moreover, the competencies and skills of managers can be enhanced

through continuous training (Bryunis

et al., 2001). On

the co-operative board aspect, Noordin

et al. (2011)

discovered that a performing co-operative has more working experience, is older

in terms of age and continuity element, and has vast expertise in engaging

co-operatives movement board members than a non-performing co-operative.

Furthermore, the study also supported that a board member of a performing

co-operative shall acquire specific skills, competencies, ability, and

knowledge to confront challenges and deal effectively with hardships faced by

the co-operative. In Thailand, Chareonwongsak

(2017) also

found evidence that board members' skills are essential in driving

co-operatives' performance. In Indonesia, Marwan et al. (2018) revealed that the entrepreneurship abilities

of board directors significantly and positively influence the members'

participation in co-operatives' programmes or initiatives. Besides, Lajuni et al. (2019) showed that board members' financial planning

competency is an important predictor of co-operatives' financial and

non-financial performance.

2.5.2. Managers' Competencies

The

managers' competency is another identified co-operative

success factor in Rajaratnam et

al. (2010).

Planning skill is considered a vital competency for co-operatives managers, and

it was found to significantly influence a co-operative's financial performance,

particularly in generating high sales growth (Noordin et al., 2011). Besides, sound planning skill by managers is

needed to ensure entities like co-operatives remain competitive, adaptive to

dynamic changes in the business environment, and deploy the proper practice in

dealing with uncertainties (Rajaratnam

et al., 2009; Rajaratnam et al., 2010; Noordin

et al., 2011). In

addition, Pathak and Kumar (2008) evidenced that one of the

factors contributing to the closure of multiple co-operatives in Fiji is

insufficient planning skills, particularly long-term planning among the

managers. Furthermore, Fathonih

et al. (2019) urged

managers to play active roles in monitoring and enhancing employees' skills

towards improving customer service and customer satisfaction in the service

industry. In addition, Ssekakubo

et al. (2014) found a

significant and positive relationship between managers' competency and the

financial performance of savings, credit and co-operative societies in Uganda.

Besides, Wan-Idris (2019) confirmed that the competent

human capital of co-operatives, including knowledgeable, talented and skilful

managers is a primary predictor in ensuring the success of women co-operatives

in Malaysia. In the more recent study, Mohamed

et al. (2020) contended that the lacking

performance of mosque

co-operatives is also closely linked with the ability, experience and skills of

managers to manage co-operatives in line with the current trend in order to be

able to survive in the volatile, uncertain, complex and ambiguity challenging

business environment.

2.6. Intellectual Capital Component – Spiritual Capital

2.6.1. Spirituality

Spirituality

is a sense of relatedness or connectedness to others, providing meaning and

purpose in life, fostering well-being, and having a belief in and a

relationship with a power higher than the self (Hawks et al., 1995). Studies like Rocha and Pinheiro

(2020) and Fathonih et al. (2019) have been carried out to examine the impact of

spirituality on organisational performance and organisational members'

behaviour. Additionally, Sachitra

and Chong (2019) found the

support of religiosity and spirituality influence in explaining the performance

of agribusiness farms in Sri Lanka, while Adi and Adawiyah (2018)

found

similar evidence in the context of entrepreneurs in West Java and Central Java,

Indonesia. Besides, Gill and Marthur

(2018) also found

an association between spirituality and organisational performance among

socially responsible agribusiness entrepreneurs in India. In a related study, Mubarak et al. (2015) found a strong influence of spirituality on

organisational performance and the individual success of selected successful

entrepreneurs in Kelantan.

As

the study focuses on the success model of mosque co-operative, the influence of

spirituality is imminent, as it is closely related to mosque institution – a

centre of worship where Muslims perform their daily, congregational, and weekly

Friday prayers. Other activities include celebrating important events in the

Islamic calendar, like Ramadhan's fasting month and Eid Mubarak. In leading

mosque co-operatives, board members, managers, and members have accountability

to Allah (vertical relationship) and accountability to other people and

surroundings (horizontal relationship). In fulfilling these horizontal

relationships, mosque co-operatives board members, managers, and members are

considered Khilafah (vicegerency). As

Khilafah, they are given trust in

managing mosque co-operatives' resources viz financial and non-financial

resources by Allah as the ultimate owner of all resources. Therefore, they are

expected to utilise the resources to benefit the community and surroundings.

These benefits include the economic enhancement of society as the history of the

Prophet Rasulullah s.a.w described the mosque's function as the centre of

economics (Sulaiman et al., 2007). Furthermore, the concept of

cooperation itself is consistent with two Islamic teachings – ta'awun (helping each other –

cooperation spirit among co-operative members and adl (fair and just – the surplus of cooperation is shared fairly

and equitably among co-operative members (Wan-Adlina,

2014a; 2014b). Therefore,

it is expected that spirituality will affect the mosque co-operatives

performance and contribution to mosque institutions.

3.1. Research Design

This study used a

quantitative research design as it intends to explain and measure antecedents

of mosque co-operatives performance, based on Intellectual Capital Theory. In

detail, the study deployed descriptive research to gauge respondents' thoughts

and perceptions of mosque co-operators regarding the understudied issue.

According to Neuman (2006),

descriptive research describes "the characteristics of a population

through the administration of questionnaire or survey form by asking the same

set of questions or a large number of individuals either by mail, telephone or

in-person". Therefore, to facilitate data collection, the study used a

cross-sectional survey.

3.2. Population and Sample of the Study

This study population

encompassed all participants of an annual business workshop organised by

ANGKASA. The participants were mosque co-operatives' board members from the

central region, encompassing the state of Selangor, Negeri Sembilan and the

Federal Territory of Kuala Lumpur. Every year, ANGKASA organises a business

workshop in each region to equip board members of mosque co-operatives with the

latest knowledge, concepts and idea of governance, administration, and

operation management. The other regions include the northern, east, southern,

and Sabah & Sarawak region. The business workshop is part of the continuous

professional development initiatives by ANGKASA, MCSC and IKM. Hence, using a

convenient sampling method, a questionnaire was distributed to all 51 mosque

co-operators who attended the annual business workshop for the central region.

3.3. Research Instrument

Data was collected using a

questionnaire. The deployment of the questionnaire in co-operative research has

been widely adopted in Malaysia, for instance by Ismail

et al. (1990), Kaur

(2006), Rajaratnam

et al. (2009), Rajaratnam et al. (2010) and Khan et al. (2016). The questionnaire was prepared in Bahasa Malaysia. It was divided into

two parts. First, Part A collects respondents' demographic information. Next,

Part B captures respondents' perceptions of determinants of mosque

co-operatives' performance. Based on Khalique et al. (2011), the questionnaire items on determinants of mosque

co-operatives performance were formulated from structural capital, relational

capital, human capital and spiritual capital. Structural capital consists of

the mosque co-operative's characteristics and internal control and supervision.

Next, Relational capital involves members' support and stakeholders' support.

Human capital refers to board members' competencies and managers' competencies.

Finally, spiritual capital explains the spirituality aspect in driving mosque

co-operatives' performance. Respondents were required to provide a response

using a five Likert scale, ranging from strongly disagree to agree strongly. A

short briefing was conducted to explain the research, its objectives and

purposes, the questionnaire's structure, and the respondents' expectations.

Respondents were given time to complete the questionnaire and were requested to

return them after the last session of the business workshop. However,

respondents were free to attempt or not to attempt the questionnaire.

3.4. Analysis Technique

For data analysis, the study employed descriptive analysis via the utilisation of SPSS 27. According to Singh et al. (2006), the central idea of the descriptive technique is 'in getting the thoughts, perceptions and opinion of a large population regarding a particular issue and 'is concerned primarily with determining "what is." Hence, based on Intellectual Capital Theory, descriptive analysis is appropriate to gauge the initial understanding of mosque co-operators' towards determinants of performance. The descriptive analysis provided information on several respondents stating particular preferences from strongly disagree to agree strongly. Besides, it provided analysis in terms of percentage. Additionally, the descriptive analysis derived the mean score of each determinant, which then enabled the ranking analysis.

4.1.

Respondents' Profile

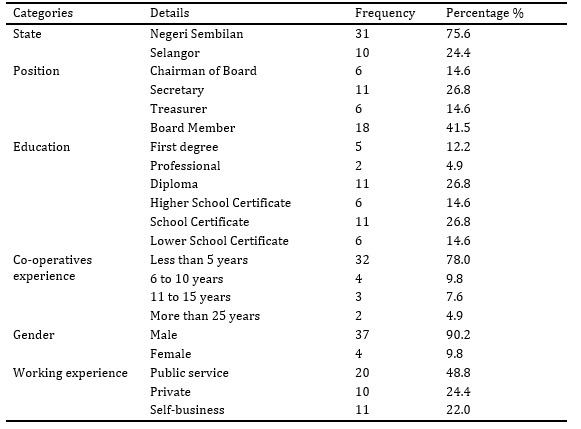

From 51 distributed

questionnaires, 41 were completed and returned. It was 80.39% of the response

rate. After further checking, all 41 questionnaires were used for further

analysis. The summary of respondents' profiles is presented in Table 1.

4.2. Data

Analysis and Findings

Table 2 depicts

respondents' feedback towards structural, human, relational, and spiritual

capital driving mosque co-operatives' performance. In total, 37 respondents or

90.2%, agreed on the essential of co-operative characteristics in driving

performance. A total of 37 respondents, or 90.2%, state a level of agreement on

the essential of internal control and supervision to spur the performance of

mosque co-operatives. In total, 39 or 95.1% state level of agreement on the

importance of having competent, skilful and talented board members to spur

mosque co-operatives' performance. Similarly, 39 respondents or 95.1%, agreed

on the importance of having capable, insightful, and knowledgeable managers to

spearhead mosque co-operatives' performance. Like a previous indicator, 38 or

92.7% of states agree on the crucial of members' support to drive mosque

co-operatives' performance. A total of 37 respondents, or 90.2%, state a level

of agreement on the significance of stakeholders' support to spearhead mosque

co-operatives' performance. In total, 37 or 90.2% of state-level agreements on

the importance of spirituality spur mosque co-operatives' performance.

Table 1 Respondents' Profile

Further assessments were carried

out to determine the mean of each predictor. With a value of 5.54, the highest

mean indicates that the main predictor of mosque co-operatives' financial and

non-financial performance is board excellence from co-operators' perception.

The next highest mean, with a value of 5.41, is spirituality. Next are

stakeholders' support and managerial excellence, with a mean of 5.39. Finally,

the lowest mean with a value of 5.22 is for internal control and supervision.

Table 3 depicts the mean value of each predictor of mosque co-operatives'

financial and non-financial performance.

Table 2 Respondents' Feedback on Structural, Human and Relational Capital

Table 3 Mean

Score for Predictors of Mosque Cooperatives' Success

Therefore, the findings revealed

that from an intellectual capital framework perspective, human capital, i.e.

board member competency, is ranked as the top determinant. It is followed by

spiritual capital, i.e. spirituality. Then, human capital, i.e. managers'

competency and social capital, i.e. stakeholders' support, is equally important

as the third essential predictor of mosque co-operatives' performance.

4.3.

Discussion and Implications of the Study

The board members'

competency is a crucial human capital element in driving mosque co-operatives'

performance. The board member is responsible for determining the direction of

the mosque co-operative, overseeing the management and staff, allocating

resources effectively and efficiently, protecting the members' interests and

rights, and representing the entity in dealing with various stakeholders,

especially the regulator and apex co-operative. Therefore, a competent board

member is essential in ensuring the board's performance. On a similar note, Chumnumporn et al.

(2022) admitted the essential of leaders in navigating

enterprises through new perspectives like Industrial Revolution 4.0 demand.

Hence, continuous and systematic training is needed to enhance board members'

competency.

Furthermore, skills-related training is

crucial among board members to bring mosque co-operatives into highly impacted

economic activities such as financial services, healthcare, tourism, and

plantation, which require technical skills related to marketing, information

communication technologies, and production. Besides, more professionals are

needed to join the mosque co-operatives' board, enhancing the pool of talents,

ideas, and knowledge. Secondly, spirituality is an intangible element of capital

that provides purpose for an individual in carrying out tasks and duties. It

reminds individuals about the superpower that governs and controls their life

and surrounding. Intense spirituality also guides individuals like co-operators

to make the right decision, act ethically, and avoid sins, i.e. fraud,

corruption, and breach of trust. The element of spirituality is essential in

the context of mosque co-operative as it is closely associated with ensuring

the well-being of mosque institutions – the sacred place in Muslim society.

Hence, efforts to enrich spiritual and ethical values among mosque

co-operatives leaders, officials and members shall be strengthened through the

learning process.

Besides another crucial human capital

element is mosque co-operatives managers' competencies. Managers play a crucial

role in implementing and monitoring the initiatives approved by the mosque

co-operatives' board. Hence, managers require business acumen skills to plan, coordinate,

organise and control resources towards achieving mosque co-operatives' economic

and social objectives. Moreover, the relevant competency of managers is

required as mosque co-operatives have to deal with dynamic changes in the

business environment, especially during the post-pandemic Covid-19 and the

emergence of the digital economy. Therefore, structured training and

development programmes for mosque co-operatives' managers are essential to

ensure updated information and knowledge, permitting managers to execute the

tasks effectively.

Furthermore,

relational capital, like vital stakeholders' support, is essential to drive

mosque co-operatives' performance. The critical stakeholders of mosque

co-operatives involve mosque committee members and officials, state Islamic

religious authorities, regulators and apex co-operative. Strong stakeholder

support enables mosque co-operative to deploy more resources, and this has been

recommended by Maarouf and Korableva

(2022) that government endeavours are essential for supporting enterprises'

ability to obtain external financing in carrying out innovation

initiatives.

This study is limited to mosque co-operators in two states, Selangor and

Negeri Sembilan. Thus, generalization should be carried out with caution. In

addition, the study is considered exploratory; therefore, the findings cannot

determine the bivariate and multivariate relationship between predictors of

mosque co-operatives' financial and non-financial performance. The study sample

can also be expanded by incorporating mosque co-operatives in other states.

Furthermore, the comparative analysis may be carried out to obtain a holistic

understanding of mosque co-operatives' performance in other jurisdictions such

as Indonesia, Cambodia, Thailand, Vietnam, Singapore and the Philippines.

The team acknowledges and expresses gratitude for

the funding assistance from the Ministry of Higher Education of Malaysia

through the Fundamental Research Grant Scheme (FRGS 1/2015) and also the Tabung

Amanah Zakat (TAZ), Yayasan Universiti Multimedia, and Lembaga Zakat Selangor

through Fi Sabilillah Research Development Grant Scheme (FRDGS 1/2016, 1/2018,

1/2021).

Abdul-Rahman, A.R., Goddard, A., 1998. An

Interpretive Inquiry of Accounting Practices In Religious Organisation. Financial

Accountability and Management: in Governments, Public Services and Charities,

Volume 14(3), pp. 183–201

Abdul-Rahman, N., Zakaria, Z., 2018.

Challenges of Managing Mosque Co-Operatives. At-Tahkim, Volume 8(20),

pp. 16–21

Adi, P.H., Adawiyah, W.R., 2018. The Impact

of religiosity, Environmental Marketing Orientation and Practices on

Performance: A Case of Muslim Entrepreneurs in Indonesia. Journal of Islamic

Marketing, Volume 9(4), pp. 841–862

Amini, A.M., Ramezani, M. (2008).

Investigating the Success Factors of Poultry Growers' Co-Operatives in Iran's

Western Provinces. World Applied Sciences Journal, Volume 5(1), pp. 81–87

Bontis, N., 2001. Assessing Knowledge Assets:

a Review of the Models Used to Measure Intellectual Capital. International

Journal of Management Reviews, Volume 3(1), pp. 41–60

Boyer, D., Creech, H., Paas, L., 2008. Critical

Success Factors and Performance Measures for Start-Up Social and Environmental Enterprises.

Report for the SEED Initiative Research Program, Winnipeg, Manitoba, Canada

Bryunis, C.L., Goldsmith, P., Hahn, D.E.,

Taylor, W.J., 2001. Critical Success Factors for Emerging Agricultural

Marketing Co-Operatives. Journal of Cooperation, Volume 16(2), pp. 14–24

Carr, A., Kariyawasam, A., Casil, M., 2008. A

Study of the Organisational Characteristics of Successful Co-Operatives. Organizational

Development Journal, Volume 26(1), pp. 79–87

Chareonwongsak, K., 2017. Enhancing Board

Motivation for Competitive Performance of Thailand's Co-Operatives. Journal

of Cooperative Organization and Management, Volume 5(1), pp. 1–13

Chumnumporn, K., Jeenanunta, C., Simpan, S.,

Srivat, K., Sanprasert, V., 2022. The Role of Leader and the Effect of

Customer's Smart Factory Investment on Firm's Industry 4.0 Technology Adoption

in Thailand. International Journal of Technology, Volume 13(1), pp. 26–37

Fathonih, A., Anggadwita, G., Ibraimi, S.,

2019. Sharia Venture Capital as Financing Alternative of Muslim Entrepreneurs:

Opportunities, Challenges and Future Research Directions. Journal of

Enterprising Communities: People and Places in the Global Economy, Volume

13(3), pp. 333–352

Gill, A., Mathur, N., 2018. Religious Beliefs

and the Promotion of Socially Responsible Entrepreneurship in the Indian

Agribusiness Industry. Journal of Management Development in Developing and

Emerging Economies, Volume 8(1), pp. 201–218

Hawks, S.R., Hull, M.L., Thalman, R.L.,

Richins, P.M., 1995. Review of Spiritual Health: Definition, Role, and

Intervention Strategies in Health Promotion. American Journal of Health

Promotion, Volume 9(5), pp. 371–378

Hind, A.M., 1999. Co-Operative Life Cycle and

Goals. Journal of Agricultural Economics, Volume 50(3), pp. 536–548

Ismail, I., Said, M.S., Zakaria, H., Mahajar,

J., Samad, R.A., 1990. Cooperatives Among Community Mosque. Monograf

Penyelidikan. Petaling Jaya: Maktab Koperasi Malaysia

Jabatan Kemajuan Islam Malaysia (JAKIM),

2010. Malaysian Mosque Rating Standard. Putrajaya: Jabatan Kemajuan

Islam Malaysia

Kaur, I., 2006. Performance Measurement: An

Evaluation of Co-Operative Performance in Malaysia. Malaysian Journal of

Cooperative Management, Volume 2(1), pp. 1–17

Khalique, M., Bontis,

N., Shaari, J.A.N., Yaacob, M.R., Ngah, R., 2018. Intellectual Capital and

Organisational Performance in Malaysian Knowledge-Intensive SMEs. International

Journal of Learning and Intellectual Capital, Volume 15(1), pp. 20–36

Khalique, M., Hina, K., Ramayah, T., Shaari,

J.A.N., 2020. Intellectual capital in tourism SMEs in Azad Jammu and Kashmir,

Pakistan. Journal of Intellectual Capital, Volume 21(3), pp. 333–355

Khalique, M., Mansor, S.A., 2016.

Intellectual Capital in Malaysian Hotel Industry: A Case Study of Malacca. International

Journal of Business Performance Management, Volume 17(1), pp. 103–116

Khalique, M., Shaari, J.A.N., Isa, A.H.M.,

2013. The Road to the Development of Intellectual Capital Theory. International

Journal of Learning and Intellectual Capital, Volume 10(2), pp. 122–136

Khalique, M., Shaari, J.A.N., Md Isa, A.H.,

2011. Intellectual Capital and its Major Components. International Journal

of Current Research, Volume 3(6), pp. 343–347

Khan, H.H.A., Yaacob, M.A., Abdullah, H., Ah,

S.H.A.B., 2016. Factors Affecting Performance of Co-Operatives in Malaysia. International

Journal of Productivity and Performance Management, Volume 65(5), pp. 641–671

Khaykin, M., Toechkina, O., 2021. Service

Capital as a Condition for the Sustainable Development of Society. International

Journal of Technology. Volume 12(7), pp. 1458–1467

Lajuni, H., Ali, M.P., Yacob, Y., Tarip, Y.,

2019. Board of Directors' Finance and Planning Competency Influence on

Co-Operative's Financial and Non-Financial Performance. Malaysia Journal of

Cooperative Studies, Volume 15(1), pp. 1–13

Lluch, D.B.L., Gomis, F.J.C., Jimenez, F.V.,

2006. A Management Model for the Evaluation of Co-Operative Success with

Special Reference to Member Objective Setting and Satisfaction. International

Journal of Cooperative Management, Volume 3(1), pp 44–53

Maarouf, A., Korableva, O.N., 2022. Credit

Constraints and Innovation Activities: Empirical Evidence on Russian

Enterprises. International Journal of Technology. Volume 13(2), pp. 254–263

Malaysian Cooperative Societies Commission

(MCSC), 2011. National Cooperative Policy 2011-2020. Kuala Lumpur: MCSC

Malaysian Cooperative Societies Commission

(MCSC), 2016. Mosque Cooperatives Strategic Development Plan 2017-2020.

Kuala Lumpur: MCSC

Marwan, M., Idris, I., Sari, I.K., 2018. The

Impact of Board Director’s Entrepreneurship and Members’ Participation on Cooperatives’

Performance. In: First Padang International Conference on Economics

Education, Economics, Business and Management, Accounting and Entrepreneurship

(PICEEBA 2018), pp. 663–667

Mayo, E., 2011. Co-Operative Performance. Sustainability

Accounting, Management and Policy Journal, Volume 2(1), pp. 158–164

Ministry of Entrepreneur Development and

Cooperatives (MEDAC), 2021. Malaysian Cooperatives Transformation Plan

2021-2025. Putrajaya: MEDAC

Mohamed, R., Kasmuri, N., Saaey, S.H., Mohd,

N.F., Aziz, N.A., 2020. The Challenges in Governing and Managing Mosque

Co-Operatives in Peninsular Malaysia. Petaling Jaya: Institut Koperasi

Malaysia

Mubarak, M.Z., Rahman, A.A., Yaacob, M.R.,

2015. Spiritual Elements in Islamic Entrepreneurship: A Research Towards Successful

Entrepreneur in Kelantan. Journal of Business and Social Development,

Volume 3(1), pp. 43–53

Mustapa, K.M., Yusof, A.R.M., Zahiruddin, A.,

2013. Critical Success Factor of Credit Co-Operatives in Malaysia. In:

Conference Proceedings. Internal Management Education Conference, University

Pendidikan Sultan Idris, 27-28 November, Tower Regency Hotel, Ipoh

Neuman, W.L., 2006. Basics of Social

Research: Qualitative and Quantitative Approaches. Second Edition. Boston:

Pearson-Allyn and Bacon

Noordin, N., Rajaratnam, S.D., Said, M.S.A.,

Juhan, R., Hanif, F.M., 2011. Attributes and Perceived Success Factors of

Performing Co-Operatives in Malaysia. Research Monograph. Petaling Jaya:

Institut Koperasi Malaysia

Norwahi, A., 2014. The

Sultan of Pahang Consented the Formation of Mosque Co-Operatives. Pelancar,

Volume 41(1), pp. 5–6

Othman, A., Mansor, N., Kari, F., 2014.

Assessing the Performance of Co-Operative in Malaysia: An Analysis of

Co-Operative Groups Using a Data Envelopment Analysis Approach. Asia Pacific

Business Review, Volume 20(3), pp. 484–505

Othman, I.W., Mohamad, M., Abdullah, A.,

2013. Co-operative Movements in Malaysia: The Issue of Governance. International

Journal of Social, Behavioral, Education, Economic, Business & Industrial

Engineering, Volume 7(6), pp. 872–876

Pathak, R.D., Kumar, N., 2008. The Key

Factors Contributing to Successful Performance of Co-Operatives in Fiji for

Building a Harmonious Society. International Journal of Public

Administration, Volume 31(6), pp. 690–706

Rajaratnam, S.D., Noordin, N., Said, M.S.A.,

Juhan, R., Mohd Hanif, F., 2009. Factors Influencing the Performance of

Co-Operative in Malaysia: A Tentative Framework. Malaysian Journal of

Cooperative Management, Volume 5(1), pp. 43–61

Rajaratnam, S.D., Noordin, N., Said, M.S.A.,

Juhan, R., Mohd Hanif, F., 2010. Success Factors of Co-Operatives in Malaysia:

An Exploratory Investigation. Malaysian Journal of Cooperative Studies,

Volume 6(1), pp. 1–24

Ramezan, M., 2011. Intellectual Capital and

Organisational Organic Structure in Knowledge Society: How Are These Concepts

Related? International Journal of Information Management, Volume 31(1),

pp. 88–95

Rocha, R.G., Pinheiro, P.G., 2020.

Organizational Spirituality: Concept and Perspectives. Journal of Business

Ethics, Volume 171(2), pp. 241–252

Sachitra, V., Chong, C.S., 2019. The

Moderating Effect on Religiosity on Resource-Capability-Competitive Advantage

Interaction: Empirical Evidence from Sri Lankan Agribusiness Farm Owners. International

Journal of Social Economics, Volume 46(5), pp. 722–740

Sallehhudin, A., Abu Said, A.M., Abu Hasan,

N.H., Mustafa, M.A., Masuod, M.S., Samsudin, A., Jais, M., Ismail, H., 2017. An

Evaluation of Religion Based Cooperatives Performance Dimension. Advanced

Science Letter, Volume 23(11), pp. 10586–10590

Singh, P., Fook, C.Y., Sidhu, G.K., 2006. A

Comprehensive Guide to Writing a Research Proposal. Surrey, United Kingdom:

Venton Publishing

Ssekakubo, J., Ndiwalana, G., Lwanga, F.,

2014. Managerial Competency and the Financial Performance of Savings, Credit

and Co-Operative Societies in Uganda. International Research Journal of Arts

and Social Science, Volume 3(3), pp. 66–74

Sulaiman, M., Siraj, S.A., Ibrahim, S.H.M.,

2007. Internal Control Systems in West Malaysia's State Mosques. The

American Journal of Islamic Social Sciences, Volume 25(1), pp. 64–81

Sveiby, K.E., 1997. The New Organisational

Wealth: Managing and Measuring Knowledge-Based Assets. CA, San Francisco:

Berrett-Koehler Publishers

Trechter, D.D., 1996. Impact of

diversification on agricultural co-operatives in Wisconsin. Agribusiness: An

International Journal, Volume 12(4), pp. 385–394

Wan-Adlina, W.A.A., 2014a. The Consortium of

Mosque Co-Operative as a Strength of Muslim Community. Pelancar, Volume

41(1), pp. 34–35

Wan-Adlina, W.A.A., 2014b. Mosque

Co-Operatives Towards Restoring the Glory of Islamic Economy. Pelancar,

Volume 41 (2), pp. 44–45

Wan-Idris, S.R., 2019. Factors Influencing

the Performance of Women Entrepreneurs in Co-Operatives Sector. Malaysia

Journal of Cooperative Studies, Volume 151(1), pp. 47–66

Ward, A., McKillop, D.G., 2005. An

Investigation into the Link Between the UK Credits Union Characteristics,

Location, and Their Success. Annals of Public and Cooperative Economics,

Volume 76(3), pp. 461–489

Yaacob, M.A., Ahmad-Khan, H.H., Yaacob, Z.,

2012. Factors Affecting Co-Operatives' Performance in Relation to Strategic

Planning and Members' Participation. Procedia-Social and Behavioral

Sciences, Volume 65(1), pp. 100–105

Zakaria, Z., Abdul Rahim, A.R., Aman, Z.,

2021. How Governance Practices Shape and Influence Oil Palm Co-Operative

Performance in Malaysia. International Journal of Academic Research in

Business & Social Sciences, Volume 11(4), pp. 1222–1238

Zaytsev, A., Rodionov, D., Dmitriev, N.,

Ilchenko, S., 2020. Assessing Intellectual Capital from the Perspective of its

Rental Income Performance. International Journal of Technology. Volume

11(8), pp. 1489–1498