Does Innovation Ambidexterity Moderate the Relationship between Intellectual Capital and Innovation Performance? Evidence from Morocco

Published at : 28 Jun 2023

Volume : IJtech

Vol 14, No 4 (2023)

DOI : https://doi.org/10.14716/ijtech.v14i4.5677

Taleb, M., Pheniqi , Y. 2023. Does Innovation Ambidexterity Moderate the Relationship between Intellectual Capital and Innovation Performance? Evidence from Morocco. International Journal of Technology. Volume 14(4), pp. 724-748

| Mahdi Taleb | Interdisciplinary Research in Economics, Finance and Management of Organizations Lab, Faculty of Law, Economics, and Social Sciences, Sidi Mohamed Ben Abdellah University, Fez, Route d'Imouzzer B.P.26 |

| Youssef Pheniqi | Interdisciplinary Research in Economics, Finance and Management of Organizations Lab, Faculty of Law, Economics, and Social Sciences, Sidi Mohamed Ben Abdellah University, Fez, Route d'Imouzzer B.P.26 |

Innovation performance is seen as the backbone of firm’s sustained competitive advantages. Scholars of the dynamic capability view suggest that Intellectual Capital (IC), such as human, structural, and relational capital, are the main driving force of a firm’s Innovation Performance (IP). The purpose of this study is to investigate the importance of developing firms’ intellectual capital and their role in leveling up innovation performance. In doing so, this paper conducts an examination by moderating the variable of Innovation Ambidexterity (IA), namely explorative and exploitative activities. By applying a quantitative and cross-sectional design, the study deploys data feedback from managers and executives of manufacturing SMEs across the Moroccan national territory collected from 286 surveys. The results show that IC has a positive and significant impact on IP, while IA has a positive and significant effect on both IP and IC. The study also finds that IA failed to moderate the relationship between IC and IP. This study contributes to advancing the capability theory by adding the importance of developing and reconfiguring firm’s human, structural, and relational capital as the main driving force of innovation performance.

Dynamic capability view; Human capital; Innovation ambidexterity; Intellectual capital; Innovation performance

Since the past decade, researchers have been emphasizing the critical role of Intellectual Capital (IC) to foster and level up innovation performance capacities to ensure business growth and sustainability. IC has emerged as one of the pivotal pillars for developing the innovation performance of Small and Medium Enterprises (SMEs) and economic growth (Demartini and Beretta, 2020). So far, very little research has been done to assess the effect of IC and its components concerning Innovation Performance (IP) and its consequences on SMEs' business growth (Zerenler et al., 2008). Therefore, firms that seek a successful IP must determine factors that can polish their efficiencies, processes, and capacity to adapt dynamically by learning and leveraging valuable resources to fit the uncertain business environment (Yen et al., 2012). Scholars suggest that firms looking to create and sustain their competitive advantages should emphasize the development of intellectual capital which is defined as organizational practices that enhance the level of innovation capabilities (Tastan and Davoudi, 2015). In addition, Ali et al. (2021a) argue that improving the training, skills, knowledge, and intangible characteristics of employees can help firm’s IC exploitation, which then leads to creating wealth via business experiences and competitive advantages gain. Scholars have been defining and examining IC in various ways according to its perspective, type, scale, and nature of the industry (Gürlek, 2021; Reza et al., 2021; Ali et al., 2021b;). Therefore, firm’s IC can be seen as a source of creating benefits and practices through the development of the employees’ skills. The possibility of utilizing IC to create valuable outcomes is based on the components of which the IC consists and the outcomes are varied accordingly (Ali et al., 2021b).

Studies (Lopez-Zapata et al., 2021; Agostini et al., 2017; Turner et al., 2015) suggest

several components of IC, such as human, relational, technological, and

structural capital on innovation performance and organizational capabilities.

Due to the strategic role of IC in innovation performance capacities and giving

the crucial role of exploration and exploitation activities, this study extends

the body of knowledge of IC by exploring the crucial role of IC integration

within exploitation and exploration activities in the area of innovation

product and innovation processes to level up overall firm performance. Hence,

this study fits and bridges the IC theoretical and empirical gaps in the

dynamic capability view. The second gap addressed is related to the heavy focus

of the existing studies on large firms (Kostopoulos

et al., 2015; Turner et al., 2013; Hsu and Wang, 2012; Subramaniam and Youndt, 2005), making Small-medium

Enterprises

(SMEs), given the limited resources and capabilities, received little

attention. It is strategically important to look into it and find ways on how

IC dimensions may improve innovation capabilities in SMEs. Furthermore, the

existing study on IC in the context of organizational ambidexterity is

overlooked and poorly estimated. Therefore, this study addresses this by

highlighting the role of the triple dimensions of IC on innovation performance

in the existing external impact of innovation ambidexterity.

Firms view innovation as the process of improvement and the art of

creating novel ideas and designing new products (Yang

and Han, 2021) or the

improvement of the workplace environment (Anderson et

al., 2014). Hence, it reflects the extent to which employees create

value in the process, products, services, and other activities that leads to

achieving competitive advantages (Shahzad et al.,

2019). Thus, this study aims to examine innovation as the source of

enhancing internal firms’ structures and enabling business processes,

responding to customer needs and market demands (Kamau

and Oluoch, 2016). A study

by McDowell et al. (2018) stated that employees' knowledge and skills are

pivotal elements of innovative ideas, products, and practices in developing new

streams of production techniques. Therefore, employees with sufficient

knowledge are seen to be important strategic intellectual assets that affect

firms’ business processes and organizational structure to establish new ways of

businesses and processes (Wendra et al.,

2019; Wang and Kafouros, 2009). Scholars and professionals viewed

employees’ skilfulness as a significant predictor of IP that resulted from strategic

and operational outcomes (Berawi, 2020; Tatiana and

Mikhail, 2020). In this regard, IP is viewed as an intermediary

construct in which firms plan to facilitate the outcomes generated from the

improvement of IP, thereby well-skilled employees help organizations to benefit

from IP (Li and Huang,

2019). A recent study found a positive correlation between innovation and

performance (Ali et al., 2021). Cabrilo and Dahms (2020) viewed IP as a

conditional parameter for determining firms’ productivity.

IP has been the core focus of strategic scholars and entrepreneurs since

decades ago. Due to its vital role in developing business growth and ensuring

the sustainability of businesses, the majority of developed economies pay

special attention to developing innovative methods, techniques, and practices

that help firms to survive fierce competition (Ali et

al., 2021a). In addition, developed countries committed plans,

procedures, and budgets to upgrade employees’ skills, knowledge, and level up

their mindset to innovate, invent, and enhance national innovation indexes (Hung et al., 2010). This is due to the

fact that innovation plays a great role in helping SMEs to survive against

large businesses and imported products. Firms need to develop innovative ways

and methods that makes to strengthen themselves to survive external challenges

as well as local competitions (Ali et al.,

2021; Trapczynski et al., 2018; Wang and Kafouros, 2009). Firms need to upgrade their business

processes, product development and functionality, and quality while preparing

for pricing competition and opening new markets.

Innovation Ambidexterity (IA) is seen as a firm’s capacity to mobilize valuable

resources to match business demands (exploitation) while simultaneously

responding to fit future business changes (exploration)

(Liu et al., 2021). Firms that aim to succeed in the long period

are required to develop and leverage incremental and radical innovative

business changes (Hayaeian et al., 2022). Acknowledging the importance of

ambidexterity and its associated benefits might motivate firms to plan and take

efficient strategic decision-making. While research attention to IA has been

increasing in the past few years, especially in developed countries, the topic

is still understudied for cases in developing countries like Morocco. In

addition, Oh and Lee (2020) reported that in

developing economies firms are not always able to acquire sufficient knowledge

and skills that lead to radical innovation. In the context of North Africa,

Morocco might be viewed as an organic laboratory to examine theories that

emerged in developed countries regarding individual, organizational, and market

behavior (Aguinis et al., 2020).

Explorative

innovation fundamentally influences the entire business on the technological

side while firms’ exploitation refers to the changes occurred in the developed

capabilities. The firm’s activity to seek new markets and customers is seen as

exploratory activity. Maintaining the existing ones, meanwhile, is viewed as an

exploitative activity (Chen et al., 2021).

Exploration is characterized by high flexibility, tracking customers,

associated with risk-taking, radical development, adaptation, and divergent

thinking (Hou et al., 2019; Brix, 2018; Andriopoulos and Lewis, 2010). Exploration consists of

the creation of new knowledge, the development of new skills and practices, and

activities combining it with the existing ones (Carnabuci

and Operti, 2013). Bierly III et al. (2009) viewed exploration consist

of yielding new technologies and developing new products and services; while

exploitation refers to firms leveraging new practices, experiential learning,

incremental development, and reuse of strategic thinking (Andriopoulos and Lewis, 2010; Smith and Tushman, 2005). Exploitation outcomes depend on the

development of new knowledge or existing ones which leads to polished business

processes, resource efficiencies, reduced costs, and extension of products and

services, thus, leading to enable existing competencies (Ryan et al., 2018). Therefore, exploitation enhances

business processes, new product development, and brand reputation (Bierly III et al., 2009; Jansen et al.,

2006).

Due to the strategic

role of IC on business growth and the crucial impact of IA on innovation

performance, literature shows a lack of studies that examine the relationship

between IC and innovation performance (Agostini et

al., 2017; Beyene et al., 2016; Campanella et al., 2014)

IA and innovative performance (Comlek et al.,

2012; Wang and Ellinger, 2011), and more in particular in

the existence of IA as an external factor (moderator). IC and IA are regarded as the key

driving force for enhancing the capabilities of SMEs' innovation performance.

Specifically, launching new products, developing production methods, and

increasing firms’ flexibility (Fernandez-Mesa and Alegre, 2015).

Since this study

emphasizes the importance of ambidexterity in the context of North Africa as

well as addressing the critical role of intellectual capital as the main

driving force of business development. It is not understood the development of

intellectual capital in Morocco and which pillar that relies on it to check the

progress of innovation performance and business growth. At the same time

knowing how ambidexterity leads to enhance the development of IC and IP needed

to be examined. Therefore, this study contributes to the body of intellectual

capital theory by linking firms’ dynamic capabilities and testing the role of

ambidexterity as an external influencer. In this context, this research

analyses the impact of IC on innovation performance and the critical effect of

IA on both innovation performance and IC; as well as assesses the moderating

role of IA on this relationship.

This research intends

to fill the gap in the ambidexterity literature since some authors have studied

the link between IC and IA (Lopez-Zapata et al., 2021; Mahmood and Mubarik, 2020; Turner

et al., 2015, 2013; Kang and Snell, 2009) and moderating variables of

this relationship such as high-performance human resource management practices (Kostopoulos et al., 2015) and technology

absorptive capacity (Mahmood and Mubarik, 2020). Yet, introducing IA as a

moderating role between IC and IP has to be specifically addressed. The study

introduced IA as a moderating variable in this relationship because we assume

that firms' IC might affect the focus of innovation on firms' internal or

external environment. Additionally, the author had a great motivation to

conduct this research due to its importance to the national policy level and

supporting social awareness to educate, support, and increase their citizens'

innovative ideas. This research thus provides further empirical contributions

to dynamic capability theory, suggesting strategic implications for top

management.

This research

consists of five sections. Section 2 discusses the theoretical background and

hypotheses development. Section 3 emphasizes the methodological setting (e.g.,

sampling technique, data collection, and measurement variables). Section 4

presents the analysis and findings. Finally, Section 5 discusses the

conclusions, the results, hypothesis validation, and elaboration on theoretical

contribution and practical implications for academicians, policymakers, and

stakeholders.

Theoretical Background and Hypotheses Development

H1:

Intellectual capital positively associated with innovation performance.

Kang and Snell (2009) stressed that IC is an

important factor in successfully implementing

strategic exploration and exploitation due to the significant role of employee’s

knowledge and skills to level up activities that are connected, particularly,

with exploration. Each dimension of IC plays a strategic role in fostering and

leveraging innovation exploration and exploitation (Turner

et al., 2015). Leveraging both exploration and exploitation

requires firms' human capital to involve skilled and knowledgeable employees (Kostopoulos et al., 2015; Kang et al., 2012). Skilled and creative individuals can handle multiple duties and respond

to work pressures. Thus, it allows for the simultaneous implementation of exploration and

exploitation (Adriansyah and Afiff, 2015; Kostopoulos et al., 2015). Skilled

employees usually possess the ability to handle multiple duties (Kang et al., 2012), to respond and handle

the often contradictory activities and effectively mobilize

appropriate resources needed to fulfill various demands of exploration and

exploitation strategies (Kostopoulos and Bozionelos, 2011). On the other hand, firms are in need to use routines, procedures, knowledge

systems, hardware, software, and databases representing structural capital;

thus, influencing innovation ambidexterity activities at the stage of

developing new products and processes (Fu et al.,

2016). Because firms' knowledge is embedded in structural capital, it

will help not only to deploy current knowledge but also to level up the

capacity to create new knowledge and incorporate it within databases and

systems (O'Reilly III and Tushman, 2013). Therefore, SC can enhance the deployment of exploration and exploitation

strategies. In contrast to SC, relational capital can support firms to

determine and deploy exploration and exploitation activities through having

access to knowledge, skills, and good practices from the external environment (Gurlek, 2021). Studies (e.g.

Fu et al., 2016) state that each dimension of IC improves

innovation ambidexterity on an individual level. Nevertheless, examining the

effect of each IC dimension on an individual level might impede researcher from

seeing the entire picture. Therefore, the adoption of a holistic approach is

chosen, since IC dimensions complement one another. More importantly, the

existence of all dimensions might help firms to gain and increase the aggregative

impact of all dimensions on innovation performance. The following hypothesis is

generated.

H2: Innovation ambidexterity is

positively associated with intellectual capital.

H3: Innovation ambidexterity

positively associated with innovation performance.

H4:

Innovation ambidexterity positively moderates the relationship between

intellectual capital and innovation

performance

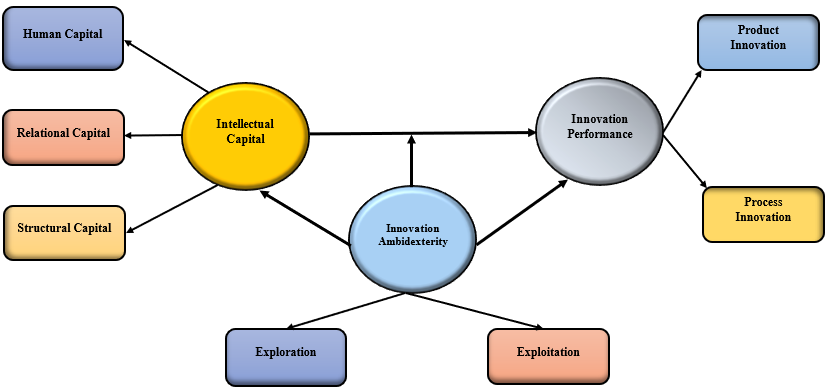

Figure 1 Research Framework

Methodology

3.1. Sampling and Targeted Respondents

The focus of this research was mainly to

investigate the critical role of IC on innovation performance by introducing

moderating variables in this relationship. From the official website of

Moroccan SMEs report, among 303,000 firms registered 6.7% of firms were

operating in the manufacturing sector. The study, therefore, targeted around

20,000 active manufacturing firms listed on the website. The study applied a

random sampling technique and based on Krejcie and

Morgan (1970), the sample size of 384 companies was determined. This research

aims to obtain data from top-to-middle managers to fulfill the objectives of

the study. A hardcover letter attached with a questionnaire explaining the

importance of the study was sent out to the appropriately selected respondents.

A questionnaire was provided in Arabic and English language versions followed

up by calls. To avoid a low-response rate and missing surveys, Wolf et al. (2013)

suggested researchers add 40% of

questionnaires (Makhloufi et al., 2018) to the total sample size (384 + 384

× 40% = 538). Consequently, this study used

self-administered and postal distribution to collect data. Out of 538

distributed questionnaires, 286 questionnaires were returned, with 12 being

incomplete. Therefore, the study response rate was 51.3%.

Data were obtained and measured through a 7-point Likert scale ranging

from 1 "strongly disagree" to 7 "strongly agree." To

adequately ensure the questionnaire items, an in-depth content validity process

was conducted. Four academic experts from the Faculty of Law, Economics, and

Social Sciences, Sidi Mohamed Ben Abdellah University, Fez, Morocco were

involved in the study process. The study invited two professional experts in

the Telecommunication-based industry for an interview. The study benefited from

experienced experts to further improve the questionnaire items by

distinguishing the research model's construct. The final draft was formulated

based on academics and professional experts' output. The final version was then

translated into the French Language.

3.2. Measurement

of Variables

Following previous studies covering the

context of the present research, the authors developed a measurement tool to

fit the study context in Morocco. Hence, this research stands on past empirical

studies to measure intellectual capital (human capital, structural capital, and

relational capital) (Ali et al., 2021; Ali et

al., 2021b; Cabrilo and Dahms, 2020; Mahmood and Mubarik, 2020; Wendra et al., 2019), innovation performance (Ali et al., 2021; Ali et al., 2021b; Cabrilo and Dahms, 2020; Najafi-Tavani et al., 2018), and innovation

ambidexterity (Jansen et al., 2006).

The measurement tool was adapted and adopted to fit the objectives of the

study.

3.3. Profile

of Respondents and Firms

The study approached

managers holding middle to upper managerial positions working in manufacturing

SMEs across the national territory of Morocco (see Table 1).

Table 1 Background of respondents and firms

Data

Analysis and Results

Several statistical

researchers viewed the Partial Least Square (PLS) as a valuable statistical

tool for predicting and assessing measurement and structural models (Henseler et al., 2015). The study consists

of mediation and moderation constructs suggesting PLS as appropriate for better

predictivity (Albort-Morant et al., 2016).

PLS does not require a large sample of data, hence well-fit for this study (Chin, 1998). This statistical tool allows us to

examine all the related tests of both measurement and structural models that

should be applied to explore the interrelationships among variables and their

output, along with determining the model relevancy Q2 through blindfolding

procedures (Q2) (Hair Jr et al., 2014).

The

study applied an independent samples t-test to detect any possibility of

non-response bias (the differences among early and later respondents that

probably share the same features). Another inquiry, namely Levane’s test, was

conducted to check the equivalence of constructs variance, in which the value

of 0.05 indicates that the study is free from non-response bias. Thus, the

requirement was achieved (Pallant, 2011).

Furthermore, the research passed measurement errors to clear the model's entire

relationships by assessing Common Method Variance (CMV) through a full

collinearity test. The results showed that all values of Variance Inflation Factors

(VIFs) were lower than 3.3, indicating that the research model is free of CMV (Kock, 2015).

4.1. The Measurement Model: Validity

and Reliability

This section consists of two-test,

namely convergent and discriminant validity. The study examines convergent

validity through several tests such as outer loading, factor loading, and Average

Variance Extracted (AVE). Table 2 shows that item loading was higher than 0.707

for all variables (Hair Jr et al., 2014).

Table 2 Measurement model

assessment: Loadings, Cronbach's Alpha (CA), Composite Reliability (CR), and Average

Variance Extracted (AVE)

|

Constructs | ||||||

|

1st Order |

2nd Order |

Items |

Loadings |

CA |

CR |

AVE |

|

Intellectual Capital |

Human Capital |

HC1 |

0.914 |

0.949 |

0.961 |

0.478 |

|

HC 2 |

0.912 | |||||

|

HC 3 |

0.915 | |||||

|

HC 4 |

0.887 | |||||

|

HC 5 |

0.926 | |||||

|

Structural Capital |

SC 1 |

0.864 |

0.887 |

0.92 |

0.693 | |

|

SC 2 |

0.843 | |||||

|

SC 3 |

0.913 | |||||

|

SC 4 |

0.887 | |||||

|

SC 5 |

0.874 | |||||

|

SC 6 |

0.412 | |||||

|

Relational Capital |

RC 1 |

0.691 |

0.928 |

0.94 |

0.616 | |

|

RC 2 |

0.748 | |||||

|

RC 3 |

0.785 | |||||

|

RC 4 |

0.824 | |||||

|

RC 5 |

0.868 | |||||

|

RC 6 |

0.761 | |||||

|

RC 7 |

0.854 | |||||

|

RC 8 |

0.832 | |||||

|

RC 9 |

0.800 | |||||

|

|

Intellectual Capital |

Human Capital |

0.666 |

0.657 |

0.729 |

0.589 |

|

Structural Capital |

0.817 | |||||

|

Relational Capital |

0.811 | |||||

|

Innovation Ambidexterity |

Exploitation |

EXPT 1 |

0.645 |

0.899 |

0.924 |

0.807 |

|

EXPT 2 |

0.859 | |||||

|

EXPT 3 |

0.887 | |||||

|

EXPT 4 |

0.851 | |||||

|

EXPT 5 |

0.857 | |||||

|

EXPT 6 |

0.793 | |||||

|

Exploration |

EXPL 1 |

0.625 | ||||

|

EXPL 2 |

0.886 |

0.927 |

0.945 |

0.843 | ||

|

EXPL 3 |

0.887 | |||||

|

EXPL 4 |

0.911 | |||||

|

EXPL 5 |

0.926 | |||||

|

EXPL 6 |

0.902 | |||||

|

Innovation Ambidexterity |

Exploitation |

0.902 |

0.789 |

0.791 |

0.826 | |

|

Exploration |

0.915 | |||||

|

|

|

PROC 3 |

0.656 |

|

|

|

|

Innovation Performance |

Product |

PROD 1 |

0.407 |

0.876 |

0.911 |

0.57 |

|

PROD 2 |

0.890 | |||||

|

PROD 3 |

0.869 | |||||

|

PROD 4 |

0.881 | |||||

|

PROD 5 |

0.819 | |||||

|

PROD 6 |

0.824 |

0.815 |

0.87 |

0.57 | ||

|

Process |

PROC 1 |

0.810 | ||||

|

PROC 2 |

0.723 | |||||

|

PROC 4 |

0.785 | |||||

|

PROC 5 |

0.805 | |||||

|

Innovation Performance |

Product |

0.951 |

0.901 |

0.953 |

0.910 | |

|

Process |

0.957 | |||||

At the same time,

composite reliability was higher than 0.7 (Chin,

1998). Following (Hair Jr et al.,

2017), all constructs' AVE values were greater than 0.5, suggesting that

the study passed the convergent validity test. The second test that must be applied to prove the measurement model is

discriminant validity. The study used Fornell and Larcker criterion test to

compare the correlation between variables with the square root of AVE of a

particular construct. As shown in Table 3, the bold values are greater than the

values within the respective row and column, suggesting that the measures

applied in this research were discriminant. In addition, the results indicated

that the outer loading exceeded the cross-loading of all variables and remained

valid. Several researchers recently argued that both two previous tests are not

sufficient to prove the adequacy of discriminant validity, suggesting the need

to perform the Heterotrait-monotrait (HTMT) ratio (Henseler

et al., 2015). This test (HTMT) ratio is used to ensure that the

model is well-examined by proving the measurement model's effectiveness and

adequacy. PLS software allows us to examine the HTMT ratio. Table 3 shows that

the values that appeared in the parentheses were less than 0.80, indicating

that it fulfills the HTMT ratio values of maximum or below 0.85 (Kline et al., 2012). Following the results

of three major test that constitutes the discriminant validity, the study

performed and proved it successfully, with the HTMT inference showing a

confidence interval of values less than 1.0 for all variables (Henseler et al., 2015).

Table 3 Fornell-larcker

Criterion and Heterotrait-monotrait Ratio

(HTMT)

|

|

HC |

SC |

RC |

EXPT |

EXPL |

PROD |

PROC |

|

HC |

0.81 |

|

|

|

|

|

|

|

SC |

0.65 (0.37) |

0.86 |

|

|

|

|

|

|

RC |

0.32 (0.47) |

0.20 (0.68) |

0.91 |

|

|

|

|

|

EXPT |

0.35 (0.71) |

0.27 (0.21) |

0.38 (0.34) |

0.75 |

|

|

|

|

EXPL |

0.52 (0.46) |

0.28 (0.63) |

0.63 (0.54) |

0.42 (0.05) |

0.80 |

|

|

|

PROD |

0.72 (0.73) |

0.33 (0.62) |

0.42 (0.50) |

0.07 (0.18) |

0.58 (0.39) |

0.79 |

|

|

PROC |

0.58 (0.61) |

0.49 (0.54) |

0.53 (0.37) |

0.12 (0.26) |

0.37 (0.48) |

0.67 (0.62) |

0.81 |

Note: HC: Human Capital, SC: Structural Capital, RC:

Relational Capital, EXPT: Exploitation, EXPL:

Exploration, PROD: Product, PROC: Process.

4.2. Structural Model

Table 4 Structural model

analysis results

|

H |

Relationship |

Std Beta |

T-value (2-tailed) |

P-value |

ƒ2 |

Decision |

|

H1 |

IC -> IP |

0.396 |

4.886 |

0.000 |

0.138 |

Supported |

|

H2 |

IA -> IC |

0.602 |

14.654 |

0.000 |

0.568 |

supported |

|

H3 |

IA -> IP |

0.184 |

2.390 |

0.000 |

0.094 |

Supported |

Note: IC: Intellectual capital, IP:

Innovation Performance, IA: Innovation ambidexterity.

4.3. Effect Size of the Model

Testing

the effect size of the independent variables on related dependent ones can

determine the extent to of these constructs are connected and affected to

demonstrate the model's strength (Hair Jr et al.,

2014). As presented in Table 4, the effect size of IC on IP was 0.138,

and IA on IC and IP was 0.568 and 0.094, respectively, suggesting that the

effects were small, strong, and weak, respectively (Sawilowsky,

2009). These constructs explained the high-value variance of R-square

(36%) on IA, and IP (27%), indicating reliable relationships between dependent

variables (see Table 6).

4.4. The Moderation Effect of IA

The study utilized the

product indicator approach (Henseler and Fassott,

2010) to determine the strength of the moderation effect of Innovation Ambidexterity

(IA) between IC and IP.

Table 5 shows that innovation ambidexterity was

negative and insignificant in the relationship between IC and IP (B = -0.059, t

= 0.933, p<0.001). Thus, H4 is rejected. Figure 3 showed that the presence

of the moderator variable, IA, negatively affected the intensity of the

relationship between IC and IP (B = -0.059; t = 0.933). This result suggested

that higher IA would negatively influence IP.

Table 5 Results

of the moderation effect of innovation ambidexterity

Figure 3

Moderation effects

Using Smart-PLS 3.0, this study applied

blindfolding procedures (Geisser, 1975) to

determine the predictive relevance of Q2 value for IA and IP. Chin (1998) suggested that values greater than

zero can predict that the model is relevant. The nearer the Q2 value is to 1

would indicate the model's greater relevance (Chin,

1998). As stated in Table 6, the values of IA and IP's predictive

relevance were 0.18 and 0.24, respectively. As shown from these Q2 values

(Table 6), when IA is more relevant (which suggests more power), IP's influence

is more significant.

Table 6 Results of variance explained by constructs and

predictive relevance (Q2)

|

Construct |

Variance Explained R2 |

Predictive Relevance Q2 |

|

Innovation

Ambidexterity (IA) |

0.362 |

0.18 |

|

Innovation Performance (IP) |

0.278 |

0.24 |

Discussion

This study aims to predict the crucial

role of innovation ambidexterity on the relationship between intellectual

capital and innovation performance. The study advances the body of knowledge of

intellectual capital theory by examining the role of innovation ambidexterity

as a strategic dynamic capability that enables firms to level up innovation

capability and business growth. This study showed the importance of innovation

ambidexterity in developing both intellectual capital and innovation

performance and at the same time emphasizing the pivotal role of enabling the

relationship between IC and IP. This study ground from the body of dynamic

capability and intellectual capital perspectives. It is among the pioneer’s

research that emphasizes the role of the dynamic capability to polish a firm’s

human, relational and structural capital. The study findings elaborate on the

important role of firms developing valuable capabilities to integrate and help

firms’ intellectual capital to advance their businesses.

From Table 4 and Figure 2, the findings

indicate the IC has a positive and significant impact on IP, thus supporting

H1. Similar to past findings (Agostini et al.,

2017; Lerro et al., 2014; Morris and Snell, 2011; Zerenler et al., 2008), the

first hypothesis was confirmed, where intellectual capital plays a significant

role in developing firms’ capacities to reach a certain level of innovation

performance. Recently, SMEs in Morocco witnessed considerable development in

terms of human capital, e.g. more training provision, improvement in IT skills

and organizational knowledge, in addition to the changes and reconfiguration of

the structural system (Chawki and Lemqeddem, 2021; Rachidi and El Mohajir, 2021; Makhloufi et al., 2018; Cegarra-Navarro et al., 2010), which in turn leads to advance firms

absorption to innovation changes and uncertainty. It then leads to increase

innovation capacities and enhances firms’ business growth (Ali et al., 2021b). Furthermore, the study

findings revealed that innovation ambidexterity recorded a positive association

with IC and IP (Table 4 and Figure 2). Hence, H2 and H3 were confirmed. Past

studies (Lopez-Zapata et al., 2021; Wendra et al., 2019; Kostopoulos et al., 2015; Turner et al.,

2015) argued that exploration and exploitation innovation lead to improving

firm’s human, relational, and organizational capital which in turn resulted in

superior innovation outcomes and business performance. The findings of this

study confirmed that Moroccan SMEs acquire sufficient awareness and knowledge

about the importance of developing innovation capacities to achieve superior

performance. Moreover, grounded in the dynamic capability view and seeking to

extend the body of intellectual capital theory, the study introduced and tested

the moderating effect of innovation ambidexterity on the relationship between

IC and IP. The result revealed that the interaction path was negative and

insignificant. In addition, it is expected that Moroccan firms still suffering

to acquire enough organizational capabilities that help to exploit valuable

innovation activities to explore new opportunities that fit business changes

and ensure firm performance.

This result validates the importance of organizations’ investment in human (Makhloufi et al., 2018), social and structural capital, as the basis for developing organizational capabilities that enable the exploration of new knowledge and exploitation of current knowledge simultaneously, which in turn allows the balanced development of radical and incremental innovations (Makhloufi et al., 2017). SMEs in Morocco are suffering from financial and strategic resources that eventually impede their performance and innovation capacities (Bakhouche, 2021; Rachidi and El Mohajir, 2021; Asli et al., 2020). Furthermore, other studies (McDowell et al., 2018; Agostini et al., 2017; Asiaei and Jusoh, 2015; Chen et al., 2015) indicated that intellectual capital possesses a major role in upgrading and leveraging valuable capabilities that might help to foster innovation and business performance. Local studies (Rachidi and El Mohajir, 2021; Adama and Nadif, 2013; Cegarra-Navarro et al., 2010) studying Moroccan firms from different perspectives such as dynamic capabilities, resource-based view, and intellectual capital suggested that firms need to strengthen their organizational capabilities, i.e. enabling knowledge creation, leveraging valuable innovative practices, employee mindset, managerial skills and flexibility of business processes, to fit business changes and uncertainty (Makhloufi et al., 2018).

Even though innovation ambidexterity positively and significantly influences both IC and IP, the moderating effect of IA failed to strengthen the relationship between IC and IP. Studies stated that contexts and business environments, facilities, and acquiring enough resources would be one of the major reasons for this negative relationship. In the Morocco context, firms are suffering and might be reluctant to leverage valuable capabilities because of limited resources or because of a strategic mindset of managers and entrepreneurs to mobilize resources for exploration and exploitation activities due to the unexpected return from the investment.

5.1. Theoretical

Contribution

This study focuses on the strategic role of

intellectual capital and innovation ambidexterity to improve firms’ innovation

performance. The study extends the body of intellectual capital by emphasizing

the effect of dynamic capabilities of innovation exploration and innovation

exploitation to enhance the outcomes of innovation performance (Alkhatib and Valeri, 2022). In addition, the study provides significant

evidence about the role of innovation capabilities such as exploration and

exploitation activities to develop a firm’s human, structural, and relational

capital to polish innovative products and innovation processes. The study,

therefore, advances the body of intellectual capital knowledge and seeds

important evidence about the need to develop dynamic capabilities such as

innovation ambidexterity. In fact, from dynamic capability theory, IA is seen

as the backbone of innovation performance success and business growth. Thus,

this research argued that by introducing IA as an external factor that increases

the relationship between IC and IP, firms can have beneficial strategic and

operational outcomes. Theorizing and measuring IC and IA in a single mode is an

early attempt to fill the gap in the previously overlooked research topic. This

study is expected to provide important evidence about the importance of the

relationship between IC and IP in light of IA.

This research illustrated theoretical insights

which address the effect of different intellectual capital dimensions on

innovation performance. It is among the fewer empirical studies that tested the

theory and empirically predicted the proposed relationship. The findings of

this research are expected to motivate managers and professionals to develop

exploration and exploitation activities and select valuable resources that

might support the performance of innovation outputs in long term. This study

introduced innovation ambidexterity as a moderating variable between IC and IP

and more in particular from the context of developing economies. To conclude, from

the literature review and the findings, this study discussed these gaps namely

(1) existing studies still face debates about the relationship between IC and

innovation measures due to the limited resources, context differences, and the

development of IC; (2) existing studies focus on large firms abandoning the

development of IC and IA in SMEs sector, which might be due to limited

resources and inability to directly observe activities related to exploration

or exploitation activities; (3) the findings of the existing studies examining

the linkage of IC and IA are confusing and inconsistent, and it is unclear

whether IA was introduced as an external enabler factor to strengthen the path

between IC and IP, especially since IC is significantly influenced by the

development of human, relational, and structural capital.

5.2. Practical

Implication, Limitations, and Recommendation for Future Research

This study suggests that IC dimensions such as

human, structural, and relational capital should be understood as strategic

resources that influence and improve firms’ innovation outcomes. Managers and

executives are advised to revisit and upgrade their strategies, namely

selecting and developing valuable capabilities to mobilize and leverage them,

thus contributing to superior innovation performance (Konno

and Schillaci,

2021). Because of the limitation

of capabilities and access to strategic locations and facilities, Moroccan

firms needed to find alternative collaborations either with neighboring

countries or Western firm counterparts to advance their skills and innovation

capacities to fit the glocalization of business markets. Local studies (Chawki and Lemqeddem, 2021; Rachidi and El Mohajir, 2021; Asli et al.,

2020; Adama and Nadif, 2013; Cegarra-Navarro et al., 2010) argued and suggested that Moroccan SMEs, in

particular, are in need for help and is seeking alternative ways to prove and

ensure their sustainability of businesses. This study addressed strategic

issues recognized by strategic management scholars and entrepreneurs related to

firms’ intellectual capital, ambidexterity, and innovation outcomes. Moroccan

SMEs are advised to join clusters and industrial zones to level up their

networking and cooperate with others to avoid establishing a home-based business.

This can help them acquire capabilities and skills to support technological

innovation and product development.

Although this empirical study supported the

direct hypotheses between IA, IC, and IP, the results also show some

limitations. IP is seen as a strategic backbone of a firm’s business growth.

The findings of the study supported that the close interaction of IC and

innovation ambidexterity would improve the creation of business value and

empower employees’ skills, knowledge, and best practices. To highlight the

importance of developing dynamic capability and its role in fostering IC

dimensions to better predict innovation outcomes over time, a longitudinal

study is needed.

This study targeted all manufacturing firms in Morocco;

therefore, the findings are affected by the differences in terms of acquiring

valuable resources and leveraging certain capabilities. Future studies should

include also firms with sufficient resources. The findings indicate that IC and

IA explain 24% of the total variance in IP, which means that other explanatory

variables need to be discovered (up to the remaining 76%). Hence, this study

recommends future research to explore and examine other factors such as

organizational culture, government support, technological capabilities, and

open innovation.

To conclude, this research investigated the important role of IA in the

relationship between IC and IP in a single model which was an overlooked gap in

IC and firms’ ambidexterity literature. In addition, the present findings

provided theoretical and empirical evidence on the effect of IA and IC on IP

and the moderating role of IA in Moroccan SMEs and large firms.

Hence, this study develops and extends past frameworks concerning IC and

IA literature which expand the body of intellectual and ambidexterity

literature. Future research is needed to estimate the role of IA in developing,

upgrading, and leveraging firms’ IC in the proper sides of innovation

performance outcomes.

Adama, T.Y., Nadif, M., 2013.

The Influence of Managers' Social Capital on SMEs Performance and Access to External Resources in the

Moroccan Textile Industry. International Journal of Management and

Administrative Sciences, Volume 2(1), pp. 13–23

Adriansyah, A., Afiff, A.Z.,

2015. Organizational Culture, Absorptive Capacity, Innovation Performance and Competitive Advantage: An Integrated Assessment in

Indonesian Banking Industry. The South East Asian Journal of Management, Volume 9(1), pp. 70–86

Agostini, L., Nosella, A., Filippini, R.,

2017. Does Intellectual Capital Allow Improving Innovation Performance? a Quantitative Analysis in the

SME Context. Journal of Intellectual Capital, Volume 18(2),

pp. 400–418

Aguinis, H., Villamor, I., Lazzarini, S.G.,

Vassolo, R.S., Amoros, J.E., Allen, D.G., 2020.

Conducting Management Research in Latin America: Why and What’s in it for You?. Journal

of Management, Volume 46, pp. 615–636

Albort-Morant, G., Leal-Millan, A., Cepeda-Carrión, G., 2016. The Antecedents of Green Innovation Performance: A Model of Learning and Capabilities. Journal

of Business Research, Volume 69(11), pp. 4912–4917

Ali, M.A., Hussin, N., Haddad, H., Al-Araj, R., Abed, I.A., 2021(a). Intellectual Capital and Innovation Performance:

Systematic Literature Review. Risks, Volume 9(9), p. 170

Ali, M.A., Hussin, N., Haddad, H., Al-Araj, R., Abed, I.A., 2021(b). A Multidimensional View of Intellectual Capital: The Impact on Innovation Performance. Journal of Open Innovation: Technology, Market, and Complexity, Volume 7(4), p. 216

Ali, M.A., Hussin, N., Haddad, H., Alkhodary, D., Marei, A., 2021. Dynamic Capabilities and Their Impact on Intellectual

Capital and Innovation Performance. Sustainability, Volume 13(18), p. 10028

Alkhatib, A.W., Valeri, M.,

2022. Can Intellectual Capital Promote the Competitive Advantage? Service Innovation and Big Data Analytics Capabilities in a

Moderated Mediation Model. European Journal of Innovation Management,

Volume 2022, pp. 1–27

Anderson, N., Potocnik, K., Zhou, J., 2014.

Innovation and Creativity in Organizations: A State-of-the-science Review, Prospective Commentary, and Guiding Framework. Journal

of management, Volume 40(5), pp. 1297–1333

Andriopoulos, C., Lewis, M.W.,

2010. Managing Innovation Paradoxes: Ambidexterity Lessons from Leading Product Design Companies. Long

Range Planning, Volume 43(1), pp. 104–122

Asiaei, K., Jusoh, R., 2015. A Multidimensional View of Intellectual Capital: The Impact on Organizational Performance. Management

decision, Volume 53(3), pp. 668–697

Asiaei, K., Jusoh, R., Bontis, N.,

2018. Intellectual Capital and Performance Measurement Systems in Iran. Journal

of Intellectual Capital, Volume 19(2), pp. 294–320

Asli, A., Zohri, A., El Manzani, N.,

2020. Factors that Explain Entrepreneurial Failure of Moroccan SMES,

an Exploratory Study. In: Conference Procedings of 8th International OFEL Conference on Governance,

Management and Entrepreneurship, Croatia, pp. 216–236

Atuahene?Gima, K., Wei, Y., 2011.

The Vital Role of Problem?solving Competence in New Product Success. Journal

of Product Innovation Management, Volume 28(1), pp. 81–98

Bakhouche, A., 2022. Assessing the Innovation-finance

Nexus for SMEs: Evidence from the Arab Region (MENA). Journal of the

Knowledge Economy, Volume 13(3), pp. 1875–1895

Berawi, M. A., 2022. Managing Nature 5.0: The

Role of Digital Technologies in the Circular Economy. International Journal

of Technology, Volume 11(4), pp. 652–655

Beyene, K.T., Shi, C.S., Wu, W.W., 2016.

The Impact of Innovation Strategy on Organizational Learning and Innovation Performance: Do Firm Size and Ownership Type Make a Difference ?. South African Journal of Industrial Engineering, Volume 27(1),

pp. 125–136

Bierly III, P.E., Damanpour, F., Santoro, M.D.,

2009. The Application of External Knowledge: Organizational Conditions for Exploration and Exploitation. Journal

of Management studies, Volume 46(3), pp. 481–509

Bontis, N., Nikitopoulos, D., 2001.

Thought Leadership on Intellectual Capital. Journal of

Intellectual Capital, Volume 2(3), pp. 183–191

Brix, J., 2018. Innovation Capacity Building: An Approach to Maintaining Balance Between Exploration and Exploitation in Organizational Learning. The

Learning Organization, Volume 26(1), pp. 12–26

Buenechea-Elberdin, M.,

2017. Structured Literature Review About Intellectual Capital and Innovation. Journal

of Intellectual Capital, Volume 18(2), pp. 262–285

Cabrilo, S., Dahms, S., 2020.

The Role of Multidimensional Intellectual Capital and Organizational Learning Practices in Innovation Performance. European

Management Review, Volume 17(4), pp. 835–855

Cabrita, M.D.R., Bontis, N.,

2008. Intellectual Capital and Business Performance in the Portuguese

Banking Industry. International Journal of Technology Management,

Volume 43(1-3), pp. 212–237

Campanella, F., Rosaria Della Peruta,

M., Del Giudice, M., 2014. Creating Conditions for Innovative Performance of Science Parks in Europe.

How Manage the Intellectual Capital for Converting Knowledge Into Organizational Action. Journal

of Intellectual Capital, Volume 15(4), pp. 576–596

Carnabuci, G., Operti, E.,

2013. Where do Firms' Recombinant Capabilities Come from?

Intraorganizational Networks, Knowledge, and Firms' Ability to Innovate Through Technological Recombination. Strategic

Management Journal, Volume 34(13), pp. 1591–1613

Cegarra-Navarro, J.-G., Sánchez-Polo, M.T.,

2010. Linking National Contexts with Intellectual Capital: A Comparison Between Spain and

Morocco. The Spanish journal of psychology, Volume 13(1), pp. 329–342

Chawki, A., Lemqeddem, H.A., 2021.

The Relationship Between Strategic Management and

SMEs Performance in Morocco: Proposal for an Analytical Model. Alternatives

Managériales Economiques, Volume 3(1), pp. 289–311

Chen, H., Yao, Y., Zhou, H., 2021.

How does Knowledge Coupling Affect Exploratory and Exploitative Innovation? The Chained Mediation Role of Organisational Memory and Knowledge Creation. Technology

Analysis and Strategic Management, Volume 33(6), pp. 713–727

Chen, J., Zhao, X., Wang, Y., 2015.

A New Measurement of Intellectual Capital and its Impact on Innovation Performance in an

Open Innovation Paradigm. International Journal of Technology

Management, Volume 67(1), pp. 1–25

Chin, W.W., 1998. The Partial Least Squares Approach to Structural Equation Modeling. Modern

Methods for Business Research, Volume 295(2),

pp. 295–336

Chowdhury, L.A.M., Rana, T., Akter, M., Hoque, M., 2018. Impact of Intellectual Capital on Financial Performance: Evidence from the

Bangladeshi Textile Sector. Journal of Accounting and Organizational

Change, Volume 14(4), pp. 429–454

Cohen, W.M., Levinthal, D.A.,

1990. Absorptive Capacity: A New Perspective on Learning and Innovation. Administrative

Science Quarterly, Volume 35(1),

pp. 128–152

Comlek, O., Kitapc?, H., Celik, V., Ozsahin, M., 2012. The Effects of Organizational Learning Capacity on Firm Innovative Performance. Procedia-social and

Behavioral Sciences, Volume 41, pp. 367–374

Crupi, A., Cesaroni, F., Di Minin, A.,

2020. Understanding the Impact of Intellectual Capital on Entrepreneurship:

A Literature Review. Journal of Intellectual Capital,

Volume 22(3), pp. 528–559

Demartini, M.C., Beretta, V.,

2020. Intellectual Capital and SMEs’ Performance: A Structured Literature Review. Journal

of small business management, Volume 58(2), pp. 288–332

Diaz-Fernandez, M., Pasamar-Reyes, S., Valle-Cabrera, R., 2017. Human Capital and Human Resource Management to Achieve Ambidextrous Learning: A Structural Perspective. BRQ

Business Research Quarterly, Volume 20(1), pp. 63–77

Dumay, J.C., 2009. Intellectual Capital Measurement: A Critical Approach. Journal

of Intellectual Capital, Volume 10(2), pp. 190–210

Edvinsson, L., 1997. Developing Intellectual Capital at

Skandia. Long Range Planning, Volume 30(3), pp. 366–373

Eisenhardt, K.M., Martin, J.A.,

2000. Dynamic Capabilities: What are They?. Strategic

Management Journal, Volume 21(10?11), pp. 1105–1121

Farzaneh, M., Wilden, R., Afshari, L., Mehralian, G., 2022. Dynamic Capabilities and Innovation Ambidexterity:

The Roles of Intellectual Capital and Innovation Orientation. Journal

of Business Research, Volume 148, pp. 47–59

Fernandez-Mesa, A., Alegre, J.,

2015. Entrepreneurial Orientation and Export Intensity:

Examining the Interplay of Organizational Learning and Innovation. International

Business Review, Volume 24(1), pp. 148–156

Fu, N., Flood, P.C., Morris, T.,

2016. Organizational Ambidexterity and Professional Firm Performance: The Moderating Role of Organizational Capital. Journal

of Professions and Organization, Volume 3(1), pp. 1–16

Fu, N., Ma, Q., Bosak, J., Flood, P., 2016.

Intellectual Capital and Organizational Ambidexterity in Chinese and

Irish Professional Service Firms. Journal of

Organizational Effectiveness: People and Performance, Volume 3(2), pp. 94–114

Geisser, S., 1975. A New Approach to the Fundamental Problem of Applied Statistics. Sankhy?:

The Indian Journal of Statistics, Series B (1960-2002), Volume 37(4), pp.

385–397

Grant, R.M., 1996. Toward a Knowledge?based Theory of the Firm. Strategic

Management Journal, Volume 17(S2), pp. 109–122

Gupta, O., Roos, G., 2001. Mergers and Acquisitions Through an Intellectual Capital Perspective. Journal

of Intellectual Capital, Volume 2(3), pp. 297–309

Gurlek, M., 2021. Effects of High-performance Work Systems (HPWSs)

on Intellectual Capital, Organizational Ambidexterity and Knowledge Absorptive Capacity: Evidence from the

Hotel Industry. Journal of Hospitality Marketing and Management, Volume 30(1),

pp. 38–70

Hair Jr, J.F., Sarstedt, M., Hopkins, L., Kuppelwieser, V.G., 2014. Partial Least Squares Structural Equation Modeling

(PLS-SEM). European business review, Volume 26(2), pp. 106–121

Hair Jr, J.F., Sarstedt, M., Ringle, C.M., Gudergan, S.P., 2017. Advanced Issues in Partial Least Squares

Structural Equation Modeling. USA: SAGE Publications Inc

Ham, J., Choi, B., Lee, J.N., 2017.

Open and Closed Knowledge Sourcing: Their Effect on Innovation Performance in Small and Medium Enterprises.

Industrial Management and Data Systems, Volume 117(6),

pp. 1166–1184

Hayaeian, S., Hesarzadeh, R., Abbaszadeh, M.R., 2022. The Impact of Knowledge Management Strategies on the

Relationship Between Intellectual Capital and Innovation: Evidence from

SMEs. Journal of Intellectual Capital, Volume 23(4), pp. 765–798

He, Z.-L., Wong, P.-K., 2004.

Exploration vs. Exploitation: An Empirical Test of the Ambidexterity Hypothesis. Organization

Science, Volume 15(4), pp. 481–494

Henseler, J., Fassott, G.,

2010. Testing Moderating Effects in PLS Path Models: An Illustration of Available Procedures. In: Handbook

of Partial Least Squares, Springer, Berlin,

Heidelberg, pp. 713–735

Henseler, J., Ringle, C.M., Sarstedt, M.,

2015. A new Criterion for Assessing Discriminant Validity in Variance-based Structural Equation Modeling. Journal

of the Academy of Marketing Science, Volume 43(1),

pp. 115–135

Hou, B., Hong, J., Zhu, R., 2019.

Exploration/Exploitation Innovation and Firm Performance: The Mediation of Entrepreneurial Orientation and Moderation of Competitive Intensity. Journal

of Asia business studies, Volume 13(4), pp. 489–506

Hsu, L.C., Wang, C.H., 2012. Clarifying

the Effect of Intellectual Capital on Performance: The Mediating Role of Dynamic Capability. British

Journal of Management, Volume 23(2),

pp. 179–205

Hung, R.Y.-Y., Lien, B.Y.-H., Fang,

S.-C., McLean, G.N., 2010. Knowledge as a Facilitator for Enhancing Innovation Performance Through Total Quality Management. Total

Quality Management, Volume 21(4), pp. 425–438

Itami, H., Roehl, T.W., 1991. Mobilizing

Invisible Assets. Cambridge:

Harvard University Press

Jansen, J.J., Van Den Bosch, F.A., Volberda, H.W., 2006. Exploratory Innovation, Exploitative Innovation, and Performance:

Effects of Organizational Antecedents and Environmental Moderators. Management

Science, Volume 52(11), pp. 1661–1674

Kamath, G.B., 2007. The Intellectual Capital Performance of

the Indian Banking Sector. Journal of Intellectual Capital, Volume

8(1), pp. 96–123

Kamau, D.M., Oluoch, J.,

2016. Relationship Between Financial Innovation and Commercial Bank Performance in

Kenya. International Journal of Social Sciences and Information Technology,

Volume 2(4), pp. 34–47

Kang, S.C., Snell, S.A.,

2009. Intellectual Capital Architectures and Ambidextrous Learning: A Framework for Human Resource Management. Journal

of Management studies, Volume 46(1), pp. 65–92

Kang, S.C., Snell, S.A., Swart, J., 2012.

Options?based Human Resource Management, Intellectual

Capital, and Exploratory And Exploitative Learning in Law Firms' Practice

Groups. Human Resource Management, Volume 51(4), pp. 461–485

Khan, H.H.A., Abdullah, H., Ah, S.H.A.B.,

2016. Factors Affecting Performance of Co-operatives in Malaysia. International

Journal of Productivity and Performance Management, Volume 65(5), pp. 641–671

Kline, E., Wilson, C., Ereshefsky, S., Tsuji, T.,

Schiffman, J., Pitts, S., Reeves, G., 2012. Convergent

and Discriminant Validity of Attenuated Psychosis Screening Tools. Schizophrenia

Research, Volume 134(1), pp. 49–53

Kock, N., 2015. Common Method Bias in PLS-SEM:

A Full Collinearity Assessment Approach. International

Journal of e-Collaboration (IJeC), Volume 11(4),

pp. 1–10

Kong, E., and Thomson, S.B., 2009. An Intellectual Capital Perspective of Human Resource Strategies and Practices. Knowledge

Management Research and Practice, Volume 7(4),

pp. 356–364

Konno, N., Schillaci, C.E., 2021. Intellectual Capital in

Society 5.0 by the Lens of the Knowledge Creation Theory. Journal

of Intellectual Capital, Volume 22(3), pp. 478–505

Koroleva, E., Baggieri, M., Nalwanga, S.,

2020. Company Performance: Are Environmental, Social, and Governance Factors

Important. International Journal of Technology, Volume 11(8), pp. 1468–1477

Kostopoulos, K.C., Bozionelos, N.,

2011. Team Exploratory and Exploitative Learning:

Psychological Safety, Task Conflict, and Team Performance. Group and Organization

Management, Volume 36(3), pp. 385–415

Kostopoulos, K.C., Bozionelos, N., Syrigos, E.,

2015. Ambidexterity and Unit Performance: Intellectual Capital Antecedents and Cross?level Moderating Effects of Human Resource Practices. Human

Resource Management, Volume 54(S1), pp. s111–s132

Krejcie, R.V., Morgan, D.W., 1970. Determining

Sample Size for Research Activities. Educational and Psychological

Measurement, Volume 30(3), pp. 607–610

Lane, P.J., Koka, B.R., Pathak, S.,

2006. The Reification of Absorptive Capacity: A Critical Review and Rejuvenation of

the Construct. Academy of Management Review, Volume 31(4),

pp. 833–863

Lavie, D., Kang, J., Rosenkopf, L.,

2011. Balance within and Across Domains: The Performance Implications of Exploration and Exploitation in Alliances. Organization

Science, Volume 22(6), pp. 1517–1538

Lazzarotti, V., Manzini, R., Nosella, A., Pellegrini, L., 2017. Innovation Ambidexterity of Open Firms. The Role of Internal Relational Social Capital. Technology

Analysis and Strategic Management, Volume 29(1), pp. 105–118

Lee, S.M., Hwang, T., Choi, D., 2012.

Open Innovation in the Public Sector of Leading Countries. Management

Decision, Volume 50(1), pp. 147–162

Lenox, M., King, A., 2004. Prospects

for Developing Absorptive Capacity Through Internal Information Provision. Strategic

Management Journal, Volume 25(4), pp. 331–345

Lentjusenkova, O., Lapina, I.,

2016. The Transformation of the Organization’s Intellectual Capital: From Resource to Capital. Journal

of Intellectual Capital, Volume 17(4), pp. 610–631

Lerro, A., Linzalone, R., Schiuma, G.,

2014. Managing Intellectual Capital Dimensions for Organizational Value Creation. Journal

of Intellectual Capital, Volume 15(3), pp. 350–361

Levinthal, D.A., March, J.G.,

1993. The Myopia of Learning. Strategic Management Journal,

Volume 14(S2), pp. 95–112

Li, P.-Y., Huang, K.-F.,

2019. The Antecedents of Innovation Performance: the Moderating Role of Top Management Team Diversity. Baltic

Journal of Management, Volume 14(2), pp. 291–311

Liu, Y., Collinson, S., Cooper, C., Baglieri, D., 2021. International Business, Innovation and Ambidexterity: A Micro-foundational

Perspective. International Business

Review, Volume 31(3), p. 101852

Lopez-Zapata, E., Ramirez-Gomez, A.D.J., 2021. Intellectual Capital, Organizational Culture and Ambidexterity in

Colombian Firms. Journal of Intellectual Capital, Volume 24(2),

pp. 375–398

Mahmood, T., Mubarik, M.S.,

2020. Balancing Innovation and Exploitation in the Fourth Industrial Revolution: Role

of Intellectual Capital and Technology Absorptive Capacity. Technological

Forecasting and Social Change, Volume 160, p. 120248

Makhloufi, L., Al-Rejal, H.M.E.A., Mohtar, S., 2018. An Analysis the Relationship Between

IT-business Strategic Alignment and Intangible IT Resources on the Competitive Advantages Sustainability Moderating Effect of IT Personnel Capability. International

Journal of Asian Social Science, Volume 8(12), pp. 1170–1179

Makhloufi, L., Al-Rejal, H.M.E.A., Mohtar, S., 2018. An Investigation of the Moderating Effect of IT Personnel Capability on the

Relationship Between Intangible IT Resources and IT Infrastructure Flexibility on

the Sustainable Competitive Advantages. Journal of

Asian Scientific Research, Volume 8(9), pp. 277–286

Makhloufi, L., Azbiya Yaacob, N., Laghouag, A.A.,

Ali Sahli, A., Belaid, F., 2021. Effect of IT Capability and Intangible IT Resources on Sustainable Competitive Advantage:

Exploring Moderating and Mediating Effect of IT Flexibility and Core Competency. Cogent

Business and Management, Volume 8(1), p. 1935665

Makhloufi, L., Belaid, F., Zidane, K.,

2021. A Proposition Relationship Between Green Workplace Environment and

Employees Green Behavior on Organizational and Environmental Impacts. In: Energy

Transition, Climate Change, and COVID-19, Springer, pp. 179–191

Makhloufi, L., Laghouag, A.A., Ali Sahli, A., Belaid, F., 2021. Impact of Entrepreneurial Orientation on Innovation

Capability: The Mediating Role of Absorptive Capability and Organizational

Learning Capabilities. Sustainability, Volume 13(10), p. 5399

Makhloufi, L., Laghouag, A.A., Meirun, T.,

Belaid, F., 2021. Impact of Green Entrepreneurship Orientation on Environmental Performance: The Natural Resource?based View and Environmental Policy Perspective. Business

Strategy and the Environment, Volume 31(1), pp. 425–444

Makhloufi, L., Yaacob, N.A., Yamin, F., 2017. The Effect of Core Competence

and IT Human Resources Toward Sustaining Competitive Advantage of Malaysian

Small and Medium Enterprise. International Postgraduate Business

Journal, Volume 9(2), pp. 16–26

Makhloufi, L., Yaacob, N.A., Yamin, F.M.,

2018. Investigation on the Relationship Between IT and Core

Competency on the Sustainable Competitive Advantage of Malaysian SMEs. Journal

of International Business and Management, Volume 1(2), pp. 1–15

March, J.G., 1991. Exploration and Exploitation in Organizational Learning. Organization

Science, Volume 2(1), pp. 71–87

McDowell, W.C., Peake, W.O., Coder, L., Harris,

M.L., 2018. Building Small Firm Performance Through Intellectual Capital Development:

Exploring Innovation as the “Black Box”. Journal

of Business Research, Volume 88, pp. 321–327

Mom, T.J., van Neerijnen, P., Reinmoeller, P., Verwaal, E., 2015. Relational Capital and Individual Exploration:

Unravelling the Influence of Goal Alignment and Knowledge Acquisition. Organization

Studies, Volume 36(6), pp. 809–829

Morris, S.S., Snell, S.A.,

2011. Intellectual Capital Configurations and Organizational Capability: An Empirical Examination of Human Resource Subunits in the Multinational Enterprise.

Journal of International Business Studies, Volume 42(6), pp. 805–827

Mouritsen, J., 2004. Measuring and Intervening: How do We Theorise Intellectual Capital Management?. Journal

of Intellectual Capital, Volume 5(2), pp. 257–267

Mubarik, M.S., Chandran, V.G.R., Devadason, E.S., 2018. Measuring Human Capital in Small and Medium Manufacturing Enterprises: What Matters? Social

Indicators Research, Volume 137(2), pp. 605–623

Mubarik, M.S., Naghavi, N., Mubarak, M.F.,

2019. Impact of Supplier Relational Capital on Supply Chain Performance in

Pakistani Textile Industry. Asian Economic and Financial Review, Volume

9(3), pp. 318–328

Mubarik, S., Chandran, V.G.R., Devadason, E.S., 2016. Relational Capital Quality and Client Loyalty: Firm-level Evidence from Pharmaceuticals,

Pakistan. The Learning Organization, Volume 23(1), pp. 43–60

Najafi-Tavani, S., Najafi-Tavani, Z., Naude, P.,

Oghazi, P., Zeynaloo, E., 2018. How Collaborative Innovation Networks Affect New Product Performance: Product

Innovation Capability, Process Innovation Capability, and Absorptive Capacity. Industrial

Marketing Management, Volume 73, pp. 193–205

Nazari, J.A., Herremans, I.M.,

2007. Extended VAIC Model: Measuring Intellectual Capital Components. Journal

of Intellectual Capital, Volume 8(4), pp. 595–609

Nonaka, I., Takeuchi, H., 1995. The

Knowledge-Creating Company: How Japanese Companies Create the Dynamics of

Innovation. In: Oxford University Press, Oxford, New York

Oh, N., Lee, J., 2020. Changing Landscape of Emergency Management Research: A Systematic Review with Bibliometric Analysis. International

Journal of Disaster Risk Reduction, Volume 49, p. 101658

Ojha, D., Struckell, E., Acharya, C., Patel, P.C., 2018. Supply Chain Organizational Learning, Exploration, Exploitation, and

Firm Performance: A Creation-dispersion Perspective. International

Journal of Production Economics, Volume 204, pp. 70–82

O'Reilly III, C.A., Tushman, M.L.,

2013. Organizational Ambidexterity: Past, Present, and Future. Academy

of Management Perspectives, Volume 27(4), pp. 324–338

Pallant, J. (2011). Survival Manual. In : A Step by Step Guide to Data Analysis Using SPSS, 4th Edition,

Allen and Unwin, Berkshire, Australia

Paoloni, N., Mattei, G., Strologo, A.D., Celli, M., 2020. The Present and Future of Intellectual Capital in the Healthcare Sector: A Systematic Literature Review. Journal

of Intellectual Capital, Volume 21(3), pp. 357–379

Quintane, E., Casselman, R.M., Reiche, B.S., Nylund, P.A., 2011. Innovation as a Knowledge?based Outcome. Journal

of Knowledge Management, Volume 15(6), pp. 928–947

Rachidi, H., El Mohajir, M.,

2021. Improving SMEs’ Performance Using Innovative Knowledge and Financial System Designed from the

Moroccan Business Environment. African Journal of Science,

Technology, Innovation and Development, Volume 13(1), pp. 15–30

Reza, S., Mubarik, M.S., Naghavi, N., Nawaz, R.R., 2021. Internationalisation Challenges of SMEs: Role of Intellectual Capital. International

Journal of Learning and Intellectual Capital, Volume 18(3), pp. 252–277

Ryan, P., Geoghegan, W., Hilliard, R.,

2018. The Microfoundations of Firms’ Explorative Innovation Capabilities within the Triple Helix Framework. Technovation,

Volume 76, pp. 15–27

Salicru, S., Perryer, C., Hancock, P.,

2007. Intellectual Capital and Company Performance–Literature Review and

Research Opportunities in Australia. In: Proceedings of 21st annual

Australian and New Zealand Academy of Management Conference–ANZAM, Perth,

Australia, pp. 4–7

Sawilowsky, S.S., 2009. New Effect Size Rules of Thumb. Journal

of Modern Applied Statistical Methods, Volume 8(2),

pp. 597–599

Secundo, G., Ndou, V., Del Vecchio, P., De Pascale, G., 2020. Sustainable Development, Intellectual Capital and Technology Policies: A Structured Literature Review and Future Research Agenda. Technological

Forecasting and Social Change, Volume 153, p. 119917

Shahzad, K., Arenius, P., Muller, A., Rasheed,

M.A., Bajwa, S.U., 2019. Unpacking the Relationship Between High-performance Work Systems and Innovation Performance in

SMEs. Personnel Review, Volume 48(4), pp. 977–1000

Smith, W.K., Tushman, M.L.,

2005. Managing Strategic Contradictions: A Top Management Model for Managing Innovation Streams. Organization

Science, Volume 16(5), pp. 522–536

Subramaniam, M., Youndt, M.A.,

2005. The Influence of Intellectual Capital on the Types of Innovative Capabilities. Academy

of Management journal, Volume 48(3), pp. 450–463

Tastan, S., Davoudi, S.M.M., 2015. A Research on the Relevance of Intellectual Capital and Employee Job Performance as Measured with Distinct Constructs of In-role and Extra-role Behaviors. Indian

Journal of Science and Technology, Volume 8(7), pp. 724–734

Tatiana, B., Mikhail, K.,

2020. Problems of Competitive Strategy Choice According to Industry and Regional Factors. International

Journal of Technology, Volume 11(8), pp. 1478–1488

Trapczynski, P., Puslecki, L., Staszkow, M., 2018. Determinants of Innovation Cooperation Performance:

What Do We Know and What Should We Know? Sustainability, Volume 10(12),

p. 4517

Turner, N., Maylor, H., Swart, J., 2013.

Ambidexterity in Managing Business Projects–an Intellectual Capital Perspective. International

Journal of Managing Projects in Business, Volume 6(2), pp. 379–389

Turner, N., Maylor, H., Swart, J., 2015.

Ambidexterity in Projects: An Intellectual Capital Perspective. International

Journal of Project Management, Volume 33(1), pp. 177–188

Uziene, L., Stankute, E., 2015. Factors Influencing Intellectual Capital Measurement Practices. Procedia-Social

and Behavioral Sciences, Volume 213, pp. 351–357

Wang, C., Kafouros, M.I., 2009. What Factors Determine Innovation Performance in Emerging Economies?

Evidence from China. International Business Review, Volume 18(6), pp.

606–616

Wang, Y.L., Ellinger, A.D., 2011. Organizational Learning: Perception of External Environment and Innovation Performance. International

Journal of Manpower, Volume 32 (5/6), pp. 512–536

Wendra, W., Sule, E.T., Joeliaty, J., Azis, Y., 2019. Exploring Dynamic Capabilities, Intellectual Capital and Innovation Performance Relationship: Evidence from the

Garment Manufacturing. Business: Theory and Practice, Volume

20, pp. 123–136

Widener, S.K., 2006. Human Capital, Pay Structure, and

the Use of Performance Measures in Bonus Compensation. Management

Accounting Research, Volume 17(2),

pp. 198–221

Wolf, E.J., Harrington, K.M., Clark, S.L., Miller, M.W., 2013. Sample Size Requirements for Structural Equation Models: An Evaluation of Power, Bias, and Solution Propriety. Educational

and Psychological Measurement, Volume 73(6),

pp. 913–934

Yang, M., Han, C., 2021. Stimulating Innovation:

Managing Peer Interaction for Idea Generation on Digital Innovation Platforms. Journal

of Business Research, Volume 125, pp. 456–465

Yen, H.R., Wang, W., Wei, C.-P., Hsu, S.H.Y., Chiu, H.-C., 2012. Service Innovation Readiness:

Dimensions and Performance Outcome. Decision Support Systems, Volume

53(4), pp. 813–824

Yong, J.Y., Yusliza, M.Y., Ramayah, T., Farooq,

K., Tanveer, M.I., 2022. Accentuating the Interconnection Between Green Intellectual Capital, Green Human Resource Management and Sustainability. Benchmarking:

An International Journal, Volume 2022, pp. 1–26

Zahra, S.A., George, G.,

2002. Absorptive Capacity: A Review, Reconceptualization, and Extension.

Academy of Management Review, Volume 27(2),

pp. 185–203

Zangoueinezhad, A., Moshabaki, A.,

2009. The Role of Structural Capital on Competitive Intelligence. Industrial

Management and Data Systems, Volume 109(2), pp. 262–280

Zerenler, M., Hasiloglu, S.B., Sezgin, M., 2008. Intellectual Capital and Innovation Performance: Empirical Evidence in the

Turkish Automotive Supplier. Journal of Technology Management and Innovation, Volume 3(4),

pp. 31–40