Performance Evaluation of The Industrial Resilience Index by Using Cross-Correlation Method

Corresponding email: putrajandhana@yahoo.co.id

Published at : 18 Sep 2024

Volume : IJtech

Vol 15, No 5 (2024)

DOI : https://doi.org/10.14716/ijtech.v15i5.5599

Jandhana, I.B.M.P., Agustini, H.N., 2024. Performance Evaluation of The Industrial Resilience Index by Using Cross-Correlation Method. International Journal of Technology. Volume 15(5), pp. 1462-1472

| Ida Bagus Made Putra Jandhana | Faculty at The Defence University of Republic of Indonesia, Faculty of Science and Defence Technology, The Education Program of Defense Industry, Bogor 16810, Indonesia |

| Haerani Natali Agustini | Analyst, Directorate Analysis and Development Statistics, Statistics Indonesia, Jakarta 10710, Indonesia |

This paper shows how

resilience-based measurements, Industrial Resilience Index (IRI), is able to

indicate the performance trend of general manufacturing, measured in Gross

Domestic Product (GDP), impacted by shocks represented by the value drops of

the Rupiah to the US Dollar. This paper argues that IRI is able to measure not

only the resilience of the Metal Product Manufacturing Sector (MPMS) but also

the performance dynamic of the general manufacturing industry. This study

evaluates the IRI performance by using the cross-correlation method. The

cross-correlation process consists of a comparison between IRI and the GDP of

the manufacturing industry, as well as a comparison to other indices related to

manufacturing sectors, such as the Purchasing Manager Index (PMI), the

Production Index of Large and Medium Manufacturing Industry (PII), the

Competitiveness Industrial Performance (CIP), and the Global Competitiveness

Index (GCI). The positive and high value of the correlations in this study

shows IRI’s ability to reflect the sector resilience and the GDP of the general

manufacturing industry trend. The result of this study suggests that IRI can be

utilized as a dynamic indicator of the general manufacturing industry. Through

its data series and trend analysis, decision or policymakers may employ IRI to

forecast how resilient MPMS, as well as the general manufacturing industry

trend, is when the sector faces shocks in the future. The result of the study shows that cross-correlation coefficient of

IRI is 0.74. The coefficient value

indicates that IRI is a coincident indicator within the business cycles of the

general manufacturing industry. Therefore,

as an alternative of resilience-based measurement, the study suggests that IRI is

able to demonstrate its significance in predicting the resilience of MPMS and the

general manufacturing industry, in anticipating a dynamic shock is in the

future.

Analysis; Cross-correlation; Evaluation; Industrial resilience index; Performance

In recent years, studies related to resilience or

risk-adjusted performance measurement have received significant attention among

scholars (Fauzi and Jahidi, 2022; Sambowo and Hidayatno,

2021; Berawi, 2018). The

capability to analyze the impact of the dynamic environment on a system and to

respond any disturbance correctly determines how well the system performs and

sustain in the long run. This study explores such phenomenon by evaluating

Metal Product Manufacturing Sector (MPMS), representing a system, and the

exchange rate fluctuation, representing a shock, that impacts the system

This study is a further

exploration of developing and evaluating a composite index, the Industrial

Resilience Index (IRI) or Indeks

Ketahanan Industri (Jandhana, 2019; Jandhana, Zagloel, and Nurcahyo, 2018). The index measures the

resilience as well as the performance trend of the MPMS in Indonesia, in Gross

Domestic Product (GDP), adjusted by the impact of exchange rate shock (Rupiah

to US Dollar) caused by drastic macroeconomic disturbances. Although the study uses

statistical data of MPMS to measure its resilience,

the same calculation method can be used to measure resilience in any system

schemes. Other than measuring the current performance, IRI also provides

the simulated stress test for decision and policymakers to find out about the

impact of the future exchange rate shock on the sector. The previous study also

shows a strong correlation between IRI and GDP of MPMS as shown in Figure 1.

Based on previous studies

in the field of resilience (Barrett et al., 2021; Jandhana, 2019; Bradtmöller,

Grimm, and Riel-Salvatore, 2017; Carlson et al., 2012), this study defines resilience in the

industrial sector as the property or the character of the industrial sector

that reflects the sector's ability to anticipate disturbances and absorb the

impact of disturbances in the form of shock or stress, that may spoil the

performance of the industrial sector, and to recover from various the disruption and to return to the normal

state of production, and to compete in the market soon. The IRI value measures how resilience of the

sector. According

to Jandhana (2019) there are four dimensions

in the formation of IRI, such as Basic Production Dimensions, Industrial

Environment Carrying Capacity Dimensions, Innovation Dimensions and Efficiency,

and Macroeconomic Dimensions. The four dimensions consist of nineteen variables.

IRI is the result of combining several concepts in building industrial

resilience measurement methods based on the Production Theory. To see the

impact caused by the shock dynamically, IRI employs Vector Autoregressive (VAR)

and Vector Autoregressive modeling systems with exogenous variables (VARX).

This modeling system can capture the presence of changes in IRI due to the

shocks.

Figure 1 The Comparison of the Industrial Resilience Index (IRI) and Gross Domestic Product (GDP) of MPMS in Billion Rupiah, Quarter I/1992 to Quarter IV/2019

This study also draws on

the widely known theory of the business cycle that has been in existence since

the industrial era. This theory, subsequently, describes the fluctuation of

economic activities in nations, including phases of expansion, recession, contraction,

and revival within a certain period of time (Kose, Sugawara, and Terrones, 2020; Harding and Pagan, 2002; Burns and Mitchell, 1946). The fluctuation is diffused over an

integrated economic system involving industrial, commercial, finance, and

service sectors. Today, there have been several studies conducted to explore

uncertainty and measurement related to the business cycle. Those studies led to

two main research topics (Ludvigson, Ma, and Ng, 2021; 2020). The first research topic relates to the uncertainty of the prime

source of the business cycle. The second research topic concerns the type of

uncertainty that is responsible for causing the business cycle. From their

literature study, they explained that macro uncertainty is the driver of

economic fluctuation that contributes to the business cycle. Despite the findings, the study still finds that a variety of

parameterizations and specifications show macro uncertainty rises endogenously

in response to business activity shocks (Ludvigson, Ma, and Ng, 2021; 2020). This contributes to the countercyclical behavior that creates

financial uncertainty within a system. Therefore, instead of macro uncertainty,

financial uncertainty becomes the driver of economic fluctuation. Macro

uncertainty may augment the downturn and push it toward a recession. This

behavior needs to be studied further. This paper contributes to explaining how uncertainty in

financial markets is transmitted to the real economy that, includes the

manufacturing industry sector.

Based on the equation, it

can be said that as the level of technology implementation (A)

increases, the output of the given combination of inputs will increase as

well. This model underscores how

important technology implementation in improving the production process as well

as creating process or product innovations and the sector output growth (Juhász, Squicciarini, and

Voigtländer, 2024; Kask and Sieber, 2002; Solow, 1956).

Therefore,

successful technology implementation, along with the availability of other

production factors, will determines the sector’s performance and its resilience.

Unlike the previous study (Jandhana, 2019), the measurement of IRI in this study

employs more recent data, which was based on the 2019 data that was forecasted

previously by the ARIMA method. ARIMA

method is employed to forecast each variable which was included in the

calculation of IRI. ARIMA is basically an Auto-Regressive method that

integrates three principles and processes to find the best fitting forecasting

by determining the parameters (Fattah et

al., 2018; Bhuiyan, Ahmed, and Jahan, 2008; Box et al., 1976). Those principles are:

- Auto Regression. This is a process of changing a variable that regresses its own lagged values, with p representing the number of lag observations in a model (lag order).

- Differencing. This is a process that converts data to become stationary by differentiating the data values from the previous data, with d representing the number of times that data values are differenced (degree of differentiating).

- Moving Average. In order to allow the dependency of data from the residual error, this process applies a moving average method to autoregression, with q denoting the order of the moving average.

ARIMA allows a model

developer to construct a forecasting tool that simulates the trends, cycles,

seasonality, and other dynamic data based on historical data. However, just

like any model, the ARIMA model needs to be used with caution. The

effectiveness of ARIMA also depends on the time span a future trend will be

forecasted (Grogan, 2020). In general, the longer

the time span to be forecasted, the less precise the trend forecast.

This study employs cross-correlation analysis to verify the trend similarity between two data series. This method can also be employed to predict the movement of the data in a system (Cowperwait and Metcalve, 2009). To perform the calculation, the two data series must have the data mean and variance in a stationary condition. In other words, through the cross-correlations analysis, one can examine “the degree of similarity between two sets of numbers and can be quantified” (Costa, 2021; Derrick and Thomas, 2004). Like autocorrelation analysis, the cross-correlation method has been used in the field of engineering and science, such as electronic, acoustic, and geophysical (Nelson-Wong et al., 2009). The method will be employed to analyze how noises or signals can be isolated and observe their similarities. It involves correlating different time-varying signals against one another. Cross-correlations have a value between -1 and 1 (Derrick and Thomas, 2004; Sensoy et al., 2013). Furthermore, this value should be accompanied by the degrees of freedom (DOF). A high cross-correlation value with a high DOF is better than a high cross-correlation value with a low DOF (Chao and Chung, 2019).

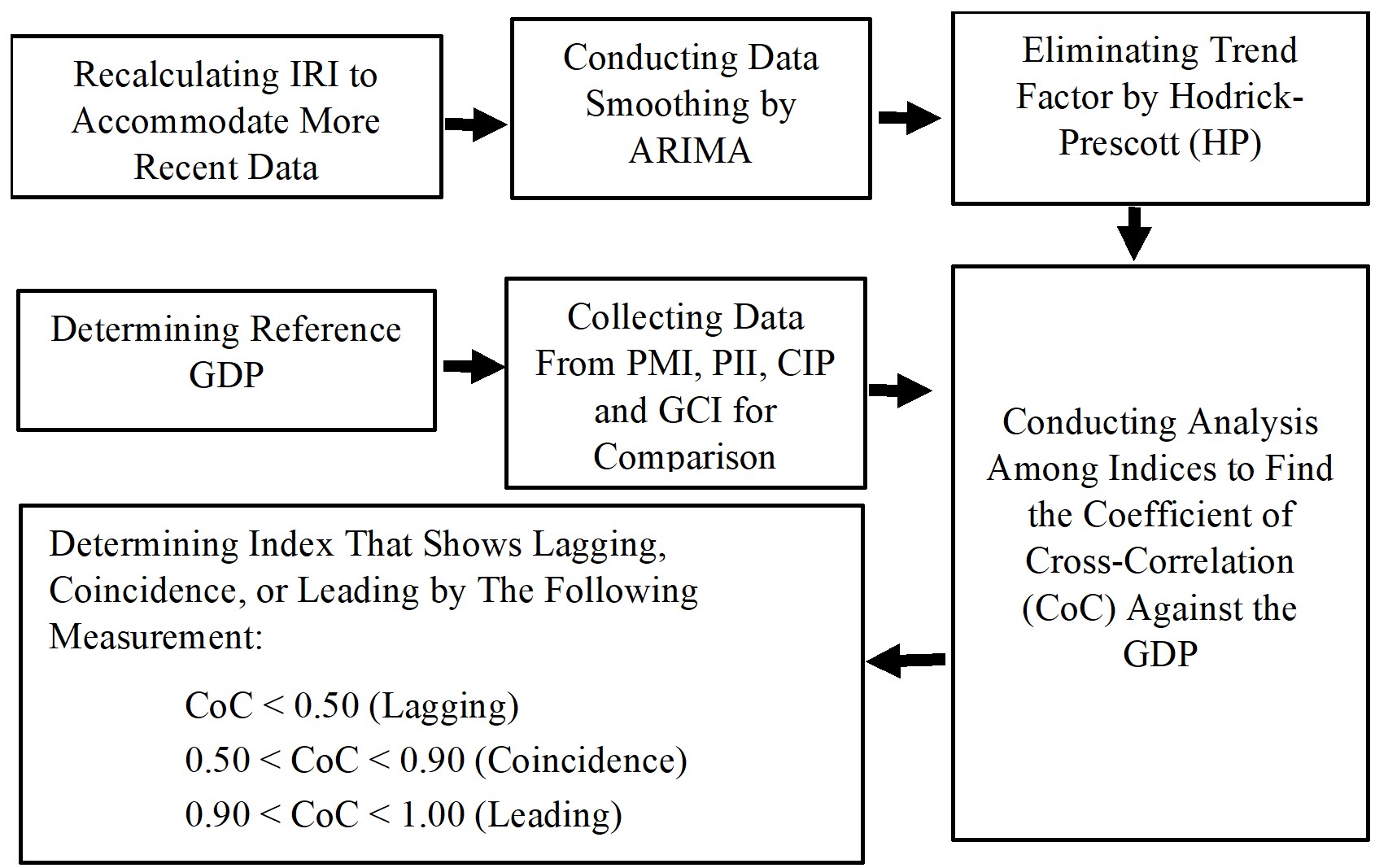

To achieve the research objectives, several

steps need to be carried out sequentially as shown in the following Figure 2. The first step involved recalculating the IRI

to incorporate the latest data adjustments. The study utilized the

manufacturing sector data administered by the Statistics Indonesia, as in

previous studies. This study includes the input and output data of the MPMS

generated from 1992 until fourth quarter of 2019, instead of 2017 from the

previous study (Jandhana, 2019). As previously stated, the result of IRI

measurement shows that the shock of the Rupiah value against the US Dollar has

a negative impact on the MPMS in Indonesia recorded until 2017. The next step

is to determine the reference variable that describes and measures the system's

value. In this study, the most appropriate variable to use is the Gross

Domestic Product (GDP) generated by the manufacturing industry in Indonesia.

For comparison, this study incorporates business cycles analysis from three

other well-known indicators in the industrial sector, such as the Purchasing

Manager Index (PMI), Production Index of Large and Medium Manufacturing

Industry (PII), Competitiveness Industrial Performance (CIP) from the United

Nations Industrial Development Organization (UNIDO), and the Global

Competitiveness Index (GCI) from World Economic Forum (WEF).

Figure 2 Cycles

Comparison: GDP of Manufacturing Industry vs IRI (Quarter 1/1992 - Quarter

4/2019)

The study explores the

correlation between IRI, PMI, PII, CIP, GCI, and GDP of the manufacturing

industry. By using the simple

correlation calculation, as shown on Table 1, the result seems to demonstrate

positive correlation between IRI, PMI, PII, CIP, GCI, and GDP of MPMS. IRI and GDP of the manufacturing industry show

the correlation coefficient of 0.98, while the correlation coefficient between

PII and GDP of the manufacturing industry is 0.97. Additionally, a correlation

coefficient of GCI and GDP of the manufacturing industry indicates 0.95. The

high correlation coefficient might be interpreted as such that the increase

IRI, GCI, and PII follows the surge of GDP in the manufacturing industry. It

also may imply that the lower GDP of the manufacturing industry can correlate

to the lower IRI, GCI, and PII, respectively.

Table

1

The Correlation Between Various Indices Related to the GDP of Manufacturing

Industry

|

Indexes |

Correlations with GDP of

Manufacturing Industry |

Correlations with IRI |

|

1.

Industrial Resilience Index (IRI) |

0.98 |

|

|

2. Purchasing Managers Index (PMI) |

-0.12 |

-0.01 |

|

3. Production Index of Large and Medium

Manufacturing Industry (PII) |

0.97 |

0.98 |

|

4. Competitiveness Industrial Performance (CIP) |

0.50 |

0.55 |

|

5. Global Competitiveness Index (GCI) |

0.95 |

0.96 |

Since the data still

consists of the embedded trend factor, there should be a cross-correlation

analysis to align the movement of each index with the GDP of the manufacturing

industry. Cross-correlation analysis

requires any trend factor to be removed from all of the analyzed data by

utilizing Hodrick-Prescott (HP) and the ARIMA X-12 Model. After data detrending, both charts of IRI and

GDP of the manufacturing industry show that they move in the same direction

(Figure 3). Furthermore, as displayed in Figure 2, IRI is able to display the impact of the Indonesian economic crisis on

the manufacturing industry that occurred between 1997 and 1998, as well as the

global crisis in 2008. Unlike IRI, the

other indices, such as PMI, PII, CIP, and GCI could not capture the shock of

the sector’s PDB during a crisis as shown in Figure 3. The study result also suggests that those indices

could not capture the GDP and the movement of its input variables. Figure 3 also describes the cycle comparison

between the manufacturing sector’s GDP and PMI, PII, CIP, or GCI. Specifically, based on the correlation

coefficient, between GDP and PII indicates a coefficient of 0.97, while between

GDP and GCI shows a coefficient of 0.95.

Figure 3 Cycles Comparison: GDP of Manufacturing

Industry vs PMI vs CIP vs PII vs GCI

(Quarter 1/1992 - Quarter 4/2019)

Based on the

cross-correlations analysis, as presented in Table 2, the result suggests that

the movement of IRI has the closest match to the movement of the GDP of the

manufacturing industry with a coefficient of cross-correlation of 0.74 which is

directly significant at lag ‘0’. This suggests that the IRI movement can be

used to forecast the variation in GDP of the manufacturing industry. Therefore,

IRI can detect the sector experiencing a recession, stagnation, or contraction

in the manufacturing industry in general.

Table 2 The Result of

Cross-Correlation Analysis on Multiple Indices in the Indonesian Manufacturing

Industry, period 1992/Q1-2019/Q4

|

No |

Variable |

Lead/Lag (Quarter) |

Coeff |

|

1. |

Industrial Resilience Index (IRI) |

Lag 0 |

0.74 |

|

2. |

Purchasing Managers Index (PMI) |

Lead 3 |

0.20 |

|

3. |

Production Index of Large and Medium Manufacturing

Industry (PII) |

Lead 7 |

0.44 |

|

4. |

Competitiveness Industrial Performance (CIP) |

Lead 5 |

0.22 |

|

5. |

Global Competitiveness Index (GCI) |

Lag 4 |

0.53 |

This study is an extension of the previous study in constructing a tool

to measure system resilience in the Metal Product Manufacturing Sector (MPMS),

the Industrial Resilience Industry (IRI). By using the

cross-correlation method, the study compares the results from IRI measurement against

the results from the manufacturing industry’s GDP, the Purchasing Manager Index

(PMI), the Production Index of Large and Medium Manufacturing Industry (PII),

the Competitiveness Industrial Performance (CIP), and the Global

Competitiveness Index (GCI). Accordingly,

this

study produces three results. First, the correlation calculation suggests that

IRI has a close relationship with the GDP of the manufacturing industry. The

correlation coefficient between the two is 0.98 appears to be highest among the

correlation coefficient with other manufacturing indices. Secondly, IRI appears to move in line with

the movement of the GDP cycle in the manufacturing industry. Additionally,

based on the business cycle analysis, the result implies that IRI can be

identified as a coincident indicator with a fairly high cross-correlation rate

of 0.74. This suggests that the IRI

method might be used as a tool to predict the direction or the movement of the

general manufacturing industry cycle. Thirdly,

however, IRI is not able to see the magnitude of the cyclic movement. Finally, this study contributes to the

development of the resilience measurement and the dynamic measurement for analyzing

risks and their impact in a system performance. For the future agenda, this study should lead

to investigations on how IRI can be implemented in different fields of science.

The

completion of this study would not be possible without the assistance of Ms.

Dyah Retno in explaining the various data from Statistics of Indonesia. A sense

of appreciation is also extended to the Faculty of Defense Technology, Defense

University of the Republic of Indonesia for giving the opportunity to conduct

the study.

Ahern, N.R., Kiehl, E.M., Lou Sole, M.,

Byers, J., 2006. A Review of Instruments Measuring Resilience. Issues in Comprehensive Pediatric Nursing, Volume 29(2), pp. 103–125

Angeon, V., Bates, S., 2015. Reviewing Composite Vulnerability and

Resilience Indexes: A Sustainable Approach and Application. World Development, Volume 72, pp. 140–162

Bajo-Rubio, O. 2000. A

Further Generalization of the Solow Growth Model: The Role of the Public

Sector. Economics Letters, 2000, Volume 68(1), pp. 79–84

Barrett, C.B., Ghezzi-Kopel, K.,

Hoddinott, J., Homami, N., Tennant, E., Upton, J., Wu, T., 2021. A Scoping Review of

The Development Resilience Literature: Theory, Methods and Evidence. World

Development, Volume 146, p. 105612

Benazir, A.D., Achsani, M.A., 2008. Composing Early

Warning Indicators of Exchange Rate Movements in Indonesia: Development of

Business Cycle Analysis. Journal of Management & Agribusiness, Volume 5(1), pp. 1–15

Berawi,

M.A., 2018. The Role of Technology in Building a Resilient City: Managing

Natural Disasters. International Journal of Technology, Volume 9(5), pp.

862–865

Bhuiyan,

M.N.A., Ahmed, K.S., Jahan, R., 2002. Study on Modeling and Forecasting of the

GDP of Manufacturing Industries in Bangladesh. CMU. Journal of Social

Science and Humanities, Volume 2(2), pp. 143–157

Box,

G.E., Jenkins, G.M., Reinsel, G.C., Ljung, G.M., 1976. Time Series Analysis Forecasting and

Control-Rev. John Wiley & Sons

Bradtmöller, M., Grimm, S.,

Riel-Salvatore, J., 2017. Resilience Theory in Archaeological Practice–An

Annotated Review. Quaternary International, Volume 446, pp. 3–16

Burns,

A.F., Mitchell, W.C., 1946. Measuring Business Cycles (No. burn

46-1). National Bureau of Economic Research

Carlson,

J.L., Haffenden, R.A., Bassett,

G.W., Buehring, W.A., Collins, M.J., Folga, S.M., Whitfield, R.G., 2012. Resilience: Theory and Application (No. ANL/DIS-12-1).

Argonne National Laboratory (ANL), Argonne, Illinois, United States

Chao, B.F., Chung, C.H., 2019. On Estimating

the Cross-Correlation and Least Squares Fit of One Data Setto another with Time

Shift. Earth and Space Science,

Volume 6, pp. 1409–1415

Costa, L.D.F., 2021. Comparing

cross correlation-based similarities. arXiv preprint arXiv:2111.08513.

Cowperwait, P.S.P., Metcalve, A.V., 2009. Time

Series Analysis. New York: Springer

Dean, R.T., Dunsmuir, W.T., 2016. Dangers and Uses of

Cross-Correlation in Analyzing Time Series in Perception, Performance,

Movement, and Neuroscience: The Importance of Constructing Transfer Function

Autoregressive Models. Behavior

Research Methods, Volume 48(2),

pp. 783–802

Derrick, T., Thomas, J., 2004. Time Series

Analysis: The Cross-Correlation Function, In: Innovative Analyses of Human

Movement, Chapter 7, Stergiau, N. (ed.), Human Kinetic Publishers,

Champaign, Illinois, pp. 189–205

Diebold, F.X., Rudebusch, G.D., 2020. Business

Cycles: Durations, Dynamics, and Forecasting. Princeton University Press

Fattah, J., Ezzine, L., Aman, Z.,

El Moussami, H., Lachhab, A., 2018. Forecasting of Demand using ARIMA

Model. International Journal of Engineering Business Management, Volume

10, p. 1847979018808673

Fauzi, P.N.F.N.M., Jahidi,

Z., 2022. Identification of Risks Exposed to The Development of Zakat and Wakaf

Housing in Malaysia. International Journal of Technology, Volume 13(4),

pp. 727–739

Ferguson, C.E., Gould., J.P., 1975. Microeconomic

Theory. Illinois:

Richard D. Irwin

Fuss, M., McFadden, D., 2014. Production

Economics: A Dual Approach to Theory and Applications: Applications of The

Theory of Production. Elsevier

Grogan, M., 2020. Limitations of ARIMA:

Dealing with Outliers. Available Online at:

https://towardsdatascience.com/limitations-of-arima-dealing-with-outliers-30cc0c6ddf33, Accessed on May 30, 2021

Harding, D., Pagan, A.

2002. Dissecting the Cycle: A

Methodological Investigation. Journal of Monetary Economics, Volume 49(2), pp. 365–381

Holling, C.S., 1973. Resilience and

Stability of Ecological Systems. Annual

Review of Ecology and Systematics, Volume 4(1), pp. 1–23

Hudecheck,

M., Sirén, C., Grichnik, D., Wincent, J., 2020. How Companies Can Respond to

the Coronavirus. MIT Sloan Management Review. Available Online at: https://sloanreview.

mit.edu/article/how-companies-can-respond-to-the-coronavirus/. Accessed on May 30, 2021

Jandhana, I.B.M.P.,

2019. Pembangunan Indeks Ketahanan Industri (IKI) Sebagai

Alternatif Pengukuran Kinerja Sektor Industri (The development of the

Industrial Resilience Index (IRI) as an Alternative Performance Measurement in

the Industrial Sector). Disertation, Universitas Indonesia

Jandhana, I.B.M.P.,

Zagloel, T.Y.M., Nurcahyo, R.,

2017. Measuring Industrial Resiliency by Using

Data Envelopment Analysis Approach. In: 3rd International Conference on Business and Engineering

Research (ICBER), Osaka, Japan 17th-18th November, 2017

Jandhana, I.B.M.P., Zagloel, T.Y.M.,

Nurcahyo, R., 2018. Resilient Structure Assessment

using Cobb-Douglas Production Function: The Case of the Indonesian Metal

Industry. International Journal of Technology, Volume 9(5), pp. 1061–1071

Juhász, R., Squicciarini, M.P.,

Voigtländer, N., 2024. Technology Adoption and Productivity Growth: Evidence

from Industrialization in France. Journal of Political Economy, Volume

132(10), pp. 1–42

Kask, C.,

Sieber, E., 2002. Productivity Growth in ‘High-tech' Manufacturing Industries. Monthly

Labor Review, Volume 125, p. 16

Kose,

M.A., Sugawara, N., Terrones, M.E., 2020. Global Recessions. CAMA Working

Paper 10/2020, Centre for Applied Macroeconomic Analysis

Ludvigson, S.C., Ma,

S., Ng, S., 2020. COVID-19 and the Macroeconomic Effects of

Costly Disasters. National Bureau of Economic Research, Volume 2020, p. 26987

Ludvigson, S.C., Ma, S., Ng, S., 2021.

Uncertainty and Business Cycles: Exogenous Impulse or Endogenous Response? American

Economic Journal: Macroeconomics, Volume 13(4), pp. 369–410

Mandal, S., 2014. Supply Chain Resilience: A State-Of-The-Art

Review and Reandrch Directions. International

Journal of Disaster Resilience in the Built Environment, Volume

5(4), pp. 427–453

Mankiw, N.G., 2020. Principles of

Macroeconomics. 9th Edition. Cengage Learning

Mohamed, A.S., Mohammed, N.A., 2021. Forecasting Enhancement

Using a Hodrick-Prescott Filter. Turkish

Journal of Computer and Mathematics Education (TURCOMAT), Volume 12(6), pp. 3378–3391

Narayan, S.W., Falianty, T., Tobing, L., 2019. The

Influence of Oil Prices on Indonesia’s Exchange Rate. Bulletin of

Monetary Economics and Banking, Volume 21(3), pp. 303–322

Nelson-Wong, E., Howarth, S., Winter, D.A.,

Callaghan, J.P., 2009.

Application of Autocorrelation and Cross-Correlation Analysis in Human Movement

and Rehabilitation Research. Journal of

Orthopaedic & Sports Physical Therapy, Volume 39(4), pp. 287–295

Nilsson, R. and

Gyomai, G., 2011. Cycle Extraction: A Comparison of the Phase-Average Trend

Method, the Hodrick-Prescott and Christiano-Fitzgerald Filters. OECD

Statistics Working Papers, No. 2011/4, OECD Publishing, Paris

Podobnik, B., Stanley, H.E., 2008. Detrended Cross-Correlation Analysis: A New Method for Analyzing Two

Non-Stationary Time Series. Physical

Review Letters, Volume 100(8),

p. 084102

Sambowo, A.L., Hidayatno, A., 2021. Resilience Index

Development for the Manufacturing Industry based on Robustness, Resourcefulness,

Redundancy, and Rapidity. International Journal of Technology,

Volume 12(6), pp. 1177–1186

Senhadji, A. 2000. Sources of Economic

Growth: An Extensive Growth Accounting Exercisex. IMF Staff Papers, Volume 47(1),

pp. 129–157

Sensoy, A., Yuksel,

S., Erturk, M., 2013. Analysis of Cross-Correlations Between

Financial Markets After the 2008 Crisis. Physica A: Statistical

Mechanics and its Applications, Volume 392(20), pp. 5027–5045

Serfilippi, E., Ramnath, G., 2018. Resilience Measurement and

Conceptual Frameworks: A Review of the Literature. Annals of Public and Cooperative Economics, Volume 89(4), pp. 645–664

Solow,

R.M., 1956. A Contribution

to the Theory of Economic Growth. The

Quarterly Journal of Economics, Volume 70(1), pp. 65–94

Van Meerbeek, K.,

Jucker, T., Svenning, J.C., 2021. Unifying the Concepts of Stability and

Resilience in Ecology. Journal of Ecology, Volume 109(9), pp. 3114–3132

Walker, B., Holling, C.S.S., Carpenter, R., Kinzig, A., 2004.

Resilience, Adaptability and Transformability in Social–Ecological Systems. Ecology

and Society, Volume 9(2), p. 5

Windle, G., Bennett, K.M., Noyes, J., 2011. A Methodological Review of

Resilience Measurement Scales. Health

and Quality of Life Outcomes, Volume 9(1), pp. 1–18

Woods, D.D., Hollnagel, E., 2017. Prologue: Resilience

Engineering Concepts. In: Resilience

Engineering, CRC Press, pp. 1–6

Zagloel,

Y., Jandhana, I.B.M.P., 2016. Literature Review of

Industrial Competitiveness Index: Research Gap. In: Proceeding of

Industrial Engineering and Operations Management (IEOM) Conference. Kuala

Lumpur, Malaysia, pp. 613–627