A Multivariate Regression with Time Series Error in Forecasting Jakarta Composite Index and Stock Prices of Banking Industry in Indonesia by Considering COVID-19 Effect

Corresponding email: maghfirotul.ulyah@fst.unair.ac.id

Published at : 24 Dec 2024

Volume : IJtech

Vol 15, No 6 (2024)

DOI : https://doi.org/10.14716/ijtech.v15i6.5469

Ulyah, S.M., Susanti, R., Andreas, C., Rahmayanti, I.A., Rifada, M., Fitriyani, N.L., Ana, E., 2023. A Multivariate Regression with Time Series Error in Forecasting Jakarta Composite Index and Stock Prices of Banking Industry in Indonesia by Considering COVID-19 Effect. International Journal of Technology. Volume 15(6), pp. 1839-1850

| Siti Maghfirotul Ulyah | 1. Department of Mathematics, Faculty of Science and Technology, Universitas Airlangga, Surabaya, 60115, Indonesia. 2. Department of Mathematics, College of Computing and Mathematical Sciences, Khali |

| Rika Susanti | PT. PLN Energi Primer Indonesia, Jakarta 12160, Indonesia |

| Christopher Andreas | School of Information Technology, Universitas Ciputra Surabaya, Surabaya 60219, Indonesia |

| Ilma Amira Rahmayanti | Department of Mathematics, Faculty of Science and Technology, Universitas Airlangga, Surabaya, 60115, Indonesia |

| Marisa Rifada | Department of Mathematics, Faculty of Science and Technology, Universitas Airlangga, Surabaya, 60115, Indonesia |

| Norma Latif Fitriyani | Department of Data Science, Sejong University, Seoul 05006, Korea |

| Elly Ana | Department of Mathematics, Faculty of Science and Technology, Universitas Airlangga, Surabaya, 60115, Indonesia |

The

stability of the financial system in Indonesia and the world has been severely

disrupted by COVID-19. With the unstable financial system conditions, there

were drastic fluctuations in the composite stock price index and other stocks.

This study focuses on stocks of the banking industry in Indonesia, especially

banks that are State-Owned Enterprises. The main objectives of this study are

to evaluate the significant effect of COVID-19 on the price of the Jakarta

Composite Index (JCI) and some stocks in the banking industry, determine the

dependence between the prices of these shares, and forecast the price of JCI

and other stock prices in the banking industry.

The method used in this study is Multivariate Regression with Time

Series Errors, a multivariate technique for analyzing time series data. One of

the interesting independent variables included in the model is a variable

representing three phases of the COVID-19 pandemic, based on newly confirmed

cases. The results indicate a significant impact of the pandemic on the Jakarta

Composite Index (JCI) and stock prices of state-owned banks. Furthermore, the

study reveals a dependency between the JCI and the stock prices of these banks.

Banking industry; COVID-19; Financial system stability; Jakarta Composite Index; Multivariate regression with time series error

Coronavirus Disease 2019 (COVID-19) has been designated as a pandemic by

WHO due to its rapid spread in almost all parts of the world (Cucinotta and Vanelli, 2020). The increasing number of

countries affected by the COVID-19 virus over the world has made the global

economic situation worse

Indonesia recorded a GDP

growth of only 2.97% in the first quarter of 2020, which represents a

significant slowdown compared to the previous achievement of a 4.97% growth

rate (Setianto and Kurniawan, 2020). The contraction occurred

due to activity restrictions and lockdowns to control the spread of the

COVID-19 pandemic

Therefore, some efforts are

needed to model stock prices in Indonesia to produce very useful predictions

for investors and the government as a reference for making policies. This study

focuses on stocks of the banking industry in Indonesia, especially banks that

are State-Owned Enterprises (BUMN). The goal of this study is to examine the

significant effect of COVID-19 on the price of the Jakarta Composite Index

(JCI) and some stocks in the banking industry. In addition, this study also

wants to determine the dependence between the prices of these shares so that

later several recommendations will be formulated for Bank Indonesia as one of

the controlling financial stabilities in Indonesia. The final objective is to

forecast the JCI price and other stock prices in the banking industry based on

the modeling results obtained.

A stock price index is a

number that is used to express changes in stock prices within a certain time

interval and becomes a measuring instrument for the situation in the capital

market (Damajanti, Yulianti, and Rosyati, 2018).The Composite Stock Price Index (abbreviated as JCI, or

also known as the Jakarta Composite Index (JKSE)) is a stock price index to

measure the combination of all common and preferred shares listed at the

Indonesia Stock Exchange (IDX)

This study used stock price

data from state-owned banks, including Bank Rakyat Indonesia (BRI), Bank Negara

Indonesia (BNI), Bank Tabungan Negara (BTN), and Mandiri Bank. These banks were

selected because they are the state-owned banks with the largest assets in

Indonesia. According to the bank's financial report as of the first quarter of

2020, BRI is ranked first with assets of Rp 1287.09 trillion, followed by

Mandiri Bank with assets of Rp 1130.7 trillion, and BNI with assets of Rp 953.7

trillion. The positive stock return and a high number of assets make them

attractive to investors. Moreover, these four banks have a long-standing

history and have made significant contributions to the banking industry and the

Indonesian economy (Herlin, 2018).

Previous studies in

forecasting were done using classical regression (Smolak et al., 2020;

Zubakin et al., 2015), exponential smoothing (Ostertagova and Ostertag, 2012; Hyndman et al., 2002), and ARIMA

The use of exogenous

variables that consider the COVID-19 pandemic with the Multivariate Regression

with Time Series Errors method in predicting the stock price is the novelty of

this study. This work produces statistical models and predictions of JCI prices

and banking stock prices in Indonesia over a certain period. The results of

this study can be used as a reference and statistical review in formulating

policies in the capital market, especially in Indonesia.

The organization of the paper

is as follows. Section 1 gives the motivation and the aims of this study.

Section 2 provides some useful literature. Then, section 3 explains the

dataset and the method used in this work. The results and discussion section

elaborate the descriptive statistics, modeling, and forecasting. Finally, the

last section summarizes this work.

2.1. Size

of Dataset and Research Variables

This

study used secondary data downloaded from Yahoo Finance and kawalcovid19.id

website. These include the Jakarta Composite Index (JKSE or JCI), stock prices

of Bank Negara Indonesia (BBNI), Bank Rakyat Indonesia (BBRI), Bank Tabungan

Negara (BBTN), and Bank Mandiri (BMRI). The data used in this study are daily

data from January 1st, 2018 to July 1st, 2021, and are

expressed in Indonesian Rupiah (IDR). In addition, the data taken from the

website kawalcovid19.id are daily data on the number of Indonesia's new

positive COVID-19 cases. We split the data into two parts, which are training

and testing data. Data from 1st January 2018 – 22nd June

2021 are called training data, and data from 23rd June – 1st

July 2021 are considered testing data. Training data are used to construct the

model, whereas testing data will be used for validation. The variables in this

study were divided into endogenous (core) variables and exogenous variables.

The endogenous variables include JCI (JKSE), BNI (BBNI), BRI (BBRI), BTN (BBTN),

and Mandiri Bank (BMRI) stock prices. Then, the exogenous variables are the

dummy variables representing the period of COVID-19 with a value of 1 (from 2nd

March 2020-31st to July 2021) and zero otherwise. In general, the

COVID-19 pandemic in Indonesia has formed several trends. The pandemic period

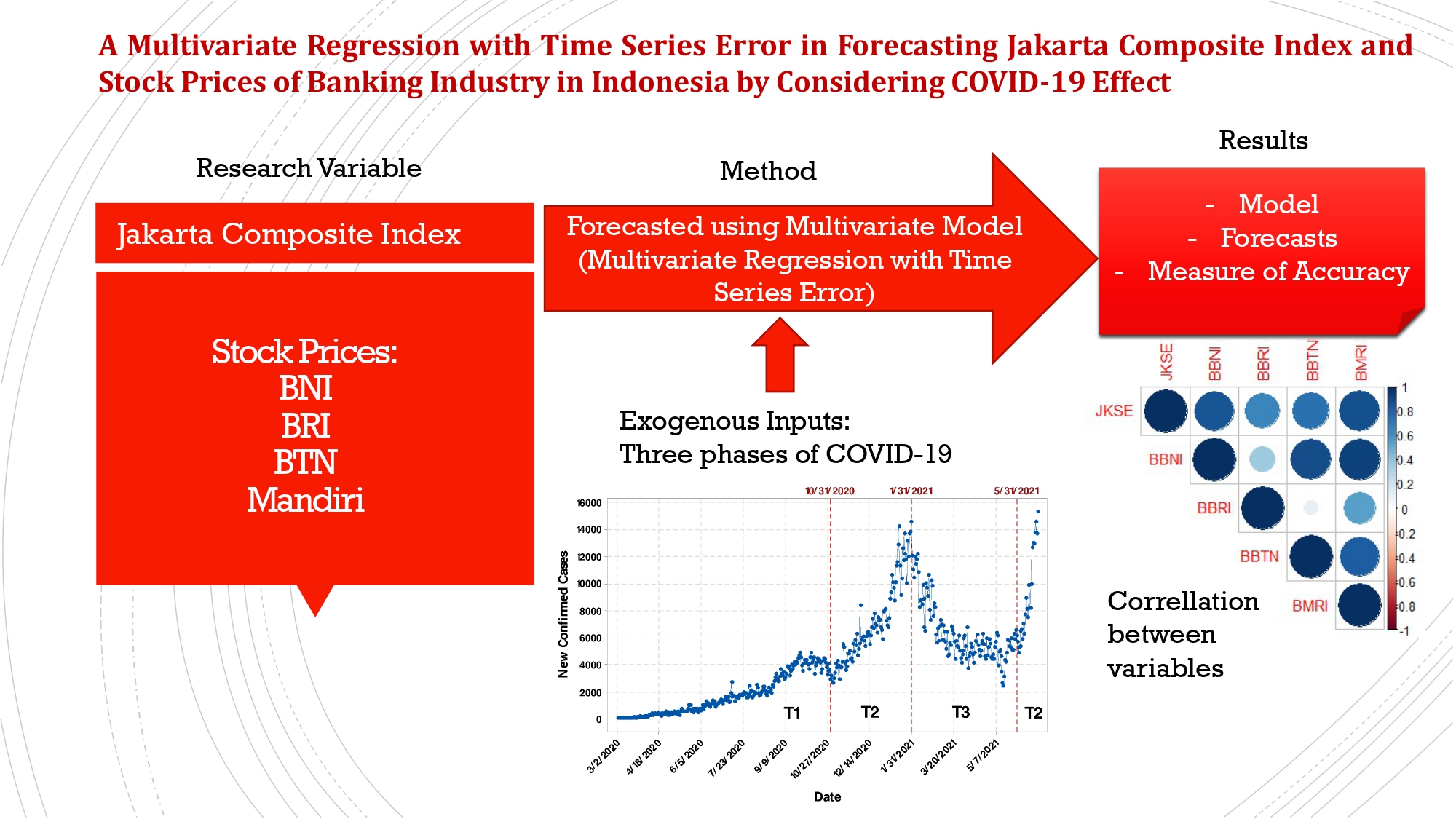

was divided into three parts based on the trend and pattern in Figure 1.

Figure 1 displays the behaviour of new confirmed cases in Indonesia. COVID-19 first infected Indonesia on March 2, 2020, and the number of cases gradually increased until late October 2020. This period was referred to as the first phase of the COVID-19 wave (T1), during which there was an upward trend in cases, and people were concerned about the spread of COVID-19. The second phase of the COVID-19 wave (T2) represents periods in which COVID-19 cases have a significant rising trend. This increase is more drastic than that of the T1 period. Then, the third phase of the COVID-19 wave (T3) was the period with decreasing trend of new confirmed COVID-19 cases.

The details about the dummy variables are as follows.

Figure 1 Time Series Plot of New Confirmed COVID-19 Cases

2.2. Procedure

of Analysis

The

analysis was carried out using the MINITAB 18 and RStudio software. The stages

of analysis in this study are as follows:

a)

Conducting

exploration and visualization on each research variable. The descriptive

analysis conducted in this study is the mean, standard deviation, diagrams, and

correlations.

b)

Multivariate

modeling was conducted using multivariate regressions. Two regression models

were developed. The first model included the COVID-19 dummy variable as a

predictor to determine whether there were differences between the stock prices

before and during the pandemic. The second model incorporated the T1,

T2, and T3 dummy variables as predictors to gain a better

understanding of the price variations among the different patterns of the

pandemic period.

c)

Modelling and

forecasting of the prices were conducted using Multivariate Regression with

Time Series Errors. The steps included identifying data patterns through the

results of descriptive statistics. The effect of the COVID-19 pandemic was

removed from the response variable by fitting the multivariate regression

equation with T1, T2, and T3 predictors to

obtain the residual. Subsequently, VAR modelling of the residuals was performed

to obtain the best model that met all the residual assumptions.

d)

Computing the

accuracy of the forecasts using Mean Absolute Percentage Error (MAPE).

e)

Performing model

interpretation and giving the recommendation.

2.3. Multivariate

Regression with Time Series Error Model

In general, every condition that occurs

in the financial industry will have an impact on other variables. This is

called an exogenous variable. By considering the effect of exogenous variables

on the response variable, the analysis and forecasting of the response variable

will be closer to the actual value. This concept has been applied in the

univariate forecasting of gold prices and Brent crude oil prices using the

Autoregressive Integrated Moving Average with Exogenous Input (ARIMAX) model.

By considering the effect of the US-China Trade War, which had a significant

effect on price movements, forecasting results with a good level of accuracy

were obtained

3.1. Statistical

Features of The Data

Figure 2 presents

the time series plots of the Jakarta Composite Index and some state-owned

banks’ stock prices. Overall, considering the time series plot of COVID-19 new

confirmed cases in Figure 1, all the indexes and stock prices had a significant

fall during the beginning period of the COVID-19 case in Indonesia (T1).

This condition happened because all people were panicking and facing the effect

of the COVID-19 pandemic. Then, in the second period (T), when the

cases rocketed significantly, the prices of index and stock prices started to

rise, but the value was still lower than that before the pandemic. During this

period, the Government introduced the “New Normal” and people were adapting to

it. Therefore, the business has already adapted and adjusted and made good

upward movements in the prices

Figure 2 Time Series Plots of Index and Stock Prices

Table

1 displays the statistical descriptive analysis, indicating that the average

share price of BBNI is higher than those of JKSE, BBRI, BBTN, and BMRI.

However, the standard deviation of BBNI's stock price is very large, reaching

23.8% of the average value. This suggests that the fluctuations that occurred

during the last two years were very high. The same condition also occurs in

BBTN's stock price, with a deviation of 33.6% from the average. In general, the

skewness value of variables (except BBTN) is negative, which indicates that the

data tends to skew to the left. In addition, the distribution of JKSE and BMRI

data tends to be more pointed. The stock price of BBNI and BBRI tend to be

flatter than the normal distribution (indicated by their respective kurtosis

values), while the BBTN data is close to a normal distribution.

Moreover, based on the results of the

correlation plot in Figure 3, it is concluded that the prices between stocks,

both JKSE, BBNI, BBRI, BBTN, and BMRI, behave in the same direction, proven by

the positive correlation among each other. All the stock prices of state-owned

banks are highly correlated with JKSE, which means that the association between

them is very strong. The least correlated stock price is between BBTN and BBRI,

followed by the correlation between BBNI and BBRI. In contrast, BBNI has a strong

correlation with BMRI and BBTN.

Table 1 Statistics Descriptive of The Data

|

Variable |

Count |

Mean |

StDev |

Minimum |

Maximum |

Skewness |

Kurtosis |

|

JKSE |

841 |

5910.8 |

550.1 |

3937.6 |

6689.3 |

-1.19 |

3.60 |

|

BBNI |

841 |

7108.8 |

1695.1 |

3160.0 |

10175.0 |

-0.35 |

2.08 |

|

BBRI |

841 |

3765.7 |

583.5 |

2170.0 |

4890.0 |

-0.23 |

2.02 |

|

BBTN |

841 |

2158.3 |

725.4 |

745.0 |

3840.0 |

0.38 |

2.87 |

|

BMRI |

841 |

6775.2 |

999.2 |

3720.0 |

9050.0 |

-0.78 |

3.24 |

Figure 3 Correlation among Index and Stock Prices

3.2. Modelling of

The Index and Stock Prices of Banking Industry with the Effect of COVID-19

Pandemic

In this subsection, we aimed to investigate whether there was a

significant difference in price before and during the COVID-19 pandemic and

quantify the magnitude of this difference. To achieve this, a multivariate time

series regression was conducted. The regression included all variables as

dependent variables, and the COVID-19 dummy variable was used as the

independent variable. The results are presented in Table 2.

According

to Table 2, the p-values of all variables are significant at a 5% significance

level. It means that there is a significant difference between the prices

before and after the pandemic. On average, the price of the JKSE index is IDR

723.8 less than that before the COVID-19 pandemic infects Indonesians. The most

affected stock is the BNI stock price, with an average of IDR 3,020 less than

the period before the pandemic came to Indonesia, followed by Mandiri Bank and

BTN (IDR 1,542.8 and IDR 1,121.1, respectively). BRI became the least affected

stock price with a difference of IDR 91.6 less than the period before the

pandemic started in Indonesia. Considering the pattern in Figure 1, the time

partition will be included as the independent variable to see the behavior of

the index and stock prices in more detail. The same multivariate regression

model is built with T1, T2, and T3 dummy

variables as predictors. The results are provided in Table 3.

Table 2 Regression Results of Index and Stock Prices on COVID-19

Dummy Variable

|

Variable |

Parameter |

Estimate |

s.d. |

t-ratio |

p-value |

|

JKSE |

Constant |

6181.1 |

18.5 |

334.4 |

0 |

|

|

COVID-19 |

-723.8 |

30.3 |

-23.93 |

0 |

|

BBNI |

Constant |

8236.3 |

37.4 |

220.09 |

0 |

|

|

COVID-19 |

-3020 |

61.2 |

-49.31 |

0 |

|

BBRI |

Constant |

3800 |

25.4 |

149.85 |

0 |

|

|

COVID-19 |

-91.6 |

41.5 |

-2.21 |

0.0275 |

|

BBTN |

Constant |

2576.9 |

21 |

122.79 |

0 |

|

|

COVID-19 |

-1121.1 |

34.3 |

-32.64 |

0 |

|

BMRI |

Constant |

7351.2 |

28.9 |

253.98 |

0 |

|

|

COVID-19 |

-1542.8 |

47.4 |

-32.57 |

0 |

Table 3 Regression Results of Index and Stock Prices on T1,

T2, T3 Dummy Variable

|

Variable |

|

Estimate |

s.d. |

t-ratio |

p-value |

|

Variable |

|

Estimate |

s.d. |

t-ratio |

p-value | ||

|

JKSE |

b0 |

6181.1 |

11.3 |

546.97 |

0 |

|

BBTN |

b0 |

2576.9 |

19.7 |

130.96 |

0 | ||

|

|

T1 |

-1259.7 |

23.4 |

-53.79 |

0 |

|

|

T1 |

-1391 |

40.8 |

-34.12 |

0 | ||

|

|

T2 |

-253 |

32 |

-7.9 |

8.6E-15 |

|

|

T2 |

-876.3 |

55.7 |

-15.72 |

0 | ||

|

|

T3 |

-85.7 |

31.3 |

-2.74 |

0.00633 |

|

|

T3 |

-807 |

54.5 |

-14.81 |

0 | ||

|

BBNI |

b0 |

8236.3 |

32.7 |

251.51 |

0 |

|

BMRI |

b0 |

7351.2 |

24.5 |

300.26 |

0 | ||

|

|

T1 |

-3688.9 |

67.9 |

-54.36 |

0 |

|

|

T1 |

-2108 |

50.7 |

-41.55 |

0 | ||

|

|

T2 |

-2290 |

92.8 |

-24.68 |

0 |

|

|

T2 |

-844.5 |

69.4 |

-12.18 |

0 | ||

|

|

T3 |

-2358.2 |

90.7 |

-26 |

0 |

|

|

T3 |

-1061 |

67.8 |

-15.65 |

0 | ||

|

BBRI |

b0 |

3800 |

19.6 |

193.43 |

0 |

|

|

|

|

|

|

| ||

|

|

T1 |

-680.1 |

40.7 |

-16.71 |

0 |

|

|

|

|

|

|

| ||

|

|

T2 |

431.9 |

55.7 |

7.76 |

2.5E-14 |

|

|

|

|

|

|

| ||

|

|

T3 |

603.1 |

54.4 |

11.08 |

0 |

|

|

|

|

|

|

| ||

Overall,

on average, the price of the JKSE index and some bank stocks are falling in T1

(the period when COVID-19 started infecting Indonesians, and the new confirmed

case was increasing). This fall is the largest compared to T2 and T3.

BBRI has a different pattern from others. Its price in the second and third

phases of COVID-19 (T2 and T3) is IDR 431 and IDR 603,

greater than that before the pandemic, while the average prices of others

(JKSE, BBNI, BBTN, BMRI) are less than those before the pandemic.

BBRI's

share price shows a similar pattern but has a higher amplitude than that of other

state-owned banks. In comparison to other banks, the share price of BBRI

started to increase significantly during T2. There was a consistent

trend for BBRI's share price to go back to its initial stock price prior to the

pandemic during the T2 period. The following are the possible

reasons for that. The Micro Small Medium Enterprise (MSME) and small trader

groups utilize BBRI more frequently because of market confidence. From 2014 to

2022, BBRI became the largest distributing bank for “Kredit Usaha Rakyat”

(People's Business Credit), with a contract value of IDR 899.07 trillion

3.3. Forecasting

The Index and Stock Prices of Banking Industry with The Effect of COVID-19

Pandemic

In this section, we conducted a multivariate regression with time series errors. We used the regression model from the previous subsection, in which the predictors were the T1, T2, and T3 period partitions. The regression results presented in Table 3 were utilized, and the residuals of the model were modeled using multivariate time series modeling. The residuals are modeled with vector autoregressive (VAR). Lag order 1 is selected based on the minimum value of some Information Criterions (AIC, BIC, HQ). The optimal order for VAR(p) based on AIC is 2, while BIC and HQ are 1. Therefore, the possible models for the regression model residuals are VAR(1) and VAR(2). After modeling, the model that has the minimum AIC and BIC values and satisfies the residual assumption is VAR(1). In the modeling process, All the insignificant estimates are removed from the model with a 5% level of significance. Therefore, there are 28 significant parameters in predicting the price of the index and stocks. Mathematically, the final model with the significant parameter estimates can be written in a matrix form as follows.

Equation

2 is the final

model in which all non-zero coefficients are significant. In general, the dummy

variables from the 3 phases of COVID-19 significantly affect stock prices, both

the Jakarta Composite Index and shares of state-owned banks. The interpretation

of the model of each stock is as follows. Today's JCI is dependent on the first

and second phases of COVID-19, JCI one day earlier, and the share price of BNI

and BRI on the previous day. Then, today's share of BNI is dependent on all

three phases of COVID-19 and the stock price of BNI one day earlier. Moreover,

today's share of BRI is dependent on all three phases of COVID-19. It also

depends on its share price and BTN's share price on the previous day. For BTN

today’s share of BTN is dependent on all three phases of COVID-19. It also

depends on its share price on the previous day. Furthermore, today's share of

Mandiri Bank is dependent on all three phases of COVID-19. It also depends on

its share price and BRI share price on the previous day.

After having the final model, the next step is to forecast and calculate the accuracy of the forecast results against the testing data using the Mean Absolute Percentage Error (MAPE) which is defined as the average of |(Forecast-Actual)/Actual| x 100%. The results of the MAPE calculation for the next 7 days (testing data) for JKSE, BBNI, BBRI, BBTN, and BMRI are 1.3%, 7.9%, 3.2%, 7.1%. 5.9%, respectively. These MAPE values are quite small, which means that the forecasting results have high accuracy. Then, the 30-day step-ahead forecasts are obtained using the model in Equation 2 by assuming the second phase of COVID-19 (i.e., T2 is equal to 1). The forecasts show that all share prices of the state-owned Bank will have a slightly increasing trend.

The COVID-19 pandemic has had a significant influence on the movement

of the JCI and stock prices in the Indonesian banking industry. BBRI has a

different trend among others, where it has good performance in the second and

third phases of COVID-19. The prediction results show that the JCI value will

tend to decrease slightly, while the stock price of the Indonesian banking

industry has an increasing trend with the assumption that there will still be

an increase in the number of positive cases of COVID-19 in Indonesia. The

recommendations for the governments are (1) to take more serious action in

dealing with COVID-19 cases as it affects JCI and the stock prices, (2) to

encourage people to invest, and (3) to minimize the gap between the local

interest rate and the Federal Reserve fund rate. The limitation of the study is

that the data for the analysis is limited to the range specified in Section 2.

More updated data may have different results. Therefore, the future study can

consider more updated data to be carried out using another time series or

machine learning approach to improve the accuracy of the forecasts.

The authors thank Universitas Airlangga for the support of this work.

Amul, G.G., Ang, M., Kraybill,

D., Ong, S.E., Yoong, J., 2021. Responses to COVID?19 in Southeast Asia:

Diverse Paths and Ongoing Challenges. Asian Economic Policy Review,

Volume 17 (1), pp. 90–110. DOI: https://doi.org/10.1111/aepr.12362

Andreas, C., Rahmayanti,

I.A., Ulyah, S.M., 2021. The Impact of US-China Trade War in Forecasting the

Gold Price using ARIMAX Model. In: AIP Conference Proceedings, Volume

23299(1), p. 060011. DOI: https://doi.org/10.1063/5.0042361

Berawi, M.A., Suwartha,

N., Kurnia, K., Gunawan., Miraj, P., Berawi, A.R.B., 2018. Forecasting the Land

Value around Commuter Rail Stations using Hedonic Price Modeling. International

Journal of Technology, Volume 9(7), pp. 1329–1337. DOI: https://doi.org/10.14716/ijtech.v9i7.2589

Chu, D.T., Vu Ngoc,

S.M., Vu Thi, H., Nguyen Thi, Y.V., Ho, T.T., Hoang, V.T., Al-Tawfiq, J.A.,

2022. COVID-19 in Southeast Asia: Current Status and Perspectives. Bioengineered, Volume

13 (2), pp. 3797–3809. DOI: 10.1080/21655979.2022.2031417

Cryer, J.D., Chan,

K.-S., 2008. Time Series Analysis: with Applications to R. New York:

Springer. http://dx.doi.org/10.1007/978-0-387-75959-3

Cucinotta, D., Vanelli,

M., 2020. WHO Declares COVID-19 a Pandemic. Acta Biomed, Volume 91(1),

pp. 157–160. DOI: 10.23750/abm.v91i1.9397

Damajanti,

A., Yulianti, Y., Rosyati, R., 2018. The Effect of

Global Stock Price Index and Rupiah Exchage Rate on Indonesian Composite Stock

Price Index (CSPI) in Indonesian Stock Exchange (IDX). Economics and

Business Solutions Journal, Volume 2(2), pp. 49–58. DOI:10.26623/EBSJ.V2I2.1206

Dhini,

A., Surjandari, I., Riefqi, M., Puspasari, M.A., 2015. Forecasting

Analysis of Consumer Goods Demand using Neural Networks and ARIMA. International

Journal of Technology, Volume 6(5), pp. 872–880. DOI:

https://doi.org/10.14716/ijtech.v6i5.1882

Fridayani, H.D., Iqbal,

M., 2020. An Analysis: Indonesia’s New Normal Policy Implementation During

COVID-19 and Its Impact on Economic Aspect. Jurnal Caraka Prabu, Volume

4(2), pp. 197–205. DOI: https://doi.org/10.36859/jcp.v4i2.293

Galbraith, J.K., 2015. The

End of Normal: The Great Crisis and The Future of Growth. Simon and

Schuster

Herlin, 2018. The

Prediction of Bankruptcy Using Altman Z-Score Model (Case Study in BRI Bank,

BNI Bank, Mandiri Bank, BTN Bank). Integrated Journal of Business and

Economics, Volume 2(1), pp. 12–23

Hyndman, R.J., Koehler,

A.B., Snyder, R.D., Grose, S., 2002. A State Space Framework for Automatic Forecasting Using Exponential

Smoothing Methods. International

Journal of Forecasting, Volume 18(3), pp. 439–454. DOI: https://doi.org/10.1016/S0169-2070(01)00110-8

Ministry of National Development Planning Republic of Indonesia (Ministry PPN RI), 2020. Laporan Perkembangan Ekonomi Indonesia dan Dunia Triwulan III Tahun 2020 (Indonesian and World Economic Development Report for the Third Quarter of 2020). Volume 4(3). Ministry of National Development Planning Republic of Indonesia, Jakarta. Available online at: https://www.bappenas.go.id/files/5516/0819/5837/Laporan_Perkembangan_Ekonomi_Indonesia_dan_Dunia_Triwulan_III_2020.pdf, Accessed on December 24, 2021

Mofijur, M., Fattah,

I.M.R., Alam, M.A., Islam, A.B.M.S., Ong, H.C., Rahman, S.M.A., Najafi, G.,

Ahmed, S.F., Uddin, M.A., Mahlia, T.M.I., 2020. Impact of COVID-19 on the

Social, Economic, Environmental and Energy Domains: Lessons Learnt from A

Global Pandemic. Sustain Prod Consum, Volume 26, pp. 343–359. DOI:

10.1016/j.spc.2020.10.016

Nicholson, W., Matteson,

D.S., Bien, J. 2017. VARX-L: Structured Regularization for Large Vector

Autoregressions with Exogenous Variables. International Journal of

Forecasting, Volume 33(3), pp 627–651. DOI:

10.1016/j.ijforecast.2017.01.003

Ostertagova, E., and

Ostertag, O., 2012. Forecasting Using Simple Exponential Smoothing Method. Acta

Electrotechnica et Informatica, Volume 12(3), pp. 62–66. DOI:

10.2478/v10198-012-0034-2

Otoritas

Jasa Keuangan (OJK), 2021. Stabilitas Sistem Keuangan (Financial System

Stability). Otoritas Jasa Keuangan. Available at:

https://www.ojk.go.id

/id/kanal/perbankan/stabilitas-sistem-keuangan/Pages/Ikhtisar.aspx, Accessed on

December 24, 2021

Parameswaran, S.K.,

2007. Equity Shares, Preferred Shares and Stock Market Indices. New

Delhi: Tata McGraw-Hill

Pradita, S.P.,

Ongkunaruk, P., Leingpibul, T.D., 2020. Utilizing an Intervention Forecasting

Approach to Improve Reefer Container Demand Forecasting Accuracy: A Case Study

in Indonesia. International Journal of Technology, Volume 11(1),

pp. 144–154. DOI: https://doi.org/10.14716/ijtech.v11i1.3220

Puspasari, R., 2020. Pemerintah Waspada Dampak Pandemi Covid-19 Terhadap Ekonomi Indonesia (Government Wary of Impact of Covid-19 Pandemic on Indonesian Economy). Biro Komunikasi dan Layanan Informasi Kementerian Keuangan. Available online at: https://www.kemenkeu.go.id/publikasi/siaran-pers/siaran-pers-pemerintah-waspada-dampak-pandemi-covid-19-terhadap-ekonomi-indonesia/, Accessed December 24, 2021

Putri, A.M.H., 2022.

Sangat Dominan! Ini Bank Penyalur KUR Terbesar Hingga 2022 (Very Dominant!

These Are the Largest KUR Distributing Banks Until 2022). Available online at:

https://www.cnbcindonesia.com/research/20221226115913-128-400096/ sangat-dominan-ini-bank-penyalur-kur-terbesar-hingga2022#:~:text=Bank%20Penyalur%20Kredit%20Usaha%20Raky

at%20(KUR) Penyalur%20Kredit%20Usaha%20Rakyat%20(KUR)%20dengan%20Nilai%20Akad%20Terbesar&text=Dalam%20periode%202014%20hingga%2026,akad%20Rp%20899%2C07%20triliun,

Accessed on February 7, 2023

Rahmayanti, I.A.,

Andreas, C., Ulyah, S.M., 2021. Does US-China Trade War Affect the Brent Crude

Oil Price? An ARIMAX Forecasting Approach. In: AIP Conference

Proceedings, Volume 2329(1), p. 060010. DOI: 10.1063/5.0042359

Robiyanto,

R., Santoso, M. A., Atahau, A. D. R., & Harijono, H. 2019. The

Indonesia Stock Exchange and Its Dynamics: An Analysis of The Effect of

Macroeconomic Variables. Montenegrin Journal of Economics, Volume 15(4),

pp. 59–73. DOI: 10.14254/1800-5845/2019.15-4.5

Setianto,

Kurniawan, P.A., 2020. Pertumbuhan Ekonomi Indonesia Triwulan I-2020

(Indonesia's Economic Growth in Quarterly1-2020). Available

online at:

https://www.bps.go.id/pressrelease/2020/05/05/1736/ekonomi-indonesia-triwu

lan-i-2020-tumbuh-2-97-persen.html, Accessed on December 24, 2021

Smolak, K., Kasieczka,

B., Fialkiewicz, W., Rohm, W., Si?a-Nowicka, K., Kopa?czyk, K., 2020. Applying

Human Mobility and Water Consumption Data for Short-Term Water Demand

Forecasting Using Classical and Machine Learning Models. Urban Water Journal,

Volume 17(1), pp. 32–42. DOI: https://doi.org/10.1080/1573062X.2020.1734947

Tsay, R.S., 2013. Multivariate

Time Series Analysis: with R and Financial Applications. New Jersey: John

Wiley & Sons, Inc

Ulyah, S.M., 2019.

Forecasting Index and Stock Returns by Considering the Effect of Indonesia

Pre-presidential Election 2019 Using ARIMAX and VARX Approaches. Journal of

Physics: Conference Series, Volume 1277(1), p. 012053. DOI:

10.1088/1742-6596/1277/1/012053

Ulyah, S.M., Andreas,

C., Rahmayanti, I.A., 2021. Forecasting Gold and Oil Prices Considering

US-China Trade War using Vector Autoregressive with Exogenous Input. AIP

Conference Proceedings, Volume 2329(1), p. 060020. DOI: https://doi.org/10.1063/5.0042362

Ulyah, S.M.,

Susilaningrum, D., Suhartono, 2014. Peramalan Volume Penjualan Total Sepeda

Motor di Kabupaten Bojonegoro dan Lamongan dengan Pendekatan Model ARIMAX dan

VARX (Forecasting Total Motorcycle Sales Volume in Bojonegoro and Lamongan

Regencies Using ARIMAX and VARX Model Approaches). Jurnal Sains dan Seni ITS,

Volume 3(2), pp. D230–D235. DOI: 10.12962/j23373520.v3i2.8148

Vaithilingam, C.A.,

Natesan, S., Rajalaxmi, R.R., Tamilarasi, K., Praveena, N.G., Abdul Karim, S.A.

2022. Evolution of Outbreaks, Lessons Learnt and Challenges Towards “New

Normalcy”—Post COVID-19 World. In: Shifting Economic, Financial and

Banking Paradigm. Studies in Systems, Decision and Control, Volume 382, pp.

1–22

Warsono, Russel, E.,

Wamiliana, Widiarti, Usman, M., 2019. Vector Autoregressive with Exogenous

Variable Model and its Application in Modeling and Forecasting Energy Data:

Case Study of PTBA and HRUM Energy. International Journal of Energy

Economics and Policy, Volume 9(2), pp. 390–398. DOI:

https://doi.org/10.32479/ijeep.7223

Wei, W.W.S., 2019. Multivariate

Time Series Analysis and Applications. New Jersey: John Wiley & Sons,

Inc

Worldometers, 2021.

COVID Live - Coronavirus Statistics. Worldometer. Available online at:

https://www.worldometers.info/coronavirus/, Accessed on December 24, 2021

Zhang, D., Hu,

M., Ji, Q., 2020. Financial Markets

Under The Global Pandemic of COVID-19. Finance Research Letters. Volume 36, pp. 1–6. DOI: https://doi.org/10.1016/j.frl.2020.101528

Zhao, C., Hu, P.,

Liu, X., Lan, X., Zhang, H., 2023. Stock Market Analysis Using Time Series

Relational Models for Stock Price Prediction. Mathematics, Volume 11(5),

pp. 1–13. DOI: https://doi.org/10.3390/math11051130

Zubakin, V.A., Kosorukov, O.A., Moiseev, N.A., 2015. Improvement of Regression Forecasting Models. Modern applied science, Volume 9 (6), pp. 344–353. DOI:10.5539/mas.v9n6p344