Credit Constraints and Innovation Activities: Empirical Evidence on Russian Enterprises

Published at : 01 Apr 2022

Volume : IJtech

Vol 13, No 2 (2022)

DOI : https://doi.org/10.14716/ijtech.v13i2.4835

Maarouf, A., Korableva, O.N., 2022. Credit Constraints and Innovation Activities: Empirical Evidence on Russian Enterprises. International Journal of Technology. Volume 13(2), pp. 254-263

| Ali Maarouf | St. Petersburg State University, 199178 St. Petersburg, Russia |

| Olga N. Korableva | St. Petersburg State University, 199178 St. Petersburg, Russia. |

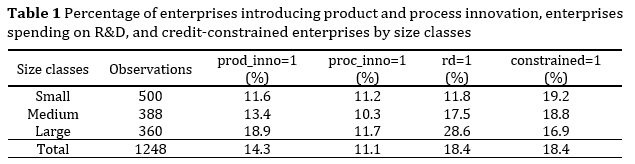

This

article studies the relationship between the credit constraints on Russian

enterprises and their decision to introduce product innovation, process

innovation, and to spend on research and development (R&D). The evidence

regarding the relationship between R&D spending remains somewhat ambiguous

and could differ between countries. A cross-sectional macro dataset of the

World Bank Enterprises Survey in Russia in 2019 is used in a system of

seemingly unrelated regressions. The results show that the existence of credit

constraints is associated with a lower probability of introducing product

innovations and spending on R&D activities. Nevertheless, there is no

significant relationship between being credit constrained and the enterprise decision

to introduce process innovations. The importance of this article stems from the

fact that previous works showed that these relationships differ by country and

that these relationships are considered simultaneously, while other works

concentrate mainly on one of these relationships.

Credit constraints; Financial constraints; Innovation activities; Research and development; World Bank Enterprises Survey

Innovation activity is

considered to be one of the main drivers of economic growth on the national

level (Aghion

et al., 2009; Solow, 1957). Innovations are of

great importance for company growth and competitiveness. Companies develop new

products and processes or improve old ones to maintain and increase their

productivity and market share (Berawi,

2016, 2017; Dabla-Norris et al., 2012; Leland & Pyle, 1977). However, many factors

could hinder investment in innovation activities, particularly in R&D

activities. Innovation projects require high sunk costs, especially projects containing R&D

activities that could require large investments in their initial stages (Alderson

& Betker, 1996). In addition to

research activities, numerous other activities are necessary to develop new

products and release them to the market, which creates a large time lag between

investing in these projects and starting to get a return on such investments.

This time lag discourages banks from giving companies credit to finance their

innovative projects (Bakker,

2013).

Other factors that hamper investing in innovation

activities include the inherent high level of uncertainty in such projects.

Many technological, strategic, and market factors lead

Applying

a system of simultaneous seemingly unrelated regressions led to the conclusion

that credit constraints are negatively correlated with the decision of the company

to introduce new products or to spend on R&D internally or externally. Such

a relationship has not been observed between credit constrained and introducing

process innovation. The development of new products and spending on R&D

activities require large investments from enterprises. Financially constrained

enterprises may not have enough resources to invest in such activities.

Meanwhile, the enterprise decision to introduce process innovation, which needs

less investment, is not correlated with credit constraints. It is worth noting

that the correlations between credit constraints and both product innovation

and R&D spending are of the same size, while not all enterprises that

introduced a product innovation decided to spend on R&D. This means that the

existence of financial constraints led companies to avoid activities that

require high investments or that associated with high risks. Process

innovations are less risky and do not require large investments, so the

enterprise can introduce them whether or not it is constrained.

These results have many policy

implications, especially considering the notion that credit finance is not

vital for innovation activities. Government endeavors should be evenly directed

to support enterprises’ access to external financial resources in order to

increase their ability to spend on R&D and to introduce product

innovations. This support should be directed evenly to help enterprises to

develop new products and to engage in R&D activities such that enterprises under

credit constraints are equally inclined to undertake such activities. Among the

main limitations of this work was the absence of panel data to consider the

relationships over time and to check the causality relationship. Is there only

a correlation between credit constraints, product innovation, process

innovation, and R&D spending? Or does limited access to external financial

resources lead companies to decide not to introduce new product innovations and

not to spend on R&D?

Aghion, P., Blundell, R.,

Griffith, R., Howitt, P., Prantl, S., 2009. The Effects of Entry on Incumbent

Innovation and Productivity. Review of Economics and Statistics,

Volume 91(1), pp. 20–32

Alderson, M.J., Betker, B.L., 1996.

Liquidation Costs and Accounting Data. Financial Management, Volume

25(2), pp. 25–36

Altomonte, C., Gamba, S., Mancusi, M.L.,

Vezzulli, A., 2016. R&D Investments, Financing Constraints, Exporting and

Productivity. Economics of Innovation and New Technology, Voulme

25(3), pp. 283–303

Álvarez, R., Crespi, G.A., 2015.

Heterogeneous Effects of Financial Constraints on Innovation: Evidence from

Chile. Science and Public Policy, Volume 42(5), pp. 711–724

Bakker, G., 2013. Money for Nothing: How

Firms Have Financed R&D Projects Since the Industrial Revolution. Research

Policy. Volume 42(10), pp. 1793–1814

Berawi, M.A., 2017. Stimulating Innovation

and Creativity: The Way Forward. International Journal of Technology,

Volume 8(1), pp. 1–4

Berawi, M.A., 2016. Value-Based Innovation:

Knowledge and Technology Transfer in Triple Helix Model. International

Journal of Technology, Volume 7(1), pp. 1–4

Bigsten, A., Collier, P., Dercon, S.,

Fafchamps, M., Gauthier, B., Gunning, J.W., Oduro, A., Oostendorp, R., Patillo,

C., Söderbom, M., Teal, F., Zeufack, A., 2003. Credit Constraints in

Manufacturing Enterprises in Africa. Journal of African Economics,

Volume 12(1), pp. 104–125

Bond, S., Harhoff, D.,

Van Reenen, J., 2005. Investment, R&D and Financial Constraints in Britain

and Germany. Annales d’Économie et de Statistique, Volume 79/80,

pp. 433–460

Borisova, G., Brown, J.R., 2013. R&D

sensitivity to asset sale proceeds: New evidence on financing constraints and

intangible investment. Journal of Banking & Finance, 37(1), pp.159-173

Bottazzi, G., Secchi, A., Tamagni, F., 2014.

Financial Constraints and Firm Dynamics. Small Business Economics,

Volume 42, pp. 99–116

Brown, J.R., Fazzari, S.M., Petersen, B.C.,

2009. Financing Innovation and Growth: Cash Flow, External Equity, and the

1990s R&D Boom. Journal of Finance, Volume 64(1), pp. 151–185

Brown, J.R., Martinsson, G., Petersen, B. C.,

2012. Do Financing Constraints Matter for R&D? European Economic

Review, Volume 56(8), pp. 1512–1529

Canepa, A., Stoneman, P., 2008. Financial

Constraints to Innovation in the UK: Evidence from CIS2 and CIS3. Oxford

Economic Papers, Volume 60(4), pp. 711–730

Cincera, M., Ravet, J., Veugelers, R., 2016.

The sensitivity of R&D investments to cash flows: comparing young and old

EU and US leading innovators. Economics of Innovation and new technology,

25(3), pp.304-320

Czarnitzki, D., 2006. Research and

Development in Small and Medium-Sized Enterprises: The Role of Financial

Constraints and Public Funding. Scottish Journal of Political Economy,

Volume 53(3), pp. 335–357

Czarnitzki, D., Hottenrott, H., 2010.

Financing Constraints for Industrial Innovation: What Do We Know? Review of

Business and Economics, pp. 1–23

Czarnitzki, D., Hottenrott, H., 2011. R&D

Investment and Financing Constraints of Small and Medium-Sized Firms. Small

Business Economics, Volume 36, pp. 65–83

Dabla-Norris, E., Kersting, E.K., Verdier,

G., 2012. Firm Productivity, Innovation, and Financial Development. Southern

Economic Journal, Volume 79(2), pp. 422–449

Evangelista, R., 2006. Innovation in the

European Service Industries. Science and Public Policy, Volume 33(9),

pp. 653–668

Fazzari, S.M., Hubbard, R.G., Petersen, B.C.,

Blinder, A.S., Poterba, J.M., 1988. Financing Constraints and Corporate

Investment. Brookings Papers on Economic Activity, Volume 1988(1),

pp. 141–206

Gorodnichenko, Y., Schnitzer, M., 2013.

Financial Constraints and Innovation: Why Poor Countries Don’t Catch Up. Journal

of the European Economic Association, Volume 11(5), pp. 1115–1152

Guriev, S., Lazareva, O., Rachinsky, A.,

Tsukhlo, S., 2004. Corporate Governance in Russian Industry. Problems

of Economic Transition, Volume 47(3), pp. 6–83

Hall, B.H., 1992. Investment and Research and

Development at the Firm Level: Does the Source of Financing Matter? National

Bureau of Economic Research Working Paper Series.

Hall, B.H., Moncada-Paternò-Castello, P.,

Montresor, S., Vezzani, A., 2016. Financing Constraints, R&D Investments

and Innovative Performances: New Empirical Evidence at the Firm Level for

Europe. Economics of Innovation and New Technology, Volume 25(3), pp.

183–196

Hansen, H., Rand, J., 2014. The Myth of

Female Credit Discrimination in African Manufacturing. Journal of

Development Studies, Volume 50(1), pp. 81–96

Hottenrott, H., Peters, B., 2012. Innovative

Capability and Financing Constraints for Innovation: More Money, More

Innovation? Review of Economics and Statistics, Volume 94(4), pp.

1126–1142

Kaplan, S.N., Zingales, L., 1997. Do

Investment-Cash Flow Sensitivities Provide Useful Measures of Financing

Constraints? Quarterly Journal of Economics, Volume 112(1), pp.

169–215

Leland, H.E., Pyle, D.H., 1977. Informational

Asymmetries, Financial Structure, and Financial Intermediation. The

Journal of Finance, Volume 32(2), pp. 371–378

Lööf, H., Nabavi, P., 2016. Innovation and

Credit Constraints: Evidence from Swedish Exporting Firms. Economics of

Innovation and New Technology, Volume 25(3), pp. 269–282

Moyen, N., 2004. Investment-Cash Flow

Sensitivities: Constrained Versus Unconstrained Firms. Journal of

Finance, Volume 59(5), pp. 2061–2092

OECD/Eurostat, 2018. Oslo Manual 2018:

Guidelines for Collecting. Reporting and Using Data on Innovation, 4th

Edition, The Measurement of Scientific, Technological and Innovation

Activities, OECD Publishing, Paris/Eurostat, Luxembourg.

Piga, C.A., Atzeni, G., 2007. R&D

Investment, Credit Rationing and Sample Selection. Bulletin of Economic

Research, Volume 59(2), pp. 149–178

Savignac, F., 2008. Impact of Financial

Constraints on Innovation: What Can Be Learned from a Direct Measure? Economics

of Innovation and New Technology, Volume 17, pp. 553–569

Solon, G., Haider, S.J., Wooldridge, J.,

2013. What are We Weighting For? National Bureau of Economic Research,

Volume 50(2), pp. 301–316

Solow, R.M., 1957. Technical Change and the

Aggregate Production Function. The Review of Economics and

Statistics, Volume 39(3), pp. 312–320

Spielkamp, A., Rammer, C., 2009. Financing of

Innovations–Thresholds and Options. Management & Marketing,

Volume 4(2), pp. 3–18

Sun, S., 2020. Financial Constraints and

Likelihood of Product Innovation: Firm-level Evidence from China. SSRN

Electronic Journal.

Tiwari, A.K., Mohnen, P., Palm, F.C., Van der

Loeff, S. S., 2008. Financial Constraint and R&D Investment: Evidence from

CIS. Determinants of Innovative Behaviour: A Firm’s Internal Practices

and Its External Environment, Volume 31, pp. 217–242

Wellalage, N.H., Locke, S., 2016. Informality

and Credit Constraints: Evidence from Sub-Saharan African MSEs. Applied

Economics, Volume 48(29), pp. 2756–2770

West, J., 2014. Financing Innovation: Markets

and the Structure of Risk. Growth, Volume 53, pp. 12–34

World Bank, 2019. Russian Federation

- Enterprise Survey (ES) 2019. Available Online at https://www.enterprisesurveys.org/portal/login.aspx, Accessed on March 2, 2021

Zellner, A., 1962. An Efficient Method of

Estimating Seemingly Unrelated Regressions and Tests for Aggregation

Bias. Journal of the American Statistical Association, Volume 57(298),

pp. 348–368

Zellner, A., 1963. Estimators for Seemingly

Unrelated Regression Equations: Some Exact Finite Sample Results. Journal

of the American Statistical Association. Volume 58(304), pp. 977–992